Ajanta Pharma Offices Face Tax Raids: When news broke that Ajanta Pharma offices face tax raids, investors across the globe perked up. It’s the kind of headline that can rattle markets, raise eyebrows, and spark panic among traders who thrive on breaking news. For long-term investors, though, the bigger question is: Does this really change Ajanta Pharma’s story? On August 19, 2025, India’s Income Tax Department (ITD) carried out search-and-seizure operations at multiple Ajanta Pharma facilities. The company confirmed the raids the next day through a stock exchange filing. It assured stakeholders that it is cooperating fully and that business operations remain unaffected. Despite this reassurance, Ajanta Pharma’s stock dropped nearly 3% on the Bombay Stock Exchange (BSE), reflecting market jitters rather than confirmed financial damage.

Ajanta Pharma Offices Face Tax Raids

The fact that Ajanta Pharma offices face tax raids is significant but not necessarily disastrous. The company continues operations, holds strong financials, and has a history of disciplined compliance. Short-term volatility is natural, but long-term investors should focus on fundamentals rather than headlines. Unless major irregularities surface, Ajanta’s story remains one of growth, global presence, and specialty-driven pharma leadership. For now, the smart move is simple: stay informed, stay calm, and avoid knee-jerk reactions.

| Aspect | Details |

|---|---|

| Event | Income Tax Department raids at Ajanta Pharma offices (August 19, 2025) |

| Company Statement | Confirmed raids, stated full cooperation; business operations “unaffected” |

| Market Impact | Shares dropped ~3% post-announcement |

| Possible Concerns | Tax compliance, potential contingent liabilities, reputational risk |

| Investor Takeaway | Expect short-term volatility, monitor disclosures, diversify portfolio |

| Official Source | Ajanta Pharma Website |

Why Do Tax Raids Happen?

In simple terms, a tax raid is a government check to ensure a company isn’t cutting corners on taxes. Indian authorities usually step in when they suspect:

- Under-reported income

- Inflated or fake expenses

- Improper use of tax credits (especially R&D deductions)

- Unexplained cash transactions or overseas fund flows

Think of it as an IRS audit on steroids. Instead of a polite letter, tax officers show up, check accounts, seize documents, and interview executives. It doesn’t mean guilt—it means scrutiny.

Ajanta Pharma: From Family-Owned to Global Player

Ajanta Pharma started in 1973 as a modest Mumbai-based firm. Over the years, it evolved into a specialty-driven pharmaceutical powerhouse. The transformation was fueled by:

- Early bets on ophthalmology and dermatology, markets often overlooked by larger players.

- Heavy investment in R&D, allowing Ajanta to build a pipeline of branded generics.

- Global expansion into Africa, Southeast Asia, and eventually regulated markets like the U.S.

Today, Ajanta generates over ₹4,100 crore (~$500 million) in annual revenues, with exports contributing nearly 40% of its business. Its net profit margin hovers around 18%, supported by a lean cost structure and low debt levels.

Market Reaction: Why Investors Spooked

When the news broke, shares of Ajanta Pharma fell about 3%. Why?

- Uncertainty: Investors fear the unknown more than confirmed bad news.

- Reputation Damage: A raid—fair or not—creates negative perception, especially abroad.

- Short-Term Selling: Traders often sell first and ask questions later.

Historical Precedents

- Sun Pharma (2018): Faced regulatory scrutiny from SEBI. Stock dipped but recovered within months.

- Dr. Reddy’s (2016): Hit by U.S. FDA warnings. While short-term damage was steep, corrective action restored trust.

- Ranbaxy (2013): Faced both FDA and tax issues. Unlike others, repeated compliance failures hurt its long-term trajectory, eventually leading to a takeover by Sun Pharma.

Lesson: The outcome depends on how the company responds and whether core operations stay intact.

Best-Case vs. Worst-Case Scenarios

Best-Case Scenario

- Raids uncover minor accounting discrepancies.

- Ajanta pays a penalty or adjusts filings.

- Operations remain unaffected, stock rebounds.

Moderate Scenario

- Larger tax demands surface.

- Company settles dues, possibly impacting quarterly profits.

- Market sentiment recovers once liabilities are quantified.

Worst-Case Scenario

- Significant irregularities emerge.

- Authorities impose hefty back taxes and penalties.

- Reputational damage hampers partnerships and global expansion.

So far, based on Ajanta’s low debt, strong compliance track record, and official statement, markets lean toward the first two scenarios.

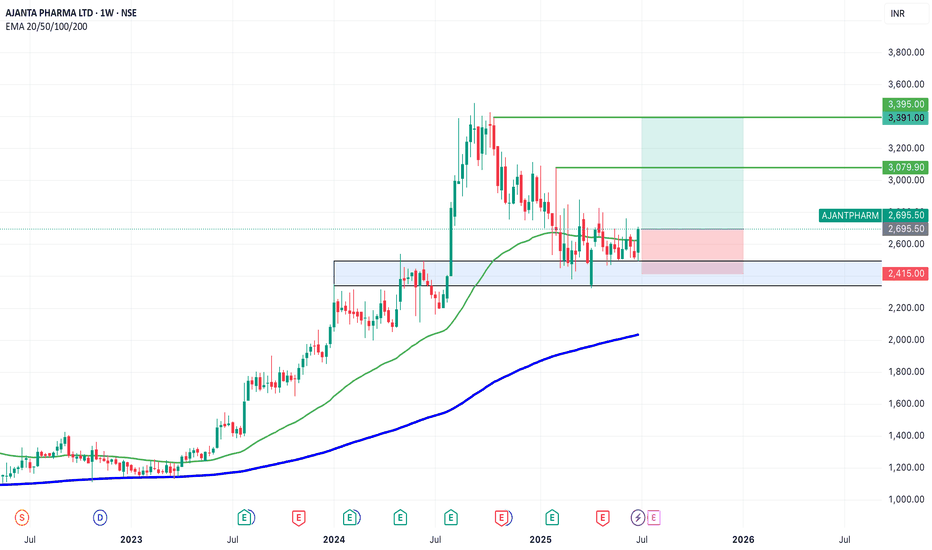

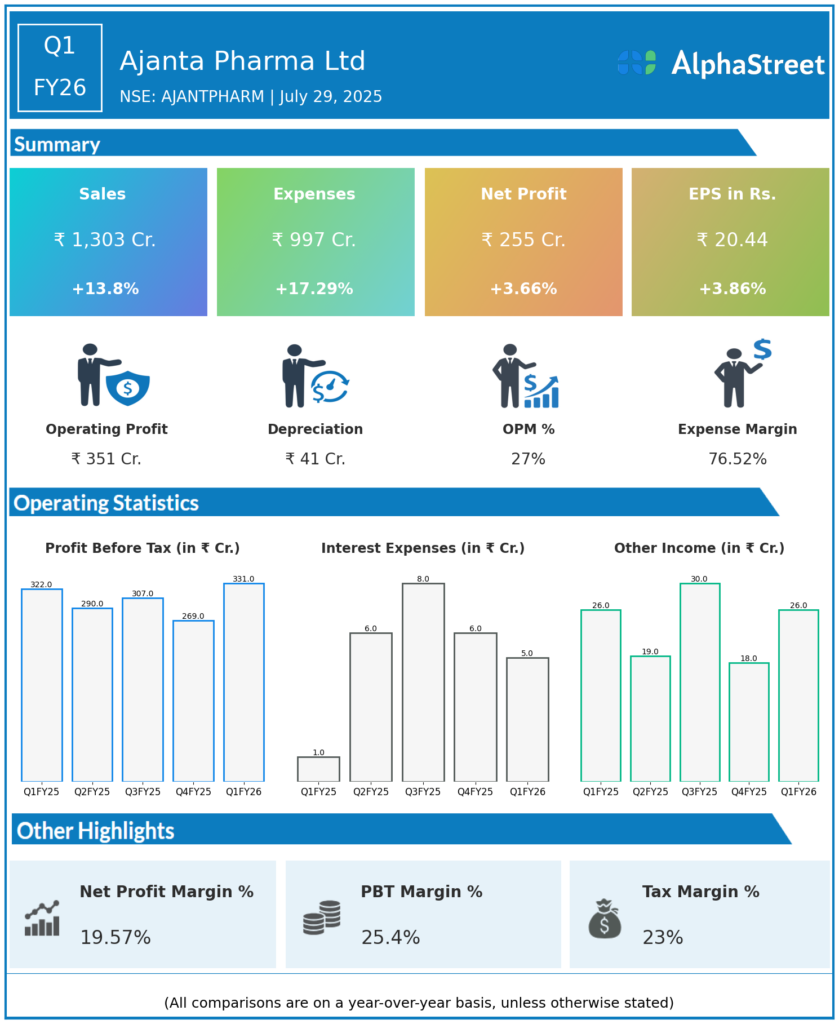

Ajanta Pharma Financial Health

Ajanta isn’t a weak company scrambling for survival. Its numbers suggest resilience:

- Debt-to-Equity: Less than 0.1 (very healthy).

- Cash Reserves: Over ₹700 crore (~$85 million).

- P/E Ratio: Around 25x, slightly higher than peers, reflecting growth premium.

- Export Share: ~40%, diversified across geographies.

That means even if tax penalties emerge, Ajanta likely has the financial muscle to absorb the hit.

Investor Psychology: Lessons from U.S. Cases

In the U.S., markets have seen their fair share of corporate investigations.

- Apple (2013): Investigated by the U.S. Senate for tax practices. While headlines were harsh, Apple’s fundamentals remained strong, and the stock surged over the next decade.

- Enron (2001): A cautionary tale. What started as scrutiny revealed deep fraud, leading to collapse.

The takeaway? Not all raids are red flags. Strong companies weather storms; weak ones crumble. Ajanta, by most measures, falls in the first category.

Ajanta Pharma Offices Face Tax Raids: A Step-by-Step Investor Guide

- Stay Calm: Don’t panic sell. Raids don’t equal fraud.

- Check Disclosures: Follow Ajanta’s Investor Relations page.

- Diversify: Limit exposure. Keep pharma at 10–15% of portfolio max.

- Follow Analyst Notes: Brokerages like HDFC Securities or ICICI Direct provide updates factoring in risks.

- Look for Peer Signals: If rivals are unaffected, this is company-specific, not industry-wide.

- Consider Buying on Dips: Historically, strong pharma players rebound once clarity emerges.

What to Watch Over the Next 6–12 Months?

- Regulatory Updates: Any interim findings or settlement announcements.

- Quarterly Earnings: Check if penalties impact profits.

- Analyst Downgrades/Upgrades: These can drive sentiment shifts.

- Global Partnerships: Any slowdown in licensing deals or collaborations may reflect reputational drag.

- Sector Trends: If India’s pharma sector faces wider scrutiny, sentiment could remain cautious.

Global Context

Regulatory probes aren’t unique to India:

- Pfizer: Faced DOJ investigations in the U.S. over pricing.

- Novartis: Penalized in Europe for improper practices.

- Indian Pharma: Frequently under the tax lens due to R&D tax credits and global transfer pricing issues.

This highlights that scrutiny is part of doing business in a heavily regulated sector.

Expert Takeaways

Most analysts agree:

- Ajanta Pharma’s fundamentals are solid.

- Raids may lead to short-term volatility but not long-term derailment.

- Transparency will be key. Clear, timely communication will determine how quickly the stock regains investor trust.

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid

Income Tax Department Raids Over 10 Locations Across Tamil Nadu