Pune Directors Caught in ₹50 Crore Fraud: When the headline “Pune Directors Caught in ₹50 Crore Fraud” began trending, it raised eyebrows. Was this another big-ticket corporate scandal from India’s tech capital? Here’s the twist: the case wasn’t in Pune at all—it happened in Mumbai. Two company directors, from completely different industries, allegedly staged one of the biggest recent Goods and Services Tax (GST) frauds. The amount involved? More than ₹50 crore (around $6 million USD). That’s not just pocket change—that’s enough to fund new schools, healthcare centers, or public infrastructure projects. The State GST (SGST) department investigated, and what they uncovered reads like a crime drama: fake invoices, bogus firms, and business addresses that didn’t even exist. This isn’t just another “corporate fraud” story—it’s a reminder for taxpayers, business owners, and even everyday citizens that fraud in the GST system affects all of us. Let’s break this down in plain English, with context, practical advice, and lessons you can use.

Pune Directors Caught in ₹50 Crore Fraud

The ₹50 crore GST fraud in Mumbai is a sharp reminder that tax fraud isn’t a victimless crime. Two directors, through bogus firms and fake invoices, tried to cheat the system—but SGST caught up with them. For businesses, the message is crystal clear: stay compliant, keep clean books, verify partners, and don’t chase shortcuts. Fraud may look like easy money, but the risks—legal, financial, and reputational—are far too high. India’s GST system is evolving, and as authorities sharpen their tools, fraudsters are running out of places to hide. The smartest move for any business is simple: play it straight.

| Aspect | Details |

|---|---|

| Incident | Two Mumbai-based directors arrested for GST fraud |

| Fraud Amount | Over ₹50 crore (≈ $6 million USD) |

| People Involved | Yashwant Kumar Tailor (Magic Gold Bullion Pvt Ltd) and Om Jay Ramrakhiani (RFIC Trading Pvt Ltd) |

| Fraud Tactics | Fake invoices, bogus Input Tax Credit (ITC), shell companies |

| SGST Findings | Non-existent firms, false registrations, missing records |

| Impact | Public revenue loss, unfair competition, erosion of trust |

| Law Applied | CGST Act, 2017 (Sections 132 & 74) |

| Official Source | Press Information Bureau – Government of India |

The Case: Two Directors, Two Frauds, One Big Loss

The Gold Bullion Illusion

The first director in the spotlight is Yashwant Kumar Tailor, who ran a company called Magic Gold Bullion Pvt Ltd. The business name itself carries weight—after all, bullion companies handle high-value gold trades. But investigators found that Tailor’s operations weren’t shining with gold. Instead, he allegedly claimed ₹30.5 crore in Input Tax Credit (ITC) through invoices from firms that simply did not exist.

His company had no employees, no physical infrastructure, and no ability to justify the massive turnover he declared. Essentially, it was a shell—a company that looked solid on paper but was hollow in reality.

The Phantom Trader

The second arrest was Om Jay Ramrakhiani, director of RFIC Trading Pvt Ltd. According to SGST, he staged a tax evasion worth ₹20.05 crore. His trick? Fictitious purchases from Bharat Metal Corporation, backed by canceled or fake registrations. On paper, he claimed ₹3.73 crore in ITC. On the ground, his registered address was just a residential flat with no records of commercial activity.

The pattern was clear: create fake transactions, claim credits, and disappear the taxes.

How GST Fraud Works (Explained for Everyone)

If you’re scratching your head about how GST fraud is even possible, here’s the simple version.

The Goods and Services Tax (GST) is like a nationwide sales tax system. It works like this:

- You buy something, you pay GST.

- You sell something, you collect GST.

- You file your GST returns, subtracting the GST you already paid (this is Input Tax Credit, or ITC).

Now, here’s the loophole fraudsters exploit: they create fake invoices for purchases that never happened. That way, they can claim ITC they don’t deserve. It’s like trying to get a tax refund for groceries you never bought.

Why Pune Directors Caught in ₹50 Crore Fraud Matters: The Bigger Picture

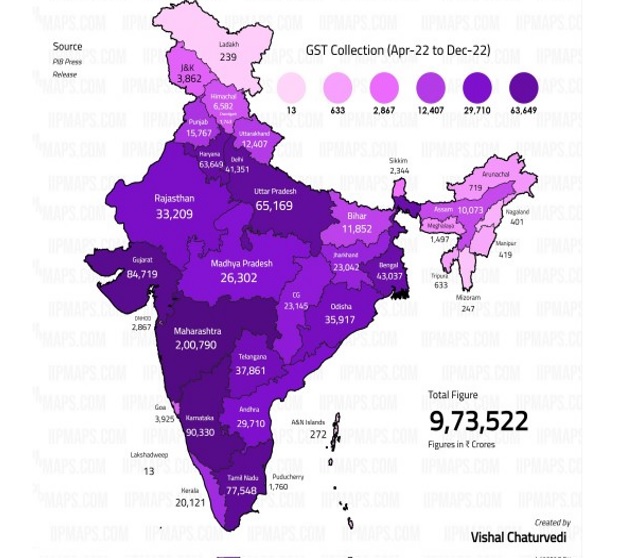

This fraud isn’t just about two individuals—it reflects a growing pattern. According to the Directorate General of GST Intelligence (DGGI), authorities uncovered more than ₹3,200 crore worth of GST fraud in just one year.

Here’s what that means in real terms:

- Revenue Loss: Every rupee stolen in fraud is money that could have funded highways, schools, or rural electrification.

- Unfair Competition: Fake companies can undercut genuine businesses by avoiding tax.

- Erosion of Trust: Foreign investors look at these cases and question India’s compliance standards.

- Bigger Audits: Honest taxpayers face more scrutiny, more paperwork, and higher compliance costs.

Fraud like this is essentially theft—not just from the government, but from every citizen.

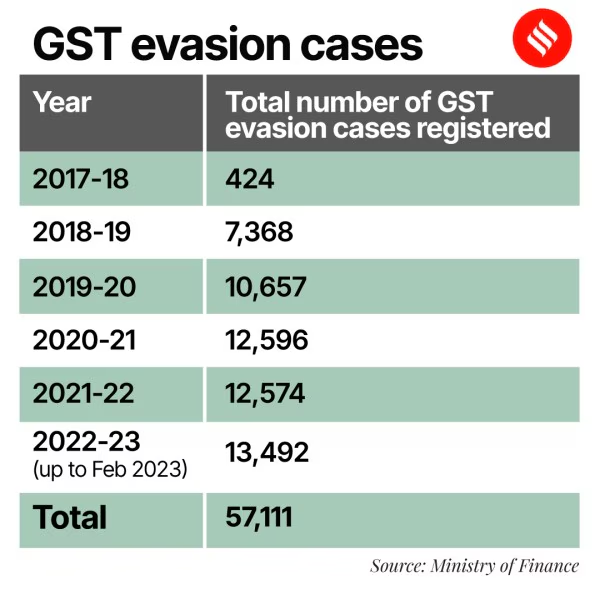

Historical Context: This Isn’t New

GST fraud didn’t start with this case. Ever since GST was rolled out in 2017, fraudsters have been testing its boundaries.

- In 2019, the DGGI busted a syndicate that used 5,000 fake companies to claim ITC worth ₹1,200 crore.

- In 2021, authorities uncovered fraud rings in Delhi where businesses used fly-by-night firms to scam GST credits.

- By 2023, the government reported over 20,000 fake GST registrations detected through nationwide drives.

The pattern is the same: ghost companies, fake paperwork, and a system struggling to keep up with fraudsters’ creativity.

Global Perspective: Not Just India’s Problem

Fraud in tax systems is a worldwide headache.

- In the United States, the IRS estimates the tax gap (the difference between taxes owed and taxes paid) is around $441 billion annually.

- In the European Union, Value Added Tax (VAT) fraud drains about €93 billion every year.

- In Canada, GST/HST fraud cases have also been prosecuted, with businesses fined and directors jailed.

India’s ₹50 crore case may look massive, but in the global scheme of things, it’s part of a much bigger battle.

What the Law Says: CGST Act, 2017

The Central Goods and Services Tax (CGST) Act, 2017 lays out strict penalties:

- Section 132: If fraud exceeds ₹5 crore, it’s a cognizable and non-bailable offense. Offenders can face up to 5 years in prison.

- Section 74: Authorities can recover the tax, charge interest, and impose penalties of up to 100% of the tax evaded.

- Section 122: Businesses involved in fake invoicing can be fined heavily—even if they claim ignorance.

So, for the two directors in this case, the road ahead is steep, both legally and financially.

Expert Take: Why Fraud Persists

Experts say GST fraud thrives due to three main reasons:

- Complex System: Multiple rates, constant amendments, and evolving compliance rules create loopholes.

- Cash-Heavy Sectors: Industries like bullion and trading often deal in large cash transactions, making them prone to manipulation.

- Weak Due Diligence: Many firms don’t vet suppliers or clients properly, unknowingly getting tangled in fraud networks.

As tax consultant Rajesh Mehta in Mumbai puts it:

“Fraud rarely begins with crores. It starts with lakhs. When early checks fail, the fraud snowballs. The solution is vigilance and data-driven audits.”

Practical Guide: How Businesses Can Stay Safe

Here’s a simple checklist for any business that doesn’t want to end up on the wrong side of an SGST raid:

Step 1: Verify Every Supplier and Client

- Use the GST portal to check GSTINs.

- Watch out for addresses that don’t match business activity.

Step 2: Keep Digital Records

- Store invoices, purchase orders, and contracts digitally.

- Use accounting tools that integrate with GST filings.

Step 3: Audit Regularly

- Run quarterly compliance checks.

- Hire external auditors once a year to spot red flags.

Step 4: Train Your Employees

- Teach staff to identify suspicious invoices.

- Create a safe whistleblowing mechanism.

Step 5: Don’t Cut Corners

- Avoid shortcuts in compliance.

- Remember: the short-term “gain” of tax evasion comes with long-term pain.

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

GST Crackdown in Aligarh: 11 Fake Firms Hit With Notices in Major Fraud Probe

Supreme Court Denies Plea Challenging GST ECL Blocking Relief