$496 GST/HST Credit Confirmed for 2025: If you’ve been hearing chatter about the $496 GST/HST Credit for 2025, you might be wondering: “Is that number accurate, and what does it mean for my wallet?” The truth is, while there’s a kernel of truth behind that figure, the real amounts for 2025 are actually higher for most Canadians. And yes—it’s real money, tax-free, sent straight to your bank account if you qualify. This article breaks it all down—what the GST/HST Credit is, who qualifies, how much you can expect, and when the payments arrive—in plain English that anyone can understand, while also offering insights for professionals who want all the details.

$496 GST/HST Credit Confirmed for 2025

The 2025 GST/HST Credit offers more than just the outdated $496 figure—it provides up to $533 for singles, $698 for couples, and $184 per child under 19. Payments arrive quarterly in January, April, July, and October, and many provinces add their own top-ups. By filing your taxes, keeping your information current, and using smart tax planning, you can maximize this tax-free benefit.

| Item | Details |

|---|---|

| Annual Max for Singles | $533 (not $496) |

| Annual Max for Couples | $698 |

| Annual Amount per Child Under 19 | $184 |

| Eligibility | Must be a Canadian resident, 19+, or a parent/spouse; meet income limits |

| Income Threshold (Single) | ~$52,255 adjusted family net income |

| Income Threshold (Family with 4 Kids) | ~$69,015 |

| Payment Dates (2025) | Jan 3, Apr 4, Jul 4, Oct 3 |

| Source | Canada.ca Official GST/HST Credit Info |

What Is the GST/HST Credit and Why It Exists

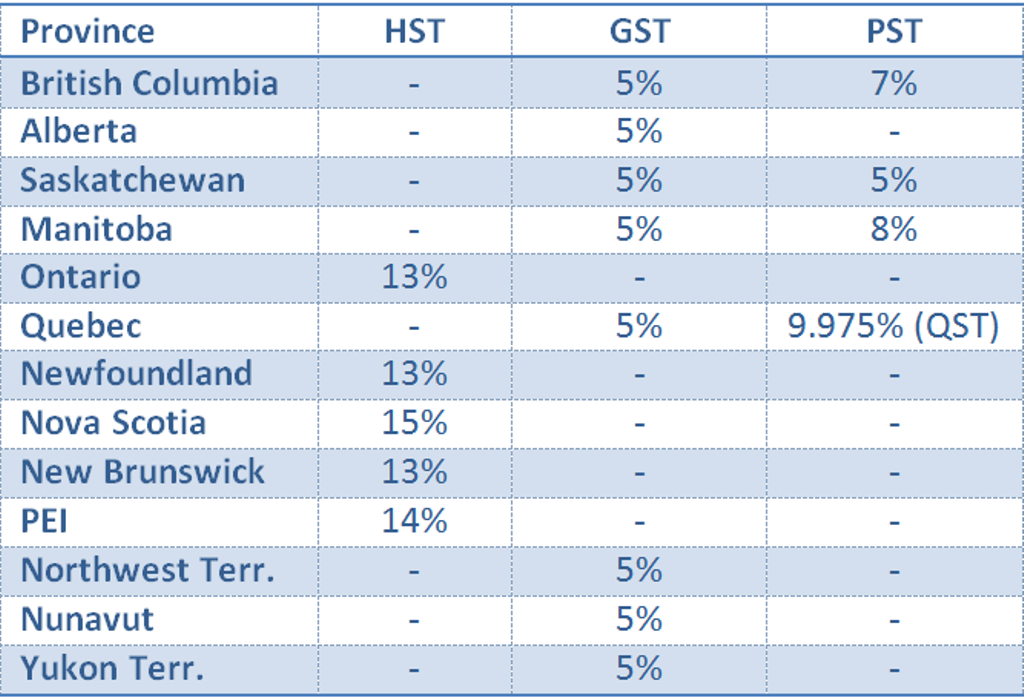

The GST/HST Credit is a quarterly, tax-free payment from the Government of Canada. It’s meant to help lower and modest-income Canadians offset some of the GST (Goods and Services Tax) or HST (Harmonized Sales Tax) they pay throughout the year on goods and services.

Here’s why it exists: GST is a consumption tax—every time you buy something taxable, you pay a percentage on top of the price. For example:

- Buy a $100 jacket in a GST-only province? You’ll pay $105.

- Buy the same jacket in an HST province with a 13% rate? You’ll pay $113.

The government knows this tax hits lower-income households harder, so the GST/HST Credit is essentially a refund to level the playing field.

The Truth About the $496 GST/HST Credit Confirmed for 2025?

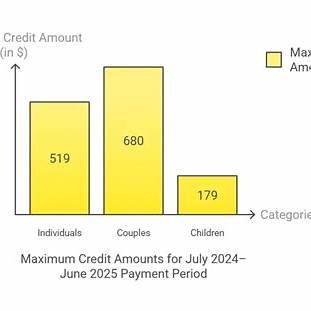

The $496 number floating around isn’t made up—it’s just outdated. It was the annual maximum for singles several years ago. For 2025, the official CRA amounts are:

- $533 for singles

- $698 for married/common-law couples

- $184 for each child under 19

Example: A single parent with two children would receive:

$533 + (2 × $184) = $901/year, split into four quarterly payments.

How Much You Can Get in 2025

For the July 2025–June 2026 payment period (based on your 2024 tax return):

- Single individual: $533/year (~$133 per quarter)

- Married/common-law couple: $698/year (~$174 per quarter)

- Each child under 19: +$184/year (~$46 per quarter)

If your quarterly amount is less than $50, CRA will combine it into a lump sum and pay it in July.

Who Qualifies?

You must meet all of these:

- Be 19 or older before the month of your first payment, OR be married/common-law, OR be a parent living with your child

- Be a Canadian resident for tax purposes

- File a tax return, even if your income is zero

Income thresholds:

- Single: ~$52,255

- Married/common-law with 4 children: ~$69,015

How CRA Calculates the GST/HST Credit?

The CRA bases your eligibility and amount on:

- Your adjusted family net income from your previous year’s tax return (for 2025 payments, they use your 2024 return).

- The number of people in your family (spouse, common-law partner, children under 19).

- The annual base amounts set by the federal government, adjusted for inflation.

If your income is above a certain threshold, the credit is gradually reduced until it reaches zero.

When You’ll Get Paid?

The GST/HST Credit is paid quarterly:

- January 3, 2025

- April 4, 2025

- July 4, 2025

- October 3, 2025

If you set up direct deposit with CRA, you’ll usually see the payment the same day. Paper checks can take longer.

Step-by-Step Guide to Ensure You Get the $496 GST/HST Credit Confirmed for 2025

- File your 2024 tax return, even if you have no income.

- Keep your marital status and dependent information up to date with CRA.

- Sign up for CRA My Account to track eligibility and payment details.

- Set up direct deposit for faster payments.

Historical Context — How the Credit Has Grown

When the credit started in the early ‘90s, the amounts were much smaller—under $200 for singles. Over the decades, the government has adjusted the amounts for inflation and cost-of-living changes. In 2010, singles could get up to about $250/year; today, that’s more than doubled.

Provincial and Territorial Top-Ups

In addition to the federal GST/HST Credit, some provinces offer their own top-ups:

- Ontario Sales Tax Credit

- BC Climate Action Tax Credit

- Newfoundland and Labrador Income Supplement

- New Brunswick Harmonized Sales Tax Credit

These are often paid on the same schedule as the federal credit.

How Inflation Adjustments Work?

The federal government reviews the GST/HST Credit annually. They apply an inflation adjustment factor based on the Consumer Price Index (CPI). This ensures the credit keeps pace with the rising cost of goods and services.

For example, if inflation is 3%, the maximum credit amounts are increased by about 3% for the next payment year.

How the Credit Impacts Cost of Living?

For some households, the GST/HST Credit covers:

- A week’s worth of groceries

- A utility bill

- Several tanks of gas

- School supplies for children

It may not seem huge, but when combined with provincial credits and other benefits like the Canada Child Benefit, it can make a real difference in monthly budgeting.

Tax Planning Tips to Maximize Your Credit?

- Contribute to an RRSP to lower your net income and increase your eligibility.

- Update CRA immediately if your marital status changes to avoid overpayment clawbacks.

- If your income fluctuates, consider timing deductions and contributions to stay under the threshold.

Scenarios

Single person earning $30,000: Full $533/year.

Couple earning $55,000 with one child: $698 + $184 = $882/year.

Single parent earning $40,000 with two kids: $533 + $368 = $901/year.

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay

Gold and Silver Traders Demand GST Reduction to 1% on Gold Jewellery