₹50 Crore GST Fraud Busted In Mumbai: When you hear about a ₹50 crore GST fraud busted in Mumbai, it sounds like something straight out of a Hollywood crime drama—but this time, it’s real life. Two company directors have been arrested in connection with a massive tax evasion scam, sending shockwaves through India’s financial capital. While the numbers may sound mind-boggling, the story behind it is not only important for professionals but also easy enough to explain to a 10-year-old. Think of it this way: imagine you run a lemonade stand. You tell your parents you sold 100 cups of lemonade when, in reality, you only sold 10. You then ask for an allowance bonus based on the fake numbers. That’s basically what these companies did with India’s Goods and Services Tax (GST) system—just on a much, much bigger scale.

₹50 Crore GST Fraud Busted In Mumbai

The ₹50 crore GST fraud in Mumbai isn’t just about two dishonest directors—it’s about the challenges India faces in managing a complex tax system. Fraudsters will always look for loopholes, but with advanced technology and stronger laws, the system is catching up. For businesses, the message is clear: keep your records clean, verify your partners, and never cut corners. The short-term gain of fraud will never outweigh the long-term cost of getting caught.

| Aspect | Details |

|---|---|

| Case | ₹50 Crore GST Fraud Busted in Mumbai |

| Accused | Two Directors – Yashwant Kumar Tailor (Magic Gold Bullion Pvt Ltd) & Om Jay Ramrakhiani (RFIC Trading Pvt Ltd) |

| Fraudulent Method | Fake invoices & bogus Input Tax Credit (ITC) claims |

| Fraud Amount | ₹30.51 crore (Tailor), ₹20.05 crore (Ramrakhiani) |

| Action Taken | Arrested by Mumbai State GST Department |

| Legal Status | Currently in judicial custody |

| Reference | Official GST Portal |

What Exactly Happened?

The State Goods and Services Tax (SGST) department in Mumbai discovered that two directors had orchestrated elaborate schemes to dodge taxes. Their weapon of choice? Fake invoices and fraudulent Input Tax Credit (ITC) claims.

- Yashwant Kumar Tailor, director of Magic Gold Bullion Pvt Ltd, allegedly created fake invoices that enabled him to claim ₹30.51 crore in ITC without conducting any real business. His company showed transactions on paper but lacked the infrastructure, staff, or operations to justify them.

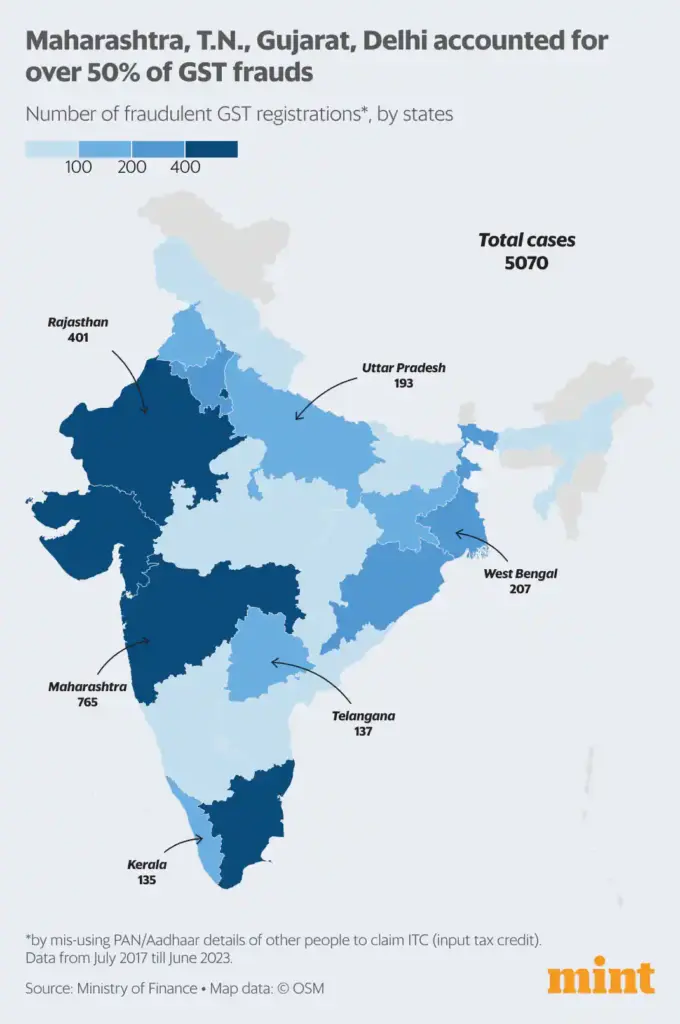

- Om Jay Ramrakhiani, director of RFIC Trading Pvt Ltd, was accused of evading ₹20.05 crore. Investigations revealed that his company sourced ITC through suppliers that were themselves fake or had canceled GST registrations.

In other words, these men built elaborate paper castles—fictitious transactions designed to trick the tax system into refunding or crediting money they never truly paid.

Why Is This a Big Deal?

The fraud matters for several reasons.

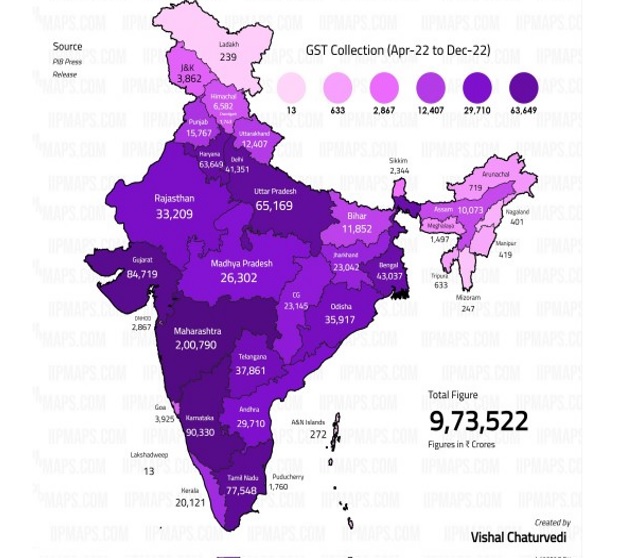

- Revenue Loss – ₹50 crore may not sound huge compared to India’s trillion-dollar economy, but every rupee lost to fraud is a rupee less for hospitals, schools, and infrastructure.

- System Trust – GST was created in 2017 to simplify taxation and make compliance easier. Fraud undermines that trust.

- Ripple Effect – Scams like this result in tighter rules, meaning more paperwork, audits, and scrutiny for honest businesses.

Breaking Down the ₹50 Crore GST Fraud Busted In Mumbai

The method used in this scam follows a pattern investigators often see:

- Step 1: Fake Invoices – Invoices were generated for goods and services that never existed.

- Step 2: Claim ITC – The companies claimed tax credits on these fake transactions, reducing their liability.

- Step 3: Evade Taxes – By showing they had already paid GST (when they had not), they reduced what they owed to the government.

- Step 4: Vanishing Act – Many of the so-called suppliers turned out to be non-existent or operating from fake addresses.

This scam may sound clever, but once officials started digging into the paperwork, the lack of real-world evidence—no warehouses, no shipments, no employees—unraveled the scheme.

Historical Context: Not the First Scam

This is not the first time India has faced such frauds.

- In 2020, GST officials uncovered a ₹4,200 crore fake invoicing racket involving over 1,000 shell companies.

- In 2021, a pan-India crackdown led to the arrest of more than 200 people in connection with GST scams.

- In Gujarat, a ₹1,200 crore ITC fraud was exposed in 2022.

These cases highlight how widespread the problem is, and why enforcement agencies are under pressure to crack down harder.

The Legal Framework

India’s Central Goods and Services Tax (CGST) Act, 2017 provides clear penalties for fraud.

- Tax evasion above ₹5 crore is classified as a serious, cognizable, and non-bailable offense.

- Punishment can include imprisonment of up to 5 years.

- Offenders may also face penalties equal to or greater than the fraud amount.

- Their GST registrations can be canceled, and their assets can be seized.

In short, GST fraud is treated with the same seriousness as financial crimes like money laundering.

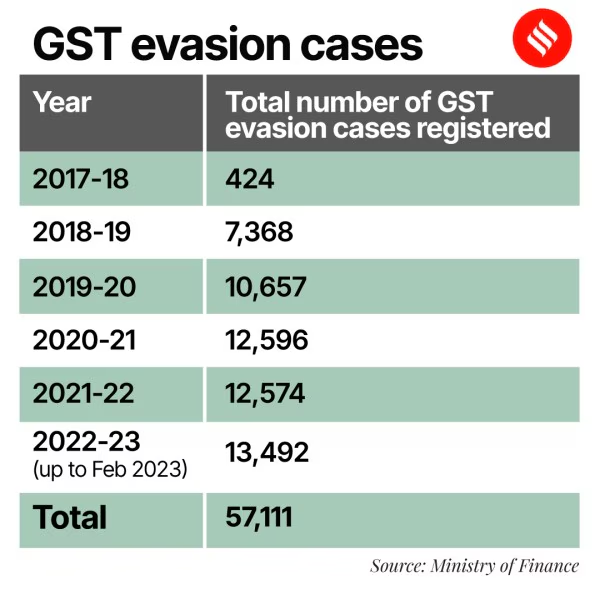

How Common Is GST Fraud in India?

According to the Economic Times, the Indian government detected GST frauds worth ₹1.3 lakh crore in 2023 alone. Much of this stems from Input Tax Credit abuse, where fraudsters exploit loopholes by creating bogus supply chains.

Such numbers show how big the problem has become, and why authorities are now adopting advanced technology to fight back.

Technology vs. Fraudsters

The government is using technology as its most powerful weapon.

- E-invoicing – Businesses are required to generate invoices in real time through government systems, making fake invoices harder to create.

- Data Analytics – Authorities cross-check invoice data across businesses to spot patterns of fraud.

- AI and Machine Learning – Algorithms now flag unusual tax filings and transactions that don’t match a company’s size or sector.

- GSTN Monitoring – The GST Network (GSTN) identifies and tracks high-risk taxpayers and their supply chains.

These steps are making fraud more difficult, though not impossible.

The Impact on Small Businesses

While scams like this are run by larger players, small businesses often pay the price.

- More Audits – Small businesses face increased inspections, even when they are compliant.

- Delayed Refunds – Refunds of ITC often get delayed due to stricter checks.

- Compliance Costs – Many businesses have to hire accountants or invest in GST software to avoid mistakes.

For small enterprises struggling with cash flow, even a few weeks’ delay in refunds can be crippling.

Practical Advice: Staying Safe as a Business

Here’s a quick checklist that business owners and professionals can use:

- Verify Suppliers – Always validate GST numbers on the GST Portal.

- Maintain Proper Records – Keep copies of invoices, contracts, and proof of delivery.

- Avoid Suspicious Deals – Be wary of unusually cheap deals or suppliers without a proper office.

- Reconcile Regularly – Match your GSTR-2A with your own records.

- Hire Experts – Work with a qualified Chartered Accountant for compliance.

By following these practices, businesses can avoid being caught in fraudulent supply chains.

Global Perspective

Fraud is not just an Indian problem.

- In the United States, the IRS estimates tax evasion costs the country over $1 trillion annually.

- In Europe, VAT fraud costs governments nearly €50 billion each year.

These global examples show that tax fraud is universal. What varies is how quickly governments detect it and punish offenders.

Government’s Response

The Indian government has already taken several steps:

- Expanding mandatory e-invoicing to more businesses.

- Strengthening audits for high-value taxpayers.

- Using artificial intelligence for risk profiling.

- Amending laws to make fraudulent ITC claims more difficult.

Officials have also been conducting nationwide drives to detect shell companies and deregister suspicious GST accounts.

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

Fraud Worth Crores? Group Booked for Creating Fake GST Invoices to Con Govt