Cement Stocks Could Boom: If you’ve been following business news lately, one headline stands out: Cement stocks could boom as analysts eye a possible GST slash. This isn’t just some boring tax reform buried in government paperwork—this is a move that could shake up India’s entire construction sector, affect homebuyers, and open up new opportunities for investors. Cement may not be as flashy as tech stocks or electric vehicles, but it’s the backbone of India’s growth story. From the highways we drive on to the homes we live in, cement is everywhere. And if the government decides to cut the Goods and Services Tax (GST) on cement, the ripple effects could be massive.

Cement Stocks Could Boom

At the end of the day, cement stocks could boom as analysts eye a possible GST slash, but it’s not just about speculation. The fundamentals—rising demand, strong earnings, and infrastructure push—are already in place. A tax cut could simply speed things up. For investors, the smart play is to stay informed, diversify, and think long-term. Cement may not get the hype of tech or AI stocks, but it’s the foundation of India’s growth story—literally and financially.

| Factor | Details |

|---|---|

| GST Reform Proposal | India may move cement from 28% to 18% GST slab. |

| Expected Impact | Cement prices could fall by 7–8%, boosting demand in construction. |

| Stock Market Reaction | Earlier GST rumors pushed UltraTech and Ambuja shares up ~3% intraday. |

| Company Performance | UltraTech profit up 49% YoY; Ambuja profit up 37% YoY in Q1 2025. |

| Top Brokerage Picks | UltraTech, Ambuja, Dalmia Bharat, JK Lakshmi identified as top winners. |

| Implementation Timeline | GST Council review expected by September–October 2025. |

| Official Resource | Government of India GST Portal |

Understanding GST and Why It Matters for Cement

GST (Goods and Services Tax) is India’s unified tax system that replaced multiple state and central levies. Right now, cement falls under the 28% slab, which is one of the highest rates. For context, many essential goods are taxed at 5% or 12%.

Now, think about it: cement isn’t a luxury—it’s essential for housing, infrastructure, and industry. Yet, it gets taxed like a luxury item. If the rate is cut to 18%, that’s a 10 percentage point drop, which could translate into significantly lower costs for builders and homebuyers.

To put this into perspective, in the U.S., sales tax on building materials generally runs between 6–10%. In Europe, VAT on cement ranges between 5–20%. India’s 28% is clearly an outlier, and that’s why industry leaders have been lobbying for reform.

Why Analysts Are Optimistic?

Financial experts aren’t hyping this up for nothing. They see a GST cut as a trigger for a fresh wave of demand.

- Emkay Global projects 10–15% earnings upgrades for cement and related industries if GST slabs are reduced.

- Nomura has flagged UltraTech and Ambuja as long-term winners due to robust fundamentals and efficiency improvements.

- Jefferies calculates that customer prices could fall by 7–8%, giving the sector a big demand push.

And history backs this up. In February 2023, mere speculation of a GST cut led cement giants UltraTech and Ambuja to jump nearly 3% in a single trading session.

Spotlight on Major Cement Companies

UltraTech Cement

- Reported a 49% YoY surge in net profit in Q1 2025.

- Volumes grew nearly 10%, revenue increased by 13%.

- Brokerages like Motilal Oswal boosted their target price to ₹14,600.

- Its scale and cost efficiency make UltraTech the bellwether for the industry.

Ambuja Cements

- Logged a 37% YoY rise in pre-tax profit for Q1 2025.

- Managed growth despite seasonally weak conditions.

- Strong distribution network positions Ambuja well for demand spikes.

Others Worth Watching

- Dalmia Bharat – Aggressive expansion plans make it a strong mid-cap candidate.

- JK Lakshmi Cement – Benefiting from regional strength and cost discipline.

- Shree Cement – Another heavyweight, though often more volatile in earnings.

These companies aren’t waiting for GST changes to succeed—they’re already delivering strong numbers. A tax cut could act as rocket fuel.

How a GST Cut Impacts Real Life?

It’s one thing to talk numbers, but let’s make this practical.

- Homebuyers: A family building a house in India could save tens of thousands of rupees on construction costs. That makes home ownership more affordable.

- Contractors and Builders: Small contractors get more competitive because they can take on bigger projects at lower input costs.

- Government Projects: Roads, bridges, airports, and affordable housing become cheaper to build, stretching budget allocations further.

Lower cement prices ripple through the entire economy—boosting demand, creating jobs, and accelerating infrastructure development.

Government’s Side of the Story

Why is the government even considering this now?

- Economic Growth Push: Infrastructure spending is a proven way to boost GDP and job creation.

- Election Year Incentive: Making housing more affordable is always a political win.

- Simplification Goal: The Finance Ministry has been working toward fewer GST slabs to make compliance easier.

The challenge? Cutting GST means a loss of tax revenue. The government must balance stimulating growth with maintaining fiscal discipline.

Risks You Can’t Ignore

While the upside looks great, investors need to keep both feet on the ground.

- Approval Delays: GST Council discussions can drag on, with reforms pushed back multiple times.

- Margin Capture: Cement companies may keep part of the tax savings instead of fully passing them to customers.

- Global Costs: Rising energy or coal prices could still pressure profit margins, offsetting tax benefits.

- Market Hype: Retail investors often rush in late, buying when stocks are already overvalued.

Investor Guide: How to Play the Cement Boom

If you’re eyeing this sector, here’s a smart way to approach it.

Step 1: Follow Official Sources

Monitor GST.gov.in and Finance Ministry updates. Avoid relying only on TV debates or market gossip.

Step 2: Start with Leaders

Begin with UltraTech or Ambuja. These companies are safer bets because they’re diversified and financially strong.

Step 3: Add Mid-Caps for Growth

If you’re comfortable with risk, look at Dalmia Bharat or JK Lakshmi for higher returns.

Step 4: Spread Risk

Don’t put everything into cement stocks. Balance your portfolio with infrastructure, housing finance, or real estate stocks.

Step 5: Stay Long-Term

India’s urbanization and infrastructure needs guarantee demand for decades. Don’t get rattled by short-term price swings.

Historical Perspective and Global Lessons

This wouldn’t be the first time tax policy boosted an industry.

- In 2017, when GST first launched, many industries saw initial slowdowns but later benefited from simplified taxation.

- Globally, countries like China have used tax incentives in construction to stimulate growth during slowdowns.

- In the U.S., infrastructure bills tied to lower costs for materials often fuel rallies in related stocks.

The lesson: tax cuts in essential industries nearly always translate into broader economic growth.

Caught Profiteering! Subway Franchise Penalized ₹5.45 Lakh for Withholding GST Rate Cut Benefits

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

Future Outlook

Looking ahead, the future of cement stocks will depend on two main factors:

- Policy Approval: If GST is cut, expect a sharp rerating of cement companies.

- Macro Environment: Strong infrastructure demand and easing input costs support long-term growth regardless of tax changes.

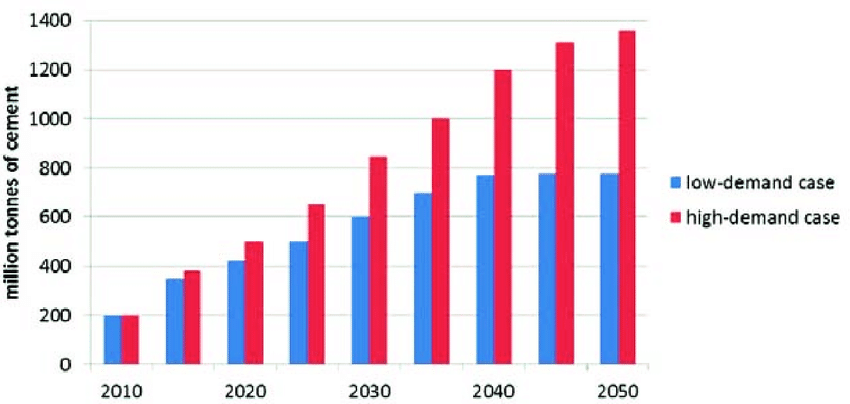

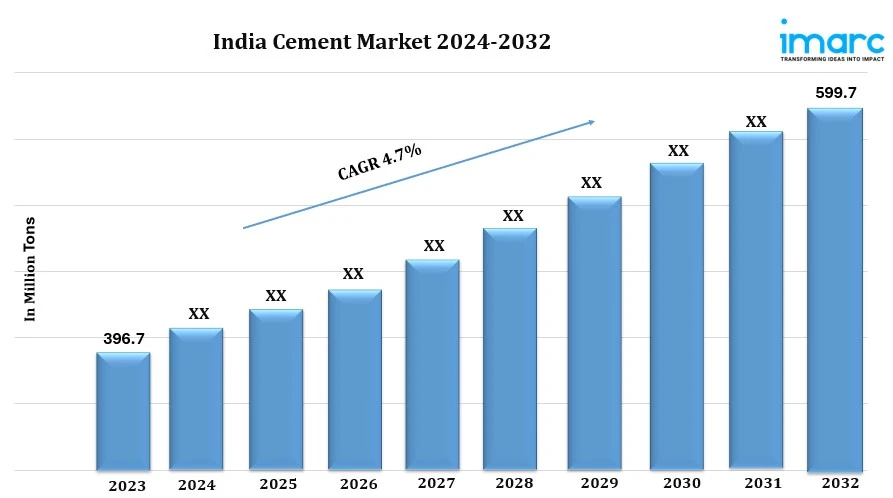

Analysts believe that even without reforms, India’s cement industry could see 7–9% annual demand growth over the next decade due to urbanization, affordable housing, and mega infrastructure projects. A GST cut would only accelerate that trend.