Govt Plans 40% Sin Tax on Alcohol, Cigarettes and Gaming: The Indian government is shaking things up with its latest announcement of a 40% sin tax on alcohol, cigarettes, and gaming under GST 2.0. Yes, you read that right—a flat forty percent. This bold proposal is part of the much-talked-about GST 2.0 overhaul, which aims to simplify India’s Goods and Services Tax system while discouraging consumption of products often labeled as “demerit goods.” For everyday people, this means weekend drinks, cigarette packs, and even online fantasy sports or poker apps may soon get a lot more expensive. For businesses and investors, the reform could spell both risks and opportunities. And for the government, it’s about simplifying taxes, plugging revenue leaks, and tackling public health challenges.

Govt Plans 40% Sin Tax on Alcohol, Cigarettes and Gaming

The government’s proposal for a 40% sin tax under GST 2.0 is a bold reform that could reshape India’s tax structure and consumer habits. While alcohol and tobacco taxes are expected to remain steady, online gaming faces an uncertain future. The stock market has already reacted, industries are preparing for impact, and consumers may soon feel the pinch in their wallets. Whether this becomes a landmark tax reform success or a cautionary tale depends on execution, enforcement, and whether the revenues are used to build a healthier, more sustainable India.

| Point of Focus | Details | Source |

|---|---|---|

| Proposal | 40% sin tax under GST 2.0 on alcohol, tobacco, and online gaming | Economic Times |

| Impact on Tobacco | Effective tax stays ~88% due to excise duty adjustments | Times of India |

| Impact on Gaming | 40% rate could lead to mass shutdowns and loss of jobs | Storyboard18 |

| Market Reaction | Stocks of alcohol, cigarette, and gaming firms dropped 4.5% after the announcement | Economic Times |

| GST 2.0 Goal | Simplify tax slabs to 5% & 18% with special 40% sin tax | Government sources |

| Timeline | GST Council discussions expected by Sept–Oct 2025 | Govt statements |

GST 2017 vs. GST 2.0: What’s New?

When GST launched in 2017, it replaced a messy web of state and central taxes. But the system ended up with multiple slabs: 5%, 12%, 18%, 28%, plus a compensation cess for items like luxury cars, tobacco, and aerated drinks. Businesses often complained of confusion and compliance headaches.

GST 2.0 is meant to simplify this structure:

- 5% for essentials like food and medicine.

- 18% for most goods and services.

- 40% sin tax for products seen as harmful or luxury indulgences—alcohol, tobacco, and real-money gaming.

By cutting the slabs down to just two plus a sin tax, the government hopes to create a cleaner, more predictable system.

Why Govt Plans 40% Sin Tax on Alcohol, Cigarettes and Gaming?

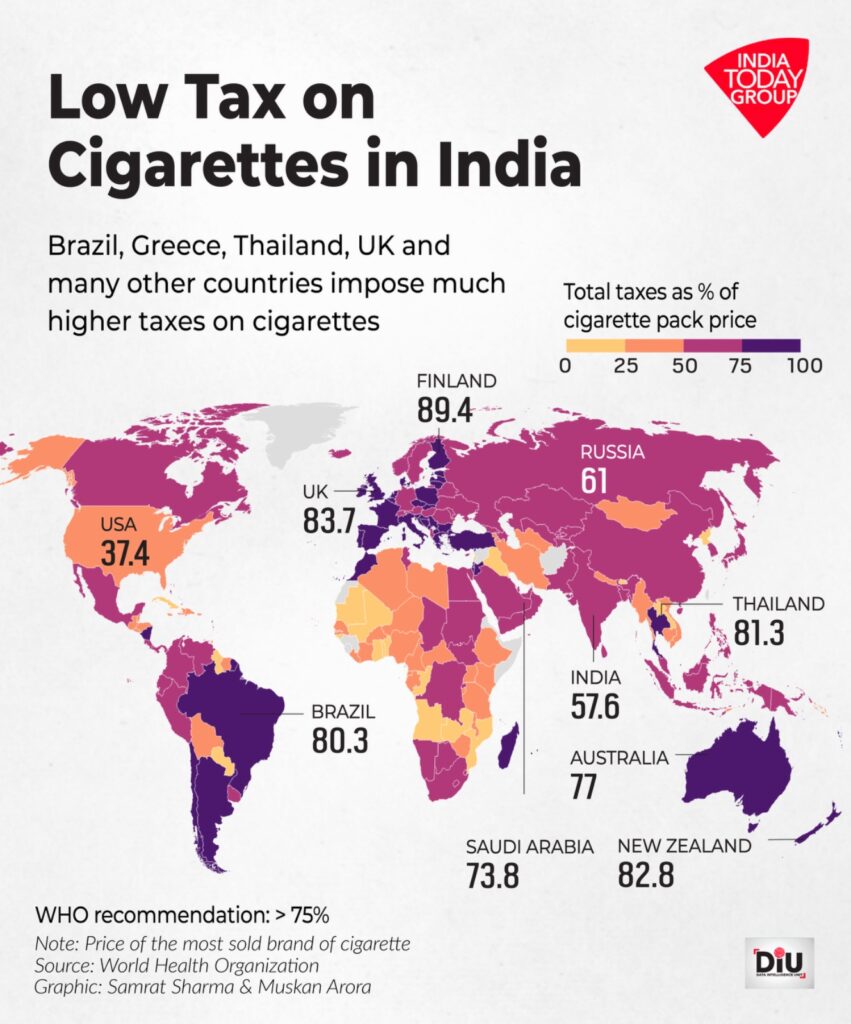

The concept of a sin tax isn’t new. Globally, governments tax harmful goods to discourage use and generate funds for healthcare or infrastructure.

- In the United States, cigarettes carry a $1.01 federal tax per pack, plus state-level taxes (New York adds $4.35 per pack).

- In the UK, alcohol is taxed through a system that increases with inflation, and cigarettes face one of the highest duties in Europe.

- In Singapore, tobacco taxes are so steep a pack costs nearly $14 USD.

India is moving in the same direction with GST 2.0. The 40% rate is designed to replace the cess system, which expires soon. Without it, the government risks losing over ₹1.5 lakh crore annually in revenue from these goods.

Impact Across Sectors

1. Alcohol

Alcohol taxation in India is mostly controlled by states. But premium alcohol, like imported whiskey or craft beer, could face additional levies under GST 2.0. Expect prices of foreign spirits and premium brands to rise sharply. For middle-class consumers, this could mean switching to local options or reducing consumption.

2. Cigarettes and Tobacco

The total tax burden on cigarettes will remain ~88%, one of the highest in the world. This is intentional: higher costs deter young people from starting. However, industry experts caution that if prices get too high, it could push smokers toward illegal or smuggled products.

3. Online Gaming

Perhaps the most controversial part of GST 2.0 is the 40% slab on online gaming. The sector has been booming, valued at $3.1 billion in 2025 and projected to hit $7.5 billion by 2030. But with such a heavy tax burden, companies warn of:

- Mass shutdowns of startups.

- Layoffs across an industry that employs 100,000+ people.

- Gamers shifting to offshore, unregulated platforms.

Unlike alcohol or tobacco, online gaming doesn’t carry the same physical health risks, making the inclusion in the sin tax bracket a heated debate.

4. Stock Market Reaction

On August 18, 2025, shares of companies in these sectors tumbled:

- ITC (cigarettes) fell nearly 4%.

- United Spirits (alcohol) dropped around 3.5%.

- Delta Corp (gaming) plunged 4.5%.

This shows investor nervousness about future revenues and regulatory uncertainty.

Expert Opinions

- Economists argue sin taxes can only succeed if revenues are reinvested in public health and education.

- Public health experts point to WHO studies showing higher tobacco taxes directly reduce smoking rates.

- Industry leaders warn of job losses, lower investment, and higher black-market activity if rates are set too high.

Case Studies from Around the World

- Philippines (2012): Introduced higher sin taxes on tobacco. Smoking prevalence dropped 13% in four years, and funds were used to expand healthcare access.

- Mexico (2014): Introduced a soda tax. Within two years, sugary drink sales fell by 7.6%, showing taxes can change consumer behavior.

- New York City: With the highest cigarette tax in the U.S., smoking rates are among the lowest nationwide.

India hopes for similar health benefits, but enforcement will be critical.

Government’s View vs. Industry’s Concerns

Government’s Goals:

- Simplify GST into fewer slabs.

- Maintain steady revenues after cess expiry.

- Discourage consumption of harmful goods.

Industry’s Concerns:

- Gaming firms argue they are unfairly clubbed with alcohol and tobacco.

- Alcohol companies fear higher taxes could hurt premium markets.

- Tobacco firms warn of growth in illegal cigarette trade.

Practical Advice

For Consumers:

- Expect alcohol and tobacco prices to remain high or increase.

- Online gamers should prepare for higher fees or fewer platforms.

For Businesses:

- Alcohol brands may need to diversify into affordable segments.

- Gaming startups should explore ad-based revenue models.

- Tobacco firms will need stricter anti-smuggling measures.

For Investors:

- Reevaluate portfolios with heavy exposure to sin industries.

- Monitor upcoming GST Council meetings in Sept–Oct 2025 for clarity.

Future Outlook

GST 2.0 is part of India’s long-term plan to simplify taxation by 2047, when the government envisions a single tax slab. In the short run, though, the 40% sin tax could reshape industries, consumer behavior, and investor strategies.

The big question is: Will this reform actually reduce harmful consumption and strengthen India’s economy, or will it backfire by pushing people into black markets and hurting legitimate businesses?

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay

Atlassian Executives Forced To Sell Shares – The Tax Reason Behind It

Income Tax Bill 2025 Brings No Rate Hike – But Here’s The Catch