Income Tax Department Raids Over 10 Locations: The buzz across India this week centers around the Income Tax Department raids over 10 locations across Tamil Nadu. On August 18, 2025, tax officials carried out coordinated searches in places like Chennai, Kancheepuram, and Vellore, sending a clear message: the government is stepping up its fight against tax fraud. These raids weren’t just routine checks. They are part of a much larger, nationwide campaign against bogus tax refund claims and fake deductions—fraudulent practices that have already drained the government of hundreds of crores of rupees.

Income Tax Department Raids Over 10 Locations

The Income Tax Department raids across Tamil Nadu are part of a much bigger story: India’s ongoing battle against fraudulent tax practices. With over ₹500 crore scams uncovered in recent months, the government is making it clear—there is no room for tax cheats. For regular taxpayers, the message is straightforward: be honest, keep records, and don’t fall for shortcuts. The taxman may not come knocking at your door today, but if you play fast and loose with your filings, it’s only a matter of time.

| Point | Details |

|---|---|

| Event | Income Tax Department raids over 10 locations in Tamil Nadu (Aug 18, 2025) |

| Where | Chennai, Kancheepuram, Vellore (among others) |

| Why | Crackdown on fake refund claims, bogus deductions, and tax fraud |

| Recent Findings | ₹500 crore tax refund fraud uncovered in Trichy and other southern districts |

| Nationwide Effort | 200+ locations raided across India in July 2025 |

| Official Info | Visit Income Tax India Official Website |

Why These Raids Matter?

Tax fraud is not a victimless crime. When people or businesses claim refunds they don’t deserve, it reduces the pool of resources available for essential services like education, healthcare, and infrastructure. In simple terms: when one person cheats, everyone else pays.

This is why these raids are making headlines. It’s not just about catching a few rule-breakers—it’s about restoring faith in the tax system and protecting honest taxpayers who play by the rules.

A Look Back: Previous Raids in Tamil Nadu

The August 18 raids follow a major operation in July 2025, when the Income Tax Department searched 18 locations across Tamil Nadu and exposed a ₹500 crore fraud racket.

Officials discovered that fraudulent intermediaries were filing bogus claims for deductions under sections such as:

- Section 80C (investments in LIC, PF, etc.)

- Section 80D (medical insurance premiums)

- Section 80GGC (political donations)

- Section 10(13A) (house rent allowance)

These deductions were fabricated with forged documents, and the refunds were quickly released by the system before red flags were raised. The fraudsters and some taxpayers then shared the illicit refunds.

How the Scam Worked?

Think of it like a three-step hustle:

- Fabricate Documents: Fake donation receipts, rent agreements, and medical bills were created.

- File Returns with Bogus Deductions: Tax intermediaries uploaded fraudulent claims into the official system.

- Pocket Refunds: The IT system processed these claims as genuine and released refunds, which were then split between fraudsters and taxpayers.

While this trick worked for years, the new AI-driven verification system started spotting irregularities—like unusually high rent claims from low-income earners or donation receipts that didn’t match registered charities.

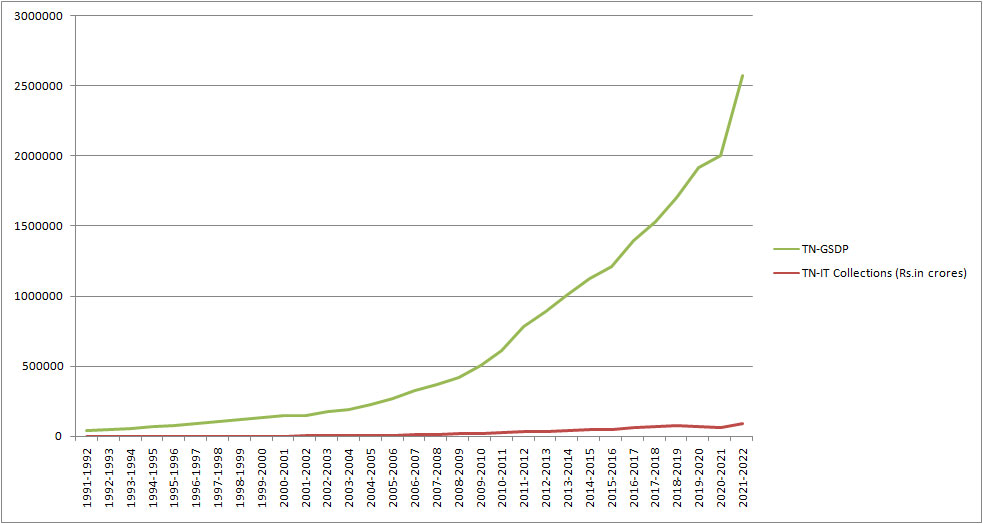

Historical Context: Tax Raids in India

The concept of tax raids in India dates back to the 1970s, when authorities first targeted black money hoarders and gold smugglers. These raids became a major tool to fight financial crimes in the decades that followed.

Over the years, the scope expanded to include:

- Corporate fraud

- Political funding scams

- Real estate money laundering

- Fake charitable donations

Today, with digitization and stronger analytics, raids are faster, sharper, and broader in scope. Instead of targeting just one big businessman, raids now focus on entire networks—like accountants, middlemen, and taxpayers linked to fraudulent filings.

Legal Consequences: Income Tax Department Raids Over 10 Locations

Under the Income Tax Act, 1961, tax fraud is taken very seriously. If caught, here’s what you could face:

- Penalty: Ranging from 100% to 300% of the tax evaded.

- Prosecution: Jail terms between 3 months to 7 years, depending on the size of fraud.

- Asset Seizure: Properties, bank accounts, and even business assets can be frozen.

- Reputation Loss: Businesses caught in fraud often lose credibility with banks, investors, and customers.

For example, in a high-profile 2017 raid, a Tamil Nadu politician’s properties worth ₹1,200 crore were seized. The reputational damage was as devastating as the financial loss.

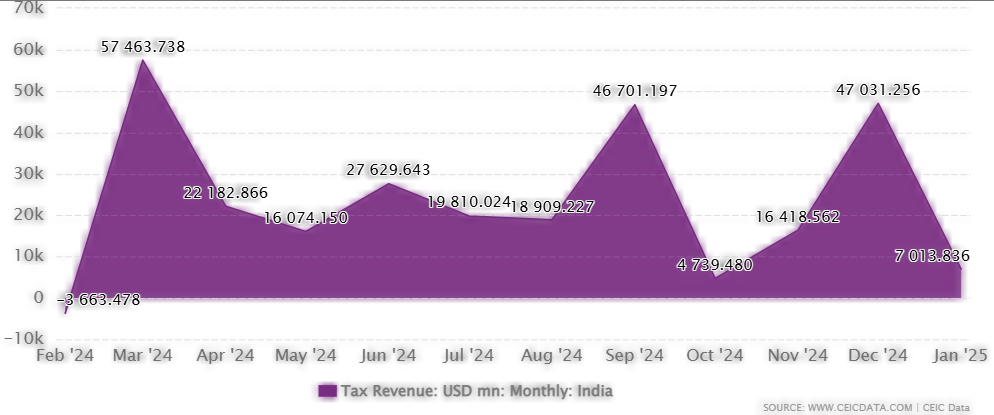

Economic Impact of Raids

Raids aren’t just about punishment—they also send a deterrent signal to others. Economists argue that visible enforcement boosts compliance because people realize that cheating isn’t worth the risk.

At the same time, raids can disrupt businesses temporarily. When offices are sealed and accounts frozen, operations grind to a halt. Startups and small firms, in particular, face a double challenge: proving their innocence while keeping their business running.

International Comparison: India vs. USA

For American readers, this may sound familiar. The IRS (Internal Revenue Service) in the U.S. has a similar approach. In fact, IRS audits often target:

- Fake Child Tax Credits

- Exaggerated business expenses

- Unreported freelance income

Both India and the U.S. use data analytics and AI to catch anomalies in tax filings. In both countries, penalties are steep, and prosecutions are publicized to set an example.

Practical Advice: How to Stay Safe as a Taxpayer

Here are simple yet crucial steps to keep your tax record clean:

- File Honestly: Don’t be tempted by shortcuts or inflated claims.

- Keep Documentation: Save receipts for donations, medical bills, and rent agreements.

- Use Official Platforms: File only through Income Tax India e-filing or licensed tax software.

- Beware of Middlemen: Avoid agents promising “guaranteed refunds.”

- Hire a Professional: If taxes feel overwhelming, hire a Chartered Accountant who is certified and accountable.

Case Study: A Tale of Two Taxpayers

- The Fraudster: A shop owner in Trichy claimed fake political donation deductions for three years. Eventually, the system flagged him, and after raids, he was slapped with a penalty double the refund plus criminal charges.

- The Compliant Taxpayer: A salaried employee in Chennai, meanwhile, kept every medical bill and rent receipt. Even when she was issued a notice for cross-verification, her clean records cleared her in weeks—no fines, no stress.

The difference? One played the short game, the other played it smart.

Public Trust and the Role of Tax Compliance in Society

Beyond the headlines and big numbers, tax compliance is fundamentally about trust. When citizens pay their taxes honestly, they trust that the government will use that money for the public good—schools, hospitals, roads, safety, and welfare programs.

But when scams like these emerge, that trust gets shaken. Honest taxpayers may start to wonder, “Why should I play fair if others are gaming the system and getting away with it?” This erosion of trust can be dangerous, because once compliance starts slipping, it can snowball into a culture of tax evasion.

This is why the Income Tax Department’s raids are not just about recovering money—they’re about restoring confidence. By showing that fraud will be caught and punished, the government reassures honest taxpayers that the system isn’t rigged in favor of cheaters.

In fact, global studies (like those by the OECD) show that countries with higher tax compliance usually have stronger public institutions, better infrastructure, and higher citizen satisfaction. India’s crackdown can therefore be seen not just as a financial clean-up, but also as a step toward building a fairer, more transparent economy.

The Future of Tax Enforcement in India

The IT Department is ramping up efforts with AI, blockchain, and real-time verification systems. In the near future, refunds may only be issued after direct cross-checks with banks, hospitals, and charitable organizations.

This means fraudsters will find it almost impossible to manipulate the system, and honest taxpayers will benefit from faster, hassle-free refunds.

New Income Tax Bill Tackles Filing Delays and Gives Your Refund Back

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Planning A Second Home? These Tax Rules On Rental Income Could Cost You