GST on Health and Term Insurance May Drop to Just 5%: When it comes to money, nobody likes paying extra. And when we’re talking about something as important as health insurance or term life insurance, even a few percentage points in taxes can add up to big bucks over time. That’s why the recent buzz around the possibility that the GST (Goods and Services Tax) on health and term insurance may drop to just 5%—or maybe even zero—has folks in India paying close attention. Right now, policyholders pay a steep 18% GST on their insurance premiums. For families already feeling the pinch of rising costs, that tax adds a heavy burden. If the government actually slashes it to 5%, the savings could be game-changing for millions of households. But as with any policy shift, there’s a lot more to the story.

GST on Health and Term Insurance May Drop to Just 5%

The news that GST on health and term insurance may drop to just 5% is more than a tax adjustment—it’s a reform that could reshape the insurance landscape in India. For households, it means real savings. For the government, it’s a balancing act between revenue loss and long-term gains from higher coverage. And for insurers, it’s about adapting to a new pricing structure while ensuring affordability. If implemented, this move could finally make insurance accessible to millions more Indians, turning protection from a privilege into a necessity for all.

| Point | Details |

|---|---|

| Current GST Rate | 18% on health & term insurance premiums |

| Proposed Rate | 5% (with talks of possibly going to 0%) |

| Impact on Households | Example: On a ₹25,000 policy, tax drops from ₹4,500 to just ₹1,250 – saving ₹3,250 annually |

| Industry Concerns | Insurers may lose Input Tax Credit (ITC), which could impact premiums |

| Govt Revenue Impact | Estimated annual loss ~₹17,000 crore |

| Timeline | Likely announcement around Diwali 2025, pending GST Council approval |

| Source | Government of India GST Council |

A Quick History: How GST Hit Insurance

When GST was introduced in July 2017, it was hailed as India’s biggest tax reform. But for insurance customers, it came with a sting. Premiums were placed under the 18% slab, which was a jump from the earlier 15% service tax. Overnight, buying or renewing a policy became more expensive.

For instance, a ₹10,000 premium that attracted ₹1,500 in tax under the service tax regime suddenly jumped to ₹1,800 under GST. While the hike looked small in percentage terms, it mattered for middle-class families juggling rising living costs.

Since then, industry bodies like IRDAI and business associations have consistently pushed the government to reduce the GST burden on insurance, arguing that high taxation discourages people from securing coverage.

Why GST on Health and Term Insurance May Drop to Just 5% Matters So Much?

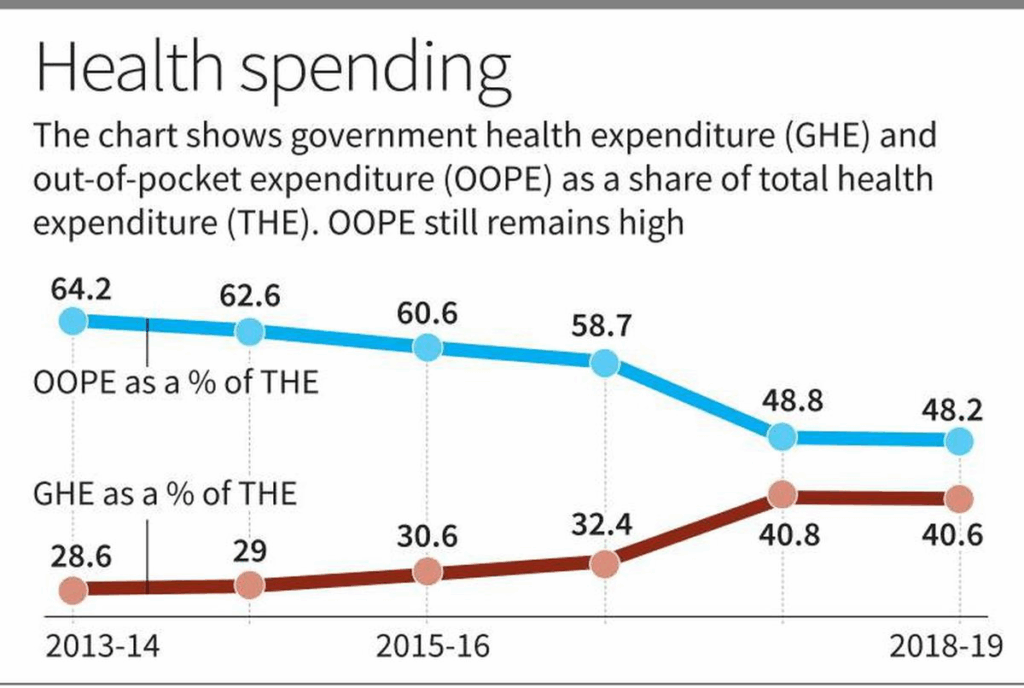

Insurance—whether it’s health coverage or life protection for your family—isn’t a luxury. It’s a necessity. Yet India has one of the lowest insurance penetrations among major economies.

According to Swiss Re’s 2023 global report, India’s overall insurance penetration (life and non-life combined) is about 4.2% of GDP, compared to 11% in the United States and 7.5% in China. In health specifically, less than 30% of Indians have any meaningful private health insurance.

The high cost of premiums—pushed up further by GST—remains one of the biggest reasons. Reducing GST from 18% to 5% could make coverage significantly more affordable and help bring millions of new policyholders into the fold.

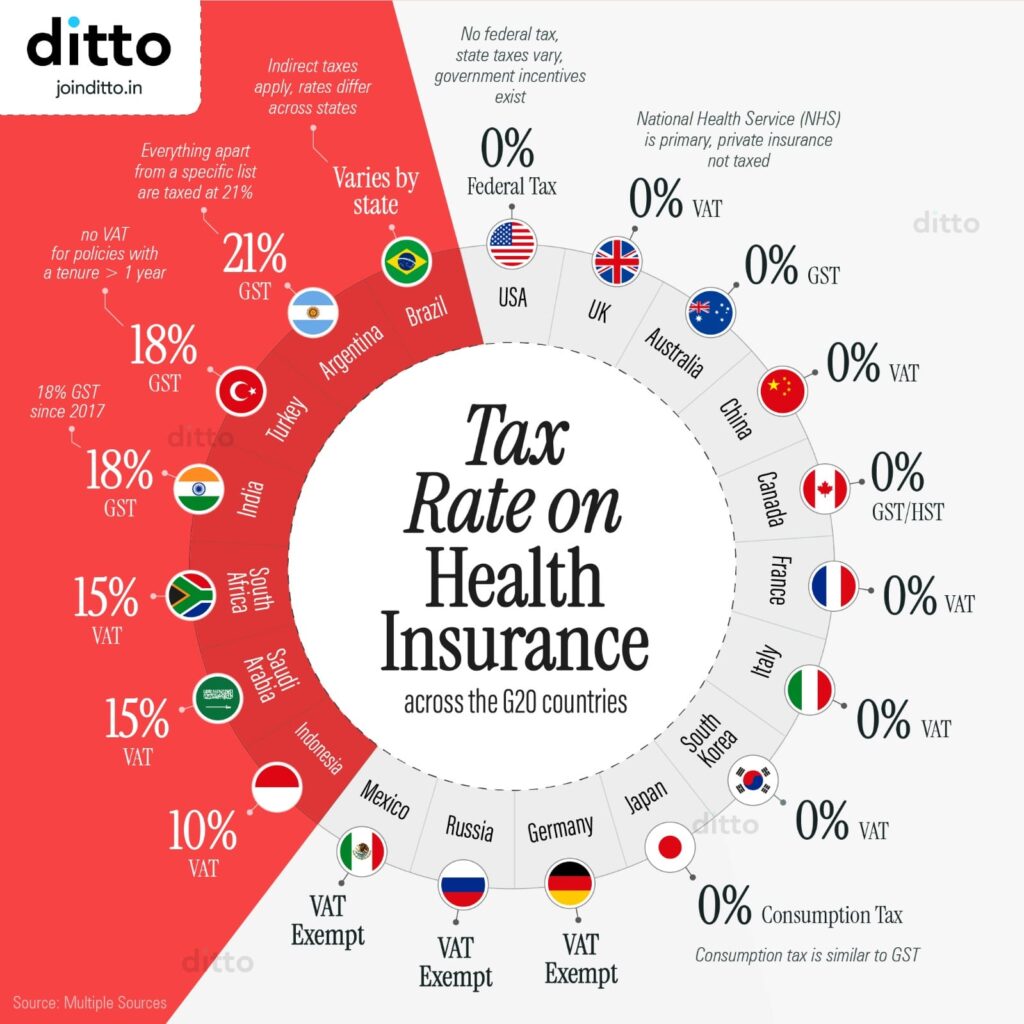

A Global Comparison

Here’s how India stacks up against other countries on insurance taxes:

| Country | Tax on Health/Term Insurance |

|---|---|

| India | 18% GST (proposed cut to 5%) |

| USA | No federal GST; insurance is state-regulated, many states exempt health insurance premiums |

| UK | Exempt from VAT |

| Singapore | 7% GST (but medical insurance largely exempt) |

| Australia | 10% GST (private health insurance enjoys rebates) |

As you can see, India is currently on the higher side of taxation, which makes its insurance sector less competitive compared to global standards.

A Quick Example: What You’d Actually Save

Let’s say you buy a ₹25,000 annual health insurance policy for your family:

- At 18% GST (current) → You pay ₹25,000 + ₹4,500 = ₹29,500

- At 5% GST (proposed) → You pay ₹25,000 + ₹1,250 = ₹26,250

That’s ₹3,250 saved annually. Over a 10-year period, the savings could add up to ₹32,500, which is almost the cost of an extra year of coverage.

For seniors, the difference is even larger. A ₹50,000 annual premium currently attracts ₹9,000 in tax. With 5% GST, that drops to ₹2,500, saving ₹6,500 every year.

Impact on Different Groups

- Families: Middle-class households stand to benefit the most, as even modest savings free up budgets for education, food, or savings.

- Senior Citizens: With high premiums already a burden, a tax cut would ease financial strain and encourage more seniors to buy adequate coverage.

- Young Professionals: Term insurance will become more attractive, helping young earners secure long-term protection at affordable rates.

- Small Businesses: Group health insurance plans for employees will become cheaper, supporting workplace benefits without straining company budgets.

Industry Concerns: It’s Not All Sunshine

While policyholders welcome the news, insurers are cautious. Their main worry centers around Input Tax Credit (ITC).

Currently, insurers can offset the GST they pay on services like hospital tie-ups, advertising, or agent commissions through ITC. If GST on premiums is cut to 5% or abolished, they may lose this benefit. This could:

- Increase their operating costs

- Lead to adjustments in base premium pricing

- Reduce the extent of savings passed on to customers

So while customers will definitely save, the exact benefit could vary depending on how insurers adjust their pricing.

Government’s Challenge: Balancing Revenue

Another angle is the impact on government revenues. According to reports, reducing GST on insurance could lead to an annual revenue shortfall of around ₹17,000 crore.

However, policymakers argue that this loss could be offset by higher insurance penetration. As more people buy policies, the overall tax base expands, leading to better long-term revenue stability. Plus, wider insurance coverage reduces the government’s own burden in funding healthcare schemes.

Expert Opinions

Several industry voices have weighed in:

- Finance Minister Nirmala Sitharaman has signaled that GST reforms will focus on “making essentials affordable and boosting insurance coverage.”

- IRDAI officials have repeatedly emphasized that insurance is a social good, and high taxes disincentivize citizens from buying protection.

- CRISIL analysts project that a tax cut could lead to a 15–20% increase in policy sales annually over the next few years.

Step-by-Step: How to Calculate Your Savings

If you want to figure out your potential savings under the proposed GST cut, follow these steps:

- Check your base premium (the cost before GST).

- Apply 18% GST to see your current tax outgo.

- Apply 5% GST to see what you’d pay under the new regime.

- Subtract the two amounts to calculate your savings.

Example: Premium = ₹30,000

- Current tax: ₹30,000 × 18% = ₹5,400

- Proposed tax: ₹30,000 × 5% = ₹1,500

- Savings = ₹3,900 per year

What Should You Do Now?

- Do not wait for the cut: Insurance is protection, not an investment to time. If you need coverage, buy it now.

- Consider long-term policies: Term insurance especially becomes cheaper in the long run; GST savings later will only add more value.

- Compare plans: With ITC adjustments, some insurers may pass on more savings than others. Use platforms like PolicyBazaar to compare.

India Set to Announce Big Consumption Tax Cuts by October to Boost Economy

Experts Warn Dismantling Justice Department Tax Division Could Cost Billions

BBC Drops a Tax Secret That Could Save You Thousands in 2025