You Might Be Hit With a Tax Penalty: If you’ve ever spotted a buddy in a jam and said, “Don’t worry, I got you—just pay me back when you can,” you’re not alone. Lending money to friends or family is as American as backyard BBQs and Fourth of July fireworks. We do it out of kindness, loyalty, or simply because it feels right.

But here’s the curveball—the IRS doesn’t care about your good intentions. When money changes hands without proper paperwork or interest, Uncle Sam might treat it as a taxable gift or hit you with an unexpected tax penalty. This isn’t just theory—it’s happened to plenty of people who thought they were just helping out. And that’s why knowing the rules isn’t just smart—it’s essential.

You Might Be Hit With a Tax Penalty

Lending money to friends or family can be a great way to help—but without planning, it can cause IRS headaches. Treat every loan like a professional transaction—clear terms, fair interest, written agreements—and you’ll avoid penalties while protecting relationships. Remember, Uncle Sam doesn’t care about your personal backstory—he cares about whether you followed the rules.

| Topic | Details |

|---|---|

| IRS View | Money lent without paperwork or interest can be treated as a gift, triggering gift tax rules. |

| Gift Tax Limit (2024) | $18,000 per person annually ($36,000 for married couples splitting the gift). Requires filing Form 709 if exceeded. |

| Interest Rule | Loans must meet the Applicable Federal Rate (AFR) or risk “imputed interest” taxation. |

| Small Loan Exemption | Loans under $10,000 are exempt unless used to produce income. |

| Bad Debt Deduction | Available if the loan is documented, unpaid, and collection attempts were made. |

| Source | IRS.gov |

Why the IRS Cares About Your “Friendly Loan”?

The IRS’s main concern is that people might try to disguise gifts as loans to dodge gift tax rules. If you “loan” your daughter $100,000 to buy a house and never collect, that’s essentially a gift in the eyes of the IRS.

They use three main factors to decide:

- Documentation — Was there a written contract with repayment terms?

- Interest rate — Does it match or exceed the AFR?

- Enforcement — Did you make genuine efforts to collect if payments stopped?

If you fail any of these tests, the IRS can reclassify your “loan” as a gift. That means gift tax reporting—and possibly reducing your lifetime gift and estate tax exemption, which is $13.61 million in 2024.

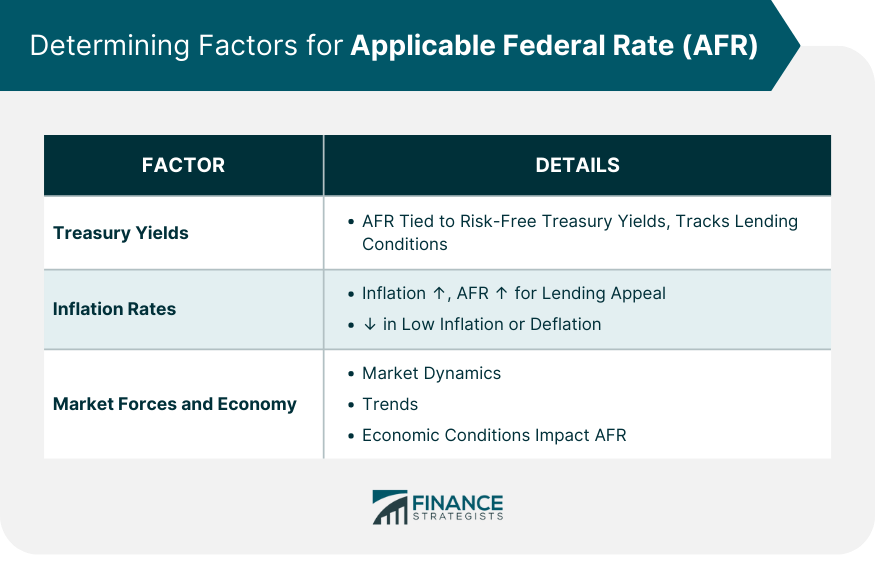

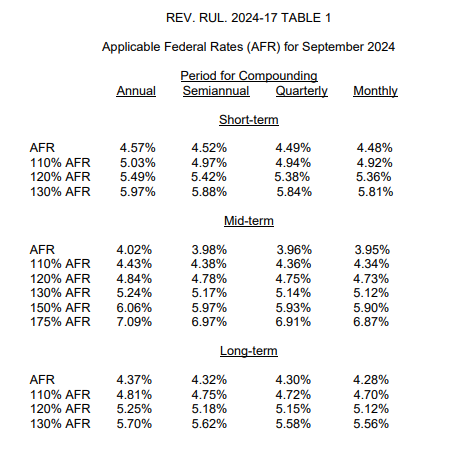

The Applicable Federal Rate (AFR): Your Loan’s “Magic Number”

The AFR is the minimum interest rate the IRS allows for private loans. It changes every month based on U.S. Treasury yields.

July 2024 AFR examples:

- Short-term (≤3 years): 5.07%

- Mid-term (3–9 years): 4.42%

- Long-term (9+ years): 4.56%

Why it matters:

If you charge less than AFR, the IRS assumes you charged AFR anyway (imputed interest). You’ll be taxed on income you never actually got.

Example:

You lend $20,000 for one year at 2% interest when AFR is 5%.

- Interest you earn: $400

- Interest IRS says you earned: $1,000

- You pay tax on the extra $600 you didn’t get.

This can get even more costly with larger loans.

Small Loan Exceptions

The IRS provides relief for genuinely small loans:

- Loans under $10,000 are generally exempt—unless used to generate income (e.g., investing in stocks).

- Loans under $100,000 may be exempt from imputed interest if the borrower’s net investment income is under $1,000 for the year.

Practical tip: Even if you qualify for these exemptions, still create a written agreement. It protects both sides if the relationship sours.

A Little History: Why These Rules Exist

The gift tax was introduced in 1932 to stop wealthy families from transferring assets tax-free. AFR rules came later, in 1984, through the Deficit Reduction Act, to stop “sweetheart loans” with near-zero interest.

Before AFR, parents could “loan” children large sums at 0% interest, letting them invest the money and keep all profits without tax consequences. AFR closed that loophole.

Step-by-Step Guide: Lending Money Without Getting Hit With a Tax Penalty

Step 1: Put It in Writing

Use a promissory note—a legal document stating:

- Principal amount

- Interest rate (≥ AFR)

- Repayment schedule (monthly, quarterly, annually)

- Penalties for late payment

Step 2: Charge the Right Interest

Check the latest IRS AFR rates before finalizing terms.

Step 3: Keep a Paper Trail

- Make payments through bank transfers, not cash.

- Record every payment—date, amount, method.

Step 4: Report Interest Income

All interest must be reported on Schedule B with your tax return.

Step 5: If the Loan Fails

If the borrower defaults and you have documentation, you may claim a nonbusiness bad debt deduction—reported as a short-term capital loss.

Real-Life Case Studies

Case 1 – The Smart Lender

Mia loans $15,000 to her cousin at AFR with a written agreement. All payments are logged via bank transfers. She reports interest annually. Result? No IRS trouble.

Case 2 – The Costly Mistake

Jake “loans” his sister $50,000 without paperwork or interest. IRS reclassifies it as a gift. He files Form 709 and loses part of his lifetime exemption.

Case 3 – The Bad Debt Write-Off

David lends $30,000 at 4.5% AFR with a contract. After six months, the borrower stops paying. David documents multiple collection attempts, then deducts the loss as a bad debt.

State-Level Considerations

While the IRS rules apply federally, some states add their own twists:

- Connecticut has its own gift tax rules.

- California enforces written contracts over $500 for certain transactions.

Always check your state’s Department of Revenue.

Common Mistakes People Make

- Handshake deals — No record, no proof for IRS.

- No interest charged — Looks like a gift.

- Debt forgiveness without tracking — Can be taxable as a gift.

- Mixing personal & business loans — Causes confusion and audit risk.

Tax Planning Tips

- Break up large loans over several years to stay under annual gift limits.

- Loan when AFR is low—makes repayment easier and still IRS-compliant.

- Annual review—adjust interest if AFR changes.

- Forgive strategically—do so under the annual exclusion to avoid gift reporting.

NRI Students With Foreign Investments or Bank Accounts — The Income Tax Rules You Can’t Ignore

Wedding Gifts Not Taxable! ITAT Scraps ₹10 Lakh Cash Deposit Addition

India@100: Why Experts Say Fixing GST Could Unlock a Health Insurance Boom

Extra Example: Helping a Small Business Without Tax Trouble

If you lend $40,000 to a niece to start a coffee shop at AFR interest, with a 5-year repayment plan, you’re:

- Providing startup capital

- Earning legitimate interest income

- Staying within IRS rules

If she defaults, your documentation protects your right to claim a bad debt deduction.

Quick Action Checklist

- Draft a written promissory note

- Charge ≥ AFR interest rate

- Use bank transfers for all payments

- Record every transaction

- Report interest on taxes

- Check gift limits before forgiving debt