NMMC Rolls Out Property ID Cards: The Navi Mumbai Municipal Corporation (NMMC) has rolled out Property Identity Cards, and this is set to be a game-changer in the way residents handle property tax payments. Think of it like getting a driver’s license for your house. It’s official, standardized, and makes life a whole lot easier when dealing with government paperwork. This initiative is not just about paperwork convenience—it’s about building a transparent, accountable, and modern property tax system. For a growing city like Navi Mumbai, this marks a shift toward global standards of urban governance and smart city practices.

NMMC Rolls Out Property ID Cards

The launch of Property Identity Cards by NMMC is more than a tax reform—it represents a paradigm shift in property governance. It makes property transactions faster, reduces disputes, increases transparency, and ensures citizens have a smoother, more trustworthy experience. For homeowners, professionals, and businesses, this reform means fewer hassles, stronger compliance, and more reliable urban governance. As other cities watch Navi Mumbai’s progress, this initiative could set the stage for a nationwide property ID revolution.

| Point | Details |

|---|---|

| What’s New | NMMC launched Property Identity Cards – first of its kind in India |

| Purpose | Simplifies ownership verification and property tax payments |

| Benefits | Faster transactions, fewer disputes, digital integration with tax systems |

| Impact | Helps over 3.5 lakh properties in Navi Mumbai |

| Extra Perks | Works with NMMC’s “One Year, One Bill” tax system, early-bird discounts |

| Global Benchmark | Similar to U.S. Parcel IDs and Singapore’s property tax registry |

| Official Reference | NMMC Official Website |

Why India Needed This Reform?

Property tax is the lifeblood of local governance. In Navi Mumbai, property tax generates nearly 70 percent of the municipal budget, funding schools, parks, roads, sewage systems, and public health programs. Despite its importance, India historically struggled with low tax compliance and outdated manual systems.

According to the World Bank, property tax collection in India accounts for just 0.2 to 0.3 percent of GDP, compared with 3 percent in developed countries like the U.S. This gap directly impacts city development, slowing infrastructure upgrades and quality-of-life improvements.

In a city with more than 3.5 lakh registered properties, the old system created bottlenecks: duplicate records, disputes, delays in sales and transfers, and widespread confusion over who owed what. The Property Identity Card addresses this head-on.

What Is a Property Identity Card?

The Property Identity Card is essentially your home’s official ID. Every property—whether it’s an apartment, bungalow, or commercial unit—will now have a unique identification number linked to municipal records.

This single card becomes the one-stop proof of ownership and a gateway to services like:

- Paying property taxes

- Selling or transferring property

- Applying for loans and clearances

- Resolving ownership disputes

- Checking historical tax records

It simplifies what used to take multiple documents, offices, and weeks into a straightforward, verifiable process.

How NMMC Rolls Out Property ID Cards Will Change Property Tax Payments?

The rollout introduces multiple improvements for taxpayers and the civic body alike.

Faster Verification

Municipal staff can verify ownership details instantly. Instead of digging through ledgers or requesting duplicate documents, the card offers a single, reliable reference.

Single Reference for Payments

Property owners no longer need to carry old tax receipts or multiple identification papers. The card works as a universal pass for all property-related services.

Digital Integration

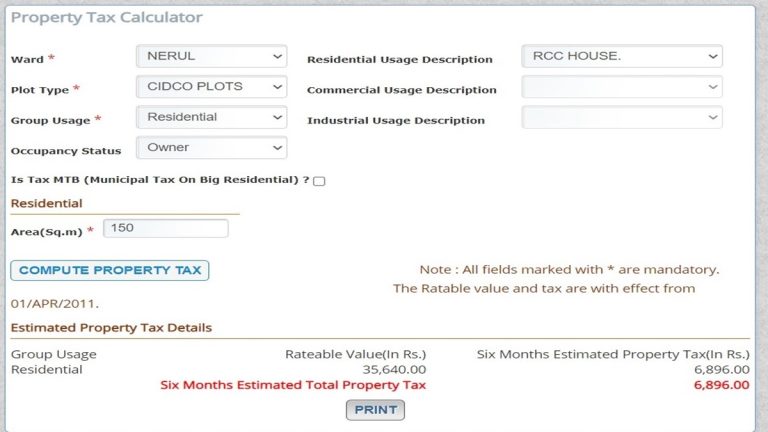

The card links directly to NMMC’s digital tax payment system, which already allows for online payments, SMS/email reminders, and early-bird discounts of up to 10 percent for timely payments.

Reduced Disputes

Property disputes clog Indian courts and delay real estate transactions. Verified identity cards reduce ambiguity, cutting down the chance of fraudulent claims.

Transparent Governance

Every property becomes traceable and verifiable, reducing the scope for manipulation or evasion.

Step-by-Step Guide to Using the Property ID Card

- Application: Visit the NMMC office or apply through its online portal with your latest property tax receipt and ownership documents.

- Issuance: Receive a unique card linked with your property details. Many cards are expected to carry QR codes for instant digital verification.

- Linking: Connect your card with NMMC’s online payment portal.

- Payments: Use the card or ID number to pay property taxes online or offline.

- Transactions: During sales, transfers, or loan applications, provide the card to verify authenticity.

A Homeowner’s Story: From Chaos to Clarity

Consider the example of Mrs. Mehta, who recently tried to sell her apartment in Vashi. Earlier, she would have needed six separate documents—tax receipts, society no-dues, electricity bills, and NMMC clearance. Verification could take weeks.

With the Property ID Card, her buyer simply checked the card number in NMMC’s database, confirmed there were no outstanding dues, and proceeded with the purchase. What took weeks was completed in just days.

Legal Backing and Policy Context

The initiative fits into India’s larger policy framework:

- RERA (Real Estate Regulation Act) – pushing transparency and accountability in real estate.

- Digital India Mission – transforming government services into digital, citizen-first platforms.

- Smart Cities Mission – encouraging municipalities to use data-driven governance tools.

By providing standardized property verification, the ID card strengthens legal compliance, builds trust, and reduces disputes.

Economic and Civic Impact

Boost in Revenue

By simplifying payment and reducing disputes, compliance is expected to rise. Even a 10 percent increase in compliance could translate into hundreds of crores in additional revenue for the city.

Better Infrastructure

Increased revenue directly funds public projects—better roads, improved water supply, reliable sewage management, and enhanced healthcare facilities.

Confidence for Investors

Standardized property documentation encourages real estate investors and boosts Navi Mumbai’s credibility as a planned city.

Technology and Future Integration

The rollout is just the beginning. Future upgrades could include:

- QR Codes on every card for instant scanning.

- Blockchain-based ledgers for tamper-proof records.

- AI-driven audits to flag tax evasion.

- GIS Mapping that links property IDs with satellite data to prevent underreporting of property sizes.

Other countries already use similar tools. Singapore’s Integrated Land Information Service digitally links property details with tax systems. The U.S. assigns every property a Parcel ID. Navi Mumbai is now moving toward the same global benchmark.

Challenges Ahead

No major reform is without hurdles. A few challenges may arise:

- Digital Divide: Elderly residents or those unfamiliar with online services may struggle initially.

- Data Privacy: Securing sensitive ownership and tax data is crucial. Any breach could erode trust.

- Implementation Time: With more than 3.5 lakh properties, ensuring 100 percent coverage will take significant effort.

- Awareness Gap: Many citizens may not understand the importance of the card, delaying adoption.

NMMC plans awareness campaigns and support services to ease this transition.

How Citizens Should Prepare?

- Apply Early: Don’t wait for deadlines. The earlier you get your card, the smoother your property dealings will be.

- Check Details: Verify ownership name, area, and tax dues are correct when issued.

- Link Contact Info: Update your mobile number and email with NMMC for reminders.

- Use Discounts: Take advantage of early-bird discounts and digital payment rebates.

- Safeguard the Card: Keep both digital and physical copies safe.

GST Not Applicable on Renting Property to Government for Girl’s Hostel, Says AAR

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

Future Outlook

Navi Mumbai is the first Indian city to introduce property ID cards. If successful, the system could serve as a national model. Cities like Pune, Bengaluru, and Delhi are likely candidates for adoption in the coming years.

This reform could evolve into a nationwide property ID registry, making India’s urban governance more aligned with international standards.