Infosys Hit With GST Fine In Singapore: When you hear the name Infosys, chances are you think about innovation, IT outsourcing, and one of India’s most iconic companies making waves across the globe. But in August 2025, the tech giant popped up in the news for something less glamorous: it was hit with a GST fine in Singapore.

According to its official filing, Infosys was fined for delaying Goods and Services Tax (GST) payments during the April–June 2025 quarter. While the penalty won’t hurt its billion-dollar balance sheet, it sends a strong reminder that compliance deadlines matter everywhere—whether you’re running a billion-dollar tech company or a small e-commerce shop out of your garage. Let’s break down what happened, why it matters, and what businesses everywhere can learn.

Infosys Hit With GST Fine In Singapore

The case of Infosys being fined for GST delays in Singapore might seem like a minor blip in the tech giant’s journey, but it’s packed with lessons for businesses everywhere. For Infosys, the fine is financially insignificant. For smaller firms, however, even a fraction of this penalty could be crippling. That’s why compliance—whether with GST in Singapore, sales tax in the U.S., or VAT in Europe—should never be treated as an afterthought. The big takeaway? Compliance equals trust. When businesses stay transparent, organized, and proactive, they not only avoid fines but also build long-term credibility with customers, regulators, and investors alike.

| Detail | Insight |

|---|---|

| Company | Infosys (Global IT services giant) |

| Penalty Amount | SGD 97,035.90 (~INR 66 lakh / USD 71,000) |

| Reason | Delay in GST payment for April–June 2025 quarter |

| Authority | Inland Revenue Authority of Singapore (IRAS) |

| Date of Notice | August 13, 2025 |

| Impact on Company | No material impact on financials or operations |

What Exactly Happened?

On August 13, 2025, Infosys revealed in a filing to stock exchanges that it had been fined SGD 97,035.90 (roughly USD 71,000) by Singapore’s tax regulator, the Inland Revenue Authority of Singapore (IRAS).

The fine related to late GST payments for the quarter covering April to June 2025. Infosys immediately clarified that this fine was immaterial—meaning it wouldn’t dent its finances, affect daily operations, or shake investor confidence.

For Infosys, which generates over USD 20 billion annually in revenue, this fine is like spare change. But for the rest of us, the lessons around compliance are very real.

A Quick Primer: GST in Singapore

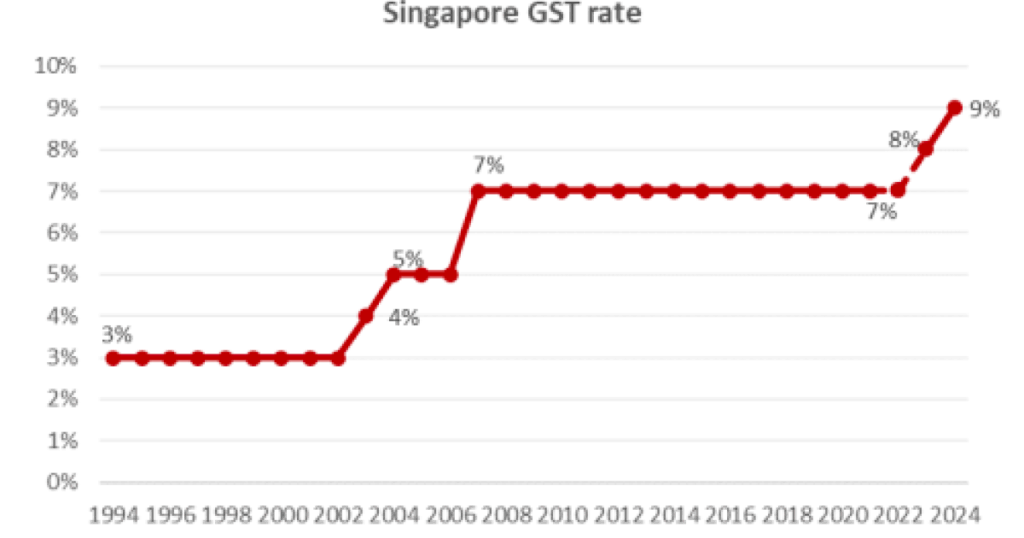

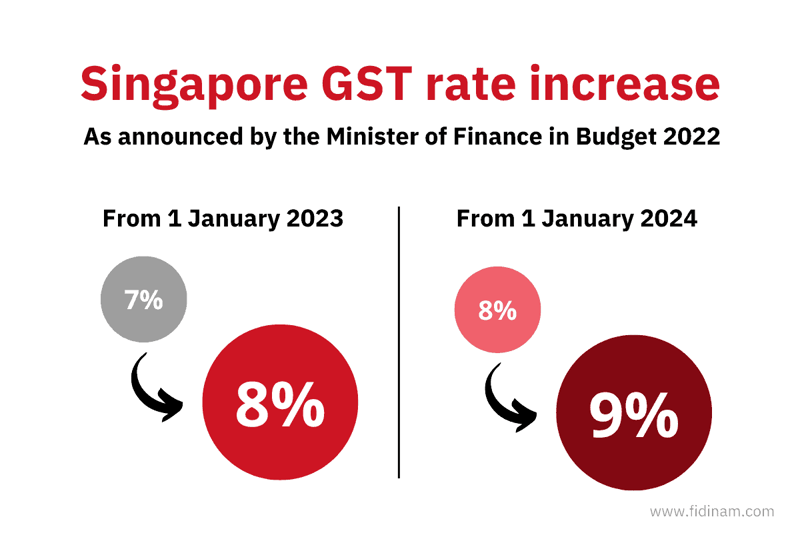

If you’re based in the U.S., think of GST (Goods and Services Tax) as Singapore’s version of a sales tax—but broader in scope. It’s currently set at 9% (as of 2025) and applies to most goods and services. Businesses collect this tax and remit it to the government.

Here’s how it works in practice:

- Registration threshold: Businesses with over SGD 1 million in annual turnover must register for GST.

- Filing frequency: Most GST-registered businesses must file quarterly returns.

- Penalties: Miss a filing deadline and you’re immediately hit with a SGD 200 late fee. Penalties can climb to SGD 10,000 and include an additional 5% of unpaid tax. Interest continues to accrue until you pay.

In short: Singapore takes compliance seriously. It’s known for being business-friendly, but that friendliness comes with clear expectations.

Why Compliance Is Tricky for Global Giants?

Managing taxes in one country is tough enough. Now imagine operating in more than 50 countries—each with its own tax codes, reporting deadlines, and compliance frameworks.

Infosys employs over 335,000 people worldwide, serving clients in 46 countries. With operations spread across Asia, Europe, the Americas, and Oceania, compliance becomes a complex orchestra that requires precision.

Challenges multinationals like Infosys face include:

- Different tax systems: VAT in Europe, GST in Singapore, state sales taxes in the U.S.—all vary.

- Constant rule changes: Governments tweak tax rules frequently, especially around digital services.

- Currency and reporting issues: Filing in multiple currencies across time zones can create bottlenecks.

- Local enforcement: Regulators are increasingly aggressive in auditing foreign companies.

So, while a fine like this looks minor, it underscores the reality that compliance complexity is a hidden cost of going global.

A Look Back: Infosys and Regulatory Fines

Infosys is not new to compliance challenges. Over the years, it has faced:

- 2019 (U.S.) – Paid a settlement over visa compliance violations.

- 2021 (India) – Received tax penalty notices for delayed filings.

- 2023 (Australia) – Fined for minor procedural lapses in employee reporting.

These incidents show that even when companies operate with strong internal controls, compliance slip-ups are part of doing business at scale.

Investor Reactions on Infosys Hit With GST Fine In Singapore: What Does It Mean for Infosys Stock?

One question investors ask when such news breaks: “Will this hit the stock?”

In Infosys’s case, the answer is no. Here’s why:

- The fine represents less than 0.0004% of annual revenue.

- The company disclosed the penalty immediately, signaling transparency.

- Historically, Infosys’s stock price has weathered far bigger challenges, like client slowdowns or currency swings.

For investors, the main takeaway is that Infosys handled the situation by owning up quickly and assuring minimal impact. That’s often more important than the fine itself.

Comparisons With Other Tech Giants

Infosys isn’t the only tech powerhouse to face tax penalties. Globally, regulators are cracking down:

- Apple: Ordered by the EU to pay €13 billion in back taxes to Ireland (later contested).

- Google (Alphabet): Fined billions in Europe for tax and antitrust cases.

- Amazon: Faced tax disputes in Luxembourg and scrutiny in the U.S. over sales tax compliance.

Compared to these, Infosys’s fine is tiny. But the bigger point is clear: no company is too big to be held accountable.

Practical Guide: How Businesses Can Avoid Tax Fines

Whether you’re running a small e-commerce store in the U.S. or expanding globally like Infosys, these steps can help you stay compliant:

1. Track Deadlines Religiously

Create a tax calendar with reminders. Tools like Google Calendar or project management apps can keep your team accountable.

2. Automate Your Compliance

Use platforms like QuickBooks, Xero, or Zoho Books to automate returns, generate reports, and reduce human error.

3. Hire Local Expertise

Each country has unique rules. A local tax consultant in Singapore or Germany can prevent costly mistakes.

4. Conduct Internal Reviews

Schedule quarterly audits within your finance team. Spotting an issue early can prevent snowballing fines.

5. Be Transparent

If you make a mistake, own up fast. Just like Infosys, transparency keeps regulators and investors on your side.

What Businesses Can Expect Next?

This fine also reflects a bigger trend: governments worldwide are tightening their grip on tax compliance.

Here’s what businesses should expect in the next decade:

- Stricter enforcement: As digital economies grow, tax authorities will double down on compliance.

- Greater use of AI: Regulators are using artificial intelligence to flag irregularities in filings.

- Global cooperation: Countries are sharing data more actively to prevent tax evasion.

- Digital reporting systems: Expect mandatory e-invoicing and real-time tax submissions to become the norm.

For companies, this means compliance will no longer be just an accounting issue—it’ll be a core business strategy.

Infosys Fined by Singapore Over GST Payments—Here’s What the Company Just Revealed

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth