Man in Hyderabad Loses ₹5.4 Lakh in Shocking Online Franchise Scam: If you think online scams only happen to “someone else,” think again.

A 46-year-old man in Hyderabad, India, just lost ₹5.4 lakh (about $6,500 USD) in a fake online franchise deal—and the way it went down should make all of us double-check our own defenses. Whether you’re in New York, Nashville, or New Delhi, scammers use the same playbook. They dangle a shiny business opportunity, make it look legitimate with fancy documents and professional phone calls, then reel you in with “just one more payment” until—bam!—you’re out thousands, and they’ve vanished into thin air. This Hyderabad case isn’t just a local news story—it’s a wake-up call for entrepreneurs, side-hustlers, and anyone looking for new business opportunities.

Man in Hyderabad Loses ₹5.4 Lakh in Shocking Online Franchise Scam

The Hyderabad franchise scam is a stark reminder that in the digital age, trust must be earned, not assumed. Whether the opportunity is across town or across the globe, you need skepticism and verification to stay safe. Scammers thrive on urgency, secrecy, and false authority. Break their chain by slowing down, checking facts, and refusing to pay until you’ve verified everything.

| Detail | Information |

|---|---|

| Victim Location | Hyderabad, India |

| Amount Lost | ₹5.41 lakh (~$6,500 USD) |

| Scam Type | Fake online franchise offer |

| Fraud Method | Phony website, fake documents, staged payment requests |

| Payments Made For | Registration, product dispatch, GST (tax), software installation |

| Key Lesson | Always verify business opportunities through official channels |

| Report Fraud | Cybercrime.gov.in |

| U.S. Equivalent Resource | FTC Complaint Assistant |

Man in Hyderabad Loses ₹5.4 Lakh in Shocking Online Franchise Scam: Step-by-Step

Think of this like a true-crime breakdown—once you know the sequence, you’ll recognize the warning signs.

1. The Hook

The victim was searching online for distributorship opportunities with a well-known paints company. He landed on a professional-looking website and filled out a contact form.

In a U.S. context, this is like searching “franchise opportunities 2025” and clicking on the first sleek website without verifying if it’s real.

2. The Friendly Face

Shortly after, he got calls from “Ayush” (Team Leader) and “Deevakar Singh” (Relationship Manager). They claimed to represent the paints company and sent brochures, forms, and contracts through WhatsApp—complete with logos and branding.

Real companies almost never conduct major franchise deals over WhatsApp or personal mobile numbers. That’s the first red flag.

3. The “Small” First Payment

The scammers asked for ₹49,500 ($590 USD) as a “registration fee.” This smaller initial amount made the deal feel low-risk, which is a common manipulation tactic.

4. The Upsell

Then came the larger charges:

- ₹2.50 lakh (~$3,000 USD) for product dispatch

- ₹90,000 (~$1,080 USD) for GST tax

- ₹1.68 lakh (~$2,020 USD) for software installation

Each payment was framed as “the final step” to start operations.

5. The Vanish

Once all payments were made—totaling ₹5.41 lakh—the scammers stopped responding. No products, no franchise rights, and no refund.

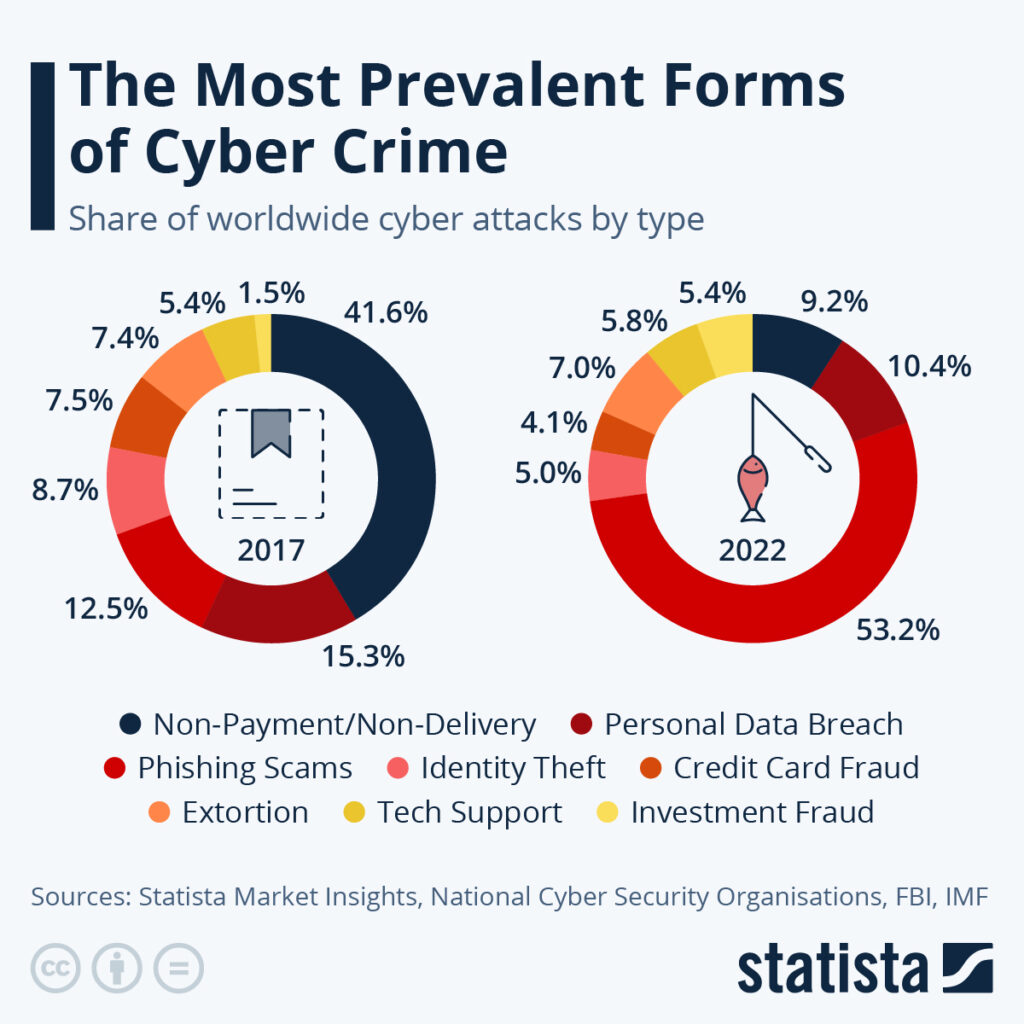

This Isn’t Just an India Problem

Franchise scams are a global issue.

In the United States, the Federal Trade Commission (FTC) has repeatedly warned about “business opportunity scams,” which include fake franchises.

One U.S. case in 2023 involved a vending machine franchise scam where fraudsters promised prime locations and high returns. Victims were given fake testimonials and even virtual tours of “existing” locations. The result? More than $1.7 million lost collectively.

The tactics are strikingly similar—impressive marketing, false authority, and relentless upselling.

Why This Works (Even on Smart People)

Scammers prey on four key psychological triggers:

- Authority: Pretending to represent a trusted, well-known brand.

- Social Proof: Using fake testimonials, reviews, and images.

- Sunk Cost Fallacy: Once you’ve paid something, you’re less likely to back out.

- Urgency: Creating a “now or never” deadline to rush your decision.

Scam Red Flags

- Requests for payment to personal bank accounts or via cryptocurrency.

- Exclusive communication through WhatsApp or social media DMs.

- No official Franchise Disclosure Document (FDD) or equivalent paperwork.

- Pressure to act immediately without time for review.

- Email addresses from free services (Gmail, Yahoo) instead of company domains.

Safe Franchise Buying Checklist

A legit franchise deal can be life-changing—but only if it’s real. Here’s how to vet an opportunity before you part with a single dollar.

Step 1: Verify the Company

- Visit the official website through a trusted source.

- Call the company’s registered phone number—not the one given by the salesperson.

- In the U.S., check the Better Business Bureau (BBB) and Franchise.org.

Step 2: Demand Documentation

- FDD (mandatory in the U.S.)

- Proof of incorporation and tax registration.

- A list of existing franchise owners you can contact.

Step 3: Payment Protocol

- Pay only to official corporate accounts.

- Use credit cards for extra fraud protection.

- Avoid wire transfers or crypto payments to individuals.

Step 4: Do a Background Check

- Search “[company name] + scam” online.

- Ask other franchisees about their experiences.

- Review public business filings where available.

Expert Tips from the Field

Karen Jacobs, a U.S.-based franchise consultant, warns:

“The easiest way to avoid a franchise scam is to slow down. Real franchisors expect you to take weeks or months to decide—not hours.”

Lt. Mark Peterson of the Chicago PD’s Cybercrime Division adds:

“Never trust an opportunity that can’t be confirmed in a verifiable meeting—virtual or in person—with official company representatives.”

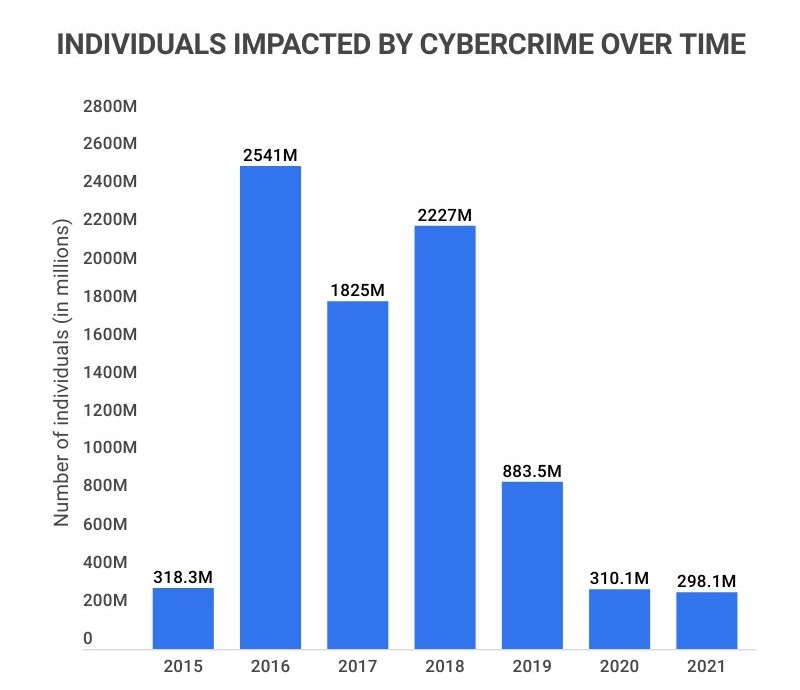

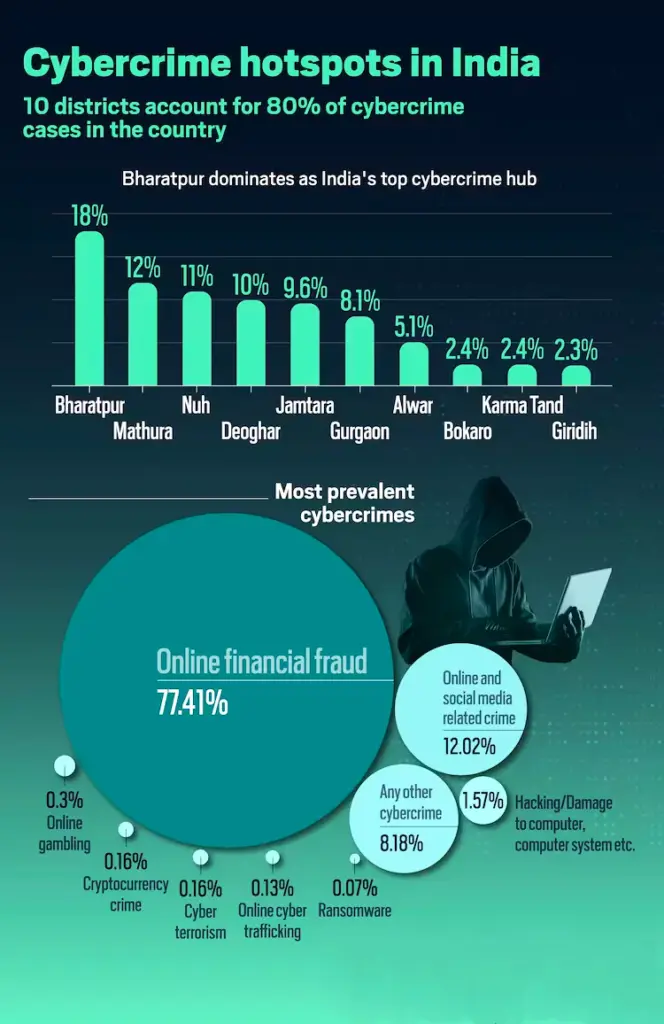

The Bigger Picture: Fraud by the Numbers

- $12.5 billion — total U.S. losses to cybercrime in 2023 (FBI IC3 report)

- $2.9 billion — losses from Business Email Compromise (BEC) scams in the U.S.

- 65,000+ — cyber fraud cases reported in India in 2023 (NCRB)

These figures show that scammers target everyone, everywhere, and in every industry.

Prevention Beyond Franchises

Even if you’re not looking for a franchise, these same rules apply to other investments, online marketplaces, and “too good to be true” deals.

- For job offers: Verify company existence before sharing personal data.

- For e-commerce deals: Use platforms with buyer protection.

- For investments: Stick to regulated brokers and registered advisors.

What To Do If You’ve Been Scammed?

In India

- Report at Cybercrime.gov.in

- Hyderabad Cybercrime Helpline: 8712665171

In the U.S.

- File at ReportFraud.ftc.gov

- Contact your bank immediately to freeze further transfers.

- File a police report for documentation purposes.

The faster you act, the higher your chances of recovering funds—or at least preventing further loss.

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

₹730 Crore GST Scam Explodes: ED Raids 8 Hotspots Across 3 States in Massive Crackdown

₹2 Crore Fake GST Scam Busted in Chhatarpur — 3 Firms Raided, 2 Were Just on Paper