Trader Faces GST Heat: When it comes to taxes, ignoring official notices is like ignoring your smoke alarm — it’s going to catch up with you sooner or later. Recently, the Delhi High Court handed down a strong message to business owners in India: you can’t just ghost the tax department and expect a happy ending. In a high-profile case, the Court upheld a GST demand against a trader who skipped a personal hearing and never filed a reply to tax authorities. The trader’s defense? He rarely checked the GST portal. The Court wasn’t buying it. The result — petition dismissed, GST demand upheld, and a ₹50,000 fine slapped on top.

Trader Faces GST Heat

The Delhi HC’s ruling sends a clear message: silence is costly in the age of digital taxation. Whether you’re a street-side trader in Delhi or a tech entrepreneur in California, the principles are the same — check your notices, respond on time, and keep your compliance tight. In a digital-first tax system, what you don’t know will hurt you.

| Point | Details |

|---|---|

| Case Name | Ganpati Polymers (Proprietor: Ankur Jain) vs. Commissioner of CGST & Another |

| Court | Delhi High Court (Justices Prathiba M. Singh & Renu Bhatnagar) |

| Core Issue | Trader failed to respond to GST notices or attend hearings |

| GST Demand | ₹50.33 crore over alleged fraudulent Input Tax Credit (ITC) |

| Trader’s Defense | Rarely checked GST portal |

| Court’s Stand | Ignorance of portal updates is no excuse |

| Penalty | Petition dismissed + ₹50,000 cost |

| Official Reference | Goods and Services Tax India |

The Case in Plain English

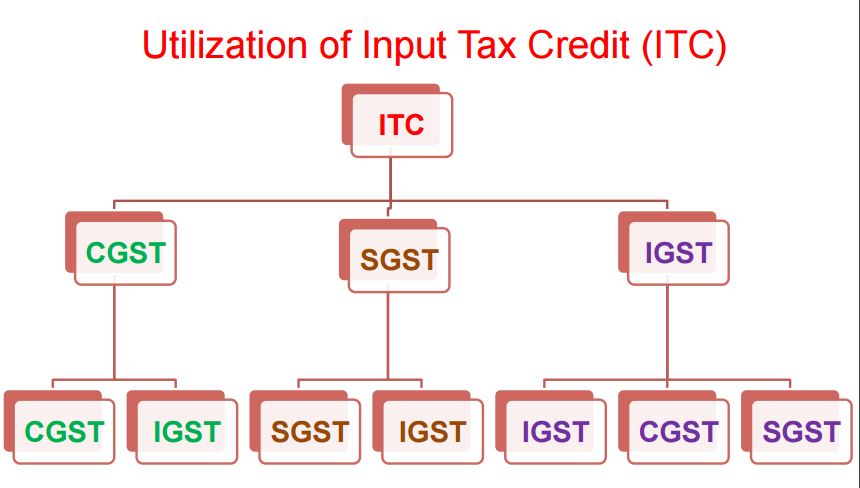

The Goods and Services Tax (GST) system in India is a fully digital regime — meaning most notices, hearings, and communications happen online, on the official GST portal. That’s like the IRS in the U.S. sending you updates through your online tax account instead of mailing letters. Ganpati Polymers, run by Ankur Jain, was accused of wrongly claiming Input Tax Credit (ITC) worth over ₹50 crore. ITC lets you reduce your tax liability by offsetting the GST you’ve already paid on purchases. But claiming it without valid underlying transactions? That’s a straight ticket to serious trouble.

The GST department issued multiple notices for hearings and asked for a reply. Instead of appearing or submitting documents, Jain did nothing. Later, he told the Court he wasn’t aware of the updates because he didn’t check the GST portal often. The Delhi High Court’s reaction was straightforward: You can’t blame the system for your own negligence.

How GST Notices Work?

Under Section 169 of the CGST Act, serving notices via the GST portal is considered legally valid service. This means:

- Once a notice is uploaded, it’s deemed delivered.

- There’s no legal obligation for the department to send physical letters.

- The clock for compliance starts ticking from the date of upload.

The system works much like a registered digital mailbox. If you ignore it, the law still considers you “informed.”

Why the Court Rejected the Trader’s Argument?

The Bench made several important points:

- Digital-first policy is intentional — GST was designed to be paperless to improve efficiency and transparency.

- Checking the portal is a taxpayer’s duty — Ignoring it is equivalent to ignoring a registered letter.

- Business scale matters — A trader dealing with transactions worth crores cannot claim ignorance of basic compliance steps.

- Pattern of negligence — This was not a single missed notice; the trader had ignored repeated opportunities.

The Court also underscored that allowing such excuses would set a dangerous precedent, undermining the efficiency of the GST system.

Background: GST and ITC Explained

Introduced in July 2017, GST replaced a complex web of central and state taxes with a single, unified tax. Its core features:

- Destination-based: Tax is collected where goods/services are consumed.

- Multi-stage levy: Tax applies at every stage of the supply chain.

- ITC Mechanism: Businesses can claim credit for tax paid on inputs, reducing double taxation.

The ITC mechanism is both GST’s biggest advantage and its biggest fraud risk. False claims can involve fake invoices, non-existent suppliers, or inflated purchase values.

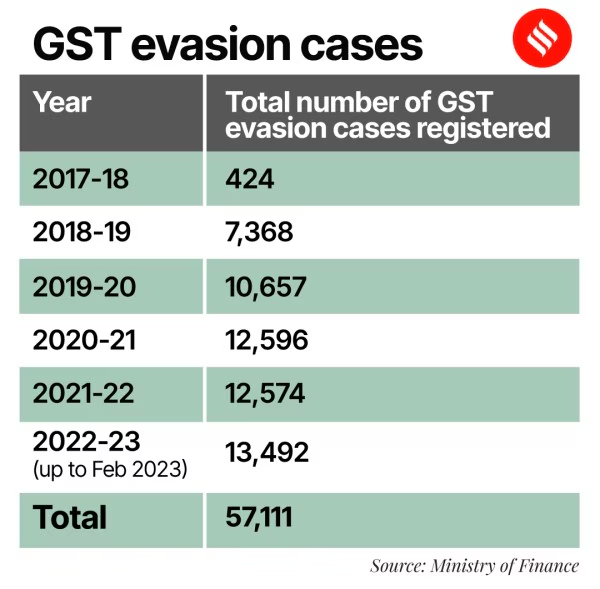

Fraudulent ITC — A Widespread Issue

According to CBIC data, ₹57,000 crore worth of fake ITC claims were detected in FY 2022–23 alone. In many cases:

- Companies set up shell entities solely to generate fake invoices.

- Fraud rings operate across multiple states to exploit tax credits.

- Small traders get caught when relying on dishonest suppliers.

Such frauds hurt government revenue and distort fair market competition.

Lessons for Business Owners and Professionals As Trader Faces GST Heat

1. Always Monitor the GST Portal

Treat your GST portal like your business bank account — check it regularly.

Pro Tip: Set recurring calendar alerts or automate notifications via GST Suvidha Providers.

2. Respond to Every Notice

Even if you believe the notice is wrong, reply within the given time. Silence equals acceptance.

3. Keep Thorough Records

Maintain invoices, contracts, and receipts for at least six years, as per GST rules.

4. Engage Professionals

Tax consultants or accountants can save you from costly errors. Consider this a business necessity, not a luxury.

Compliance Tips for Small and Medium Businesses

Small teams often lack the resources for dedicated compliance staff. Here’s how to stay on top:

- Cloud accounting tools: Integrate GST filings with automated alerts.

- Shared responsibility: Assign portal-checking duties to more than one person.

- Vendor vetting: Verify supplier GST filings before claiming ITC.

- Monthly reviews: Reconcile purchase and sales data to ensure consistency.

Expert Commentary

“This judgment reinforces a golden rule — tax compliance is proactive, not reactive,” says Ramesh Mehta, a Delhi-based GST consultant with over 20 years in indirect taxation.

He adds, “If your business lacks the bandwidth to monitor the portal, outsource it. The cost of outsourcing is nothing compared to the damage from a missed notice.”

Consequences of Ignoring GST Notices

- Financial Loss: Tax demand, interest, and penalties.

- Loss of ITC: Credits claimed may be reversed.

- Legal Action: Persistent non-compliance can lead to prosecution.

- Reputational Damage: Legal disputes can hurt partnerships and customer trust.

International Perspective

The Delhi HC’s stance mirrors trends in other countries:

- U.S.: The IRS considers e-notices legally binding. Missing them can trigger audits or liens.

- UK: HMRC’s “Making Tax Digital” program mandates digital VAT reporting, with penalties for late or missing submissions.

- Australia: The ATO communicates primarily via online business portals; failure to check them is not an acceptable defense.

Globally, the shift is toward digital responsibility — taxpayers must adapt.

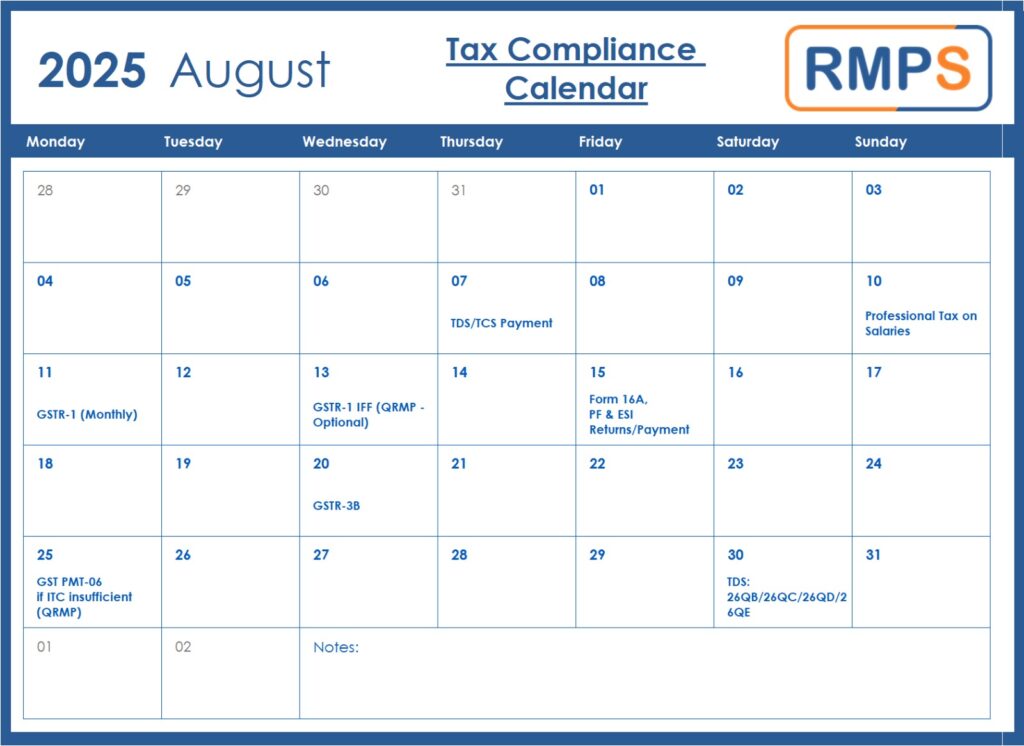

Step-by-Step Guide to GST Compliance

Step 1: Regular Logins

Check the GST portal at least once a week.

Step 2: Enable Alerts

Use third-party compliance tools or in-house systems to get real-time updates.

Step 3: Record Keeping

Maintain digital and paper copies of all transactions.

Step 4: Vendor Verification

Ensure your suppliers are GST-compliant before claiming ITC.

Step 5: Timely Response

Address every notice within the stipulated time.

Similar Cases in Recent Years

- 2022, Chennai: Exporter lost ₹3.2 crore ITC for ignoring multiple hearing notices.

- 2023, Gujarat: Trader hit with ₹7 crore liability after claiming ITC from a ghost supplier.

- 2021, Mumbai: Court upheld ₹1.8 crore demand where taxpayer cited “email issues” as reason for non-response.

In each case, the courts maintained that procedural negligence is no excuse under GST.

Tusharkanti Satapathy Joins GST Appellate Tribunal as New Member

Gold and Silver Traders Demand GST Reduction to 1% on Gold Jewellery

Fake ITC & Duplicate GST Demand: Delhi HC Declines Writ, Orders Appeal Route