₹332 Crore Bogus Copper Supply Scam: The shocking news of a ₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid has made waves across India’s financial landscape. But here’s the truth: the actual fraud involved over ₹100 crore in fake invoices and around ₹33.2 crore in fraudulent Input Tax Credit (ITC) claims. For readers in the U.S. or elsewhere, this isn’t just an “India-only” issue. It’s a case study in how tax fraud works across the globe, whether it’s called GST fraud in India, VAT fraud in Europe, or IRS tax evasion in the United States. Whether you’re running a shop in Kansas City or a copper trading unit in Hyderabad, the big lesson is clear: cheating the tax system may look tempting, but it never ends well.

₹332 Crore Bogus Copper Supply Scam

The ₹332 Crore Bogus Copper Supply Scam in Telangana may have been misreported in numbers, but the truth is clear: tax fraud is a serious crime with far-reaching consequences. From Hyderabad to Houston, governments are cracking down harder than ever. The lesson for businesses is simple: play it straight. Fraud may look like a quick win, but it’s always a long-term loss. Integrity isn’t just about following the law—it’s about building trust with customers, partners, and regulators. And in today’s interconnected world, trust is the most valuable currency of all.

| Aspect | Details |

|---|---|

| Scam Value | Over ₹100 crore (≈ $12M USD) |

| Fraudulent ITC Claimed | ₹33.2 crore |

| Company Involved | Keshaan Industries LLP, Hyderabad |

| Main Tactic | Fake invoices for copper supply, no actual goods moved |

| Action Taken | Raids, evidence seizure, criminal complaint filed |

| Directors Named | Vikash Kumar Keeshan & Rajneesh Keeshan |

| Official Reference | NDTV Report |

What Really Happened in Telangana?

Investigators discovered that Hyderabad-based Keshaan Industries LLP had been generating fake GST invoices, claiming that copper shipments were sent to Maharashtra. On paper, it all looked legit: invoices, e-way bills, and transport documents matched up. But in reality, the trucks weren’t hauling copper—they were empty vehicles.

This fake paper trail allowed the company to wrongfully claim ₹33.2 crore in Input Tax Credit (ITC). That meant they paid less tax than they owed, effectively siphoning off public money for private gain.

When raids were conducted at multiple locations—including corporate offices, warehouses, and factory units—officials found evidence like hard drives, ledgers, and even CCTV footage proving the scam.

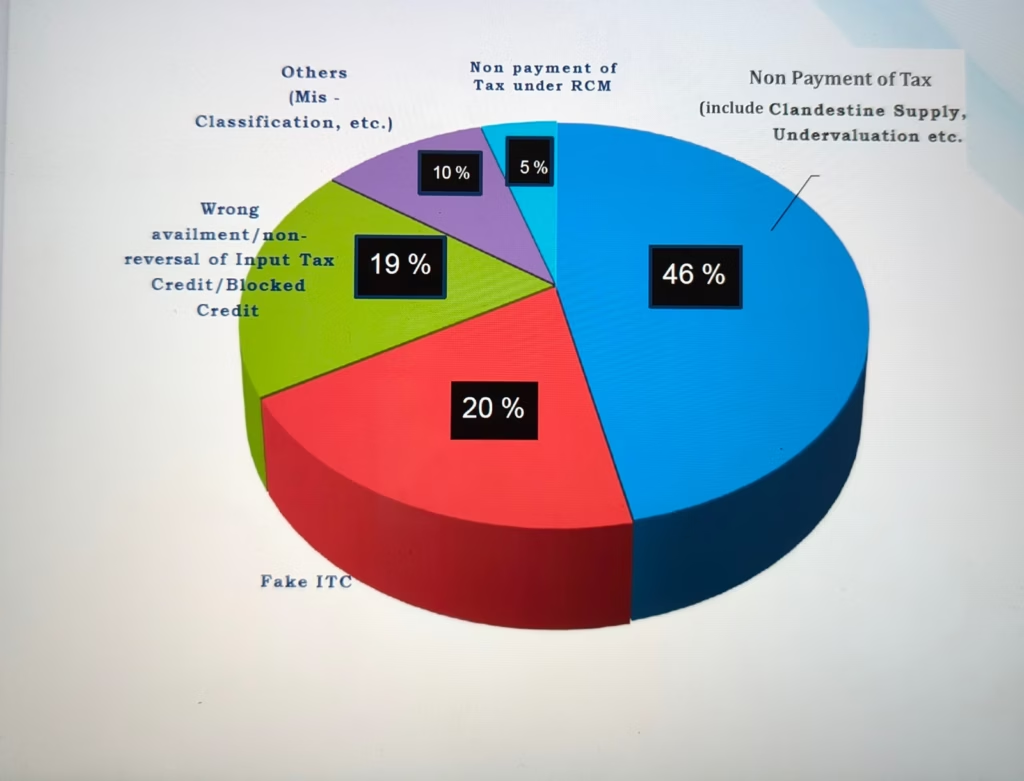

Why Tax Scams Like This Keep Happening?

Everywhere in the world, people try to game the tax system. Some of the common reasons include:

- Quick Money Grab: Bogus ITC claims or fraudulent deductions can make profits look bigger on paper.

- Loopholes in Law: Complex tax codes sometimes leave room for shady tactics.

- Overconfidence: Fraudsters believe regulators won’t notice, or audits won’t catch them.

But history shows us otherwise. Remember how Al Capone was taken down not for murder or racketeering, but for tax evasion? The same principle applies today.

The Bigger Picture: Impact on Economy and Society

Why should you or I care about what happened in Telangana? Because scams like this affect more than just the government—they ripple through society.

- Loss of Public Revenue: Taxes fund schools, hospitals, and highways. Every rupee lost means fewer resources for public services.

- Hurts Honest Businesses: Genuine traders can’t compete with fraudulent players offering artificially cheap rates.

- Distorts Market Prices: In commodities like copper, fake deals can influence global pricing trends.

- Weakens Investor Confidence: International investors want stability, not markets riddled with fraud.

How Telangana Is Fighting Back?

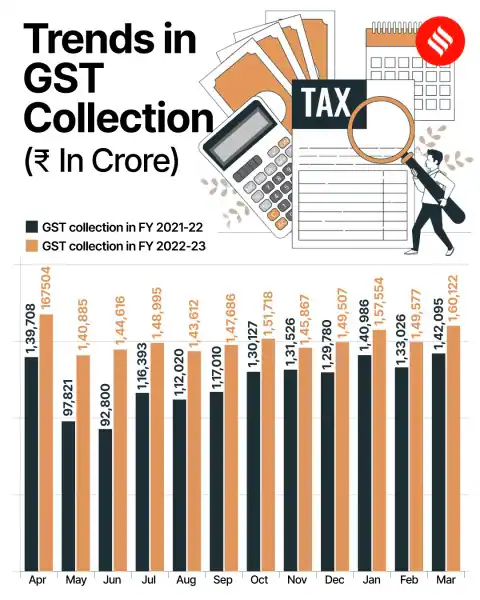

The Telangana Commercial Taxes Department isn’t taking this lightly. Since April 25, here’s what they’ve uncovered:

- 304 fake GST cases identified

- ₹170 crore fraudulent ITC blocked

- ₹49.7 crore in notices issued

- ₹8.36 crore already recovered

Authorities are also stepping up measures:

- Site verification of businesses with turnover above ₹10 crore

- Data analytics and AI tools to detect suspicious invoices

- Cross-border cooperation with other states to track fraud trails

For comparison, this is similar to how the IRS uses AI-based systems to flag suspicious tax filings before refunds are issued.

Legal Consequences for Tax Fraud in India

Some fraudsters think it’s worth the risk. But here’s the reality under Indian law:

- Fines: Equal to the amount of tax evaded.

- Jail Time: One to five years under Section 132 of the GST Act.

- Business Blacklisting: Companies found guilty may lose their GST registration permanently.

- Reputation Loss: Once branded as fraudulent, restoring credibility in the market is nearly impossible.

In short: even if the money seems good today, the long-term costs are devastating.

Global Comparisons: Tax Fraud Beyond India

This copper scam isn’t an isolated case. Across the world, tax fraud takes many forms:

- United States: The IRS frequently busts fake refund scams and identity theft cases that run into billions.

- European Union: VAT carousel frauds cost EU countries around €50 billion annually.

- India: Apart from this case, a nationwide crackdown recently uncovered ₹3,000 crore in fraudulent GST claims.

Different countries, different systems—but the same old playbook: fake paperwork, real profits.

Expert Opinions and Analysis

Economists point out that scams like this weaken fiscal stability. Tax auditors emphasize better invoice-matching technology and tighter vendor verification.

Officials from Telangana’s tax department have already said that these frauds “not only harm state revenues but also create an uneven playing field for genuine businesses.”

Globally, experts stress collaboration between states, nations, and tax systems. Fraud doesn’t stop at borders, especially in industries like metals, electronics, or international trade.

₹332 Crore Bogus Copper Supply Scam: How Businesses Can Stay Out of Trouble

Here’s a practical step-by-step guide for businesses to stay compliant and avoid trouble:

Step 1: Keep Invoices Genuine

Every invoice should represent real goods or services. Don’t “cook the books.”

Step 2: Verify Vendors and Clients

Check GST registration numbers, official addresses, and delivery documentation before doing business.

Step 3: Use Technology

Leverage tools like QuickBooks, Tally, or Zoho Books to keep records transparent. Automation reduces “manual mistakes.”

Step 4: Hire a Trusted Tax Professional

Accountants and tax consultants are worth the investment. Think of them as your defensive line in football—you need them to stay protected.

Step 5: Audit Yourself First

Don’t wait for authorities. Run internal audits at least once a year to ensure compliance.

Step 6: Avoid “Shortcuts”

If something looks too good to be true—like a scheme promising reduced taxes with no paperwork—it probably is.

Historical Context: Not the First Scam

This isn’t the first time India has faced a big fraud case.

- In 2023, authorities busted a ₹3,000 crore pan-India GST scam involving fake companies created solely to generate bogus invoices.

- In the U.S., major cases like the “Stolen Identity Refund Fraud” scheme cost billions before reforms tightened oversight.

History repeats itself, which is why governments worldwide are now investing in real-time monitoring systems to stop fraud before it snowballs.

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

₹92 Crore Digital Arrest Scam Exposed – Mohali Police Nab Mastermind Gang