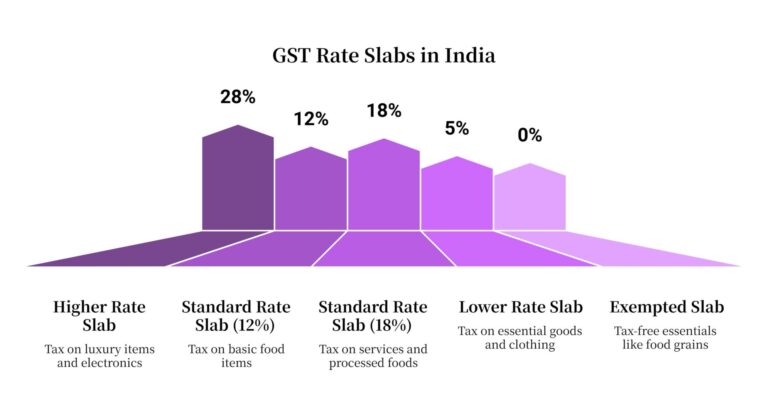

Centre Plans Major GST Overhaul: The Centre plans major GST overhaul, and it could be one of the most significant tax reforms India has seen since 2017. The government has proposed to cut the current four GST slabs—5%, 12%, 18%, and 28%—into just two main rates: 5% and 18%, with an additional 40% “sin tax” for luxury and demerit goods like tobacco, pan masala, and luxury cars. This move is not just about simplifying numbers on a bill. It’s about creating a more transparent, predictable, and business-friendly tax system that impacts every Indian—from shopkeepers and startups to large corporations and everyday households. If you’ve ever been confused about why one item is taxed at 12% and another at 18%, this reform is designed to clear the fog.

Centre Plans Major GST Overhaul

The Centre’s GST reform 2025 is more than just a tax change—it’s a bold attempt to make India’s economy more consumer-friendly, business-friendly, and globally competitive. By cutting four slabs to two and reserving 40% for luxury goods, the government is betting on simplicity and consumption-driven growth. For everyday Indians, it could mean cheaper essentials and appliances. For businesses, fewer compliance headaches. And for the economy, a shot in the arm that could push growth higher. As with any big reform, the transition won’t be without challenges, but if implemented well, this could finally make GST live up to its promise of being a “Good and Simple Tax.”

| Aspect | Details |

|---|---|

| Proposed GST Slabs | 5% (essentials), 18% (standard goods), 40% (luxury/sin goods) |

| Current System | 5%, 12%, 18%, 28% |

| Items Shifting | ~99% of 12% goods → 5%; ~90% of 28% goods → 18% |

| Timeline | Rollout expected by October 2025 (as a “Diwali gift”) |

| Revenue Impact | ~₹500,000 crore drop (~0.15% of GDP) |

| Expected GDP Boost | 0.6–0.7% growth in FY2025–26 (Reuters) |

| Compliance Improvements | Pre-filled GST returns, automated refunds, tech-driven filing |

| Official Resource | GST Council – Official Website |

Why This GST Overhaul Matters?

When GST was first introduced in July 2017, it replaced a complicated web of indirect taxes—like excise duty, VAT, and service tax—with one unified system. It was hailed as India’s “One Nation, One Tax” revolution. But the multiple slabs made the system too complex in practice.

- Consumers often couldn’t understand why two similar products had different tax rates.

- Businesses, especially small and medium enterprises (SMEs), struggled with classification disputes.

- The higher 28% slab discouraged purchases of goods like appliances and vehicles.

The new reform aims to simplify the structure while keeping it fair. It mirrors what many developed countries already practice: a simple, broad-based tax with special rates only for essentials and harmful products.

Breaking Down the New GST Slabs

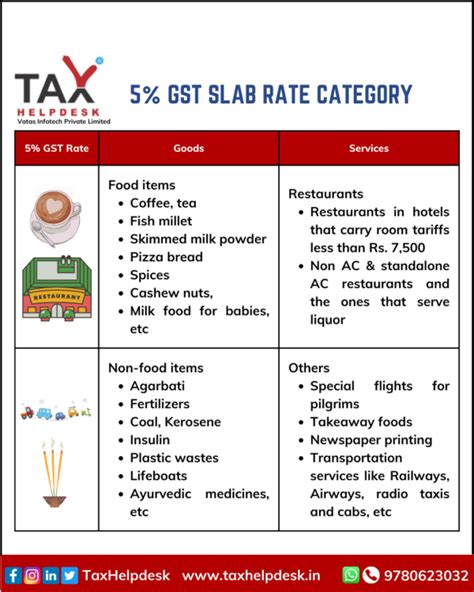

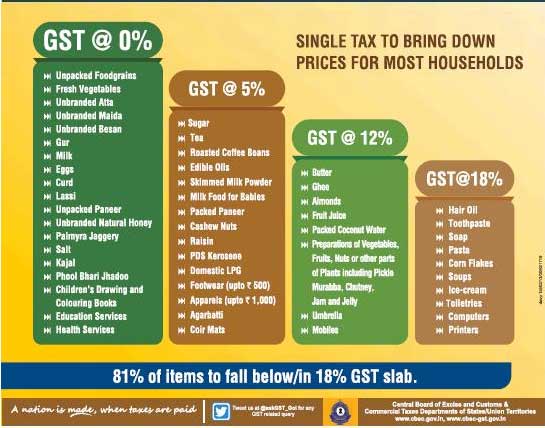

Essentials at 5%

This slab is designed to protect the common man’s pocket. Items like food grains, packaged food, life-saving medicines, school supplies, and other essentials will remain in this low bracket. The government estimates that nearly all goods currently under 12% (99%) will shift down to this level.

Standard Goods and Services at 18%

This will become the “default” slab, covering the bulk of India’s economy. From clothing to electronics to services like restaurants and transport, most items will be taxed here. Importantly, about 90% of goods currently taxed at 28% (such as washing machines and refrigerators) will move down to 18%. That’s great news for middle-class households.

Luxury and Sin Goods at 40%

High-end cars, tobacco, pan masala, and other luxury or harmful products will face a flat 40% tax. This replaces the complicated system of a 28% slab plus a variable cess. The idea is simple: keep essentials affordable, but tax products that harm health or fall into luxury consumption categories.

Consumer Impact: What It Means for Everyday Indians

For consumers, this reform could translate into lower bills and more affordable big-ticket purchases.

- Cheaper groceries and daily needs: With 12% goods dropping to 5%, families will save money on packaged food, home goods, and supplies.

- Affordable home appliances: Electronics like refrigerators, TVs, and washing machines, previously at 28%, will drop to 18%. For example, a washing machine worth ₹30,000 may cost nearly ₹3,000 less after October 2025.

- Costlier luxury habits: Smokers, pan masala users, or luxury car buyers will see steep hikes. A luxury SUV that earlier had 28% GST plus cess may now face a flat 40% tax.

This isn’t just about savings. It’s also a behavioral nudge: encourage consumption of essentials, while discouraging harmful or luxury spending.

Impact on Businesses and Startups

For businesses, especially SMEs and startups, this overhaul brings major relief.

- Simplified pricing: With only two slabs to consider, invoices and pricing strategies become easier.

- Lower legal disputes: No more hair-splitting over whether a snack is taxed at 12% or 18%.

- Improved cash flow: Automated refunds will reduce delays, particularly for exporters.

- Tech-driven compliance: Pre-filled GST returns will cut filing time, much like how American tax software like TurboTax works.

Economists believe this will improve India’s Ease of Doing Business ranking and make compliance less painful for entrepreneurs.

Revenue and Economic Impact

Now, here’s the trade-off:

- Revenue loss: Cutting slabs means the government could lose up to ₹500,000 crore, about 0.15% of GDP.

- Economic boost: But economists predict an overall 0.6–0.7% GDP boost in FY2025–26 because cheaper goods will increase consumption.

- Compliance benefits: Simpler tax rates should also reduce tax evasion, helping claw back some lost revenue.

This is essentially a calculated gamble: short-term losses for long-term economic growth.

Political and Policy Background

Prime Minister Narendra Modi announced this move as a “Diwali gift” during his Independence Day speech in August 2025. The timing isn’t accidental—India heads into crucial state elections in late 2025, and simplifying GST could be a politically popular decision.

The GST Council, which includes representatives from all states, is expected to discuss and approve the reform by September–October. Some states may worry about losing revenue, but the Centre has promised support during the transition.

This also coincides with the upcoming end of GST compensation cess in March 2026, which currently helps states make up for revenue shortfalls. By resetting the slabs now, the government is preparing for a new GST era post-2026.

Global Comparisons: How India Stacks Up

India isn’t alone in this journey. Let’s compare:

- United States: Uses state-level sales tax, typically 4–10%. It’s simple but varies widely across states.

- European Union: VAT rates range between 17–27%, with reduced rates for essentials.

- Singapore: Has a flat 9% GST across all goods and services.

India’s proposed model is a hybrid: two slabs like the EU (basic + standard) with a special rate for sin goods. This keeps the system simple while ensuring fairness.

Step-by-Step Guide to Prepare for Centre Plans Major GST Overhaul

For Businesses

- Recheck pricing models for goods currently under 12% or 28%.

- Update accounting software for new slabs.

- Train staff on GST compliance changes.

- Adjust inventory strategy—big-ticket goods may sell better after October.

For Consumers

- Time your purchases—buy essentials anytime, but wait until October for appliances or electronics.

- Budget smartly—reallocate savings from cheaper essentials into savings or investments.

- Track GST updates regularly on gstcouncil.gov.in.

For Professionals

- Stay ahead by reading council updates and government notifications.

- Offer advisory services—SMEs will need guidance.

- Educate clients through workshops and newsletters.

Expert Opinions

- Arvind Subramanian, former CEA: “This is a long-awaited simplification. A two-rate structure makes GST truly ‘Good and Simple Tax’ as envisioned originally.”

- Small business owner in Delhi (quoted in Economic Times): “Earlier, we spent hours debating whether an item was 12% or 18%. With only two slabs, our paperwork will drop by half.”

- Economists at Reuters: Predict a short-term revenue dip, but “the medium-term consumption stimulus will far outweigh the losses.”

Parliamentary Panel Demands Quicker Appointment of GST Appellate Tribunal Benches!

Odisha’s GST Act Set for Major Overhaul: Simplification & Flexibility Are Coming

Delhi High Court Slams GST Dept for Raiding Lawyer’s Office—Legal Community Outraged