RBI Report Reveals Generative AI Could Boost Banking Efficiency by 46%: Generative AI in banking isn’t just a buzzword anymore — according to the Reserve Bank of India’s (RBI) latest report, it could boost banking efficiency by a whopping 46%. That’s like telling a basketball team they can score nearly half as many points again without playing more games — a huge win. Whether you’re a banker in New York, a fintech founder in Austin, or a curious 10-year-old wondering how banks get your allowance into an app, this matters. The RBI’s deep-dive study reveals that Generative AI (think ChatGPT-like tech but built for financial operations) could supercharge customer service, slash operational costs, and even help folks with little to no credit history get loans. This isn’t some distant “sci-fi” promise — it’s already rolling out in pockets of the industry, and the future’s looking closer than you might think.

RBI Report Reveals Generative AI Could Boost Banking Efficiency by 46%

Generative AI in banking is no longer an experimental idea — it’s becoming the backbone of future banking operations. The RBI’s projection of a 46% efficiency boost might sound ambitious, but given current trends in both India and the U.S., it’s entirely realistic. For customers, this means faster service, better personalization, and more opportunities. For professionals, it’s a call to upskill in AI literacy and governance. The banks that act now will be the ones leading in 2030.

| Topic | Details |

|---|---|

| Efficiency Boost | Up to 46% improvement in banking operations (RBI Report, 2025) |

| Main Benefits | Personalization, fraud detection, cost reduction, financial inclusion |

| Market Potential | Generative AI in Indian banking projected to exceed ₹1.02 lakh crore (~$12B) by 2033 |

| Global Context | Similar trends in U.S. banking with AI chatbots, risk scoring, and process automation |

| Source | Reserve Bank of India Official Report |

What the RBI Found About Generative AI in Banking

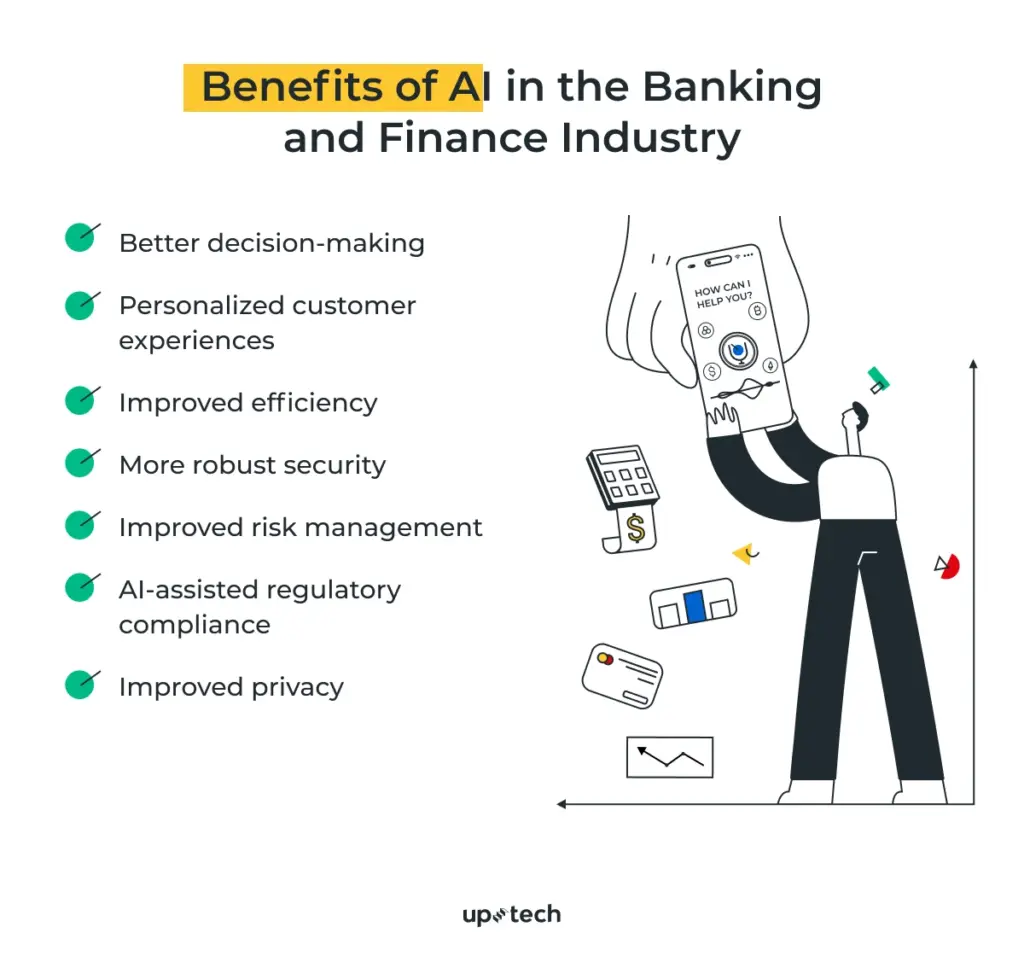

The RBI’s committee reviewed how GenAI tools — algorithms that can create, analyze, and respond in natural language — can be applied to the Indian banking system. Their findings:

- Customer Personalization: Banks can use AI to tailor services, from loan offers to savings tips, based on real-time behavior.

- Fraud Detection: GenAI models can spot unusual patterns in transactions and flag suspicious activity faster than humans.

- Alternative Credit Scoring: By analyzing utility bills, mobile usage, or even e-commerce history, AI can offer credit opportunities to people traditional scoring systems miss.

- 24/7 Service via AI Chatbots: Always-on digital assistants can handle routine queries, cutting costs and freeing up staff for complex issues.

The RBI also emphasized that data privacy and AI ethics must be central to implementation. Without proper governance, banks risk losing trust — and trust is the currency of the financial world.

Why RBI Report Reveals Generative AI Could Boost Banking Efficiency by 46% Matters in the U.S. Context Too?

While the RBI report focuses on India, U.S. banks like JPMorgan Chase, Bank of America, and Wells Fargo are already piloting similar AI technologies. Bank of America’s Erica chatbot, for example, has handled over 1 billion client interactions since launch, helping with tasks from bill reminders to investment insights.

The lesson? The leap from AI assistants to full-fledged GenAI-driven banking operations isn’t far away. Once the core models are trained with secure, anonymized financial data, the same tools could be deployed across continents, bringing faster, smarter banking everywhere.

Practical Examples of Generative AI in Banking

Here’s how a bank could roll this out in three easy steps:

Step 1: Identify the Low-Hanging Fruit

- Example: Use AI chatbots to answer account balance queries, reset passwords, and track spending habits.

- Impact: Cuts customer service wait times by up to 80%, according to McKinsey research.

Step 2: Expand Into Analytics

- Example: AI analyzes customer transaction data to suggest investment products or help detect potential overdrafts before they happen.

- Impact: Customers receive timely, personalized advice, improving retention rates.

Step 3: Integrate Risk Management

- Example: AI models scan loan applications in real-time, predicting default risk using thousands of variables humans can’t process fast enough.

- Impact: Reduces loan default rates and speeds up approvals.

Case Study: How One Hypothetical Bank Could Implement GenAI

Imagine “Sunrise National Bank”, a mid-sized lender in Texas. They start by launching an AI chatbot for online customers, reducing human call center workload by 40%. Next, they integrate AI to scan transactions for fraud in under a second, compared to 20 minutes before. Finally, they introduce AI-driven loan approvals, slashing turnaround time from 3 days to under 6 hours.

In just 18 months, they save $4 million in operational costs, boost customer satisfaction scores by 25%, and expand lending to an additional 12% of applicants who previously lacked traditional credit history.

The Pros and Cons

Pros:

- Faster service & lower operational costs

- More accurate risk assessment

- Inclusion for underbanked communities

- 24/7 availability

Cons:

- High initial investment in AI infrastructure

- Data privacy concerns

- Risk of over-reliance on automation

- Potential bias in algorithms if data isn’t diverse

The key takeaway: GenAI isn’t a silver bullet, but it’s a powerful tool if deployed with the right checks and balances.

Compliance, Ethics, and Security

AI in banking isn’t just about shiny tech — it has to meet strict regulations. In the U.S., this means aligning with Federal Reserve, FDIC, and CFPB guidelines. In India, RBI is proposing an AI governance framework that ensures transparency, fairness, and cybersecurity resilience.

Key best practices:

- Explainable AI: Use models where decisions can be traced and explained.

- Bias Audits: Regularly check for discrimination in lending or scoring.

- Customer Consent: Make data usage policies clear and easy to understand.

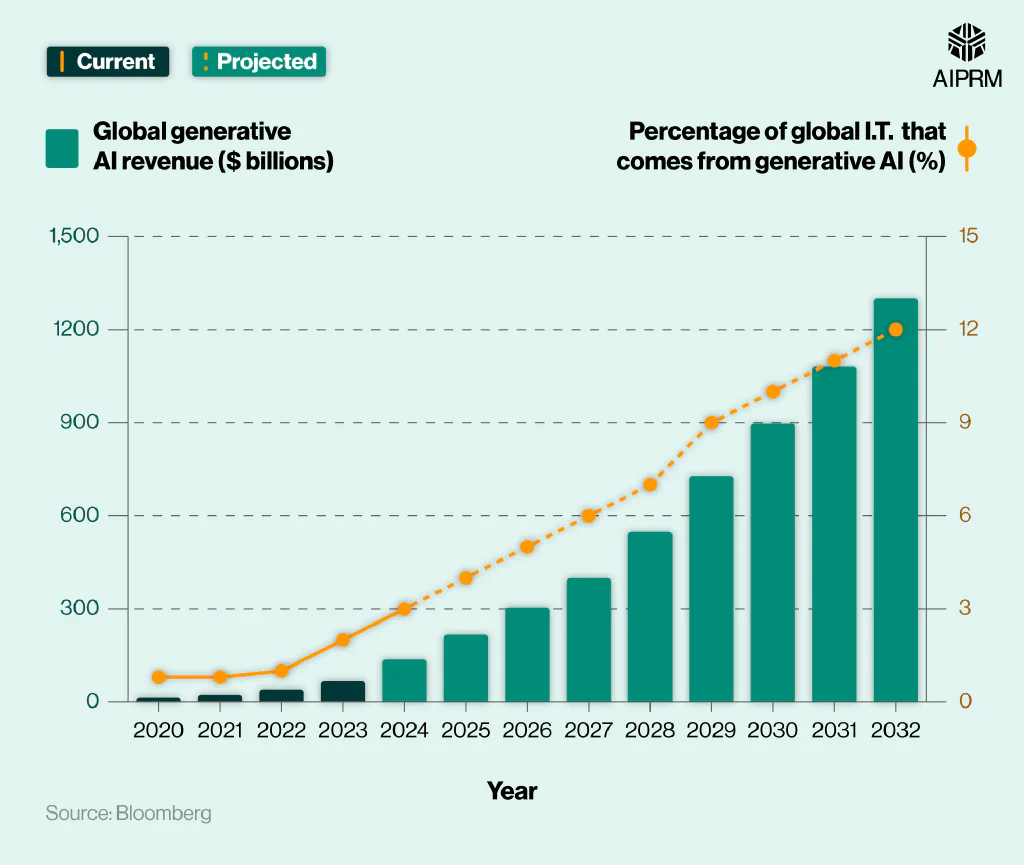

Market Outlook — Where We’re Headed by 2030

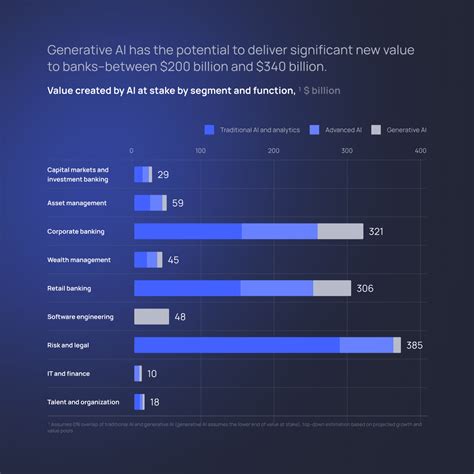

According to the RBI report and an EY India analysis:

- By 2033, India’s GenAI banking market could be worth over $12 billion.

- In the U.S., McKinsey estimates AI could add $1 trillion annually to the global banking sector by 2030.

- Expect AI to move from cost-saving tool to revenue-generating asset, with banks offering AI-driven investment advice, hyper-personalized financial plans, and proactive fraud prevention.

For career-minded professionals, this means opportunities in AI governance, data science, fintech product design, and regulatory compliance will explode over the next decade.

Implementation Guide for Banks and Professionals

For Banks:

- Pilot Before Scaling: Start with one department, such as customer service.

- Invest in Talent: Hire or train data scientists and AI ethicists.

- Choose the Right Partners: Collaborate with AI vendors experienced in financial compliance.

- Monitor Continuously: AI isn’t set-and-forget — it needs ongoing fine-tuning.

For Professionals:

- Upskill in AI Literacy: Understand the basics of how models work.

- Stay Informed on Regulation: Laws around AI are evolving quickly.

- Learn to Collaborate With AI: Use tools as assistants, not replacements.

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

India@100: Why Experts Say Fixing GST Could Unlock a Health Insurance Boom

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay