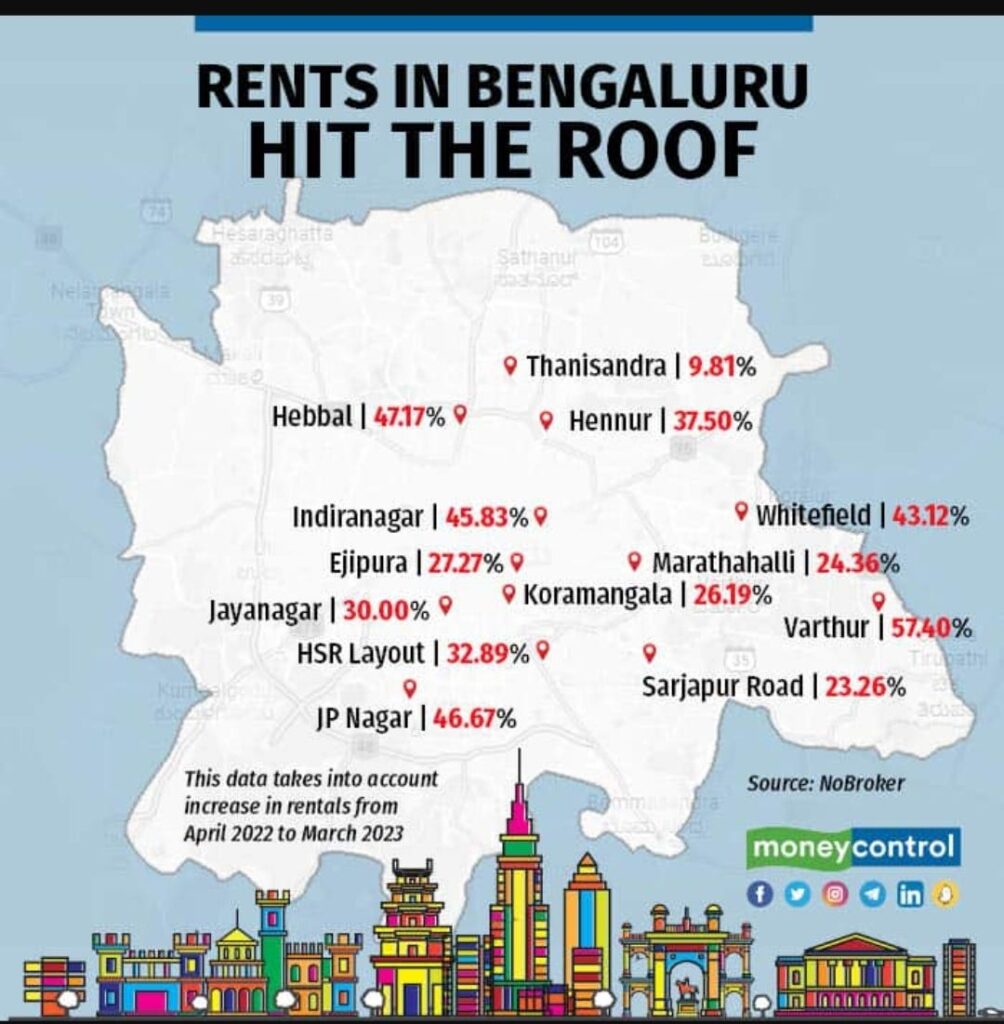

12% GST Dodge: When a Bengaluru paying guest (PG) accommodation slapped a plain white notice on its door—stating that rent must be paid in cash or else a 12% Goods and Services Tax (GST) would be added to online payments—it didn’t just raise eyebrows. It set off a digital wildfire. For the thousands of students, IT professionals, and newcomers in India’s Silicon Valley, this wasn’t merely about rent—it was about the battle between India’s digital economy push and old-school cash culture. In a city that powers India’s tech dreams, this rule hit like a hard glitch in the system.

12% GST Dodge

The Bengaluru PG cash-only GST controversy is more than a quirky landlord story—it’s a snapshot of India’s struggle to balance digital transparency with entrenched cash habits. For tenants, the safest path is clear: know the law, insist on GST invoices, and stick to traceable payments. For policymakers, this is a call to make compliance easier and enforcement sharper.

| Topic | Details |

|---|---|

| Incident | Bengaluru PG posted notice: “Cash rent only or pay 12% GST on online payments.” |

| Public Reaction | Over 31,000 views on Reddit; widespread criticism as tax evasion. |

| Tax Rule | GST applies to PG rentals above ₹1,000/day; payable regardless of payment mode. Official GST Info |

| Trend | Small vendors & landlords increasingly going cash-only to avoid audits. |

| Professional Impact | Tenants advised to request GST invoices for transparency. |

| Date | August 9, 2025 |

| Related Stats | Bengaluru has 15,000+ registered PGs; PG rental market worth ~$2B annually. |

How the Story Went Viral?

On August 9, 2025, Reddit user SKDgeek shared a photograph of a PG’s official-looking notice:

“Rent must be paid in cash. If paid online, 12% GST will be added.”

The post exploded in popularity, racking up 31,000+ views in just days. The comment section became an impromptu legal help desk.

One user wrote:

“This is straight-up tax evasion. Pay online and demand a GST invoice—they can’t refuse.”

Another chimed in:

“These guys are leeches. They make money but don’t want to contribute to the economy.”

The viral reaction wasn’t just fueled by anger—it was powered by a shared sense of unfairness and a fear that such practices might become the norm.

GST in India — The Legal Lowdown

The Goods and Services Tax (GST), rolled out in India in July 2017, was designed to unify the country’s fragmented indirect tax system. For accommodation services, the rules are straightforward:

- Applicability: PGs and hotels charging more than ₹1,000 per day must add 12% GST to the tariff.

- Collection: The landlord/operator is responsible for collecting GST and remitting it to the government.

- Invoice Requirement: A proper GST invoice must include GSTIN, rent amount, GST amount, and total payable.

- No Payment Mode Loophole: Whether you pay in cash, card, or UPI, GST still applies.

The cash-only workaround doesn’t legally erase the GST—it simply helps the operator skip reporting it. This is similar to U.S. hotel occupancy taxes, which must be collected regardless of payment method.

Why the Cash-Only Trend Is Growing?

This Bengaluru PG isn’t an isolated case. Across many Indian cities, landlords and small vendors are ditching digital payments. Here’s why:

Fear of Audits

Digital transactions leave a record. When tax filings don’t match deposits, authorities can initiate audits—resulting in fines or even criminal charges.

Skipping GST Liability

With cash, landlords can collect rent without showing it in official books. That means keeping the GST amount instead of passing it to the government.

Avoiding Paperwork

Monthly GST filings, invoice generation, and tax reconciliation can feel overwhelming for small business owners without professional help.

Expert Insights

Rajiv Mehta, a Bengaluru-based tax consultant, explains:

“There’s a misconception that paying in cash exempts you from GST. It doesn’t. The liability exists regardless of the mode of payment. But cash makes underreporting easier—and harder to detect.”

According to Mehta, penalties for evasion can include:

- A fine of 10% to 100% of the tax due

- Interest on unpaid tax

- In extreme cases, imprisonment under GST laws

How Tenants Get Hurt?

Whether you’re a college student, a young tech worker, or a relocating corporate employee, cash-only rules create risks:

- Overpayment Without Proof: You could pay GST in cash without getting an official receipt—meaning you have no proof you paid it.

- Lost Reimbursements: Many companies require GST invoices to process housing reimbursements.

- No Legal Trail: Without a digital record, you have no paper trail in case of disputes.

Steps to Protect Yourself from 12% GST Dodge?

Step 1: Check If GST Applies

If your daily rent is above ₹1,000, GST applies—no matter what the landlord says.

Step 2: Request a GST Invoice

An official GST invoice protects you in disputes and ensures the landlord is remitting the tax.

Step 3: Pay Digitally

Use UPI, bank transfer, or card for proof of payment.

Step 4: Report Violations

You can file complaints via the GST Grievance Portal.

Case Study — The Real Cost of a “Cash Discount”

Imagine your PG rent is ₹36,000/month (~$430), which works out to ₹1,200/day. GST applies.

- With GST and invoice: ₹36,000 + ₹4,320 GST = ₹40,320

- Cash dodge: ₹36,000 flat, no proof, no legal protection

It might feel like you’re saving ₹4,320, but in reality, you’re colluding—knowingly or not—in tax evasion, and you lose all legal safeguards.

Comparisons to the U.S.

