Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases: When you hear about two company directors arrested in Mumbai over major tax fraud cases, it might sound like just another headline. But this story is way bigger than it looks. It’s about millions of dollars in stolen tax money, shady business practices, and how the government is finally cracking down on fraudsters. Whether you’re a business owner, an everyday taxpayer, or just curious about what “tax fraud” means, this case is worth paying attention to. Why? Because tax fraud doesn’t just hurt the government—it affects everyone. Less tax revenue means fewer schools, weaker healthcare, fewer jobs, and potholes that never get fixed.

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

The two company directors arrested in Mumbai over major tax fraud cases show how damaging financial crime can be. Tax fraud is not a “victimless” act—it robs the government, burdens taxpayers, and puts honest businesses at risk. The lesson is simple: stay compliant, keep your records tight, and respect the system that funds our schools, hospitals, and infrastructure. Fraud might look like an easy shortcut, but the price—financial, legal, and reputational—is far too high.

| Topic | Details |

|---|---|

| Case Summary | Two Mumbai company directors arrested for fraudulent GST Input Tax Credit (ITC) claims worth approx. ₹50 crore (~$6 million). |

| Names Involved | Yashwant Kumar Tailor (Magic Gold Bullion Pvt Ltd) and Om Jay Ramrakhiani (RFIC Trading Pvt Ltd). |

| Fraud Tactics | Fake invoices, ghost firms, misuse of GST framework. |

| Impact | Loss to India’s treasury, long-term fraud from 2020–2025, taxpayers indirectly affected. |

| Legal Authority | Mumbai’s State GST Department. Official GST Portal |

| Why It Matters | Exposes tax loopholes, risks for honest businesses, need for stricter compliance. |

What Exactly Happened in Mumbai?

In August 2025, Mumbai’s State Goods and Services Tax (SGST) Department arrested two company directors in separate but related cases:

- Yashwant Kumar Tailor, director of Magic Gold Bullion Pvt Ltd, allegedly claimed ₹30.5 crore (~$3.7 million) in fake Input Tax Credit (ITC).

- Om Jay Ramrakhiani, director of RFIC Trading Pvt Ltd, is accused of evading ₹20.05 crore (~$2.4 million) in taxes.

Both men were accused of setting up ghost firms, generating fake invoices, and claiming ITC on purchases that never actually happened. Investigators found that Tailor’s company lacked the staff, infrastructure, or even operational activity to support the large turnover it claimed.

Quick Refresher – What Is GST and ITC?

To understand the fraud, you need to know the basics:

- GST (Goods and Services Tax): India’s unified tax system that replaced multiple indirect taxes. It applies to goods and services across the country.

- Input Tax Credit (ITC): A benefit under GST that allows businesses to deduct the tax they’ve already paid on inputs.

For example, if a bakery buys flour worth ₹10,000 plus ₹1,800 GST, the bakery can later deduct that ₹1,800 from its final tax liability when selling bread. This avoids double taxation and keeps costs fair.

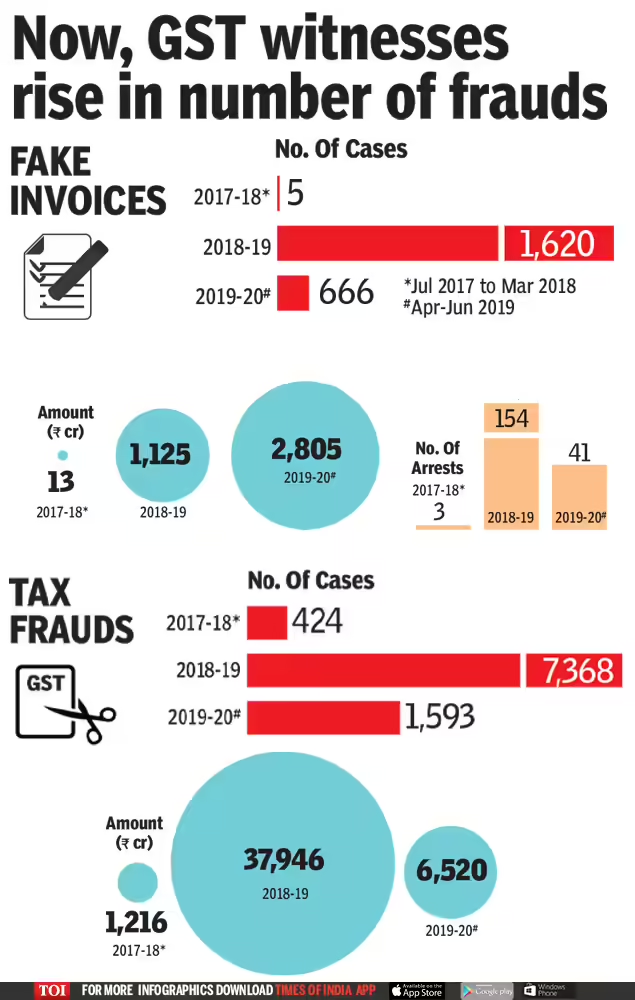

But when someone creates fake invoices to claim ITC for purchases that never happened, they’re stealing from the system. That’s exactly what these directors are accused of.

Why This Is a Big Deal?

This case matters for three reasons:

- The Amount: ₹50 crore (~$6 million) is not pocket change. That kind of money could fund major social projects.

- The Duration: The fraud allegedly ran for five years (2020–2025). That means it went undetected for a long time.

- The Message: Tax fraud cases shake public trust and put honest businesses at a disadvantage.

When fraudsters cheat the system, legitimate businesses often struggle to compete. It’s like playing a football game where one team cheats, and the referee doesn’t notice.

How They Pulled Off the Scam?

The fraud followed a familiar pattern:

- Fake Firms: Register companies that exist only on paper.

- Bogus Invoices: Generate bills for goods and services that never existed.

- ITC Claims: Use these fake bills to claim tax credits.

- Evasion: Reduce tax liability or claim refunds from the government.

- Refusal to Cooperate: When confronted, Tailor reportedly failed to provide proof of operations.

It’s like claiming a refund for groceries you never bought—only on a corporate scale.

Legal Framework and Penalties

Under the GST Act in India, fraud involving more than ₹5 crore is considered a cognizable and non-bailable offense.

- Prison: Up to 5 years in jail.

- Fines: Equal to or more than the fraud amount.

- Asset Seizure: Businesses and personal properties can be frozen or confiscated.

- Reputational Damage: Once convicted, companies often lose clients and credibility.

Comparisons With Other Cases

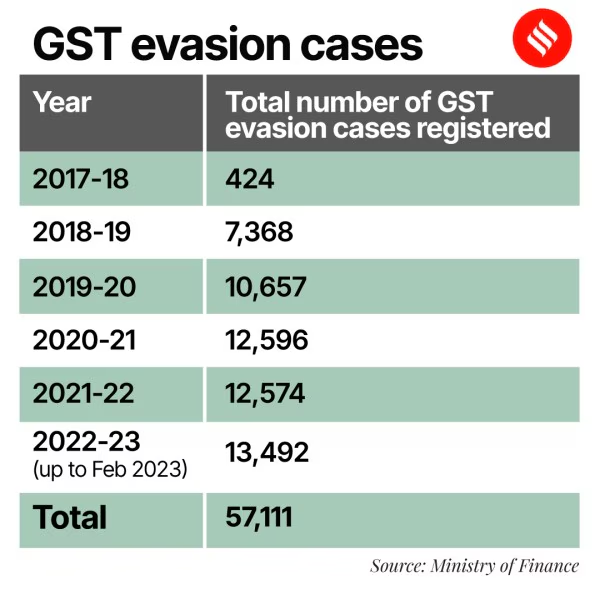

This isn’t the first time GST fraud has made headlines:

- In Delhi (2023), officials busted a network claiming ₹600 crore in fake ITC.

- In Pune (2024), a textile trader was arrested for a ₹100 crore fraud using bogus suppliers.

- Globally, the European Union loses billions annually to VAT fraud, while the IRS in the U.S. estimates tax fraud drains over $1 trillion a year.

So, while Mumbai’s case may sound shocking, it’s part of a worldwide trend of financial crimes exploiting tax loopholes.

Expert Opinions

Financial experts and tax professionals stress a few key points:

- Technology Is Critical: AI-powered data analytics can track invoice mismatches and detect suspicious activities.

- Manual Checks Still Matter: Fraudsters often exploit tech loopholes, so physical inspections of business premises remain important.

- Corporate Governance Needs Work: Many companies lack strong internal controls, which makes fraud easier.

According to PwC’s Global Economic Crime Survey, nearly 47% of companies worldwide report experiencing fraud or economic crime in the past two years.

Lessons for Businesses As Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

If you own or plan to start a business, here’s what you can take away from this case:

1. Stay Legit With Your Taxes

The cost of fraud far outweighs the “benefits.” Jail time, frozen accounts, and destroyed reputations are real risks.

2. Keep Clean Documentation

Invoices, employee records, and audited financials should always be available. If your paperwork looks fake, expect scrutiny.

3. Understand ITC Rules

Not everything qualifies for ITC. Know what you can and cannot claim.

4. Hire Professionals

A good Chartered Accountant (CA) or CPA is worth every penny. They’ll keep you out of trouble.

5. Run Internal Audits

Think of it like a health check-up for your business. Catch problems early, before the government does.

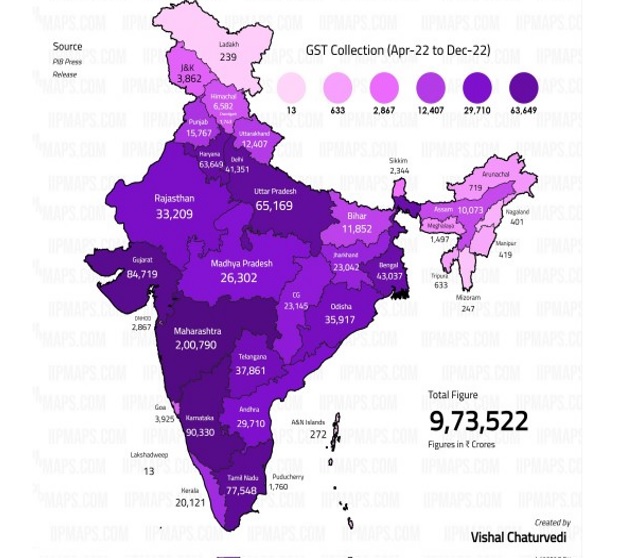

What Government Is Doing?

The Indian government has introduced multiple reforms to reduce fraud:

- Aadhaar Verification: Linking GST registrations with Aadhaar to prevent fake firms.

- AI and Big Data: Using tech to match invoices and flag mismatches.

- E-Way Bills: Ensuring goods movement is tracked.

- QR-Coded Invoices: To verify authenticity in real-time.

Still, experts argue more needs to be done:

- Stronger whistleblower protections for employees reporting fraud.

- Global data-sharing agreements to track cross-border tax crimes.

- More on-ground audits for suspicious companies.

Practical Guide – How to Stay Safe From Tax Trouble

Here’s a simple roadmap for entrepreneurs and professionals:

- Register Properly: Use official sites like GST Portal or IRS.gov.

- Vet Vendors: If your supplier seems shady, walk away.

- Adopt Accounting Software: Tools like QuickBooks, Zoho Books, or Tally keep records clean.

- Hire Experts: Don’t DIY taxes if you’re unsure—hire a professional.

- Stay Updated: Tax laws change. Sign up for newsletters or alerts from trusted sources.

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

Fraud Worth Crores? Group Booked for Creating Fake GST Invoices to Con Govt

GST Crackdown in Aligarh: 11 Fake Firms Hit With Notices in Major Fraud Probe