New Income Tax Bill Tackles Filing Delays: If you’ve ever been stuck waiting for your tax refund because you filed your return a little late—or maybe you just plain forgot to file on time—you’re going to like this. The New Income Tax Bill 2025 has passed both houses of Parliament in India, and it’s all about making life easier for taxpayers when it comes to filing returns and getting their money back. This isn’t just a small patch on an old system. We’re talking about replacing the Income Tax Act of 1961—a law that’s been running the show for over six decades. Imagine updating your smartphone after 64 years. The difference is night and day.

New Income Tax Bill Tackles Filing Delays

The New Income Tax Bill 2025 is the most significant tax reform in over 60 years. By ensuring refunds for late filers, simplifying the law, and shifting to a digital-first approach, it empowers taxpayers while maintaining compliance discipline. Filing remains mandatory, but the new rules make the process faster, clearer, and fairer.

| Feature | Details | Official Link |

|---|---|---|

| Refund for Late Filers | Even if you file late, you can still get your refund. | Income Tax India |

| Number of Sections | Reduced from over 800 to 536 for simplicity. | Press Release |

| Terminology Change | “Assessment Year” → “Tax Year” for clarity. | Gov Info |

| Digital Focus | Faceless assessments, pre-enforcement notices, online nil TDS certificates. | CBDT |

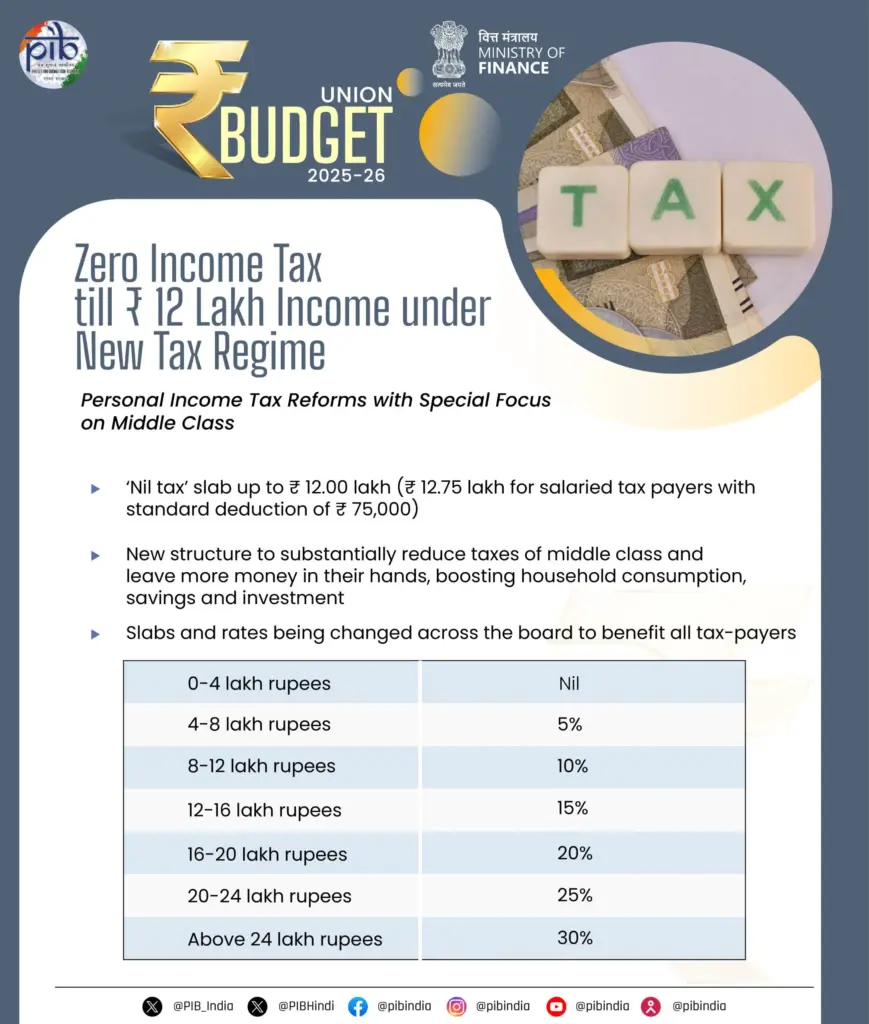

| Exemption Limit | Retained at ₹12 lakh annual income. | Budget 2025 |

| Effective Date | April 1, 2026 (pending Presidential approval). | Parliament Bill |

| Refund Stats | ₹1.35 trillion issued in refunds (April–Aug 2025), up 10% YoY. | Reuters Report |

Why This New Bill Matters?

Let’s face it—tax filing in India has been a bit like trying to find the last parking spot at a busy Walmart on Black Friday: confusing, stressful, and time-consuming. The Income Tax Act of 1961 was huge—over 800 sections, multiple confusing forms, and fine print that often left taxpayers scratching their heads.

The New Income Tax Bill 2025 is a complete cleanup. The government’s stated goals include:

- Cutting the clutter—down to 536 sections and just 23 chapters.

- Going digital-first—so you can file, respond, and get assessed entirely online.

- Clarifying refund rules—making it clear that late doesn’t mean lost when it comes to getting your money back.

A Quick Trip Down Memory Lane: Tax Refund Rules Then vs Now

Historically, late filers faced a tough time in India. While the law technically allowed delayed returns within certain timeframes, refunds for these cases were often delayed or disputed. In the 1980s and 1990s, taxpayers had to physically visit income tax offices, submit handwritten forms, and follow up multiple times to get refunds—sometimes waiting years.

With the introduction of e-filing in 2006, the system became faster, but refund eligibility for late filers remained a grey area. Many people avoided filing late altogether to dodge complications.

Old vs New System: What Changed?

| Feature | Old System (Pre-2025) | New System (Post-2025) |

|---|---|---|

| Refunds for Late Filing | Often unclear or delayed | Guaranteed if a return is filed |

| Law Size | 800+ sections, 40+ chapters | 536 sections, 23 chapters |

| Year Terminology | “Assessment Year” | “Tax Year” |

| Filing Process | Manual + online | Fully digital-first |

| Assessment | Physical meetings possible | Faceless, online-only |

| Advance TDS Relief | Limited | Nil TDS certificate available |

The Big Game-Changer: Refunds for Late Filers

Here’s the headline news: Even if you file late, you can still get your refund.

Before, if you missed the filing deadline (July 31 for most taxpayers), you could still file a belated return but faced uncertainty over whether the refund would be processed smoothly. The new bill eliminates that uncertainty.

Example: If you missed filing by July 31, 2027, but submitted your return in September, your refund will still be processed under the new rules.

But—You Still Have to File

Section 433 makes it clear: you must file a return to get a refund. No return, no refund—period. Think of it like placing an online order: no order, no delivery.

Other Key Changes

1. Terminology Shift

The term “Assessment Year” confused many taxpayers. From April 1, 2026, the government will switch to “Tax Year,” making it easier to understand which period your filing relates to.

2. Faceless Assessments

All assessments will be conducted online, reducing opportunities for corruption and speeding up dispute resolution. You’ll communicate through secure digital channels.

3. Nil TDS Certificates & Pre-Enforcement Notices

If you expect no tax liability, you can apply for a Nil TDS certificate to avoid unnecessary deductions. If there’s a compliance issue, the department will send a pre-enforcement notice before taking action.

How India Compares Globally?

In the United States, the IRS allows taxpayers to claim refunds for returns filed up to three years late. In Canada, the window is 10 years. Many European nations also have flexible refund rules, although deadlines vary.

India’s new approach puts it closer to the U.S. model—allowing refunds for late filings within the legal window, but keeping strict penalties for delays.

Step-by-Step Guide: Navigating the New Income Tax Bill Tackles Filing Delays

- Know Your Tax Year – Understand that the new terminology starts from April 1, 2026.

- Organize Your Documents Early – Collect Form 16, investment proofs, and deduction receipts.

- Check for Nil TDS – Saves money by avoiding overpayment.

- Aim to File on Time – Refunds are allowed late, but penalties remain.

- Track Refunds Online – Use the Income Tax Portal.

- Respond to Notices Promptly – The faster you respond, the quicker your case is resolved.

Real-Life Examples

Case Study 1 – Individual:

Ravi, a salaried professional, missed the FY 2026–27 deadline but filed in November. His ₹18,000 refund was processed in just 22 days—something that would have been rare under the old system.

Case Study 2 – Small Business:

A boutique owner had TDS deductions exceeding her liability. Filing two months late still got her refund within 21 days, without additional scrutiny.

Risks & Misconceptions

- Myth: “Late filing means no penalties now.”

Fact: Refunds are allowed, but late filing fees under Section 234F still apply. - Myth: “Refunds come automatically.”

Fact: Filing is mandatory—no return, no refund. - Myth: “The new bill means I can ignore deadlines.”

Fact: Penalties and interest still apply, and late filing may delay your refund.

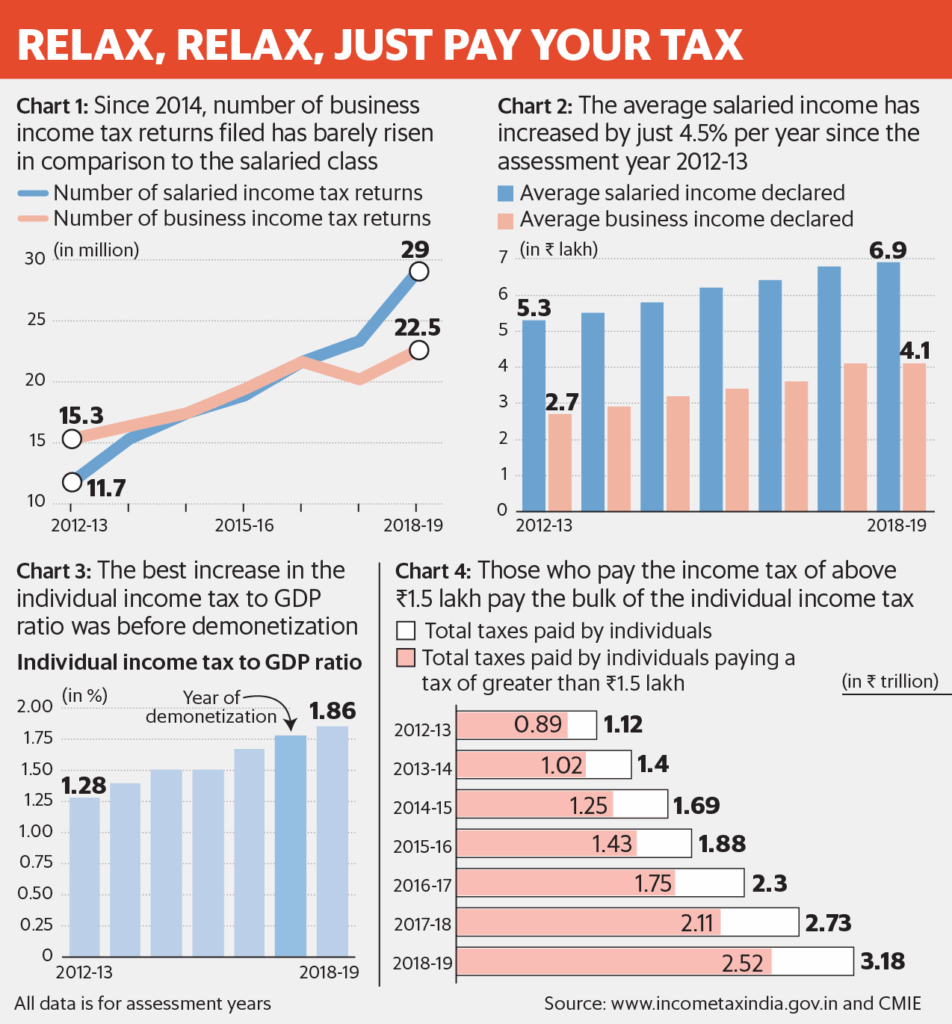

The Numbers Game

Between April 1 and August 11, 2025:

- ₹1.35 trillion was issued in refunds, a 10% increase from the previous year.

- Net direct tax collections fell 4% year-on-year, partly due to extended filing timelines and higher refund payouts.

Expert Commentary

According to a senior tax partner at a major audit firm:

“This reform brings India in line with international best practices while simplifying the compliance process. It sends a clear message—compliance is non-negotiable, but taxpayer rights will be protected.”

The move is also being welcomed by small and medium businesses, which often struggle with cash flow due to delayed refunds.

Why Professionals Should Care?

For chartered accountants, tax advisors, and financial planners, this reform:

- Reduces disputes over refund eligibility.

- Cuts administrative time through digital processes.

- Creates opportunities for offering value-added advisory services.

Action Checklist

- Note the April 1, 2026 start date.

- Gather financial documents early.

- Check for Nil TDS eligibility.

- File—even if late—to secure refunds.

- Monitor refunds and notices through the e-filing portal.

2025’s Most Important ITAT Rulings: Half-Yearly Income Tax Case Digest Reveals Critical Insights

Rajya Sabha Sends Back Manipur Budget Bill in Opposition’s Absence