In the United States, similar situations occur in short-term vacation rentals. Some Airbnb or VRBO hosts ask guests to pay in cash to avoid platform fees and taxes. Just like India’s GST law, U.S. tax law still applies whether the transaction is cash or digital.

The IRS requires all rental income to be reported. Landlords who skip this can face back taxes, penalties, and even criminal charges.

Historical Context — India’s Cash vs. Digital Battle

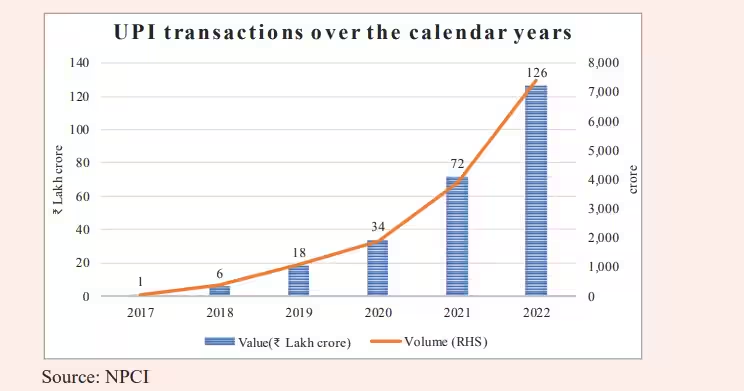

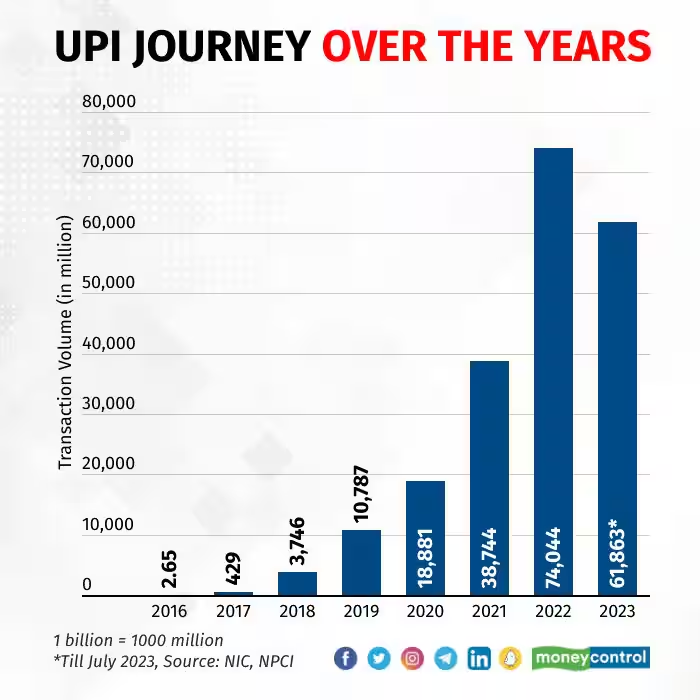

Since the 2016 demonetization, India’s government has aggressively promoted digital payments. The launch of Unified Payments Interface (UPI) transformed everyday transactions—handling over 14 billion transactions in July 2025 alone.

But despite UPI’s growth, old habits die hard. Many small businesses still prefer cash for flexibility, speed, and, unfortunately, the ability to stay under the radar.

Economic Impact

Bengaluru’s PG industry is valued at over $2 billion annually, serving a transient population of students, IT workers, and contract employees. Even if 5% of operators evade GST, that could mean tens of millions in lost government revenue each year—money that could fund infrastructure, housing, or education.

Enforcement in Action

In July 2024, Karnataka’s Commercial Tax Department cracked down on several hotels and PGs for cash-only bookings without GST remittance. Penalties included:

- Heavy fines

- Temporary license suspensions

- Public naming in compliance bulletins

Additional Tenant Rights to Remember

- You have the right to a receipt for any rent paid, cash or digital.

- GST amount must be shown separately on the invoice.

- GSTIN must be valid—check it on the GST Portal.

Vodafone Idea Faces ₹21.39 Crore GST Penalty for Alleged Short Payment Under RCM!

Tax Evasion Raids Conducted on Leading Salons in Chandigarh by Excise and GST Officials

BJP Labels GST Bill a ‘Formality’—AAP Calls It a ‘House Insult’