Bengaluru Professional Saves ₹70,000 by Switching to New Tax Regime: If you’ve ever looked at your paycheck and felt like a good chunk disappears before it even reaches your account, you’re not alone. Taxes often feel like that invisible hand reaching into your wallet. But here’s a real-world story that’s worth paying attention to: a Bengaluru professional named Avinash Tandon managed to save ₹70,000 in income tax simply by switching to the new tax regime. This is more than just a single case study. It’s a reflection of how India’s evolving tax system, especially after the Union Budget 2025, can make a tangible difference in your take-home salary. In this article, we’ll break down what happened, why it matters, and how you can evaluate whether the new regime makes sense for you. The goal is to make this simple enough for a beginner while detailed enough for professionals who want clarity and expert-backed insights.

Bengaluru Professional Saves ₹70,000 by Switching to New Tax Regime

Avinash’s example highlights that the new tax regime can lead to substantial savings—in his case, a cool ₹70,000. The real lesson is not to blindly stick to one system but to evaluate annually. For some, the old regime with deductions is still better. For others, the new system offers simplicity and higher take-home pay. In today’s financial landscape, the smartest taxpayers are not those who save the most deductions but those who align taxes with their actual financial goals.

| Topic | Details |

|---|---|

| Professional | Avinash Tandon, Bengaluru-based finance professional |

| Savings | ₹70,000 by switching to new tax regime |

| Main Benefit | Higher standard deduction (₹75,000) + wider tax slabs |

| Extra Perks | NPS contributions up to 14% exempt, better capital gains planning |

| Investment Hack | Moving from FD/NSC to debt funds saved another ~₹9,400 |

| Official Resource | Income Tax Department of India |

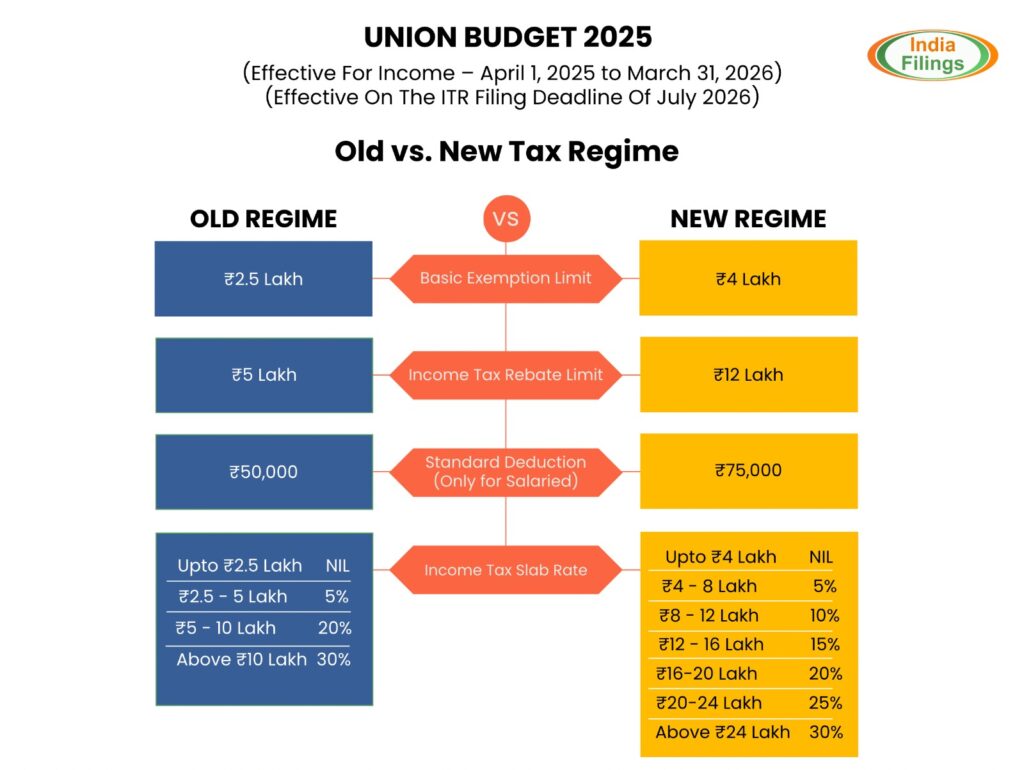

Old vs New: A Quick History

The old tax regime has been the traditional system most Indians are familiar with. It allows multiple deductions and exemptions, such as:

- Section 80C deductions for PPF, ELSS, NSC, and life insurance (up to ₹1.5 lakh).

- House Rent Allowance (HRA) exemption for salaried individuals living in rented homes.

- Home loan interest deduction of up to ₹2 lakh per year.

- Medical insurance and education loan interest deductions.

This system rewards taxpayers who actively invest in government-backed schemes, insurance policies, or real estate.

The new tax regime, introduced in 2020, took a different approach. Instead of multiple exemptions, it promised:

- Simplified filing.

- Lower tax slab rates.

- A standard deduction (currently ₹75,000 for salaried individuals).

Initially, not many opted for it. But the Union Budget 2025 increased the appeal by making income up to ₹12 lakh tax-free and offering smoother slabs beyond that.

Why Bengaluru Professional Saves ₹70,000 by Switching to New Tax Regime?

Let’s take a closer look at how one professional saved a substantial amount:

Bigger Standard Deduction

The new regime provides a flat ₹75,000 standard deduction for salaried taxpayers. In the old regime, this was smaller, and most benefits came from individual deductions under 80C, HRA, or housing loans. If you don’t fully utilize those, the new regime’s simplicity works better.

Lower and Wider Slabs

In the new regime, income up to ₹12 lakh is tax-free (₹12.75 lakh with standard deduction). For Avinash, this meant he was able to enjoy significant savings even without adding multiple layers of deductions. The lower slab rates also ensured he didn’t face sudden jumps in liability.

Employer’s NPS Contribution

One often-overlooked benefit is NPS (National Pension System). In the old regime, only 10% of basic salary contributed by an employer was tax-free. In the new one, this increases to 14%. For someone with a higher salary base, that additional 4% tax-free benefit is meaningful.

Investment Shifts

Avinash was earning interest income from Fixed Deposits (FDs) and National Savings Certificates (NSCs). The catch? That income is taxed every year. By switching to debt mutual funds and arbitrage funds, where tax is only payable when redeemed, he reduced his annual tax outflow by nearly ₹9,400.

Smart Capital Gains Harvesting

He also had ₹2.5 lakh in long-term capital gains (LTCG). The law allows up to ₹1.25 lakh of LTCG tax-free each year. By planning withdrawals strategically, he ensured he stayed within this exempted amount.

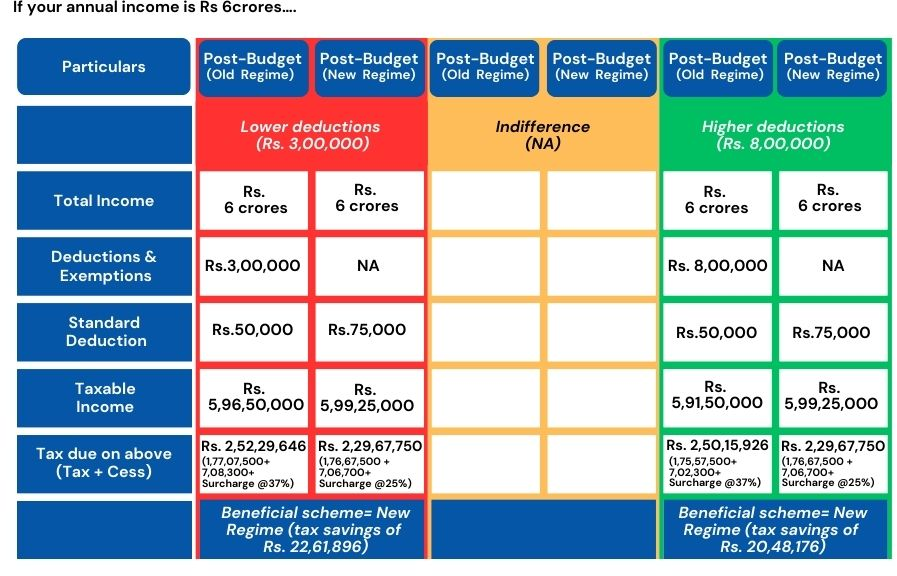

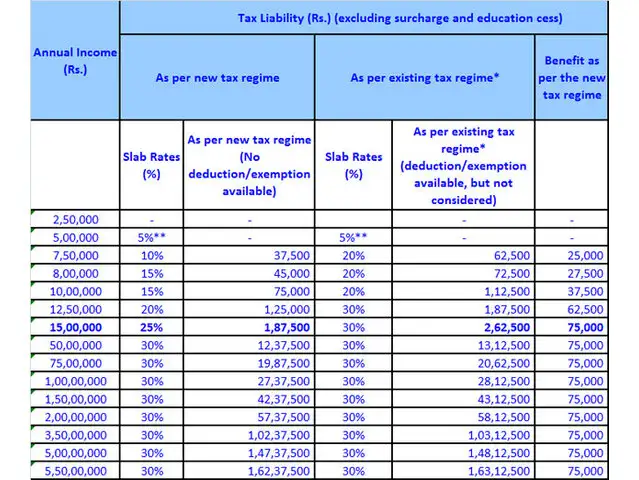

Salary Comparison Examples

To understand how the difference plays out, let’s look at three income levels under both regimes:

| Annual Income | Old Regime Tax | New Regime Tax | Savings |

|---|---|---|---|

| ₹12 lakh | ₹80,000 | 0 | ₹80,000 |

| ₹18 lakh | ₹3.5 lakh | ₹2.8 lakh | ₹70,000 |

| ₹25 lakh | ₹6.1 lakh | ₹5 lakh | ₹1.1 lakh |

(Sources: Hindustan Times, Moneycontrol)

Pros and Cons of Each Regime

| Aspect | Old Regime | New Regime |

|---|---|---|

| Deductions | Multiple (80C, HRA, loan, etc.) | Only standard deduction |

| Slabs | Higher rates, fewer slabs | Lower rates, wider slabs |

| Complexity | More paperwork and planning | Simple, minimal effort |

| Best For | People with home loans, insurance-heavy plans | Professionals with fewer deductions |

Mistakes to Avoid

Switching regimes isn’t just about guessing—it requires calculation. Here are common errors people make:

- Not comparing both regimes: Always run the numbers before choosing.

- Over-investing to save tax: Buying policies or locking money in low-return options just for deductions is a poor strategy.

- Ignoring capital gains: Many taxpayers forget to use the ₹1.25 lakh LTCG exemption.

- Not reviewing annually: You can switch regimes every year if you’re salaried. Don’t assume one choice works forever.

Expert Insight

According to financial planner Gaurav Sharma:

“The new tax regime is not a one-size-fits-all solution. For professionals without large home loans or heavy insurance investments, it provides greater take-home pay and simplicity. However, individuals with significant deductions under 80C and housing loans may still benefit more from the old system. The best approach is to review annually and align it with lifestyle goals.”

Step-by-Step: Should You Switch?

- Calculate Your Gross Income: Include salary, business income, freelancing, and side hustles.

- List Out Deductions: Check if you’re fully using 80C, HRA, and other old regime benefits.

- Run Numbers for Both Regimes: Use Income Tax Calculator or reliable tools like ClearTax.

- Review Your Investments: Are they driven by financial goals or just tax-saving?

- Check Future Plans: Planning to take a home loan soon? Old regime may suit you better.

- Decide Annually: Salaried taxpayers can switch every year; use this flexibility wisely.

How to Maximize Benefits Under the New Tax Regime?

Switching to the new tax regime is only half the story. The real trick is learning how to optimize your finances within this simplified system. Here are strategies professionals like Avinash—and you—can use:

Rethink Your Investments

Since traditional deductions like 80C don’t apply, focus on goal-based investing instead of tax-driven decisions. Mutual funds (equity or debt, depending on risk), retirement accounts, and ETFs can help grow wealth without being locked in for tax purposes.

Use Employer Benefits Wisely

Maximize employer contributions to NPS, as up to 14% of basic salary remains exempt. If your company offers perks like food cards, health insurance, or flexible allowances, ensure you take full advantage.

Manage Capital Gains Smartly

Plan your withdrawals from equity or mutual fund investments so that annual long-term capital gains stay within ₹1.25 lakh, which is tax-free. This is a practical way to avoid unnecessary tax erosion.

Keep an Eye on Debt Instruments

Avoid keeping too much money in fixed deposits if you’re under the new regime. Instead, consider debt mutual funds or arbitrage funds, where tax applies only on redemption. This strategy alone saved Avinash nearly ₹9,400 annually.

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

New Income Tax Law Explained in Simple Terms – Who Gains, Who Loses

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay