Tax Secret That Could Save You Thousands in 2025: When the headline “BBC drops a tax secret that could save you thousands in 2025” started circulating, a lot of readers brushed it off as sensational. But in reality, there’s substance behind it. The BBC has been covering changes in tax law and financial planning opportunities that will impact millions of Americans in 2025. These aren’t hidden loopholes—they’re adjustments to deductions, credits, and contributions that most taxpayers can access with the right planning. The reason 2025 is so important is simple: many provisions from the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire. That means this year represents a major turning point. Understanding the rules before they change could mean the difference between paying thousands more—or saving thousands when you file.

Tax Secret That Could Save You Thousands in 2025

The BBC wasn’t exaggerating when it teased a “tax secret” for 2025. The truth is, there isn’t one single secret—there are multiple opportunities baked into the tax code. Between the standard deduction increases, boosted retirement contribution limits, potential expansions of the Child Tax Credit, and energy efficiency incentives, taxpayers can keep thousands in their pockets. But timing matters. 2025 is the last year many of these benefits will be available under current law. Smart planning now—whether you’re a parent, investor, or small business owner—can set you up for major savings before the window closes.

| Topic | Key Insight | Data/Stat | Official Resource |

|---|---|---|---|

| Standard Deduction | Projected increase due to inflation adjustments | $14,600 (single), $29,200 (married) | IRS.gov |

| Child Tax Credit | Up to $3,600 per child if extended | $7,200 for two kids | Congress.gov |

| Retirement Contributions | 401(k): $23,000; IRA: $7,500 | +$7,500 catch-up (50+) | IRS Retirement Plans |

| Capital Gains | Bracket increases shield more middle-class investors | 0–15% long-term | IRS Tax Topics |

| Energy Credits | 30% federal credit on solar/EVs | $6,000 off $20,000 install | Energy.gov |

| Small Business Deductions | Section 179 & home office remain powerful | Deduct up to $1M in equipment | IRS Small Business |

Why 2025 Tax Changes Matter?

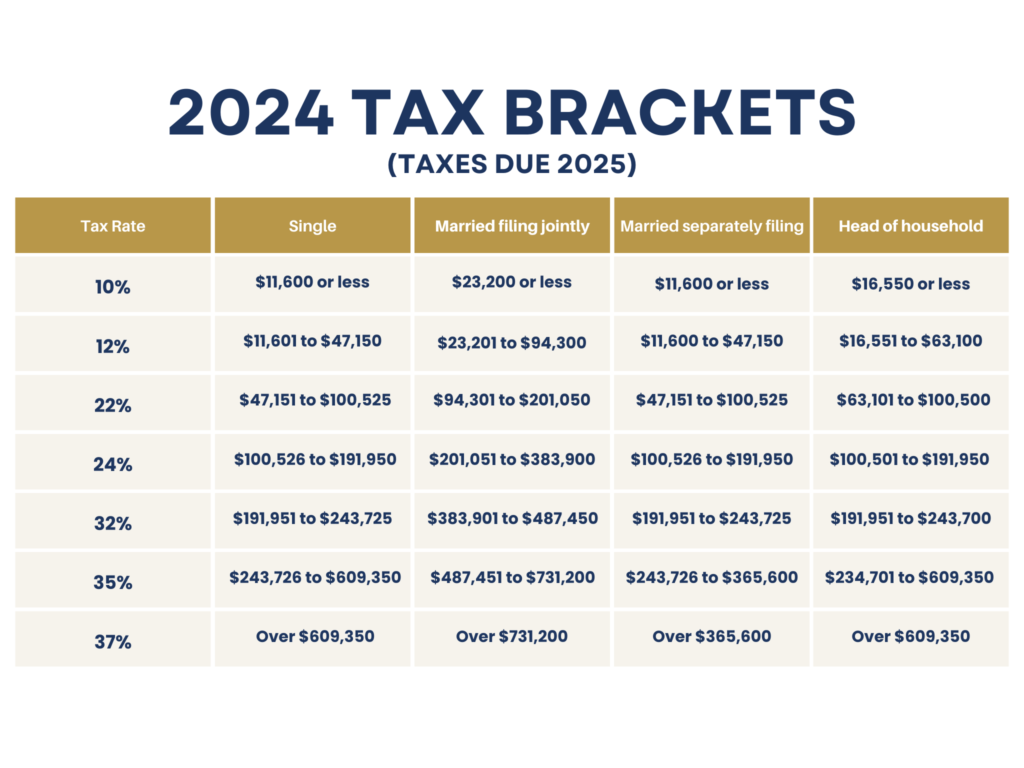

The TCJA dramatically reshaped the U.S. tax system when it passed in late 2017. It increased the standard deduction, lowered individual and corporate tax rates, capped the State and Local Tax (SALT) deduction, and nearly doubled the Child Tax Credit. But many of those changes had a built-in sunset date of 2025.

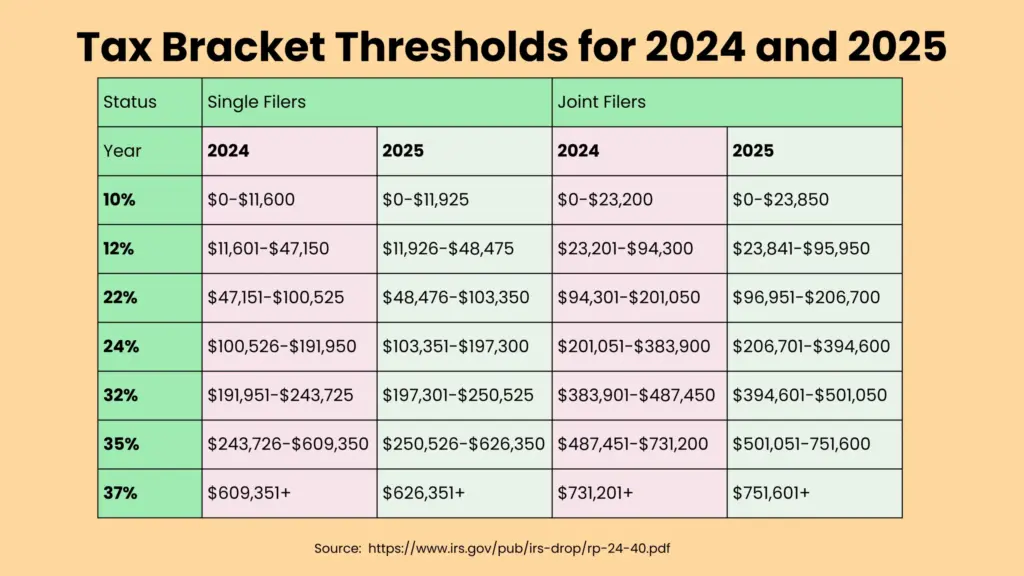

If nothing changes, tax brackets may revert to pre-2017 levels in 2026, meaning higher rates for most Americans. That’s why 2025 is often called a “last-chance year.” It’s the final opportunity to take advantage of today’s tax code before it potentially becomes less favorable.

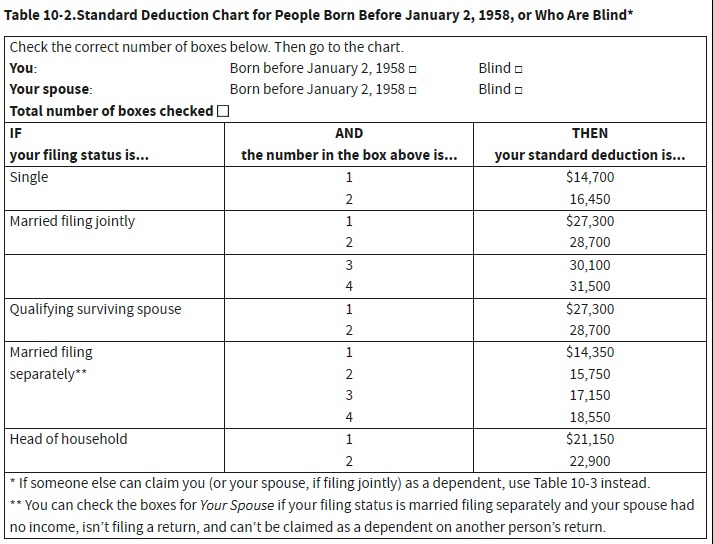

The Standard Deduction: Your Built-In Shield

One of the biggest wins for taxpayers is the standard deduction. In 2025, it is projected to rise to:

- $14,600 for single filers

- $29,200 for married couples filing jointly

This increase is tied to inflation and gives households an automatic reduction in taxable income.

Example: A single filer earning $70,000 will only be taxed on $55,400 after the deduction. Depending on their bracket, that could mean over $3,000 in federal tax savings.

For many families, the standard deduction now outweighs the benefits of itemizing, simplifying the process while keeping more money in their pockets.

The Child Tax Credit: Families on the Front Line

The Child Tax Credit (CTC) remains one of the most powerful tools for families. Currently, it provides up to $2,000 per qualifying child, but legislation is in play that could restore it to $3,600, like during the pandemic years.

Unlike deductions, credits reduce your tax bill dollar for dollar. For a household with two kids, that’s as much as $7,200 in savings.

This is especially important for middle-income families who may not itemize but still benefit from credits. If expanded, it could represent one of the single largest breaks available in 2025.

Retirement Accounts: Shelter and Growth

Retirement accounts are more than just savings—they’re one of the best legal tax shelters available. Contribution limits are rising in 2025, which means even greater savings:

- 401(k): $23,000

- IRA: $7,500

- Catch-up contributions (50+): $7,500 extra

If you’re 50 or older, you could put away $30,500 in a 401(k). In the 24% tax bracket, that translates to $7,320 in tax savings, not even counting employer matches or investment growth.

Capital Gains: Strategic Timing

Long-term capital gains taxes are generally lower than income taxes. In 2025, the brackets will adjust upward again due to inflation.

- 0% rate: Applies up to around $94,000 for married couples.

- 15% rate: Covers most middle-income households.

- 20% rate: Reserved for the highest earners.

If you’re considering selling stocks, property, or even cryptocurrency, the timing could be critical. Selling in 2025 may save you thousands compared to waiting until after TCJA provisions expire.

Energy Credits: Green Savings

The U.S. is incentivizing renewable energy through generous credits. In 2025, you can still claim:

- 30% credit on residential solar installations.

- Credits for EV chargers and battery storage.

For example, a $20,000 solar system earns a $6,000 tax credit. Combine that with state incentives, and the payback period shrinks dramatically. These credits not only cut your tax bill but also lower future utility costs.

Small Business and Self-Employed Benefits

Freelancers, gig workers, and small business owners often miss opportunities simply because they don’t know the rules. Key strategies include:

- Home Office Deduction: Deduct a portion of your rent, utilities, and internet if you use part of your home exclusively for business.

- Section 179 Deduction: Deduct up to $1 million for equipment like computers, vehicles, or office furniture.

- Self-Employed Health Insurance Deduction: Premiums for you and your family may be fully deductible.

Case Study: A self-employed graphic designer earning $85,000 could reduce taxable income by $30,000 through retirement contributions, home office deductions, and equipment write-offs. That’s a savings of more than $7,000 in taxes.

State Taxes: The SALT Factor

State and local taxes (SALT) have been capped at $10,000 since 2017. For homeowners in states like New York, New Jersey, and California, this was a painful change.

But here’s the catch: the cap is set to expire after 2025. If it does, high-income homeowners in high-tax states could once again deduct larger amounts. This could mean thousands in additional savings for property owners and professionals.

Common Mistakes to Avoid With Tax Secret That Could Save You Thousands in 2025

Even with opportunities on the table, taxpayers often make mistakes that cost them money. Some of the biggest pitfalls include:

- Waiting until tax season to plan – Strategic moves need to be made during the year.

- Overlooking credits – Many people focus on deductions but miss valuable credits like education and energy incentives.

- Not tracking expenses – Self-employed individuals often lose out by failing to keep detailed records.

- Relying on DIY software when situations are complex – Tax software is powerful, but when multiple credits, investments, or businesses are involved, a CPA may uncover savings the software misses.

Maryland’s Digital Ad Tax Crushed – CCIA Scores Major Win

Infosys Hit With GST Fine In Singapore – What The Filing Reveals

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big