GST Overhaul Sparks Split Among Analysts: The GST Overhaul in India has set off a storm of debates, not just in political circles but also among economists, business leaders, and everyday consumers. This isn’t just another tax tweak—it’s one of the most significant economic reforms since the launch of GST itself in 2017. For you, the consumer, it could mean cheaper goods, lower insurance premiums, and more money in your pocket. For states and businesses, it could mean challenges in adapting and adjusting to a new reality. Let’s walk through this step by step, in plain language that cuts through the jargon but still digs into the details.

GST Overhaul Sparks Split Among Analysts

The GST Overhaul is a bold step toward simplifying India’s tax system. For consumers, it promises lower prices and real savings. For businesses, it offers a cleaner system but with transitional challenges. For states, it raises serious questions about fiscal stability. In the short term, the reform is likely to be a consumption booster, fueling demand in autos, FMCG, and insurance. But long-term success depends on how well the government manages state compensation, compliance enforcement, and rollout logistics.

| Topic | Key Insights | Stats / Data | Source / Reference |

|---|---|---|---|

| GST Overhaul Basics | From 4-tier tax system to 2 main rates (5% and 18%), plus 40% for luxury/sin goods | Old rates: 5%, 12%, 18%, 28% → New: 5%, 18%, 40% | Reuters |

| Impact on Consumers | Lower prices for cars, appliances, insurance, and essentials | Insurance GST: 18% → 0–5% | NDTV |

| Economic Boost | Higher consumption, stronger GDP | ₹2.4 lakh crore demand rise; GDP up 50–70 bps | Informist |

| Revenue Concerns | Risk of state-level fiscal strain | Loss: ₹1.1 trillion (0.3% of GDP) annually | Times of India |

| Winners & Losers | Autos, retail, FMCG gain; states and luxury sector cautious | Auto stocks already rising | Stocktwits |

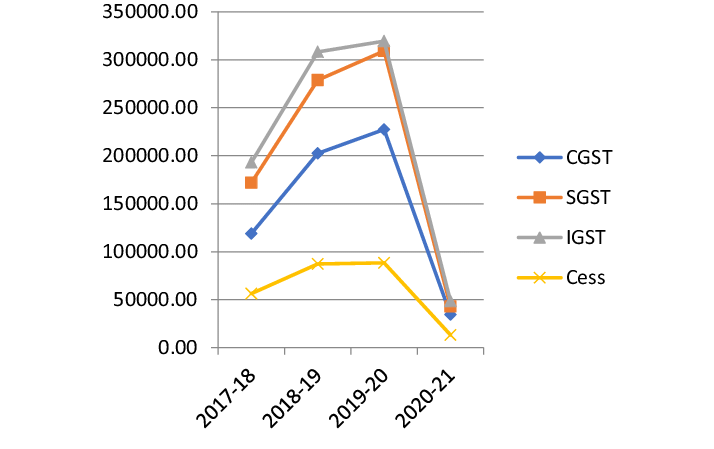

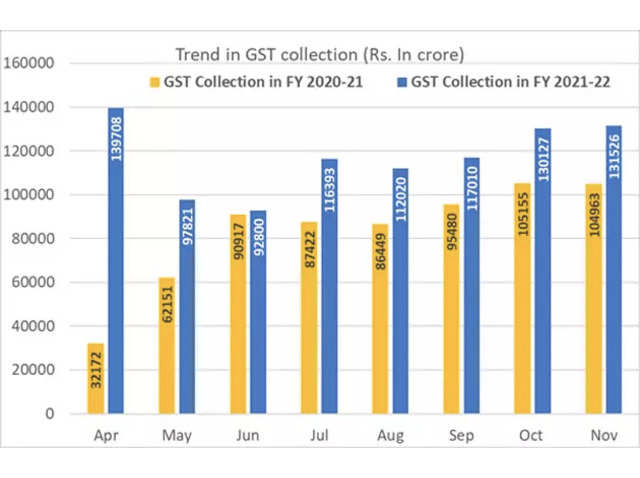

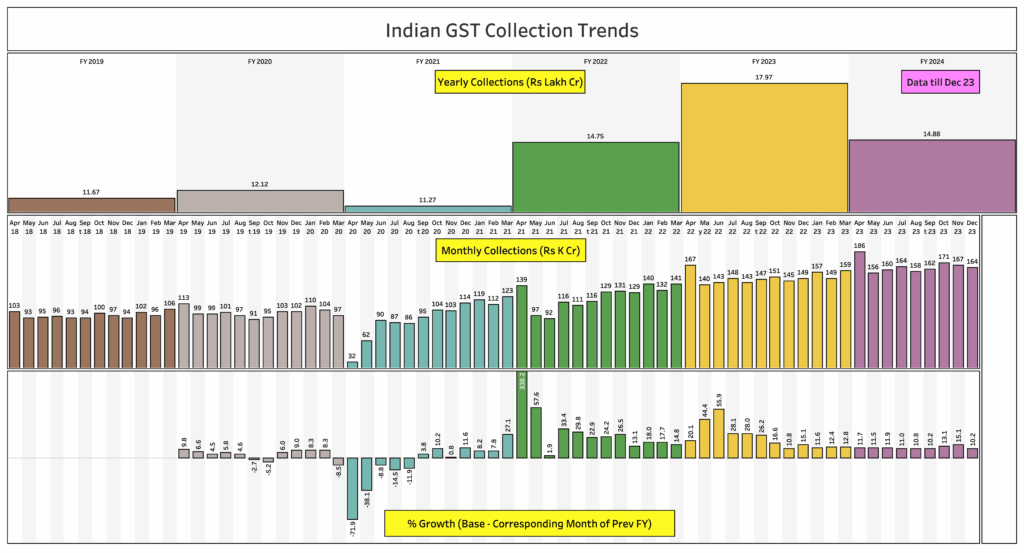

A Quick Throwback: How GST Evolved

India’s Goods and Services Tax (GST) was introduced in July 2017 with the goal of creating a unified tax system—“one nation, one tax.” Before GST, businesses dealt with a complicated mess of excise duty, VAT, service tax, and other state levies. GST merged these into one system, making life easier but still not perfect.

The problem? Too many tax slabs. With four different rates (5%, 12%, 18%, 28%), it created confusion. Businesses often complained about compliance burdens, and consumers weren’t always sure why certain items were taxed differently. Over time, calls grew for a simpler, cleaner system.

The 2025 overhaul is the government’s answer: cut the clutter, make GST easier to understand, and align India more closely with international best practices.

Why GST Overhaul Sparks Split Among Analysts?

The Optimists

Supporters see the overhaul as a much-needed economic boost.

- Lower prices for consumers will mean higher demand, especially in the middle class.

- GDP growth could get a lift of 0.5–0.7 percentage points, according to Morgan Stanley and Jefferies.

- Inflation relief: UBS estimates inflation could dip by 50 basis points as lower taxes flow through to consumers.

- Sectoral winners: Auto makers, consumer durables, insurance providers, and FMCG players could all see strong growth.

The Skeptics

Critics warn the cheerleading might be premature.

- Revenue loss: HSBC predicts states could lose as much as ₹1.43 lakh crore annually. Without compensation, this could strain their budgets.

- Implementation challenges: Businesses will need to reset pricing, rework invoices, and retrain staff. That’s not an overnight job.

- Uneven impact: Urban consumers may benefit more than rural households, since rural spending patterns lean less on high-GST categories.

Global Perspective: How Others Handle It

Looking abroad helps put India’s reform in perspective.

- Canada has a flat 5% GST, with provinces adding their own sales taxes.

- Australia runs a simple 10% GST nationwide, no fuss.

- European Union countries run VAT (value-added tax), often with just two or three rates, but strong digital systems make compliance easy.

India’s move mirrors these systems—streamlined, simplified, consumer-friendly.

Who Wins and Who Loses?

Winners

- Consumers – Cheaper goods, cars, and insurance premiums.

- Auto industry – Lower GST could spark a surge in sales of small and mid-sized cars.

- Retail and FMCG – Lower taxes could boost demand for fast-moving consumer goods and household items.

- Insurance sector – Premiums dropping to 5% could attract more customers.

Losers

- Luxury goods – The 40% slab on luxury cars, tobacco, and alcohol could drive prices up.

- State governments – Facing potential revenue losses without guaranteed compensation.

- Small businesses (short-term) – Adapting systems and compliance may cause headaches during the transition.

What It Means for Consumers?

If you’re a consumer, this overhaul is likely to put a smile on your face.

- Cars: A car priced at ₹10 lakh currently attracts ₹2.8 lakh in GST at 28%. Under the new slab, it would be ₹1.8 lakh—a saving of ₹1 lakh.

- Insurance: On a ₹25,000 premium, you currently pay ₹4,500 in GST. With a 5% slab, that’s only ₹1,250—a saving of ₹3,250 annually.

- Household appliances: Fridges, washing machines, and smartphones could all see lower prices.

In simple terms, the money you save here can go into savings, investments, or just more shopping during the festive season.

What It Means for Businesses?

Businesses need to gear up for change quickly.

- ERP and billing systems must be updated to reflect the new rates.

- Pricing strategies will need to be rethought—how much of the tax cut do you pass on to customers, and how much do you keep for margin?

- Staff training will be crucial to avoid compliance mistakes.

For SMEs, the simplified structure could reduce compliance burdens, freeing up time and money to focus on growth.

What It Means for State Governments?

States could see a serious dent in revenues—between ₹85,000 crore and ₹1.43 lakh crore per year. That’s money states rely on for funding schools, hospitals, and social schemes.

The central government may need to create a compensation mechanism, much like the original five-year compensation period after GST’s launch. Without it, state finances could be under severe strain.

What It Means for Investors?

Markets love clarity, and GST simplification brings exactly that.

- Autos: Maruti Suzuki, Tata Motors, and Hero MotoCorp have already seen share price bumps.

- FMCG/Retail: More consumer spending = higher sales volumes.

- Insurance: Lower premiums = higher penetration.

Tip: Investors should keep an eye on festive-season sales data, as this will be the first real-world test of the GST overhaul’s impact.

Career Angle: Impact on Professionals

This isn’t just about goods and markets—it’s also about careers.

- Accountants and tax consultants: Expect higher demand as businesses need help navigating the transition.

- Supply chain managers: Will need to re-plan logistics and distribution to reflect new pricing.

- Finance professionals: Companies will rely on them to forecast demand and manage margins in a shifting tax landscape.

For young professionals, this reform creates new opportunities in taxation, auditing, and compliance consulting.

Step-By-Step: How You Can Prepare

For Consumers

- Delay big purchases until new GST rates roll out.

- Compare insurance premiums again after the overhaul.

- Keep an eye on festive-season deals for maximum benefit.

For Businesses

- Start updating ERP systems immediately.

- Conduct staff training sessions on new rates.

- Review marketing and pricing strategies for Diwali sales.

For Investors

- Focus on autos, FMCG, and insurance stocks.

- Stay alert for government announcements on state compensation—this affects fiscal stability.

Centre Plans Major GST Overhaul — Four Slabs May Shrink to Just Two

Infosys Hit With GST Fine In Singapore – What The Filing Reveals

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating