Shree Cement Stock in Focus: If you’ve been keeping an eye on India’s corporate scene, you’ve probably seen the headlines: Shree Cement stock in focus after an income tax order rectification. On the surface, it might sound like just another bureaucratic shuffle, but in reality, it rattled investors, sparked heated debates in financial circles, and even nudged share prices.

Here’s the story in plain English. In May 2025, Shree Cement—one of India’s largest cement producers—was slapped with a tax demand of ₹588.65 crore (around $70 million USD) for the financial year 2021–22. The market didn’t take it well. Shares dropped sharply, investors panicked, and the stock slipped over 3% in a single session. But then came the twist. Just three months later, in August 2025, the Income Tax Department issued a rectification order under Section 154 of the Income-Tax Act, admitting that the original demand was overstated. The revised figure? ₹221.72 crore—still significant, but less than half the original bill. Shree Cement wasted no time, cleared the dues by adjusting pending refunds, and signaled to the market: crisis averted.

Shree Cement Stock in Focus

The story of Shree Cement stock in focus after income tax order rectification is a perfect reminder that markets are emotional, regulators are powerful, and transparency matters. The company moved from panic-inducing headlines to relief in just a few months by resolving the dispute swiftly and maintaining financial discipline. For investors, the big takeaway is simple: Don’t react to fear alone. Always study the fundamentals, watch for governance quality, and think long-term.

| Event | Date | Details |

|---|---|---|

| Original Tax Demand | May 27, 2025 | ₹588.65 crore under Section 143(3) |

| Rectification Order | August 19, 2025 | Reduced to ₹221.72 crore under Section 154 |

| Payment Status | August 2025 | Fully settled via pending refunds |

| Initial Market Reaction | May 2025 | Stock fell ~3.38% after tax demand |

| Current Market Focus | August 21, 2025 | Shares closed 0.73% lower at ₹30,693 on BSE |

| Official Filing | NSE Corporate Announcement | View here |

Who is Shree Cement?

For anyone new to this name, Shree Cement Ltd. is not a small fry. It is India’s third-largest cement producer, with an installed capacity of over 50 million tonnes per annum. Headquartered in Kolkata, it has plants in multiple states including Rajasthan, Uttarakhand, Bihar, and Chhattisgarh.

The company is admired for its operational efficiency, eco-friendly practices, and low debt profile. It is also among the few cement companies investing heavily in renewable energy—particularly wind and solar—to cut down on coal dependence.

Think of Shree Cement as the “quiet achiever” of the Indian cement industry. While rivals like UltraTech Cement dominate headlines, Shree Cement quietly delivers high margins and consistent growth.

Breaking Down the Timeline

- May 2025 – The Shockwave: When the ₹588.65 crore tax demand hit, the stock dropped by more than 3% in a single day. For a heavyweight like Shree Cement, that was no small dip. Investors feared a prolonged tax battle and a dent in profits.

- August 2025 – The Relief: The rectification order slashed the demand to ₹221.72 crore. That number, while still large, is much more manageable.

- August 2025 – Payment Made: Shree Cement settled the revised dues immediately using pending refunds. This was a smart move—it showed the company had strong liquidity and wasn’t scrambling for cash.

- Market Reaction: On August 21, the stock closed just 0.73% lower at ₹30,693. Compare that to the earlier 3.38% drop, and you can see investor nerves calming.

Shree Cement’s Financial Snapshot

Here’s how the numbers stack up for FY25–26:

- Revenue: ₹16,100 crore (FY25)

- EBITDA Margin: ~21%

- Net Profit: ~₹2,750 crore

- Market Cap (August 2025): ~₹1.10 lakh crore (approx. $13.2 billion USD)

- Debt-to-Equity Ratio: 0.2 (low, signaling strong balance sheet)

In simple terms: the company is profitable, cash-rich, and not drowning in debt. The tax demand reduction helps preserve these strengths.

What Analysts Are Saying?

- Motilal Oswal called the rectification “sentiment positive” and expects consolidation in the near term.

- ICICI Securities maintained a “Hold” rating with a target of ₹32,000, citing stable cement demand.

- Jefferies highlighted Shree Cement’s low leverage as a key advantage.

The overall takeaway? Analysts see the episode as a hiccup, not a long-term risk.

Market Psychology: Lessons for Investors

This case isn’t just about one company—it’s a textbook lesson in market psychology.

- Don’t Panic Sell: Investors who bailed during the initial scare probably regret it now.

- Corporate Governance Matters: Shree Cement’s prompt disclosure of both the tax demand and the rectification boosted confidence. Transparency pays.

- Factor in Regulatory Risks: Even strong companies can get blindsided by compliance issues. That’s why diversification is crucial.

The Bigger Picture: India’s Cement & Infrastructure Story

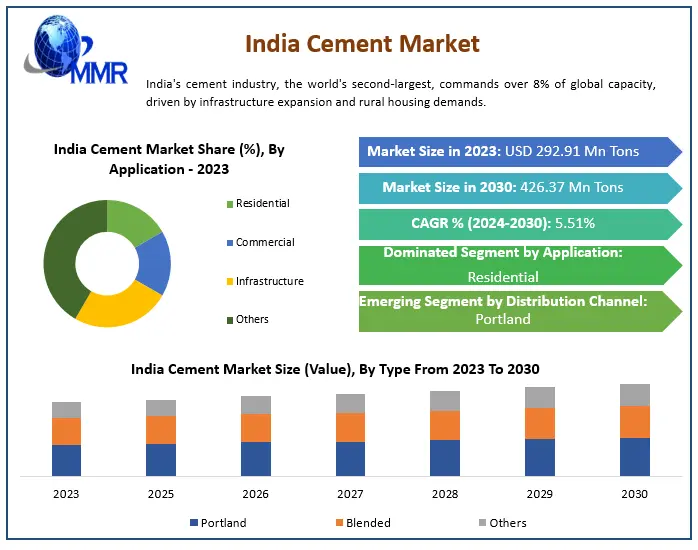

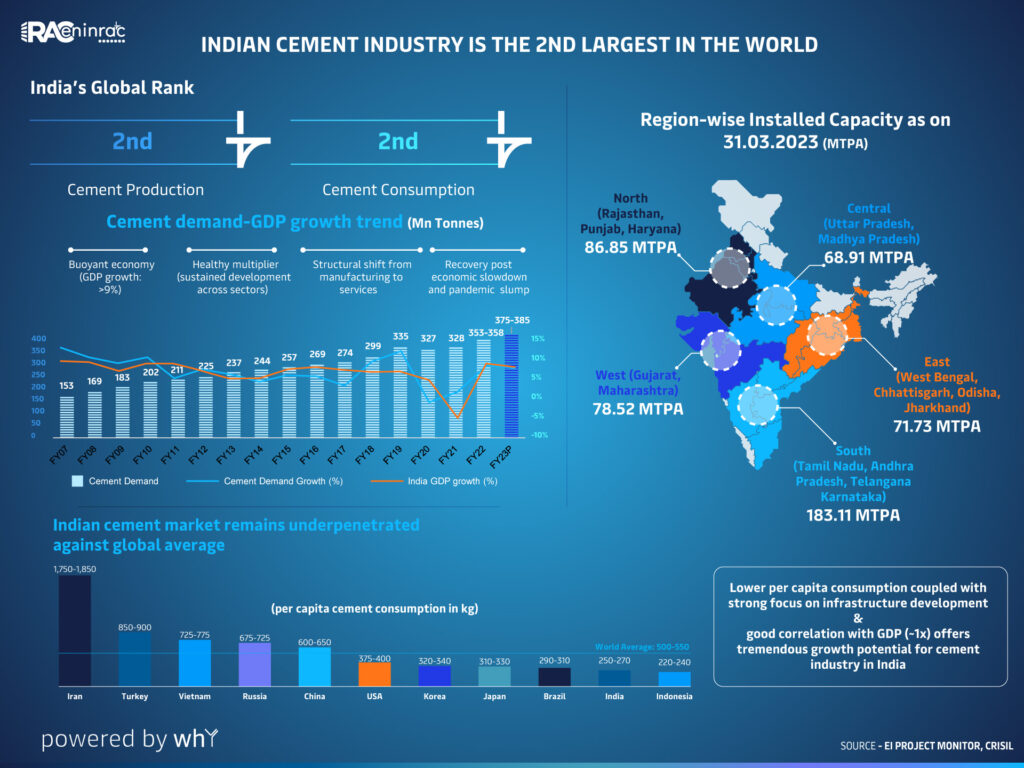

India produced more than 420 million metric tons of cement in 2023, making it the world’s second-largest producer after China. Demand is being driven by:

- Government spending on highways and infrastructure

- Housing for a growing middle class

- Industrial and commercial construction

Shree Cement, with its cost-efficient plants and focus on renewable energy, is well positioned to capture this demand.

Global Investor Angle

For U.S. or European investors, why does this matter? Because India’s cement stocks often act as a proxy for the country’s GDP growth. When India builds more highways, houses, and airports, cement consumption rises. Foreign institutional investors often use companies like Shree Cement to gain exposure to India’s booming infrastructure.

Shree Cement Stock in Focus: Risk Factors to Watch

Of course, it’s not all sunshine and cement. Investors need to stay mindful of:

- Energy Prices: Coal and petroleum coke are key cost drivers. Any surge squeezes margins.

- Competition: UltraTech, ACC, and Dalmia Bharat often engage in price wars.

- Policy Risks: Sudden tax demands or regulatory changes can hit sentiment, as we just saw.

- Global Slowdown: If global construction cools, exports may take a hit.

Real-World Analogy

Think of this tax dispute like getting a surprise bill from your credit card company. You’re told you owe $700 when in reality you only owe $270. First, you panic. Maybe you even cancel a weekend trip. Then, the company calls back and says, “Oops, our mistake.” You pay off the $270, your finances stay intact, and life moves on.

That’s exactly what Shree Cement went through—only at a scale of billions.

How to Analyze Events Like This (Step-by-Step Guide)

- Check official filings on NSE or BSE.

- Read multiple sources—don’t rely on one news headline.

- Compare tax demands with profits to see if the company can handle it.

- Track market reaction—sometimes investors overreact.

- Look at analyst notes to gauge professional sentiment.

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash

GST Rate Cut Incoming — Cement, Auto, FMCG, Insurance & AC Shares Set to Soar!

GST Bonanza Alert: ACs, Snacks, Cement — Here’s the Full List of Items That Could Get Cheaper!

Actionable Takeaways for Investors

- Stay calm during regulatory shocks.

- Always verify numbers from official filings.

- Diversify investments to cushion against sector-specific risks.

- Recognize that corporate governance and transparency can make or break investor confidence.