Planning A Second Home: So, you’re dreaming about buying that beach house in Florida, a cabin in the Rockies, or maybe a second apartment in Mumbai. Owning a second home feels like a milestone—both a lifestyle win and a smart investment move. But before you jump in, here’s the truth: tax rules on rental income could cost you big time if you don’t plan properly. Whether you rent it on Airbnb, keep it for family vacations, or let it sit vacant, both the IRS in the United States and the Income Tax Department in India have rules that directly affect your bottom line. And those rules aren’t always intuitive.

Planning A Second Home

Owning a second home is a dream for many, but tax rules on rental income could cost you dearly if you don’t plan ahead. In the United States, generous deductions like depreciation and the 14-day rule can make a property highly tax-efficient. In India, strict notional rent rules and limited exemptions require careful tax planning. The smartest move is to stay informed, keep records, and consult a professional tax advisor. That way, your second home can be both a lifestyle upgrade and a sound financial investment.

| Aspect | Details |

|---|---|

| Rental Income Tax | U.S.: Reported on Schedule E. India: Taxable under Income from House Property. |

| Standard Deduction | U.S.: Actual expenses + depreciation. India: Flat 30% deduction. |

| Vacant Homes | U.S.: No imputed rent. India: Deemed rent may still apply. |

| Loan Interest | U.S.: Deductible (mortgage cap $750,000). India: Deductible, even pre-construction. |

| Capital Gains | U.S.: 0–20% long-term. India: 20% with indexation. |

| Foreign Owners | U.S.: IRS withholding applies. India: TDS @ 31.2% on rent. |

| Official Resources | IRS Rental Income Guide | India Income Tax Dept |

Why Second Homes Can Be Tax Traps?

A second home sounds like the ultimate flex: a vacation spot when you want it, extra income when you don’t. But the reality is that taxes can make or break the deal.

In the United States, rental income is fully taxable, though you do get some generous deductions. In India, the rules can be harsher—sometimes you’ll be taxed on “notional rent” even if the property is empty. That’s right, you could be paying taxes on income you didn’t even earn.

Planning A Second Home: How Rental Income Is Taxed in the United States

IRS Basics

Rental income must be reported on Schedule E (Form 1040). Whether you get paid monthly rent, a security deposit you keep, or Airbnb guest fees, it all counts as taxable income.

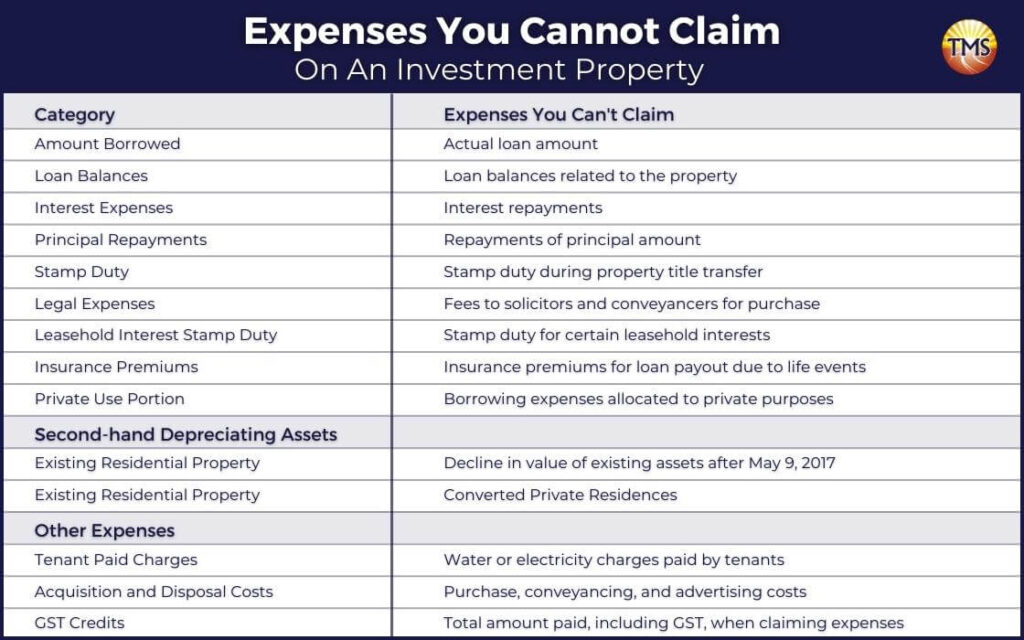

What You Can Deduct

Here’s the good news: the IRS allows a wide range of deductions to reduce your taxable rental income. These include:

- Mortgage interest (up to $750,000 loan balance for homes bought after 2017).

- Property taxes.

- Repairs and maintenance (like fixing a leaky roof or painting).

- Insurance premiums.

- Utilities you pay on behalf of tenants.

- HOA or condo fees.

- Depreciation of the property value (excluding land) over 27.5 years.

Example: You earn $20,000 in rent from a vacation property in Texas. Expenses total $13,000 (mortgage, taxes, repairs). Depreciation adds another $7,000 deduction. End result: zero taxable income.

Special Rule: The 14-Day Exemption

If you rent your property for 14 days or fewer per year, that income is completely tax-free—no matter how much you earn. Imagine renting your ski cabin in Colorado for $15,000 during Christmas. That’s pure, tax-free money.

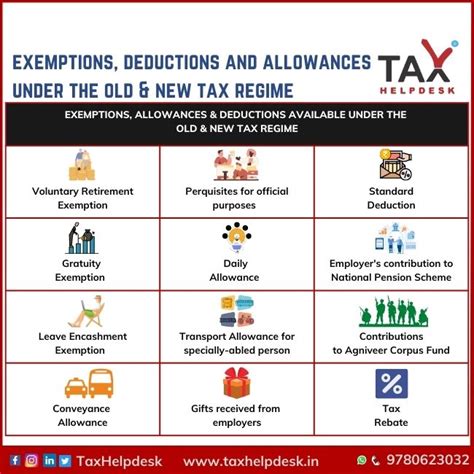

How Rental Income Is Taxed in India?

Basics of Taxation

Rental income in India falls under the head “Income from House Property.”

Here’s how it works:

- Gross Annual Value (GAV): Actual rent received or notional rent if vacant.

- Less Municipal Taxes: Deduct municipal/property taxes actually paid.

- Less Standard Deduction: Flat 30% of net value.

- Less Interest on Loan: Full deduction allowed, even pre-construction interest spread across five years.

Example: Suppose your Bangalore flat could earn ₹6,00,000 annually but remains vacant. The tax authority may assign a deemed rent of ₹5,00,000. After municipal taxes and deductions, you could still owe tax on about ₹3,50,000—even without actual rent received.

Budget 2025 Update

Earlier, only one property could be declared “self-occupied.” Now, two homes can be treated as self-occupied, meaning their annual value is “nil.” Any additional homes, however, are taxed on deemed rent.

Historical Context & Policy Updates

- U.S.: The Tax Cuts and Jobs Act of 2017 capped the mortgage interest deduction, reducing tax benefits for second homes. Depreciation rules remain favorable.

- India: Budget 2025 allowed two homes to be treated as self-occupied and clarified loan interest deduction rules.

Governments are tightening loopholes, making it critical for homeowners to stay updated.

Filing Taxes: Step-by-Step

In the U.S.

- Collect rent receipts and bank statements.

- Track all expenses—mortgage, insurance, repairs.

- Calculate depreciation using IRS guidelines.

- Report income and deductions on Schedule E.

- Pay federal tax (plus state/local if applicable).

In India

- Calculate Gross Annual Value (actual or deemed rent).

- Deduct municipal taxes.

- Apply 30% standard deduction.

- Deduct home loan interest (if any).

- Report under “Income from House Property” in ITR-2 or ITR-3.

Real-Life Case Studies

Case 1: U.S. Airbnb Success Story

Sarah bought a $300,000 lake house in Michigan. She earned $25,000 in annual rent but deducted $20,000 in expenses and depreciation. Taxable income = $5,000. With a 22% tax bracket, she owed just $1,100—keeping nearly 96% of her gross rent.

Case 2: India Apartment Challenge

Ravi purchased a second flat in Pune. He didn’t rent it out, but the income tax office applied notional rent of ₹4,00,000. Even with deductions, his taxable amount was ₹2,50,000, costing him over ₹75,000 in taxes.

Lesson: In the U.S., deductions are generous; in India, notional rent can bite.

Common Mistakes to Avoid

- Not accounting for depreciation recapture (U.S.): When you sell, IRS taxes depreciation taken at 25%.

- Forgetting notional rent (India): Vacant property doesn’t mean zero tax liability.

- Mixing personal and rental use: If you use the property often, deductions shrink.

- Skipping state/local obligations: States like California add hefty extra taxes.

- Poor record-keeping: Without receipts, you can’t prove deductions.

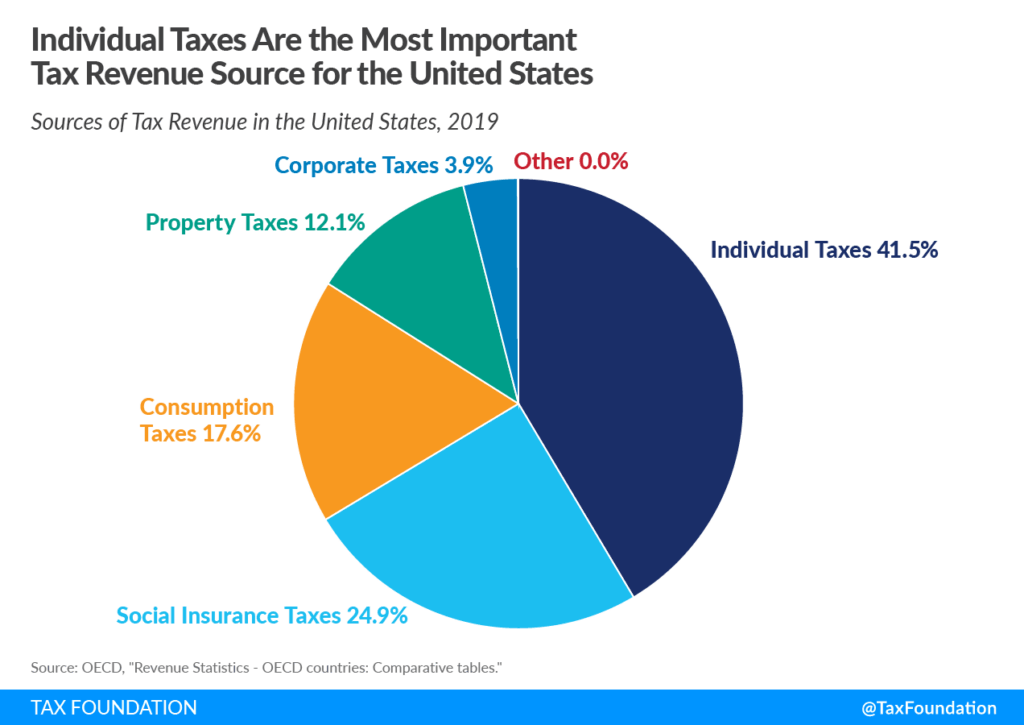

International Comparison

- UK: Rental income taxed at standard rates; mortgage relief largely phased out.

- Canada: Rental income fully taxable; capital gains taxed on 50% of profit.

- Australia: Negative gearing allows rental losses to offset other income.

This highlights that U.S. taxpayers enjoy relatively favorable deductions, while India has stricter imputed income rules.

Pro Tips for Smart Planning

- Maximize Deductions: Claim every eligible expense—don’t leave money on the table.

- Leverage Professional Help: A CPA (U.S.) or CA (India) can save you thousands.

- Think Long-Term: Plan for capital gains tax if you sell.

- Use Technology: Property management software can track expenses for easy filing.

- Consider Ownership Structure: In the U.S., LLCs may offer liability protection; in India, joint ownership can spread tax burdens.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty