Income Tax Bill 2025 Brings No Rate Hike: The Income Tax Bill 2025 has been grabbing headlines across India and even catching global attention. At first glance, the message seems simple: “No income tax rate hike this year.” That’s a relief for taxpayers who dread Budget announcements. But here’s the real story—while rates aren’t changing, the government is quietly rewriting the rules of the game. This Bill represents the most significant shake-up in India’s tax framework in decades. Instead of raising slabs, the government has focused on structural reforms, digital compliance, and widening the tax net. And though it may sound like a win for ordinary citizens, the reality is more nuanced. Let’s break it down in plain English—easy enough for a 10-year-old to follow, yet detailed enough for professionals and policymakers.

Income Tax Bill 2025 Brings No Rate Hike

The Income Tax Bill 2025 isn’t just about avoiding rate hikes—it’s about rewriting the playbook. By keeping slabs steady, the government avoids backlash, but by expanding definitions, digitizing assessments, and cracking down on crypto, it ensures higher compliance and broader collections. For taxpayers, the message is simple: be honest, be digital, and be prepared. The future of taxation in India is less about rates and more about rules—and those rules are getting tighter.

| Key Change | Details | Impact on You | Official Source |

|---|---|---|---|

| No rate hike | Slabs remain unchanged | No extra % tax on income | Finance Ministry |

| Exemption up to ₹12 lakh | Retained under new regime | Middle-class relief | Economic Times |

| Rebate under Section 87A | Raised threshold from ₹7L to ₹12L; max rebate ₹60k | Bigger cushion for taxpayers | Financial Express |

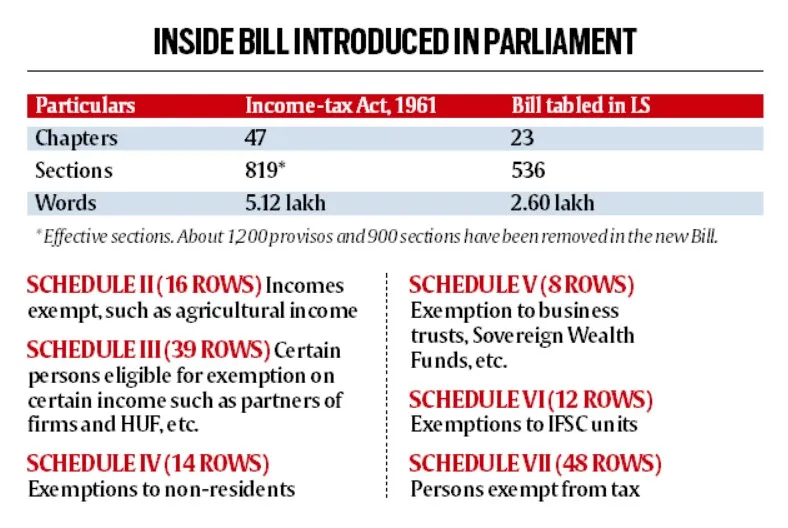

| Legal simplification | Sections cut from 800+ to 536 | Easier to navigate (in theory) | Wikipedia |

| Faceless assessments | More digital, less human touch | Faster refunds, stricter checks | India Times |

| Crypto & digital assets | Declared taxable income | Full visibility of virtual assets | India Briefing |

A Quick Throwback: How Did We Get Here?

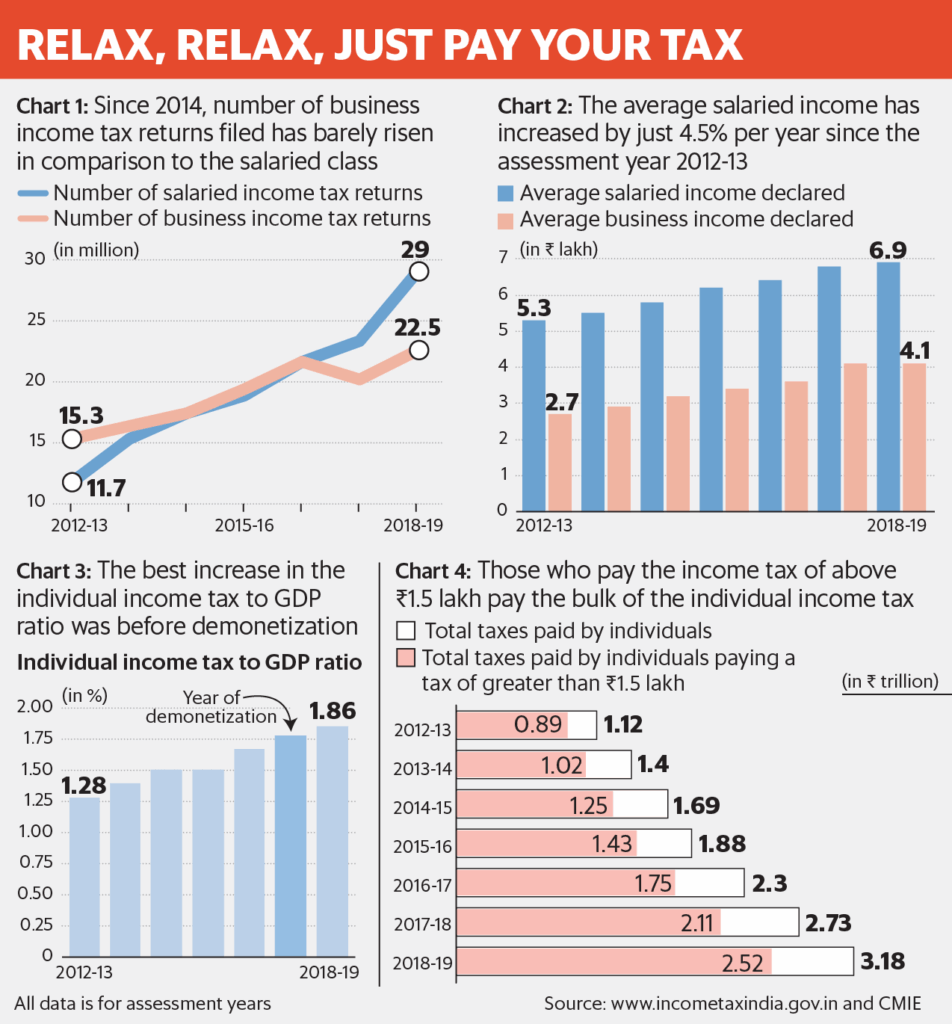

For decades, Indian taxpayers have dealt with one of the most complex tax codes in the world. The Income Tax Act of 1961, still in force until this Bill replaces it, contained over 800 sections and thousands of sub-rules.

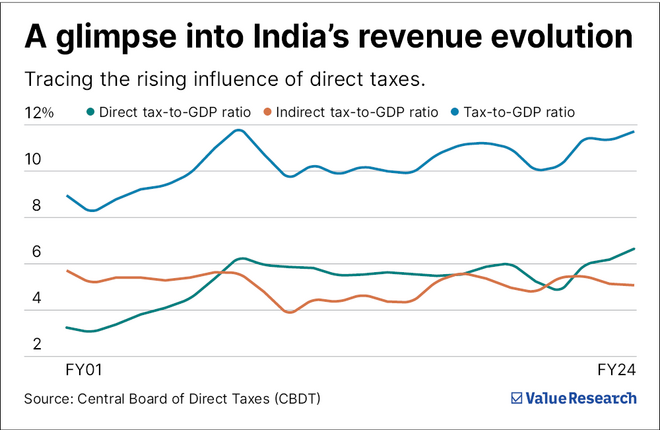

- In 2017, the Goods and Services Tax (GST) overhauled indirect taxes.

- In 2020, the government introduced a “new regime” with simpler slabs but fewer deductions. Adoption, however, was low—only around 12–15% of taxpayers opted in by 2023 because traditional deductions like HRA and Section 80C were too valuable to give up.

- Now in 2025, the government has gone a step further: not tinkering around the edges, but rewriting the very structure of the Income Tax Act.

Who Benefits the Most?

Middle-Class Salaried Workers

The most significant relief comes from the expanded rebate limit under Section 87A. If your annual taxable income is ₹12 lakh or less, you may not owe any income tax at all. For young professionals, teachers, IT workers, or government employees in this range, this is a welcome break.

MSMEs and Startups

Small and medium-sized businesses have often complained about excessive paperwork. With faceless, digital assessments and a reduced number of legal sections, compliance should be smoother. Faster refunds will also help cash flow. But digital scrutiny will make it tougher for businesses that rely heavily on unreported cash transactions.

Retirees and Pensioners

The Bill clarifies how commuted pensions and standard deductions are taxed. This predictability helps retirees plan their income without worrying about sudden interpretation changes from the tax department.

High-Earners and Investors

For those above ₹12 lakh, slabs haven’t changed. But expanded reporting requirements mean investments in property, crypto, or foreign income must be fully declared.

The Catch: It’s Not About Rates, It’s About Rules

“No rate hike” sounds like a win. But the real catch is in the redefinition of income and compliance obligations.

- More people will technically fall under the rebate, but the definition of taxable income is broader now.

- Crypto assets, NFTs, and digital tokens are squarely in the spotlight.

- Automation reduces human error (or leniency) in assessments, but also eliminates wiggle room.

In short: while your rates aren’t going up, the system is designed to ensure you can’t underreport or delay.

Pros & Cons of the Income Tax Bill 2025

| Pros | Cons |

|---|---|

| No increase in tax rates | Wider scope of taxable income |

| Relief for middle-class up to ₹12 lakh | Compliance burden for crypto investors |

| Digital, faceless assessments = faster refunds | Limited human touch if disputes arise |

| Law simplified: sections cut by ~35% | Simplification doesn’t equal clarity for all |

| Predictability for pensions & housing | More penalties for mistakes or non-disclosure |

Step-by-Step Guide for Taxpayers As Income Tax Bill 2025 Brings No Rate Hike

Step 1: Check Your Income Bracket

If your income is below ₹12 lakh, you may not owe any tax thanks to the expanded rebate.

Step 2: Collect and Declare All Sources

Include salary, rental, freelance gigs, dividends, interest, crypto, and even side hustles.

Step 3: Leverage Deductions Smartly

Standard deductions and specific exemptions (like self-occupied house property) still apply.

Step 4: Switch to Digital Filing

Set up and update your account on the Income Tax e-Filing Portal. Link PAN to Aadhaar, upload documents, and track digitally.

Step 5: Consult a Professional if Needed

For individuals with multiple properties, international income, or digital asset portfolios, consulting a tax advisor may prevent costly mistakes.

Case Studies: How It Plays Out

Case 1: Salaried Professional – Riya

- Income: ₹11.5 lakh/year

- Under the old system: Tax payable beyond ₹7 lakh.

- Under the new Bill: Rebate wipes out liability. Tax = ₹0.

Case 2: MSME Owner – Arjun

- Income: ₹18 lakh/year

- Benefit: Faster refunds, faceless filing.

- Catch: Digital audit trails make it impossible to hide unbilled cash sales.

Case 3: Crypto Trader – Neha

- Annual profit: ₹9 lakh from Bitcoin trades

- Earlier: Often went undeclared.

- Now: Explicitly covered under undisclosed income. She must pay tax or face penalties.

Wider Economic Implications

According to the Finance Ministry, India’s tax-to-GDP ratio stands at around 17.6%, compared to 26% in the U.S. and 33.6% in OECD countries. The government aims to close this gap without the political risk of raising visible tax rates.

The faceless and digital assessments also align with India’s Digital India initiative, designed to make government services less dependent on human discretion and more transparent.

International Comparisons

- United States (IRS): The IRS offers standard deductions and uses a digital-first system, with stiff penalties for under-reporting. India is now moving closer to this model.

- United Kingdom (HMRC): The U.K. has a “Making Tax Digital” program, requiring businesses and individuals to maintain digital records.

- India’s Move: By targeting crypto and tightening compliance, India is catching up to Western tax enforcement practices.

Expert Insights

- The Reserve Bank of India (RBI) has long warned about untracked cash and crypto inflows affecting financial stability. By including digital assets explicitly, the government is addressing those concerns.

- Economists suggest this is less about revenue in the short term and more about expanding the net for the next decade, as India’s digital economy grows.

New Income Tax Bill Tackles Filing Delays and Gives Your Refund Back

Is Your Alimony Taxable? What Every Divorced Husband and Wife in India Must Know Now