Zero GST on Health & Life Insurance Backed by Ministers: If you’ve been following economic news in India, you’ve probably come across a major headline: the government is considering Zero GST on health and life insurance premiums. Right now, every policyholder pays 18% Goods and Services Tax (GST) on premiums. A Group of Ministers (GoM) has recommended removing this tax to make insurance more affordable.

On the surface, it sounds like a win for families and individuals across the country. Lower costs mean more people could access life and health coverage. But here’s the twist: insurance companies aren’t celebrating. They’re worried about how this change could hurt their finances and possibly lead to unintended consequences for customers. Let’s dig deeper into why something that looks like a blessing could also carry hidden costs.

Zero GST on Health & Life Insurance Backed by Ministers

| Point | Details |

|---|---|

| Proposed Change | GoM recommends zero GST on health and life insurance premiums. |

| Current Rate | 18% GST applies to individual premiums today. |

| Why It Helps Customers | Premiums become cheaper and more people can afford insurance. |

| Why Companies Worry | Loss of Input Tax Credit (ITC) on expenses may raise costs. |

| Possible Impact | Insurers may hike base premiums, erasing benefits for consumers. |

| Alternative Solution | Lower GST (around 5%) while keeping ITC intact. |

| Expected Timeline | To be discussed in GST Council meeting (Sept–Oct 2025). |

| Official Source | GST Council – Government of India |

GST and Insurance: A Historical Context

When GST was rolled out in 2017, one of its biggest changes was the way services were taxed. For the insurance sector, the rate jumped from 15% under the service tax regime to 18% under GST. This immediately increased the cost of policies.

- A policy with ₹20,000 premium pre-GST had ₹3,000 tax = ₹23,000.

- Post-GST, it had ₹3,600 tax = ₹23,600.

That 600 rupee difference doesn’t sound like much, but when multiplied by millions of policies, it created a major affordability gap. The irony? Insurance is meant to provide financial protection, but taxation made it less accessible.

Why Zero GST Sounds Like a Dream for Customers?

For everyday folks, this reform feels like long-overdue relief. Imagine paying a ₹25,000 annual premium. Right now, GST adds another ₹4,500, making your bill ₹29,500. Remove GST, and you save that ₹4,500 instantly. That’s enough to cover a month’s school fees, utility bills, or several weeks’ worth of groceries.

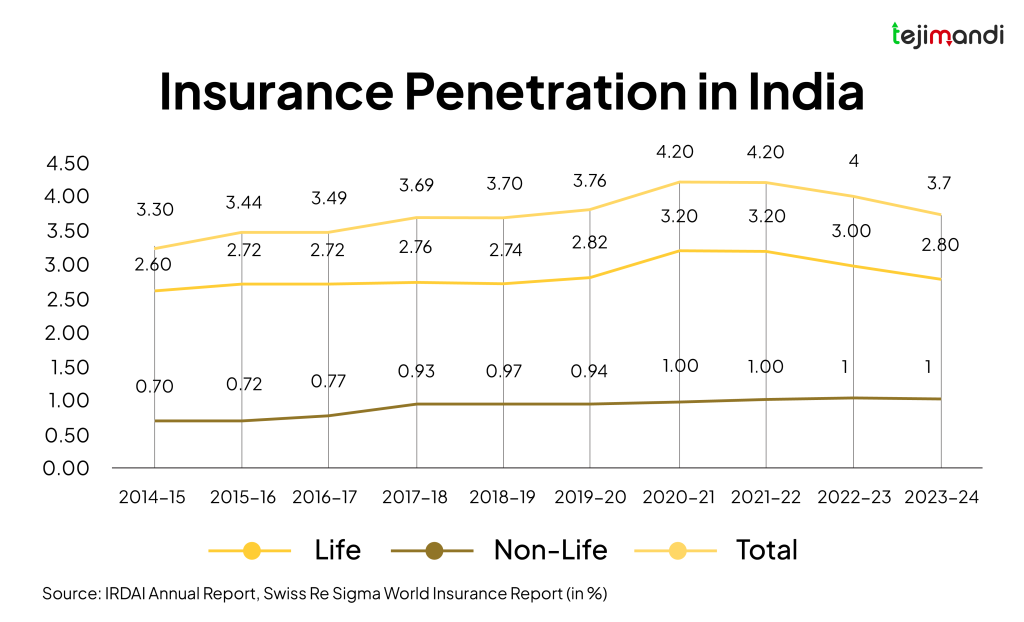

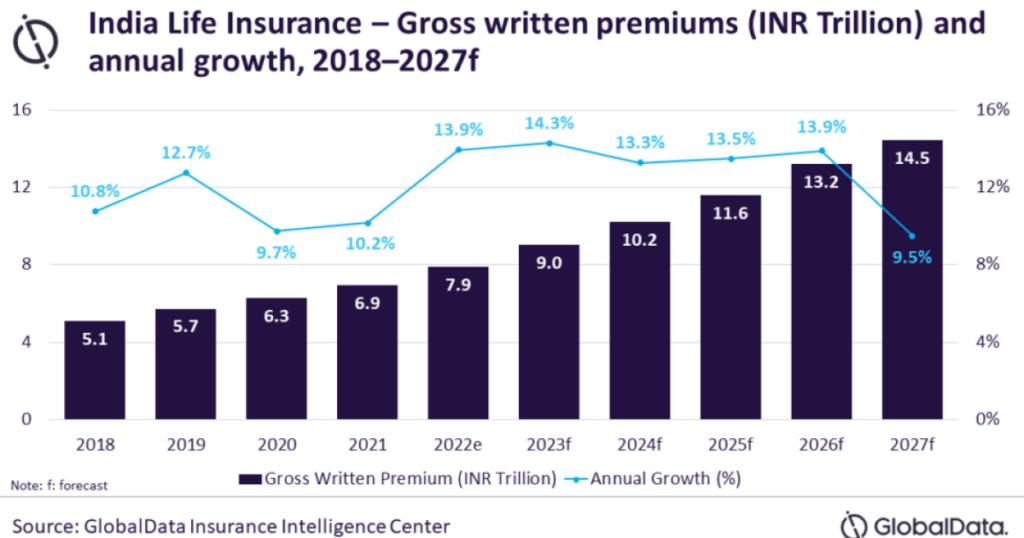

More importantly, removing GST can help boost insurance penetration. According to Swiss Re, India’s insurance penetration stands at 4.2% of GDP, far behind the global average of 7%. Lower premiums could nudge millions of uninsured Indians to finally buy coverage.

In a country where medical inflation is 13–14% annually, this move could provide critical relief.

The ITC Puzzle: Why Companies Are Worried

Here’s where things get complicated. Insurance companies don’t just collect premiums and hand over payouts. They have their own operating costs—rent, technology, agent commissions, advertising, legal fees. All these expenses attract GST.

Under the current system:

- Insurers charge customers GST on premiums.

- They also pay GST on their expenses.

- They use Input Tax Credit (ITC) to balance out what they owe.

Example: With GST

- Customer pays ₹100 premium + ₹18 GST = ₹118.

- Insurer pays ₹12.6 GST on expenses.

- Insurer offsets this with GST collected from customers, lowering their net tax burden.

Example: With Zero GST

- Customer pays ₹100 premium.

- Insurer still pays ₹12.6 GST on expenses.

- But without GST collected on premiums, there’s nothing to offset.

- Result: Insurer absorbs the full cost, which squeezes margins.

And when companies’ margins shrink, they look for ways to recover the money. The simplest option? Increase the base premium.

Customer Impact: Real-Life Case Studies

Let’s look at how this could play out for different groups.

Case 1: Young Professional

- Current premium: ₹15,000 + 18% GST = ₹17,700.

- Zero GST benefit: Pays only ₹15,000.

- But if insurer raises premium to ₹16,500 to cover ITC loss, actual saving is only ₹1,200.

Case 2: Family Floater Policy

- Current premium: ₹30,000 + 18% GST = ₹35,400.

- Zero GST benefit: Pays only ₹30,000.

- If insurer hikes to ₹33,000, saving shrinks to ₹2,400.

Case 3: Senior Citizen Plan

- Current premium: ₹50,000 + 18% GST = ₹59,000.

- Zero GST benefit: Pays only ₹50,000.

- If insurer hikes to ₹55,000, saving shrinks to ₹4,000.

So while zero GST looks like a jackpot, the real-world impact depends on how insurers react.

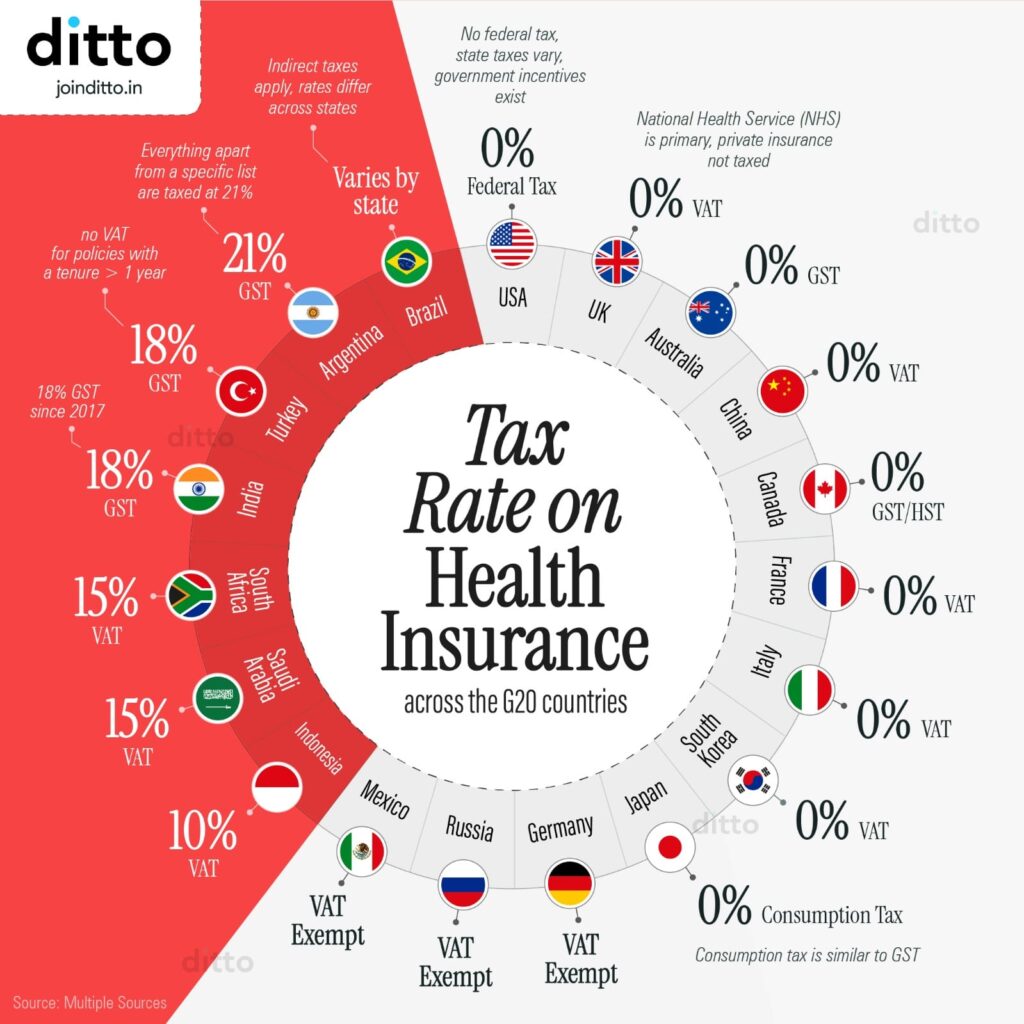

Global Perspective: How Other Countries Handle Insurance Taxes

- United States: Health insurance premiums are not taxed directly. Instead, many plans are subsidized through the Affordable Care Act or offered as tax-deductible employer benefits.

- United Kingdom: No VAT on life insurance. Health insurance provided by employers is taxed, but individual policies often receive tax reliefs.

- Singapore: Insurance is exempt from GST, but the government heavily subsidizes medical plans under MediShield Life.

Lesson: Around the world, insurance is treated as a social necessity, not a taxable luxury. India’s move to reduce or remove GST is in line with this philosophy, but execution will be the deciding factor.

Industry Opinions: What Experts Are Saying

- Life Insurance Council: “A complete exemption may not benefit customers if ITC is blocked. A reduced GST rate is more practical.”

- Economic Times Analysts: “Zero GST could backfire, with companies raising premiums quietly. Customers shouldn’t expect instant relief.”

- PolicyBazaar CEO: “Insurance is an essential service, like food or medicine. But exemptions must be structured carefully.”

This debate reflects a larger issue: how to balance affordability with industry sustainability.

Policy Implications for India

If zero GST works as intended, here’s what could happen:

- More households buy insurance.

- Government hospitals face less financial strain as private coverage increases.

- Long-term health outcomes improve, reducing poverty caused by medical bills.

If it backfires, though:

- Premiums rise.

- Trust in the insurance sector erodes.

- Penetration rates stagnate or fall.

That’s why many experts push for a middle path—lower GST (5%) with ITC intact. This would keep premiums lower while allowing insurers to stay financially healthy.

What You Should Do Now As Zero GST on Health & Life Insurance Backed by Ministers

- Don’t Delay Coverage: Buy insurance now. Waiting for reforms can leave you exposed.

- Review Your Policy Annually: If reforms lower premiums, you can switch or upgrade.

- Compare Smartly: Don’t just chase the lowest price—look for coverage benefits.

- Pay Attention to Family & Senior Plans: They’re most affected by GST changes.

- Stay Updated: Follow the GST Council for official updates.

GST Rate Cut Incoming — Cement, Auto, FMCG, Insurance & AC Shares Set to Soar!

India@100: Why Experts Say Fixing GST Could Unlock a Health Insurance Boom

GST on Health and Term Insurance May Drop to Just 5%- What We Know So Far