Net Direct Tax Collection Drops 4%: When headlines read Net Direct Tax Collection drops 4%, the first reaction for many is: “Whoa, is the economy in trouble? Should we worry about FY26?” Relax—this isn’t a doomsday signal. Sure, a 4% drop in net direct tax collections looks like a red flag, but when you dig deeper, it’s more about timing, policy choices, and structural adjustments than economic weakness. In fact, this temporary dip could even have some long-term benefits. Let’s unpack what’s happening, why it matters, and what it means for you, me, and the broader economy.

Net Direct Tax Collection Drops 4%

The news that Net Direct Tax Collection dropped 4% in early FY26 might sound alarming, but the reality is more nuanced. Most of the decline stems from policy-driven factors like tax cuts, higher refunds, and extended deadlines—not a weakening economy. India still has room to meet its ambitious ₹25.2 trillion target by year-end, provided collections rebound strongly in the second half of FY26. For individuals, it’s business as usual—file smart, claim deductions, and manage cash flow wisely. For businesses and policymakers, the next six months are about resilience, compliance, and ensuring that the momentum continues. Think of it like a marathon. The first few miles may be slower, but there’s plenty of time to pick up speed and finish strong.

| Factor | Current Status | Source |

|---|---|---|

| Net Direct Tax Collections | Dropped ~4% (₹6.64T vs ₹6.91T) between April–Aug 2025 | Reuters |

| Gross Collections | Down ~2% to ₹7.99T | Reuters |

| Refunds | Jumped ~10% to ₹1.35T | NDTV Profit |

| Government Target FY26 | ₹25.2T (13% growth) | Economic Times |

| Causes of Dip | Tax cuts, refund surge, deadline extension | Govt. & economists |

| Historical Comparison | FY25 grew ~20% in same period, FY24 grew ~17% | MoF India |

What Happened: The Numbers Behind the Drop

Between April 1 and August 11, 2025, India collected ₹6.64 trillion in net direct taxes, compared to ₹6.91 trillion in the same period last year—a 3.95% decline.

Gross collections—before accounting for refunds—fell just 2% to ₹7.99 trillion. The real kicker was refunds, which jumped by nearly 10%, hitting ₹1.35 trillion.

To put it simply, it’s like running a store where your sales only dipped slightly, but you had to issue a bunch of refunds to customers from earlier overpayments. Your books look weaker, but your business hasn’t collapsed.

Why Did Net Direct Tax Collection Drops 4%?

1. Tax Cuts for the Middle Class

The government introduced significant tax relief measures, especially for people earning up to ₹12 lakh. That’s more cash left with households. While this lowers short-term tax inflows, it can stimulate spending and consumption, fueling growth in other sectors.

2. Higher Refunds

Refunds soared by 10%. This isn’t wasted money—it simply means taxpayers overpaid earlier and the government returned it. But it does reduce “net” collections temporarily.

3. Extended Filing Deadlines

Traditionally, most taxpayers rush to file by July 31. This year, the deadline was extended to September 15. That delay means a chunk of collections will show up later, distorting early fiscal numbers.

A Look Back: Historical Perspective

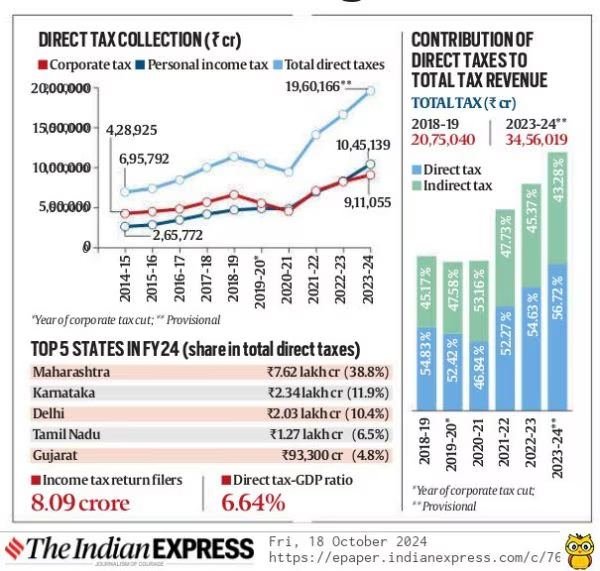

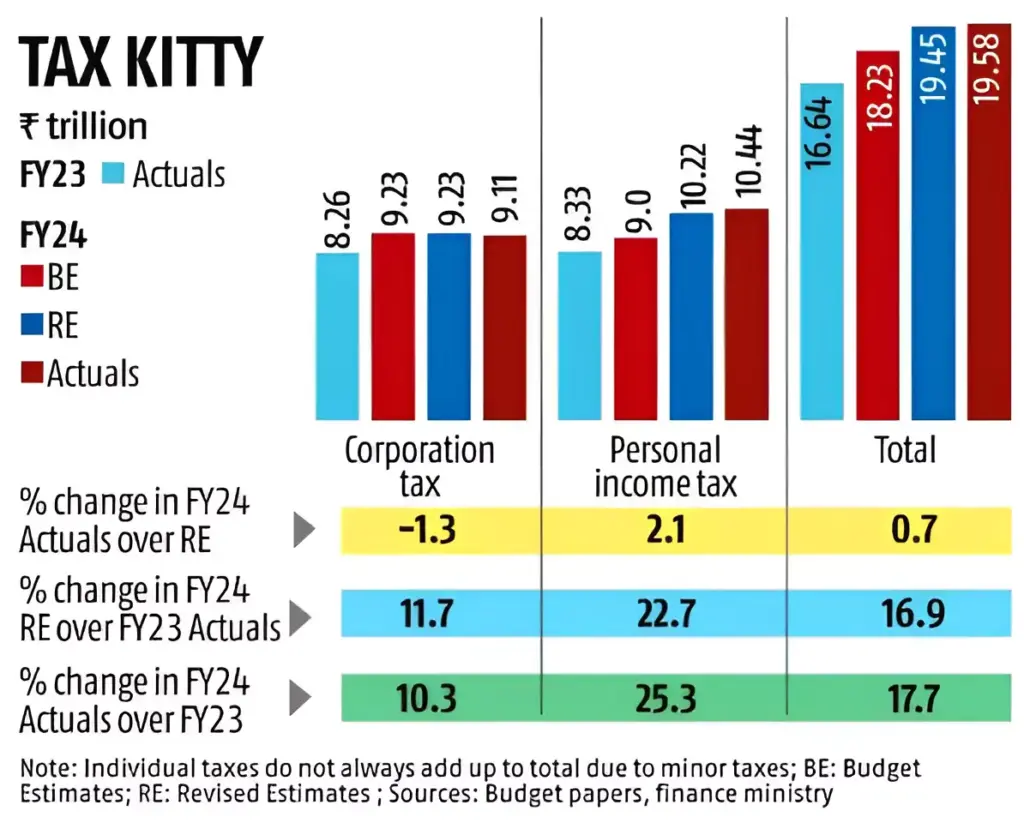

- FY24: Net direct tax collections grew nearly 17%, driven by strong corporate earnings and compliance improvements.

- FY25: Growth was even stronger at 20% during the same April–August period.

- FY26: For the first time in years, collections are showing negative growth this early in the fiscal year.

Context matters—this isn’t a reversal of India’s growth story. Instead, it reflects policy-driven adjustments rather than a shrinking tax base.

Global Context: Not Just an Indian Story

Many major economies face similar revenue swings.

- In the United States, the IRS saw a 3% dip in collections in 2023 due to extended deadlines and larger refunds after pandemic-era tax credits.

- Germany and France experienced weaker tax inflows in 2024 as subsidies for green energy projects and wage support programs reduced net collections.

- Even China, dealing with a property market slowdown, introduced tax rebates for businesses, reducing short-term revenue.

In short, tax revenue volatility is global, not unique to India.

Sector-Wise Analysis: Who’s Paying More, Who’s Paying Less

- Information Technology & Services: Still strong contributors, as India’s IT majors continue to post solid profits despite global uncertainty.

- Banking & Financial Services: High profitability boosted collections from this sector.

- Manufacturing & Exports: Sluggish, thanks to global trade tensions and weaker demand.

- Energy Sector: Volatile—linked to swings in crude oil prices and government subsidies.

If IT and banking remain healthy, they could offset some weakness in manufacturing and exports.

Impact on Government Spending and Fiscal Goals

The Union Budget 2025 laid out ambitious plans for infrastructure, welfare schemes, and fiscal deficit reduction. Here’s where the tax dip bites:

- Infrastructure Projects: Highway expansion, rail modernization, and smart city investments could see delays if collections don’t bounce back.

- Social Welfare: Food subsidies, health insurance (Ayushman Bharat), and education programs need steady revenue streams.

- Fiscal Deficit: India aims to cut its fiscal deficit below 5% of GDP in FY26. Lower tax revenue makes this target harder, potentially forcing higher borrowing.

Expert Insights

- Aditi Nayar, ICRA: “Both personal and corporate taxes must grow in double digits for the government to hit its target. While challenging, we expect collections to recover post-September.”

- Paras Jasrai, India Ratings: “A rebound is likely in the October–December quarter as the extended filing deadline brings delayed payments into the system.”

- Government Officials: “The true picture will emerge after Q2. We remain confident of meeting the ₹25.2 trillion target.”

Investor and Market Angle

Markets closely track tax collections because they affect government borrowing and spending.

- Equity Markets: Still upbeat, betting on a second-half rebound.

- Bond Markets: Watching closely—if collections stay weak, borrowing could rise, pushing yields higher.

- Foreign Investors: FIIs track India’s fiscal position. Shortfalls could raise concerns, but confidence remains steady for now.

Risks to Watch in FY26

- Global Slowdown: If the U.S. or China weakens, Indian exports could struggle, lowering corporate profits and taxes.

- Oil Prices: Rising crude prices inflate import bills, squeezing margins and lowering taxable income.

- Geopolitical Uncertainty: Wars, sanctions, or trade disruptions could dent global demand, hitting India indirectly.

Practical Advice for Taxpayers and Businesses

For Individuals

- File early: Avoid last-minute logjams.

- Track refunds: Use the Income Tax e-filing portal to monitor refund status.

- Review regimes: Check benefits under both old and new tax regimes.

For Businesses

- Plan liquidity: Assume refund delays, build cash buffers.

- Stay compliant: With pressure to meet revenue targets, expect stricter audits.

- Sector-specific planning: Export-heavy firms should prepare for global demand swings.

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty

How India’s Broken Tax System Is Crippling the Circular Economy Revolution