Massive GST Cut: If you’ve been thinking about buying a new car, bike, or SUV, here’s some exciting news: a massive GST cut on cars, bikes, and SUVs could be just around the corner. Yup, you read that right. India’s government is shaking things up in the tax system, and if the reforms go through, your next set of wheels might cost a whole lot less. Now, before you start revving the engine, let’s break this down in plain English. GST, or Goods and Services Tax, is the tax you pay on almost everything you buy—clothes, electronics, food, and yes, even your vehicle. For years, cars and bikes have been sitting in the highest tax bracket—28% plus cess. That’s one of the reasons vehicles feel so darn expensive in India. But now, things may finally be about to change.

Massive GST Cut

The massive GST cut on cars, bikes, and SUVs is shaping up to be one of the biggest consumer-friendly moves in recent years. If approved, it could make vehicles much more affordable, especially for middle-class buyers. While SUVs and luxury cars may not see dramatic savings, the entry-level segment—small cars and commuter bikes—could finally get the tax relief they’ve been waiting for. So, if you’ve been holding back on that new car or bike, this Diwali might just be the perfect time to hit the accelerator.

| Point | Details |

|---|---|

| Proposed GST Slabs | 5% (essentials), 18% (standard goods, including small cars & bikes), 40% (luxury/sin goods) |

| Impact on Small Cars | Tax could drop from ~29–30% to 18% |

| Impact on Bikes | Entry-level bikes may fall from ~28% to 18% |

| Impact on SUVs/Luxury Cars | Down from ~43–50% to ~40% |

| EVs (Electric Vehicles) | Likely to stay at 5% GST |

| Implementation Timeline | Expected by Diwali 2025 (October) |

| Official Source | Government of India GST Portal |

Why This GST Cut Matters?

Let’s be real: cars and bikes aren’t just status symbols in India—they’re necessities. Whether it’s the family hatchback, a budget commuter bike, or a rugged SUV for road trips, vehicles are central to daily life. The problem? Taxes make them pricey.

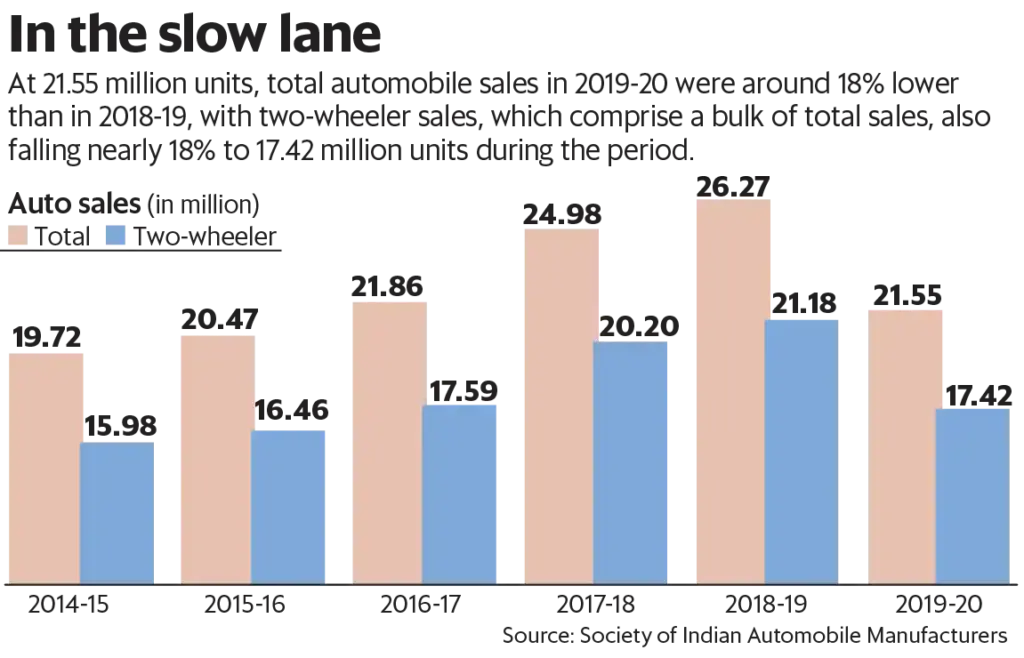

This proposed GST overhaul could slash taxes for small cars and entry-level bikes to 18%, putting more money back in the pockets of middle-class buyers. That’s not just good news for your wallet—it’s a lifeline for the auto industry, which has seen sluggish sales in recent years.

Historical Context: Why Vehicles Are So Expensive in India

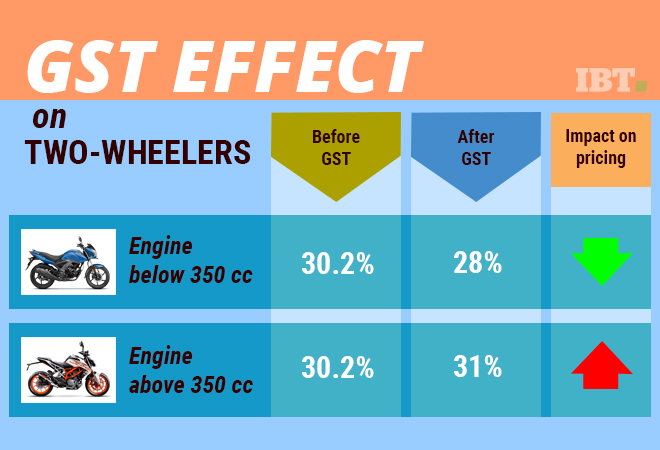

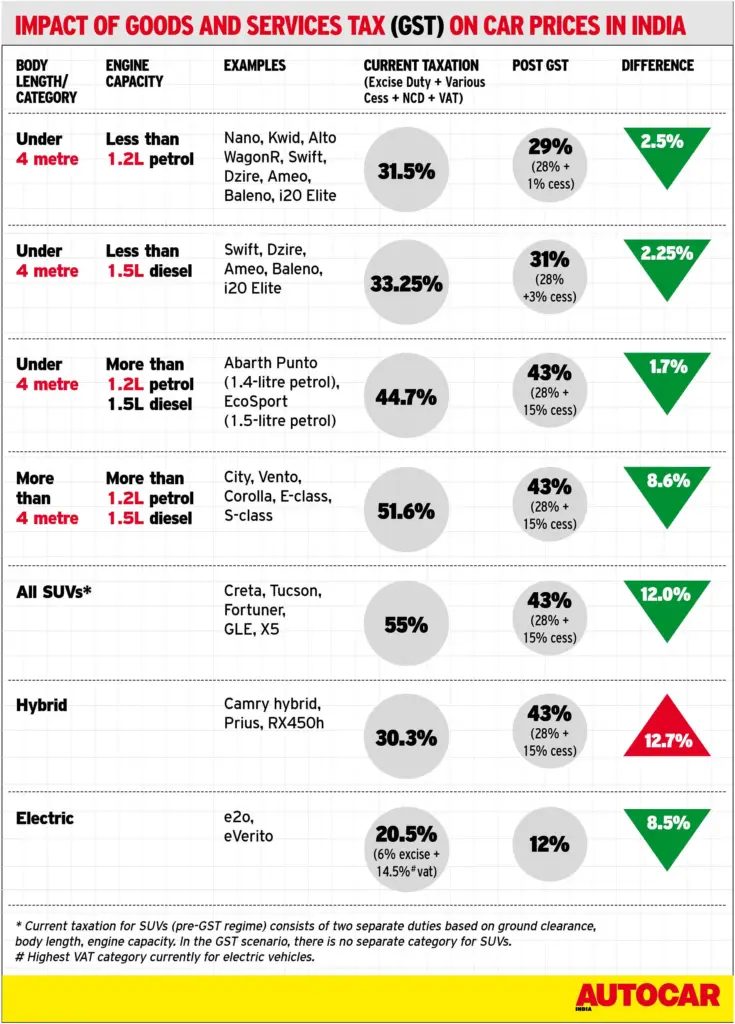

Before GST arrived in 2017, cars and bikes were already heavily taxed with excise duty, VAT, road tax, and octroi. After GST replaced these, the 28% slab plus cess kept vehicle prices high.

- Small cars: ~29% tax burden.

- SUVs/luxury cars: ~43–50% tax burden.

- Two-wheelers: 28% GST.

Compared to countries like the U.S., where average sales tax on cars is around 6–10%, India’s auto taxes remain among the steepest globally.

Breaking Down the Numbers

Small Cars and Hatchbacks

- Current rate: 28% GST + 1% cess (around 29–30%)

- Proposed new rate: 18% flat

- Example: A hatchback costing ₹6 lakh could get cheaper by ₹60,000–70,000.

Bikes and Two-Wheelers

- Current rate: 28% GST

- Proposed new rate: 18%

- Example: A commuter bike worth ₹80,000 may drop to ₹70,000.

SUVs and Larger Cars

- Current rate: 43–50% (including cess)

- Proposed new rate: 40% special slab

- Example: A ₹25 lakh SUV may see a cut of around ₹75,000–1,00,000.

Electric Vehicles (EVs)

- Already at 5% GST, and likely to remain unchanged—making them the most tax-friendly option on the market.

Why Now? The Bigger Picture

The Indian auto market has been struggling, especially in the entry-level car and bike segment. Rising fuel prices, inflation, and high taxes kept many potential buyers away. Automakers like Maruti Suzuki, Hero MotoCorp, and Tata Motors have been pushing for relief.

On top of that, festive season sales (like Diwali) are crucial for the auto industry. A tax cut rolled out in October could set the stage for a bumper sales season, giving buyers an incentive to finally take the plunge.

And let’s not forget politics—tax cuts make for good headlines, and governments love delivering “Diwali gifts” to voters.

Global Comparison: How India Stacks Up

- United States: Sales tax varies by state, but most vehicles face only 6–10% tax.

- Germany/Europe: Cars face 19–25% VAT, still far below India’s 28–50%.

- Japan: Vehicle purchase tax is around 10%, plus annual road tax.

Bottom line? India’s vehicle taxes have been on the higher end globally, which is why a GST cut could finally make cars and bikes more affordable by international standards.

Industry Impact & Market Reactions

For automakers, this could be a game-changer. Stocks of major carmakers like Maruti Suzuki, Hyundai, Tata Motors, and Hero MotoCorp already jumped by 6–8% when the news broke.

According to SIAM (Society of Indian Automobile Manufacturers), demand in the small car and bike segment could grow by 15–20% in the first six months after the tax cut. That’s huge for an industry that’s been struggling since COVID.

Suppliers and dealers could also benefit. Lower taxes mean higher sales, which means more jobs in manufacturing, logistics, and financing. Banks and NBFCs may also see a surge in auto loans.

Challenges and Criticism

While the news is great for buyers, there are some challenges:

- Revenue Loss for States – States rely heavily on GST compensation. Lower rates could squeeze state budgets.

- Luxury Segment Pushback – Makers of premium cars may argue that the 40% slab still discourages buyers.

- Implementation Delays – While the government is targeting Diwali, political negotiations in the GST Council could push timelines.

- Inflationary Pressure – Some economists warn that while cars get cheaper, the government may increase taxes elsewhere to offset losses.

What Massive GST Cut Means for Buyers?

Here’s what it means for everyday buyers:

- More Affordable Vehicles – Lower taxes = lower prices.

- Better Loan Deals – Lower prices mean smaller EMIs, making financing easier.

- Boosted Resale Value – If you already own a small car or bike, resale demand might climb when new buyers rush into the market.

- EV Advantage – With EVs still taxed at just 5%, they’ll continue to be the most affordable long-term bet for eco-conscious drivers.

Consumer Psychology: Why Timing Is Everything

In India, buying vehicles is often tied to festive seasons. Families prefer to make big purchases during Diwali or Dussehra for cultural and financial reasons. If GST cuts align with this timeline, the psychological push could double sales impact.

Auto dealers also play into this psychology by offering bundled discounts, exchange bonuses, and festive EMI offers. A GST cut could supercharge these deals.

Practical Advice: Should You Wait to Buy?

If you’re in the market for a small car or bike, you might want to wait until Diwali 2025. Prices could drop significantly, saving you thousands. But if you’re eyeing an SUV or luxury model, the cuts may not be as dramatic—so buying now versus later won’t make as big a difference.

Also, keep in mind: initial demand might skyrocket after the cuts. That could mean longer wait times and fewer discounts from dealers.

Step-by-Step Guide to Making the Most of GST Cuts

- Stay Updated – Follow official news on the GST Council’s website.

- Compare Models – Check how much tax savings apply to the vehicle category you’re interested in.

- Talk to Dealers – Ask them about expected changes in pricing. Many will give you the inside scoop.

- Plan Financing – Pre-approve loans ahead of the festive season to beat the rush.

- Time Your Purchase – If cuts roll out by October, be ready to book fast before waiting periods stretch out.

Future Outlook

Looking ahead, this tax reform could:

- Encourage greater adoption of EVs as the market shifts.

- Boost job creation in manufacturing, dealerships, and financing.

- Position India’s auto industry for global competitiveness, especially in exports.

- Help families stretch budgets further, allowing more first-time buyers to join the vehicle market.

If done right, the GST cut won’t just be a short-term festive gift—it could reshape the auto industry for the next decade.

Trader Faces GST Heat as Delhi HC Upholds Demand Over Silence and No-Show

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts