India’s Broken Tax System Is Crippling the Circular Economy Revolution: If you’ve been following the global push for sustainability, you’ve probably heard about the circular economy—that big, bold idea where nothing goes to waste, and we keep resources spinning in a never-ending loop of reuse, repair, and recycling. Sounds like the future, right? Well, in India, that future is hitting a pretty nasty roadblock: the country’s tax system. And we’re not talking about a tiny speed bump; this is more like a full-on road closure, making it incredibly hard for the circular economy to gain momentum.

India’s Broken Tax System Is Crippling the Circular Economy Revolution

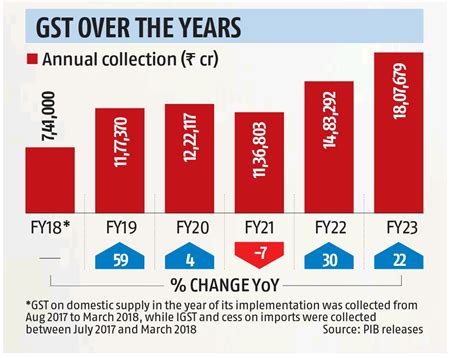

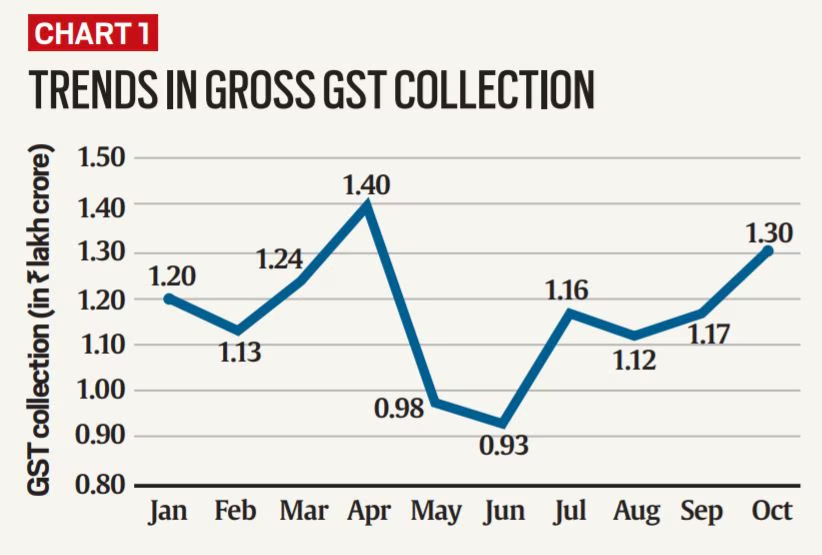

India’s tax system is unintentionally sabotaging its own sustainability goals. By taxing recycled goods and virgin materials equally, it discourages recycling, pushes workers into unsafe informal jobs, and costs billions in lost revenue. The fix is straightforward: smarter GST rates, tax credits, and small-business-friendly policies. If India aligns its tax policy with circular economy principles, it could unlock economic growth, create safer jobs, and lead the world in sustainable innovation.

| Aspect | Details |

|---|---|

| GST on recycled materials | 18% — same as virgin materials, killing cost advantage |

| Annual revenue loss due to tax distortions | ₹65,000 crore ($7.8B USD) |

| Projected loss by 2035 if unreformed | ₹86,700 crore ($10.4B USD) |

| Impact on workers | Pushes recyclers into informal sector, unsafe jobs, no benefits |

| Proposed reform | Lower GST on recycled goods, tax credits for circular services |

| Official GST rates | GST Council India |

The Problem

Here’s the short version: India charges the same 18% Goods and Services Tax (GST) on recycled materials as it does on brand-new, “virgin” materials. That means if you buy recycled steel or refurbished electronics, you pay just as much tax as if you bought fresh-off-the-factory-floor stuff. This kills the economic advantage of recycling—why pay the same for something recycled if you can get something brand-new for the same price? It’s like paying full sticker price for a used car when a new one is available for the same cost.

How India’s Broken Tax System Is Crippling the Circular Economy Revolution?

1. Push to the Shadows

Many recycling businesses—especially small scrap dealers, e-waste refurbishers, and repair shops—can’t keep up with GST paperwork and compliance costs. So, they skip formal registration altogether, operating in the informal economy.

The results are harsh:

- No workplace safety rules

- No healthcare, retirement, or insurance benefits

- Dangerous exposure to toxic materials like lead, mercury, and industrial waste

2. Government Loses Billions

The Centre for Science and Environment (CSE) estimates India loses ₹65,000 crore ($7.8 billion) annually due to tax distortions in the waste sector. If reforms aren’t made, that figure will soar to ₹86,700 crore ($10.4 billion) by 2035—money that could fund renewable energy projects, education, and healthcare.

3. Honest Players Get Squeezed

Companies that register for GST and play by the rules face stiff competition from those avoiding taxes entirely. In effect, the system penalizes those who comply and rewards those who don’t, making formal sector recycling financially unsustainable.

Sector-by-Sector Damage

Electronics

India is drowning in e-waste. Refurbished laptops, smartphones, and appliances could be a huge part of the solution. But with refurbished products taxed at 18%, they’re nearly as expensive as new imports. This discourages buyers and slows down the e-waste recycling rate.

Plastics

PET bottles and other plastics can be recycled into new packaging, textiles, or construction materials. Yet, equal GST rates make virgin plastic just as cheap, pushing companies to skip recycled content.

Metals

Recycling metals like steel and aluminum can cut energy use by up to 95% compared to making them from ore. Still, with no tax advantage, manufacturers stick to virgin materials.

Textiles

India’s secondhand clothing and thrift market is underdeveloped compared to the U.S. or Europe. High tax rates make it harder for resale businesses to compete with fast fashion.

Why the U.S. Should Care About This?

India’s recycling crisis isn’t just India’s problem:

- Global supply chains: American manufacturers sourcing materials from India could face higher costs if recycled supply stays weak.

- Climate change: More virgin production means more emissions—affecting the entire planet.

- Business opportunities: U.S. firms in recycling technology and sustainable manufacturing could find major growth in India—if the tax system allowed it.

Global Case Studies: How Others Do It Better

European Union

Many EU nations offer reduced VAT on repair services, recycled products, and refurbished electronics. Sweden gives a tax break for repairing appliances and bikes, encouraging consumers to fix rather than replace.

United States

Several states incentivize recycling with tax credits, grants, or mandates for recycled content. California’s Recycled Content Packaging Law requires beverage bottles to contain at least 15% recycled material.

Japan

Japan enforces strict recycling laws and offers subsidies to companies using recycled materials, especially in electronics, where “urban mining” of e-waste is highly profitable.

The pattern is clear: when governments financially reward sustainable practices, recycling grows and thrives.

Breaking Down the Fix

1. Lower GST on Recycled Goods

Reduce GST from 18% to 5% on recycled materials. This would create a clear cost advantage and drive demand for sustainable inputs.

Example: If a furniture maker can save 10–15% by using recycled wood, it’s a win for the bottom line and the environment.

2. Input Tax Credit (ITC) for Circular Services

Let businesses claim full ITC on purchases of recycled goods, refurbished items, or repair services, making circular practices financially attractive.

3. Tax Breaks for Small Players

Introduce a simplified GST scheme for small recyclers and refurbishers to bring them into the formal sector without heavy compliance burdens.

4. Separate GST Slab for Refurbished Products

Refurbished goods—like electronics, appliances, and furniture—should be taxed at a lower rate than new products to encourage reuse.

Step-by-Step Guide for Policymakers

- Identify key circular economy sectors: recycling, repair, refurbishment, and resale.

- Adjust GST rates to make recycled and refurbished goods cheaper than virgin materials.

- Simplify compliance for small and micro players.

- Run nationwide campaigns promoting the benefits of buying recycled or refurbished.

- Track and publish results—measuring waste diversion, job creation, and revenue impact.

Action Tips for Businesses

- Advocate for GST reform through trade bodies and industry groups.

- Promote recycled content in marketing to show environmental and cost benefits.

- Partner with NGOs for worker training and safety compliance.

What Consumers Can Do

- Ask for products with recycled content.

- Choose refurbished electronics—they’re often just as good as new, but cheaper and greener.

- Support brands committed to sustainable sourcing, even if it costs a bit more.

Real-Life Story

Meet Ramesh, an e-waste recycler in Delhi. He tried going fully legit—registering for GST, filing returns, and paying taxes. Within months, his costs went up by 20%, while competitors in the informal market sold at lower prices by skipping taxes altogether. To survive, he now operates partly off the books, despite wanting to comply with the law. His story isn’t unique—it’s a reality for thousands in the sector.

Extra Insights: Hidden Costs of Inaction

If India doesn’t fix its tax system, here’s what’s at stake:

- Environmental damage: More landfill waste, toxic leaching, and greenhouse gas emissions.

- Lost jobs: Formal recycling can provide stable employment; informal work remains unsafe and unstable.

- Missed economic opportunity: A robust recycling industry could contribute billions to GDP and attract foreign investment.

Tax Evasion Raids Conducted on Leading Salons in Chandigarh by Excise and GST Officials

India@100: Why Experts Say Fixing GST Could Unlock a Health Insurance Boom

Supreme Court Denies Plea Challenging GST ECL Blocking Relief