Infosys Fined by Singapore Over GST Payments: When the headline “Infosys fined by Singapore over GST payments” hit the news, it wasn’t just a blip in the business section — it caught the attention of professionals across the tech, finance, and compliance worlds. If one of the world’s most respected IT service companies can get snagged by a tax compliance issue, it’s worth asking: Could this happen to me or my company? The truth is, tax compliance isn’t just about paying on time — it’s about accuracy, documentation, and a deep understanding of each country’s rules. Let’s break down the story, why it matters, and what lessons both big corporations and small businesses can learn.

Infosys Fined by Singapore Over GST Payments

The Infosys GST fine in Singapore is a reminder that no company — no matter how experienced — is immune from compliance issues. While this specific case has no material impact on Infosys’ operations, it offers a clear lesson: understand the rules, automate your processes, and keep your records airtight. For companies of any size, compliance isn’t just about avoiding penalties — it’s about building trust, protecting your brand, and ensuring long-term growth.

| Key Point | Details |

|---|---|

| Penalty Amount | SGD 97,035.90 (~₹66 lakh) |

| Authority Involved | Inland Revenue Authority of Singapore (IRAS) |

| Period Concerned | April – June 2025 |

| Date of Notification | August 13, 2025 |

| Impact | No material impact on operations or finances |

| Related News | Infosys acquiring Versent Group from Telstra |

| Official Website | IRAS Official Site |

What Happened With Infosys?

On August 13, 2025, Infosys disclosed in a stock exchange filing that it had been fined SGD 97,035.90 (about ₹66 lakh) by the Inland Revenue Authority of Singapore (IRAS) for an issue related to Goods and Services Tax (GST) covering the April–June 2025 period.

The company was quick to reassure stakeholders:

“There is no material impact on financials, operations or other activities of the company.”

That statement might calm investors, but it doesn’t erase the fact that even companies with sophisticated compliance teams can run into trouble in cross-border tax matters.

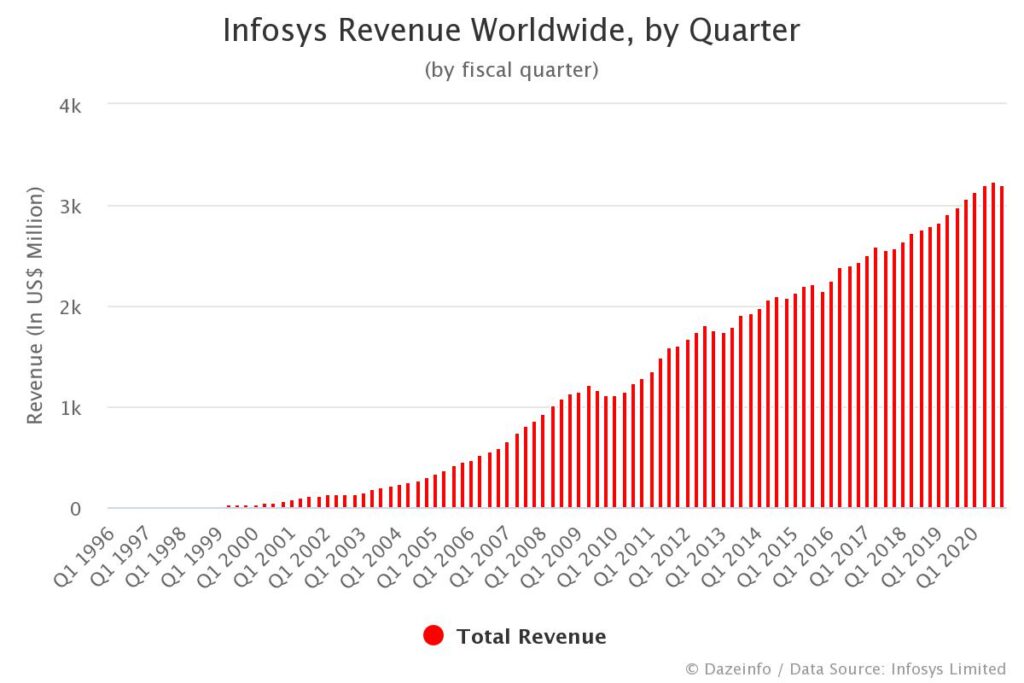

Infosys: A Global Tech Heavyweight With a Compliance Track Record

Infosys, founded in 1981 in Pune, India, has grown from a seven-person startup into a $18+ billion global enterprise with over 330,000 employees. The company operates in more than 50 countries, offering everything from cloud migration to AI-based analytics.

Historically, Infosys has had a clean record when it comes to tax compliance, but like any multinational, it occasionally faces inquiries and audits. The complexity of operating in multiple tax regimes means even the best-run companies face periodic issues.

For example:

- In 2022, Infosys addressed queries from the Indian tax authorities over indirect tax filings — all resolved without major penalties.

- In 2024, it navigated Australia’s GST compliance smoothly while expanding its client base there.

This latest fine in Singapore appears to be a one-off administrative issue rather than a systemic problem.

Infosys Fined by Singapore Over GST Payments: What You Need to Know

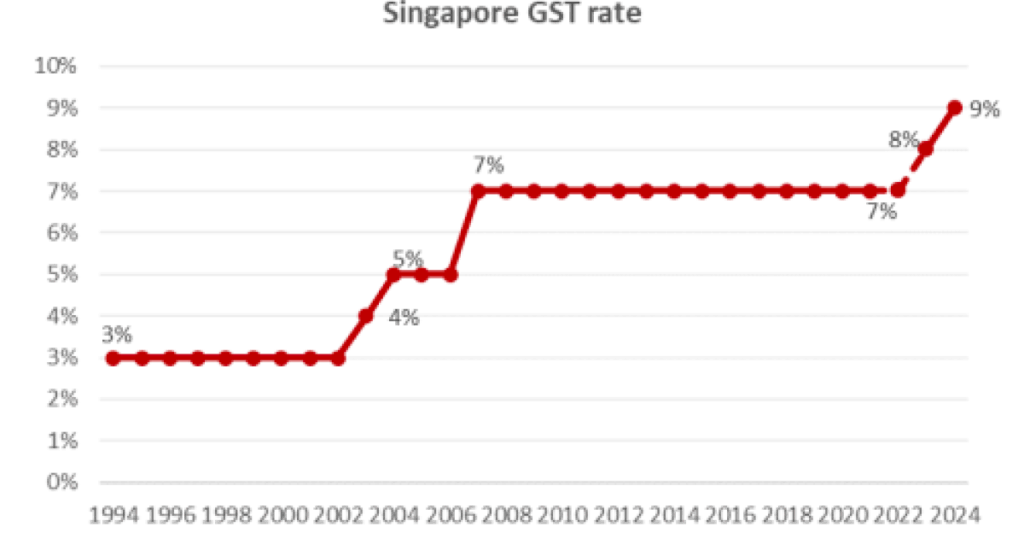

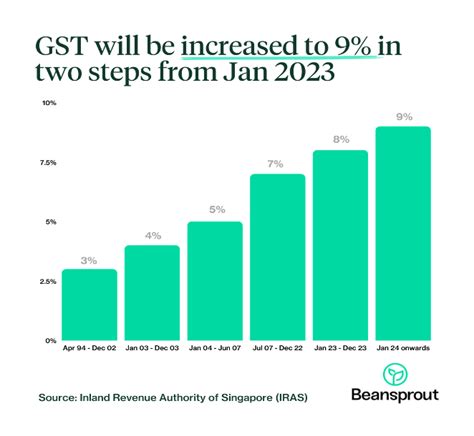

Singapore’s Goods and Services Tax (GST) is a value-added tax applied to most goods and services. Here’s a breakdown:

- Current Rate: 9% (effective January 2024)

- Who Must Register: Businesses with an annual taxable turnover of SGD 1 million or more must register for GST.

- Filing Frequency: Usually quarterly, with returns due one month after the period ends.

- Penalties:

- 5% late payment penalty on the unpaid tax amount

- Additional 1% interest per month if still unpaid

- Potential prosecution for repeated non-compliance

Example:

If your company bills SGD 1,000,000 in taxable sales for a quarter, you owe SGD 90,000 in GST. Pay that late, and IRAS can tack on SGD 4,500 (5%) immediately — plus interest.

How GST Differs From U.S. Sales Tax?

For U.S. readers, GST isn’t exactly the same as sales tax. Here’s the difference:

- GST: Charged at every stage of the supply chain, but businesses can claim credits for GST paid on purchases.

- Sales Tax: Charged only at the final sale to consumers, with no input credit system.

In short, GST requires more documentation and more frequent reconciliations than most U.S. state sales taxes.

Other Global Companies That Have Faced Tax Penalties

Infosys is not the first multinational to hit a compliance snag:

- Google paid €500 million in France (2019) to settle a long-running tax dispute.

- Apple was ordered to pay €13 billion in back taxes to Ireland (2016) by the European Commission.

- Nike faced scrutiny in 2021 over its European tax arrangements, leading to reputational questions even without direct fines.

These cases underline that complex tax environments can trip up even the most compliance-focused organizations.

The Business Risks Beyond the Fine

For Infosys, SGD 97,000 is negligible — but the risks for smaller companies can be far greater:

- Cash Flow Impact: A large fine can disrupt budgets, especially for SMEs.

- Reputational Damage: Even minor penalties can erode customer and investor trust.

- Regulatory Scrutiny: One penalty can lead to more frequent audits.

The real cost of non-compliance isn’t always the fine — it’s the ongoing scrutiny and potential reputational hit.

Red Flags That Can Lead to Tax Penalties

Here are some common pitfalls companies should watch out for:

- Incorrect GST calculation on cross-border transactions.

- Failure to account for currency fluctuations in multi-currency invoices.

- Missing zero-rated supply documentation for exports.

- Delayed or missing filings due to time zone differences in global operations.

Step-by-Step Guide to Staying Compliant

Whether you’re a startup or a multinational, these steps can keep you on the safe side:

Step 1: Understand Local Laws

Before entering a new market, research the tax structure. For Singapore, check the IRAS GST registration threshold and exemptions.

Step 2: Automate Your Systems

Adopt cloud-based accounting tools that integrate with your POS or invoicing system to automatically calculate and record GST.

Step 3: Maintain Impeccable Records

Keep all invoices, receipts, and payment confirmations organized for at least five years, as required by Singapore law.

Step 4: Schedule Periodic Reviews

Have an external auditor review your GST filings annually to catch mistakes early.

Step 5: Train Your Team

Educate your finance and sales teams on GST rules, especially if they handle invoicing or client contracts.

Pro’s Corner: Why This Matters to Investors

From an investor’s perspective, a company’s ability to manage cross-border compliance signals strong governance. A history of smooth compliance can be just as valuable as consistent profit margins.

Even minor fines, if they become frequent, can suggest gaps in internal controls — something institutional investors track closely.

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

No GST Refund for Traders with Cancelled Registration—Delhi HC’s Ruling Shakes Business Community

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties