Former MP Ranjith Reddy Under IT Scanner After Tax Raids: When the headline reads “Former MP Ranjith Reddy Under IT Scanner After Tax Raids”, it sounds like something from a political drama series. But this isn’t TV—it’s real, and it’s shaking up the political and real estate worlds in India. The case also offers lessons on tax honesty, financial transparency, and why the ultra-rich are often under government scrutiny.

On August 19–20, 2025, India’s Income Tax (I-T) Department carried out a sweeping raid against former MP Gaddam Ranjith Reddy and real estate major DSR Group. Nearly 30 locations in Hyderabad and Bengaluru were searched, with teams seizing ₹7 crore (≈$840,000 USD) in cash, along with laptops, phones, documents, and account books. The accusations? Massive tax evasion through undervaluing property deals, hiding cash transactions, and manipulating records.

Former MP Ranjith Reddy Under IT Scanner After Tax Raids

The case of Former MP Ranjith Reddy under IT scanner after tax raids is more than political gossip. It highlights the deep-rooted black money problem in real estate and the need for stricter transparency. For politicians, business leaders, and everyday professionals, the lesson is simple: short-term tricks can lead to long-term disasters. Honesty in taxes isn’t just a civic duty—it’s the foundation of trust, credibility, and sustainable wealth.

| Aspect | Details |

|---|---|

| Who’s involved? | Former MP Gaddam Ranjith Reddy & DSR Group |

| Where did raids happen? | Hyderabad & Bengaluru, India (27–30 sites) |

| What was seized? | ₹7 crore (~$840,000 USD) in cash, devices, and account books |

| Allegations | Selling flats at ₹12,000–₹13,000 per sq ft but registering at ₹7,000 to hide income |

| Declared Assets | Reddy declared ₹435 crore (~$52M USD) in 2024 elections |

| Political link | Ex-BRS MP, joined Congress before 2024 polls but lost seat |

| Official Source | Income Tax Department of India |

Who is Ranjith Reddy?

For readers outside India, let’s break it down. Ranjith Reddy is a wealthy politician-businessman. He first entered Parliament in 2019, representing Chevella constituency under the BRS (Bharat Rashtra Samithi) banner. Just before the 2024 general elections, he jumped ship to the Congress Party. However, he failed to retain his seat.

Yet, financial comfort wasn’t an issue. His election affidavit declared a jaw-dropping ₹435 crore ($52 million) in assets, putting him among the richest politicians in Telangana.

This wealth, coupled with his real estate ties, made him a natural target for deeper financial scrutiny.

What Did the Former MP Ranjith Reddy Under IT Scanner After Tax Raids Reveal?

Reports say the raids uncovered evidence of:

- Undervaluation of Apartments: DSR Group allegedly sold flats for ₹12,000–₹13,000 per sq ft but registered them at ₹7,000 per sq ft. The gap was paid in cash—an illegal but common way to dodge taxes.

- Stacks of Unreported Cash: In one raid, officials found ₹7 crore lying unaccounted for. That’s the kind of money that doesn’t sit in bank accounts—it usually fuels more “off-the-books” deals.

- Suspicious Subsidiaries: Firms such as DSR Infra Developers, DSR Prime Spaces, DSR Infrastructure Pvt Ltd are now under the scanner for possible links to Reddy’s wealth.

This strategy, known locally as “benami transactions” or “black money deals,” has long plagued Indian real estate.

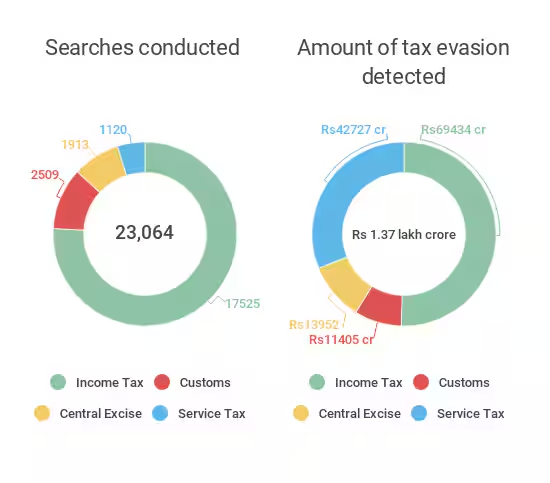

The Bigger Problem: Black Money in Indian Real Estate

Real estate in India is notorious for cash-based transactions. Why? Because it helps both buyers and sellers avoid paying full taxes and stamp duties.

According to reports from the National Institute of Public Finance and Policy, real estate has historically absorbed 30–40% of India’s black money circulation. That’s billions of dollars hidden away from official records.

While reforms like RERA (Real Estate Regulatory Authority) and demonetization in 2016 tried to curb the problem, loopholes remain. Cases like Ranjith Reddy’s show that even high-profile politicians are allegedly knee-deep in this practice.

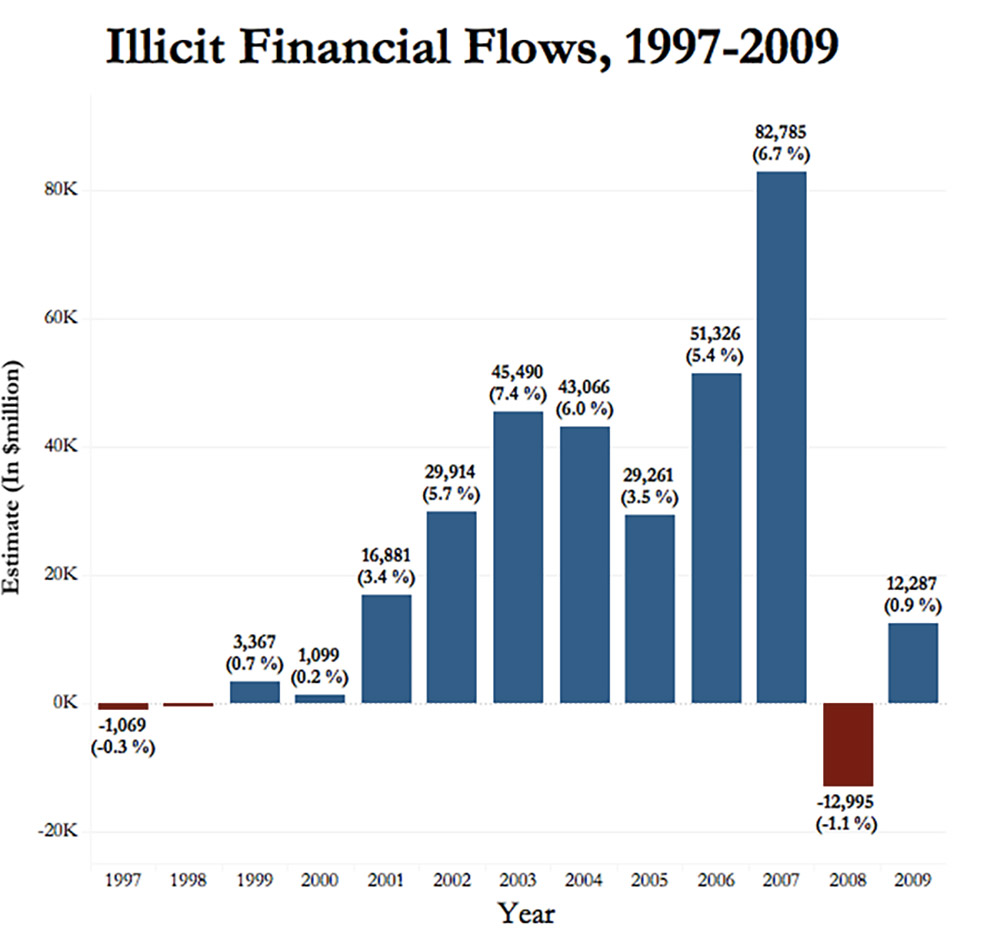

Why This Matters Globally?

This isn’t just India’s problem. Around the world, governments struggle to capture lost revenue from wealthy elites:

- United States: The IRS estimates a $688 billion tax gap annually. Much of it comes from under-reported business income and offshore accounts.

- China: In 2021, the government cracked down on wealthy celebrities for tax evasion, including actress Fan Bingbing, who had to pay over $100 million in fines.

- Europe: The EU Tax Observatory estimates that Europe loses nearly €1 trillion annually to tax evasion and avoidance.

The common thread? When elites skip taxes, the gap is filled by ordinary taxpayers.

Political Fallout

Ranjith Reddy’s troubles come at a sensitive time. Having switched from BRS to Congress, he was seen as a big-ticket candidate. His wealth and influence were supposed to help the party. Instead, this scandal could backfire, damaging Congress’s credibility in Telangana.

For the BRS, which has already been hit by defections and corruption allegations, the raids serve as vindication that former members carried baggage.

For voters, it’s another reminder of how money power dominates Indian politics, often overshadowing grassroots issues.

How Tax Raids Work?

- Intelligence Gathering – Authorities quietly track financial patterns, property prices, and suspicious transactions.

- Coordination – Multiple teams are dispatched to strike simultaneously across cities.

- Execution – Raids are sudden, often before dawn, to prevent destruction of evidence.

- Evidence Seizure – Cash, jewelry, digital files, and property papers are taken.

- Legal Follow-Up – If fraud is proven, penalties can be crushing, sometimes exceeding 200% of the tax owed, with possible jail terms.

Impact on Investors and NRIs

For homebuyers and NRIs (Non-Resident Indians) who often invest in Indian real estate, this case is a red flag.

- Due Diligence is Key: Always verify a developer’s RERA registration and past track record.

- Beware of “Discounted Deeds”: If you’re asked to pay part in cash and part officially, walk away. That’s a classic tax evasion setup.

- Long-Term Risks: Buying under-declared property might save money short-term, but it complicates resale, inheritance, or foreign remittance later.

The Impact on Common Citizens

At first glance, raids on a wealthy ex-MP might feel like a distant political drama. But here’s the reality: ordinary citizens end up paying the price when powerful people dodge taxes.

- Loss of Public Services: Every rupee hidden in black money is a rupee not spent on hospitals, schools, and roads. For example, India’s government spends around ₹2,000 crore annually on rural healthcare, but the tax gap is in the lakh crores—imagine the boost to medical care if even a fraction of hidden income were taxed.

- Higher Tax Burden on the Honest: When big players avoid taxes, governments often turn to indirect taxes like GST, which hits regular consumers hardest.

- Real Estate Distortions: Under-reporting inflates property prices, making homes less affordable for middle-class buyers. This fuels a cycle where legitimate buyers struggle while wealthy investors manipulate markets.

For professionals, entrepreneurs, and families, this is a reminder: financial dishonesty at the top always trickles down as economic pain at the bottom.

Lessons for Professionals & Entrepreneurs

- Keep Records Clean: Whether you’re in Dallas or Delhi, transparency protects you.

- Hire Experts: A certified tax advisor pays for themselves.

- Don’t Chase Shortcuts: Hidden deals may offer quick gains, but penalties and reputational loss can sink a business.

- Follow Updates: In the U.S., IRS rules change often; in India, the CBDT issues frequent circulars. Stay informed.

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty

Net Direct Tax Collection Drops 4% – Should You Worry About FY26?

How India’s Broken Tax System Is Crippling the Circular Economy Revolution