Tax Audit Evasion Crackdown Coming: Tax audit evasion crackdown is no longer a distant warning—it’s happening right now across the world. Governments are shifting from outdated manual systems to automated file selection and AI-driven audit tools that can track hidden income, flag suspicious deductions, and cross-check financial data like never before. This shift means the “good old days” of slipping under the radar are fading fast. Whether you’re a regular 9-to-5 worker, a small business owner, or a high-net-worth individual juggling multiple income streams, the taxman’s eyes are sharper, faster, and less forgiving than ever. But don’t worry—if you follow the rules, this is actually good news.

Tax Audit Evasion Crackdown Coming

The tax audit evasion crackdown with automated file selection marks a turning point in global tax enforcement. Governments are finally leveraging technology to ensure fairness, plugging leaks that cost billions every year. For honest taxpayers, this means fewer unnecessary headaches. For evaders, it’s game over. The smartest move now is simple: stay compliant, keep records, and file on time. In today’s digital world, transparency isn’t just wise—it’s survival.

| Key Point | Details | Source/Reference |

|---|---|---|

| Global crackdown | US, UK, India, Bangladesh deploying automated audit selection tools | IRS.gov |

| US IRS | AI targets millionaires, partnerships, and high-risk returns | GAO Report |

| UK HMRC | Using AI & social media surveillance to detect lifestyle mismatches | The Sun |

| India CBDT | Ramping up AI analytics ahead of new tax law changes | Economic Times |

| Bangladesh NBR | One-third of audits must target never-audited taxpayers | TBS News |

Why Governments Are Cracking Down?

The simple truth: tax evasion costs governments hundreds of billions each year. That’s money that could fund schools, healthcare, and infrastructure.

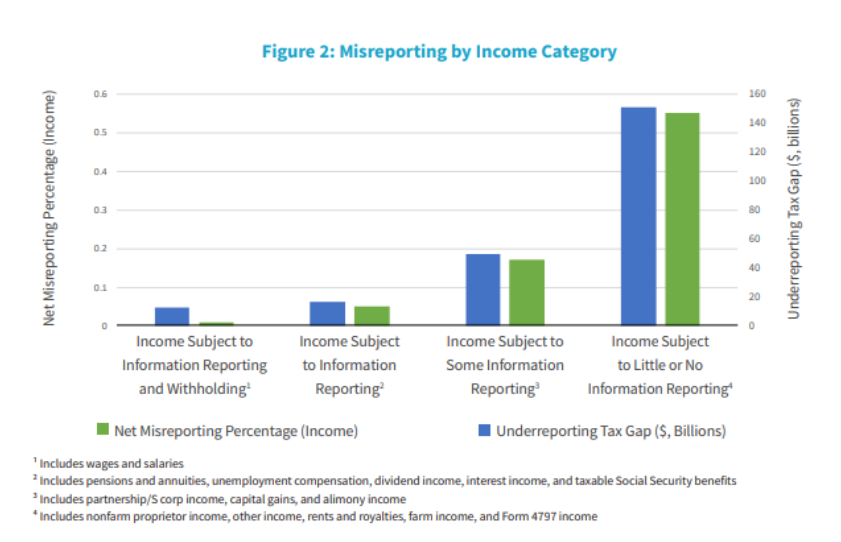

- In the United States, the IRS estimates the annual “tax gap” (what’s owed vs. what’s collected) at $540 billion. Over a decade, that’s $5.4 trillion in lost revenue.

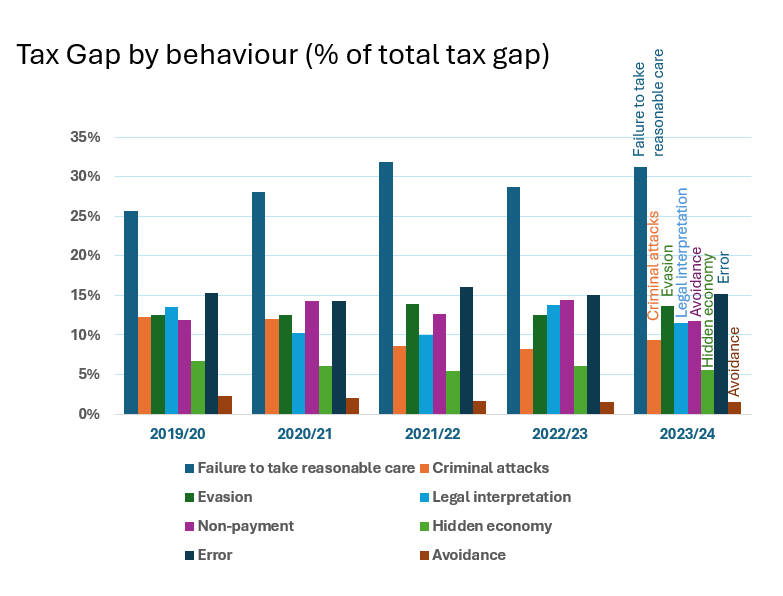

- In the UK, HMRC says about £32 billion is lost each year due to tax avoidance and evasion.

- In India, black money and tax evasion cost the economy an estimated 3-4% of GDP annually.

- In Bangladesh, corruption and weak audit processes have historically allowed thousands of taxpayers to dodge fair contributions.

For governments under pressure to fund budgets without raising taxes, plugging leaks is far easier than creating new taxes. Automated audits offer exactly that: precision, fairness, and efficiency.

How Automated File Selection Works?

Think of it like Netflix—but instead of recommending you a show, it recommends you for an audit if something looks fishy.

- Data Gathering – Authorities collect info from banks, payroll records, property registries, investment accounts, and even digital platforms like PayPal and Venmo.

- AI Scoring – Machine learning models assign a “risk score” to each taxpayer.

- Flagging Patterns – Discrepancies (like declaring $20,000 income while owning multiple homes) get flagged.

- Audit Selection – High-risk cases are automatically sent for review, ensuring no one slips through just because of connections or luck.

- Human Review – Tax officers still make final calls, but AI narrows the pool.

This process removes corruption, reduces favoritism, and ensures first-timers are not immune.

A Quick Look Back: Audits Before Automation

Audits used to rely heavily on manual selection:

- Often random, meaning low-risk people got caught up while real offenders slipped through.

- Auditors lacked real-time data, depending only on what taxpayers submitted.

- In some countries, audits were prone to corruption, where influential individuals avoided scrutiny altogether.

Now, with digitized tax filing, data-sharing agreements, and AI systems, no one is truly invisible anymore.

Real-World Examples and Case Studies

United States: IRS’s Tech-Driven Pursuit

The IRS is already reaping rewards from automation. With funding from the Inflation Reduction Act, they have:

- Collected over $500 million from millionaires who failed to pay taxes.

- Launched targeted audits of large partnerships (hedge funds, private equity firms) where audits dropped by nearly 40% over the last decade.

United Kingdom: HMRC’s “Connect” System

HMRC’s AI-driven “Connect” program pulls data from:

- 30+ government databases

- Banks and financial institutions

- Social media platforms

This system can flag someone posting Instagram pictures of luxury vacations while declaring unemployment benefits.

India: AI and the New Tax Law

The CBDT is building AI models that:

- Match GST (goods and services tax) filings with income tax returns.

- Flag discrepancies in property records.

- Prepare for a new income tax framework set to reshape compliance.

Bangladesh: First-Timer Focus

NBR’s new rule requires 33% of audited cases to be from people who’ve never faced an audit before. This ends the “safe haven” culture for politically connected taxpayers.

Famous Tax Evasion Cases That Tech Could’ve Prevented

- Al Capone: Caught for tax evasion in the 1930s. Today’s AI would have flagged his lavish spending immediately.

- Wesley Snipes: The actor served prison time for failing to file returns. Automated reminders and reporting from financial platforms would’ve prevented years of evasion.

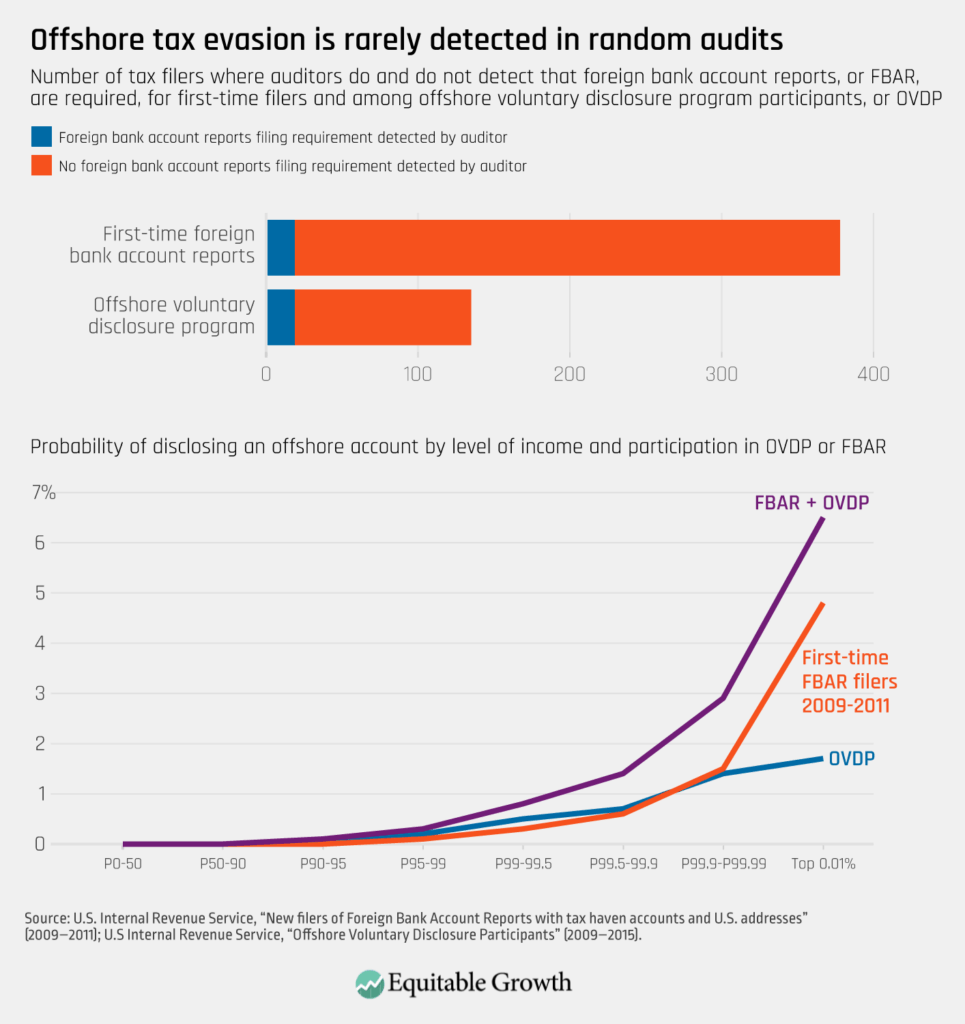

- Panama Papers Billionaires: Offshore accounts hidden for decades would now be traceable under modern cross-border data agreements.

What Tax Audit Evasion Crackdown Coming Means for Different Taxpayers?

Everyday Workers

You’re mostly safe if you file correctly. Just don’t forget to report freelance work, gig income, or side hustles.

Small Business Owners

Automation shines a light on businesses with inconsistent reporting. Double-check expenses, avoid cash-only tricks, and keep digital records.

High-Net-Worth Individuals

The IRS, HMRC, and CBDT are specifically targeting partnerships, offshore accounts, and complex trusts. Transparency is no longer optional.

Practical Guide: Staying Audit-Proof

- Report Everything – Freelance gigs, crypto trades, online sales. Payment apps now report to tax agencies.

- Track Deductions Properly – Mileage, home office, and charity are fair game—but only with documentation.

- Stop Filing “Zero Income” Returns – AI cross-checks your lifestyle against your filings. A sports car and overseas trips don’t add up to $0.

- Go Digital – Keep receipts in Google Drive, Dropbox, or QuickBooks. Auditors accept digital proof.

- File on Time – Late filings scream “audit me.”

- Get Help if Needed – CPAs and enrolled agents are your best defense in complex cases.

The Impact on Professionals

For tax professionals, this crackdown means:

- More demand for audit defense services.

- Need for training in AI-powered tax tools.

- Growing opportunities in compliance consulting.

Companies, too, will need tighter internal controls to avoid triggering audits unnecessarily.

The Future of Automated Audits

- Cryptocurrency & Blockchain: Expect agencies to demand crypto wallet disclosures. Blockchain analytics is already being used to trace hidden wallets.

- Global Cooperation: Countries are signing agreements to share tax data across borders. Offshore accounts are no longer safe havens.

- Predictive AI: Instead of finding evasion late, predictive models may prevent it before it happens.

The Debate: Fairness vs. Privacy

Automation improves fairness, but it raises tough questions:

- Should governments spy on social media to catch tax cheats?

- Can AI audits be biased against certain groups?

- Do taxpayers have the right to know how risk models work?

Balancing fairness and privacy will be the big challenge of the next decade.

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay

12% GST Dodge? Bengaluru PG’s ‘Cash-Only’ Rent Rule Triggers Massive Tax Evasion Uproar