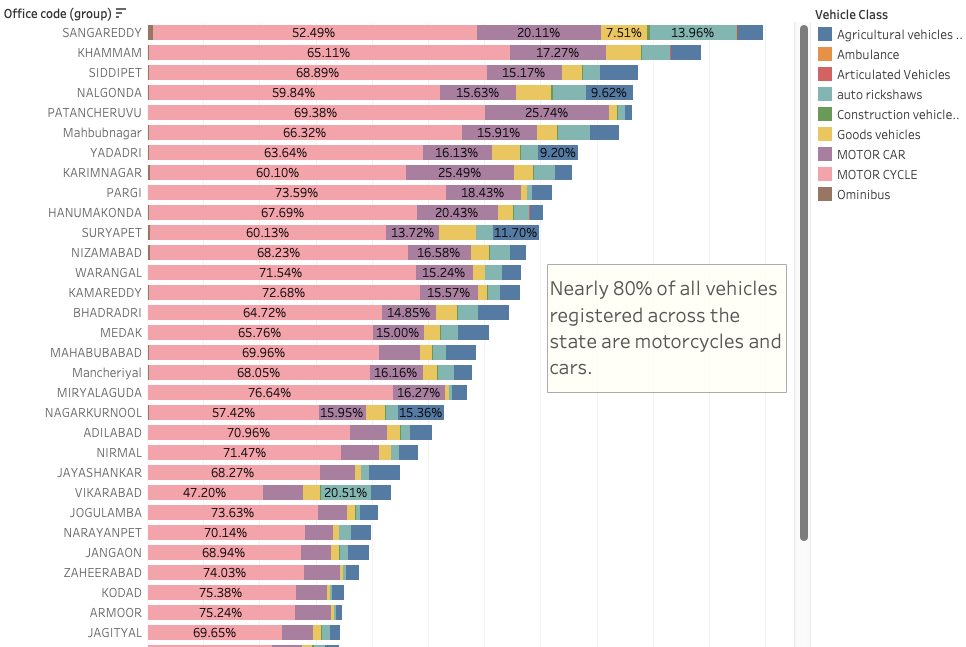

New Life Tax on Cars and Bikes: The Telangana government’s decision to increase the life tax on cars and bikes has ignited anger across the state. From college students saving up for their first scooter to middle-class families eyeing a new car, everyone now has to dig deeper into their pockets. The sudden increase, announced in mid-August 2025, has not only shocked buyers but also created ripples in the state’s automobile market. At its core, a life tax is supposed to be a contribution toward maintaining infrastructure and supporting government revenue. But the way it has been implemented this time—without phased introduction or consultation—has made ordinary people feel blindsided. Families are calling it a “burden on survival,” while critics are accusing the government of using households as an ATM to fund its infrastructure projects.

New Life Tax on Cars and Bikes

The Telangana life tax hike has become more than a financial issue—it’s a social and political flashpoint. Families feel squeezed, dealers are worried, and opposition leaders are capitalizing on public anger. While the government highlights infrastructure development and EV incentives, the timing and steepness of the hike have overshadowed these positives. For now, buyers need to weigh options carefully. EVs and used vehicles present viable alternatives. But until transparency improves, the common sentiment remains: the government has asked struggling households to shoulder the weight of progress.

| Aspect | Details |

|---|---|

| Effective Date | August 14, 2025 |

| Two-Wheeler Tax | 9% (<₹50k), 15% (₹1–2 lakh), 18% (>₹2 lakh) |

| Car Tax (Non-Transport) | 13–21% based on cost bracket |

| Higher Slabs | 15–25% for company-owned/second vehicles |

| EV Exemption | Full life tax waiver until Dec 31, 2026 |

| Projected Revenue | ₹4,350 crore in 2025–26 (vs ₹3,996 crore last year) |

| Public Backlash | Seen as regressive and anti-middle-class |

| Official Website | Transport Department of Telangana |

What Exactly Is Life Tax?

For readers unfamiliar with India’s system, life tax is a one-time levy collected during vehicle registration. It’s calculated as a percentage of the cost of the vehicle. Once paid, you don’t pay it again for that vehicle.

This differs significantly from the United States or Europe, where vehicle taxes are either annual or tied to emissions. In the U.S., most states charge a fixed registration fee ($30–$200 per year). In Germany, the motor vehicle tax is based on engine size and emissions and is paid annually. Telangana’s system, by comparison, feels like paying several years’ worth of taxes all at once—making it especially painful for households with tight budgets.

Historical Context: A Sudden Spike

Telangana’s vehicle tax rates have been stable for years, typically ranging from 9% to 12% for two-wheelers and 12% to 14% for cars under ₹10 lakh. The jump in 2025 has pushed some categories up by as much as five percentage points.

Here’s what changed:

- A scooter costing ₹1.20 lakh that previously attracted ₹14,400 in tax now demands ₹18,000.

- A mid-size SUV worth ₹12 lakh that earlier paid ₹1.92 lakh in tax now costs ₹2.16 lakh.

These increases may not seem catastrophic on paper, but for families already dealing with rising costs of fuel, food, and schooling, the jump is enough to delay or cancel vehicle purchases altogether.

Why Families Are Furious on New Life Tax on Cars and Bikes?

1. Middle-Class Strain

For the middle class, a vehicle is often not luxury but necessity. Parents rely on scooters to drop kids at school. Families living in suburbs depend on cars to commute to workplaces in Hyderabad’s IT hubs. With housing EMIs, rising grocery costs, and school fees, the extra ₹20,000–₹30,000 feels like punishment.

2. Timing Before Festivals

The government chose to implement the tax hike just before Dasara and Diwali, two periods when Indians traditionally buy vehicles. Families that saved for festive purchases now find themselves forced to either pay more or postpone dreams.

3. Job Security and Dealer Concerns

Automobile dealers, already recovering from post-pandemic slowdowns, fear a 10–15% drop in sales this quarter. This doesn’t just hurt showroom owners—it affects mechanics, bank loan agents, insurance providers, and everyone connected to the auto ecosystem.

4. Lack of Clear Accountability

Critics argue the government hasn’t explained where the additional money will go. Former Finance Minister T. Harish Rao openly accused the state of “milking families to fund road projects without transparency.”

Government’s Defense

The Telangana government insists the hike is needed to:

- Raise ₹4,350 crore in 2025–26 (compared to ₹3,996 crore last year).

- Fund road projects under the Hybrid Annuity Model (HAM).

- Expand public transport infrastructure.

- Encourage families to shift toward electric vehicles (EVs) by exempting them from tax until December 31, 2026.

On paper, this looks like a balanced approach: generate funds while incentivizing green transport. But the immediate impact is disproportionately borne by middle-class households.

Real-Life Examples

- Case 1: Two-Wheeler Buyer

Meena, a schoolteacher, wanted to buy a Honda Activa scooter worth ₹1.10 lakh. Under the old tax, she’d pay ₹13,200. Under the new regime, she owes ₹16,500. For her, that extra ₹3,300 equals nearly half a month’s salary. - Case 2: Car Buyer

Ramesh, an IT engineer, booked a Hyundai Creta for ₹12 lakh. His tax rose from ₹1.92 lakh to ₹2.16 lakh—a ₹24,000 jump. That’s money he had planned for his daughter’s school fees.

Such stories are now commonplace in Telangana households.

Comparison With Other States

- Andhra Pradesh: 8–12% for most categories, much lower.

- Tamil Nadu: 10–15%, slightly lower than Telangana.

- Karnataka: Similar to Telangana, among the highest in India.

Telangana now finds itself one of the costliest states in South India for vehicle registration, driving some buyers to register vehicles in neighboring states—a practice known as tax migration.

Global Angle: How the World Does It

In the U.S., registration fees are annual and modest. Families rarely worry about paying thousands upfront. In Germany and France, the system is tied to emissions—encouraging cleaner cars rather than penalizing ownership itself.

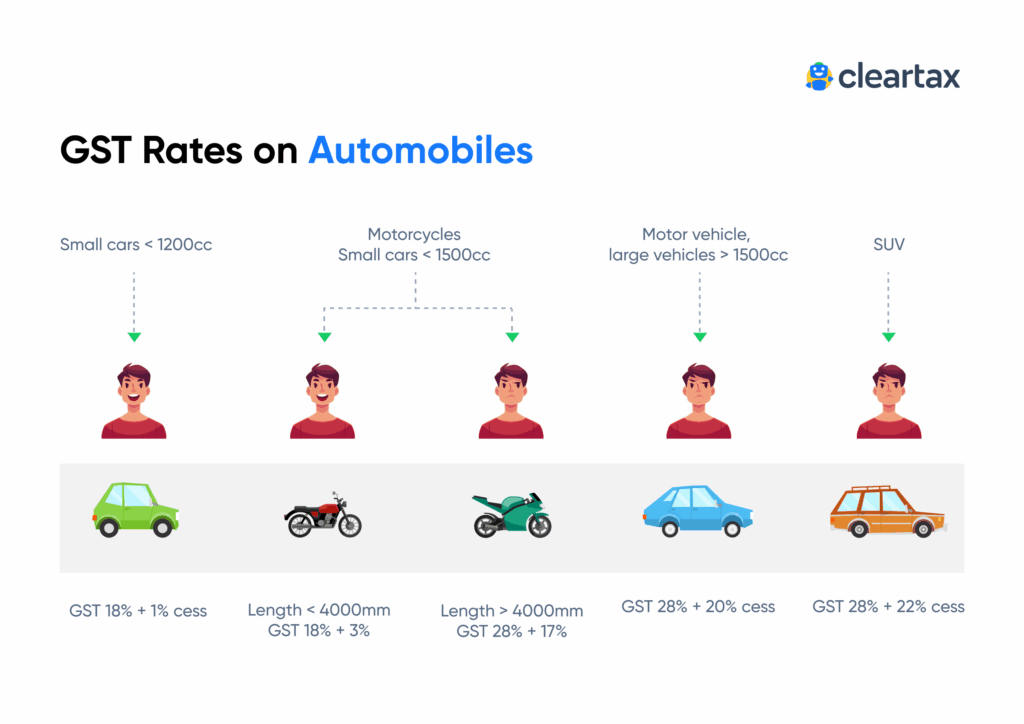

India’s system, particularly Telangana’s, is criticized for being regressive. A wealthy buyer paying ₹50 lakh for a luxury SUV pays proportionally the same percentage as a teacher buying a ₹1 lakh scooter. The burden is heavier on the poor, since the tax represents a larger share of their disposable income.

Practical Advice for Families

- Go Electric

EVs are 100% exempt until December 31, 2026. An electric scooter costing ₹1 lakh saves you at least ₹15,000 in taxes. Factor in fuel savings, and it becomes a smart financial move. - Explore Used Vehicles

Used cars and bikes already have life tax paid, making them a budget-friendly option. The resale market may see a boom thanks to the new policy. - Time Purchases Strategically

If you can wait, dealerships may roll out discounts next year to recover lost sales. Patience could save you thousands. - Recalculate Loans

Since the life tax is added upfront, it increases your loan principal. Always re-check EMI calculations with updated tax figures before signing loan papers. - Leverage Government Subsidies

Check central and state EV subsidy programs like FAME India Scheme. These incentives can significantly cut purchase costs.

Long-Term Implications

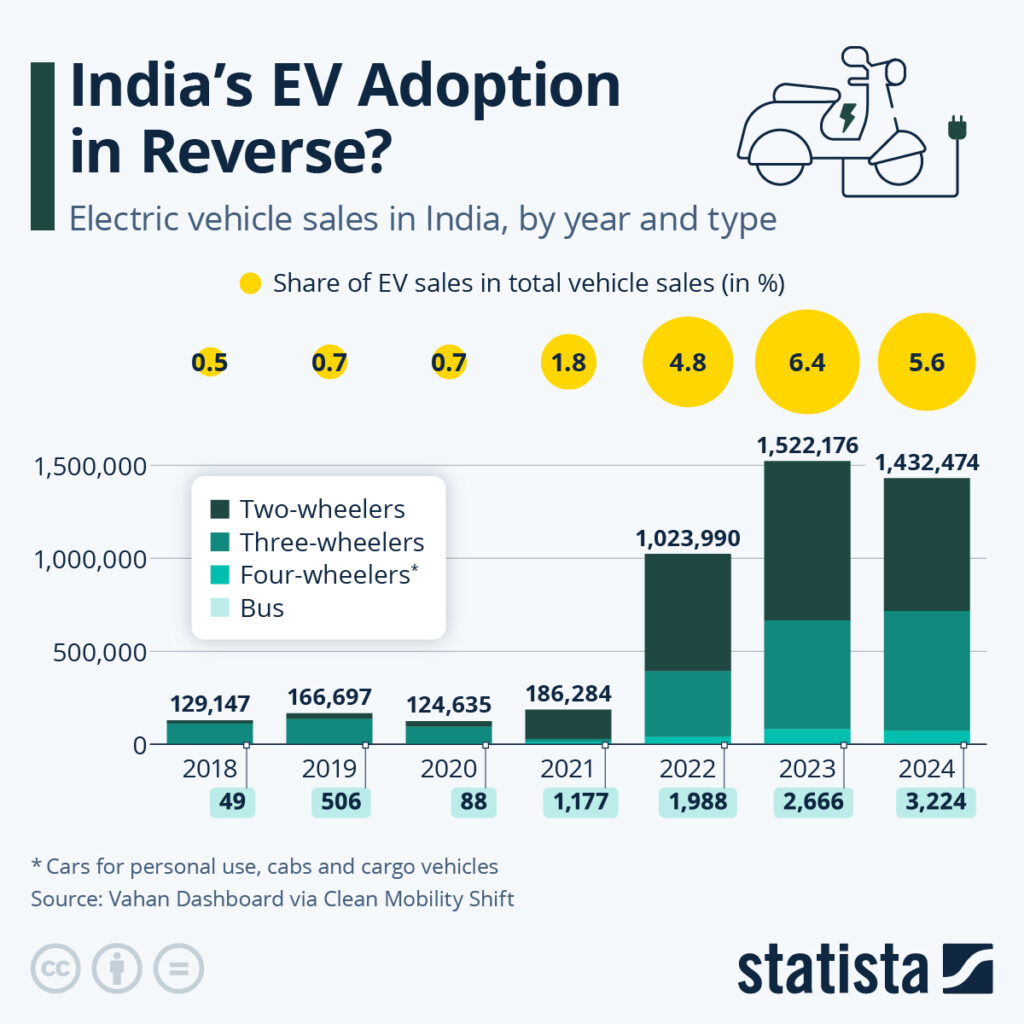

- Auto Industry Slowdown: Analysts predict a short-term dip of 10–15% in sales.

- Boost to EVs: Families seeking savings may turn to electric scooters and cars faster than expected.

- Household Budgets: Families may postpone upgrading vehicles, directly affecting mobility and productivity.

- Business Impact: Small delivery companies, taxi operators, and logistics providers will face higher upfront costs, potentially passing the burden to customers.

Net Direct Tax Collection Drops 4% – Should You Worry About FY26?

NMMC Rolls Out Property ID Cards – Here’s How It Will Change Tax Payments

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth