Filing ITR This Year: When it comes to filing ITR this year, every salaried taxpayer in India needs to sit up and pay attention. The Income Tax Return (ITR) filing season is here, and while it might sound like a boring “grown-up chore,” it’s one of the most important financial habits you can master. Whether you’re a fresh grad in your first job or a seasoned professional juggling multiple incomes, understanding the rules, deadlines, and smart choices can save you a ton of stress—and money. The good news is that while tax filing can feel intimidating, it doesn’t have to be rocket science. With a little bit of planning, awareness of government rules, and some smart decision-making, you can make filing your ITR as easy as ordering your favorite food online.

Filing ITR This Year

Filing ITR this year doesn’t have to be overwhelming. By keeping track of deadlines, choosing the right form, double-checking pre-filled details, and making an informed choice between the old and new tax regimes, you can make the process smooth and stress-free. Think of it as an annual ritual that secures your financial credibility, helps you claim refunds, and keeps you in good standing with the tax authorities. Start early, stay organized, and file with confidence.

| Point | Details |

|---|---|

| Deadline for ITR filing | 15 September 2025 (extended from 31 July 2025) |

| Tax payment deadline | Self-assessment tax must be paid by 31 July 2025 |

| Correct ITR Form | ITR-1 (basic salary up to ₹50 lakh), ITR-2/3/4 for others |

| Pre-filled forms available | Form 16 (by June 15), AIS & Form 26AS |

| Tax regime choice | Old regime (deductions) vs New regime (simplified slabs) |

| ITR-U option | Allows corrections within 24 months with penalty |

Why Filing ITR Matters (Even if You Think It Doesn’t)

Think of your ITR like your financial “report card.” Filing it doesn’t just keep the government happy, but it also helps you:

- Claim tax refunds if your employer deducted more TDS than necessary.

- Get loans approved faster—banks love folks with a clean tax record.

- Avoid penalties that can pinch your wallet later.

- Maintain financial credibility, especially if you plan to invest, buy property, or travel abroad.

Skipping ITR filing is like skipping brushing your teeth: you may not see the damage immediately, but over time, the problems pile up.

1. Mark the Calendar – Deadlines You Can’t Miss

The government has extended the ITR filing deadline to 15 September 2025 for non-audit taxpayers. That means salaried folks like you have more breathing room this year.

But the final tax payment (self-assessment tax) is still due by 31 July 2025. If you miss this date, you’ll face interest charges under sections 234A, 234B, and 234C of the Income Tax Act.

It’s important to understand the difference: filing your return is one thing, but paying your taxes is another. Even if you choose to file in August or September, you must ensure that your dues are cleared by the end of July to avoid unnecessary costs.

2. Pick the Right ITR Form – Don’t End Up in the Wrong Lane

Choosing the right ITR form is crucial. If you pick the wrong one, your return can get rejected, leading to delays and possible penalties.

Here’s a simplified guide:

- ITR-1 (SAHAJ): For residents with income up to ₹50 lakh from salary, one house property, and other sources like bank interest.

- ITR-2: For those with capital gains, multiple properties, or foreign income.

- ITR-3: For individuals running a business or profession.

- ITR-4 (SUGAM): For small business owners or professionals under presumptive taxation.

Most salaried taxpayers with a single income source fall under ITR-1. But if you’re earning rental income or dabbling in stock trading, you may need to switch to ITR-2 or ITR-3.

3. Use Pre-Filled Data—But Double-Check

The Income Tax Department has made filing simpler by providing pre-filled forms. These pull in details from:

- Form 16 (issued by your employer by June 15).

- Form 26AS (a consolidated record of tax deducted and paid).

- Annual Information Statement (AIS).

However, mistakes can still creep in. For instance, interest earned on fixed deposits may be missing, or dividend income may not be updated. Always reconcile pre-filled details with your own bank statements and investment proofs before filing.

4. Old vs. New Tax Regime – Which Side Are You On?

Since the government introduced the new tax regime, taxpayers now have two choices.

- Old regime: Higher tax slabs but more deductions. Great if you claim exemptions like HRA, 80C investments (PF, ELSS, LIC), health insurance premiums, and home loan interest.

- New regime: Lower tax rates, fewer deductions. Perfect if you don’t have many tax-saving investments.

For example, a 30-year-old professional earning ₹12 lakh annually but investing only ₹50,000 may benefit more from the new regime. But a family person investing ₹3 lakh in tax-saving schemes plus housing loan deductions may save more in the old regime

Bonus Tip: The Lifesaver Called ITR-U

The government now allows taxpayers to file an Updated Return (ITR-U) within 24 months of the end of the relevant assessment year.

But it comes with a cost:

- 25% additional tax if filed within 12 months.

- 50% additional tax if filed between 12–24 months.

This option is useful if you forgot to report some income or claimed a deduction incorrectly, but it’s not designed for reducing your tax liability or increasing refunds.

Step-by-Step Guide: Filing ITR This Year

- Log in to Income Tax e-Filing Portal using your PAN or Aadhaar.

- Select “File ITR” under the e-file tab.

- Choose the assessment year (AY 2025-26 for FY 2024-25).

- Select the applicable ITR form.

- Review pre-filled details for accuracy.

- Add deductions or exemptions if using the old regime.

- Pay any pending self-assessment tax.

- Preview the return and submit.

- Complete e-verification using Aadhaar OTP, Net Banking, or Demat account within 30 days.

Common Mistakes to Avoid

- Missing the July 31 tax payment deadline.

- Choosing the wrong ITR form.

- Not reporting interest from savings accounts or FDs.

- Ignoring income from stocks, mutual funds, or cryptocurrencies.

- Forgetting to e-verify your ITR after filing.

Real-Life Example: Priya vs. Raj

Priya, a salaried employee, filed her return in July, cross-verified Form 26AS, and chose the old regime since she had deductions worth ₹3.5 lakh. She received her refund in just 20 days.

Raj, on the other hand, delayed filing till September, didn’t reconcile his Form 16 with AIS, and ended up with a mismatch notice from the tax department. His refund was stuck for months, and he had to pay additional interest.

The takeaway is simple: be like Priya—organized, timely, and careful.

New Income Tax Law Explained in Simple Terms – Who Gains, Who Loses

ITR Filing 2025 Warning: 7 Common Issues Taxpayers Must Watch Out For

ITR Refund Delayed? Here’s Why It’s Taking Longer and How You Can Track Your Status

Extra Benefits of Filing ITR

Filing ITR isn’t just about taxes. It also helps in:

- Loan processing: Banks require ITRs for sanctioning home or personal loans.

- Visa approvals: Many embassies ask for ITR receipts.

- Insurance claims: Provides proof of income for high-value claims.

- Financial planning: Keeps your earnings and expenses documented for long-term planning.

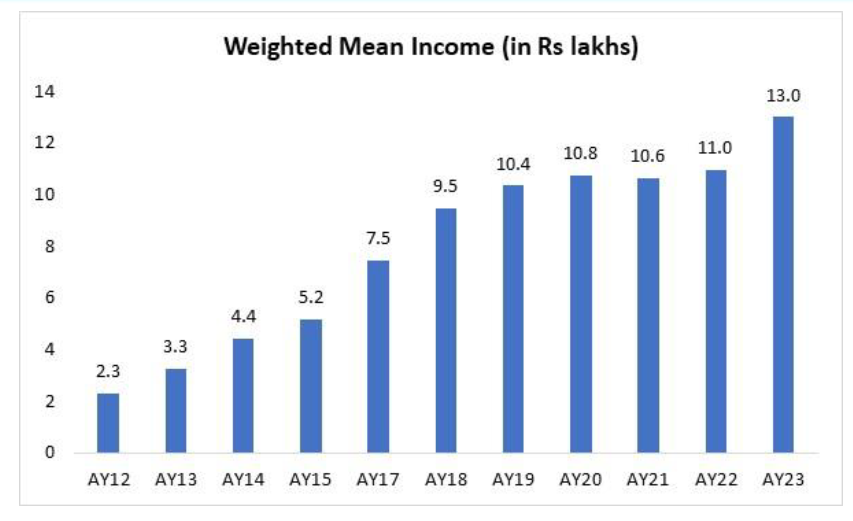

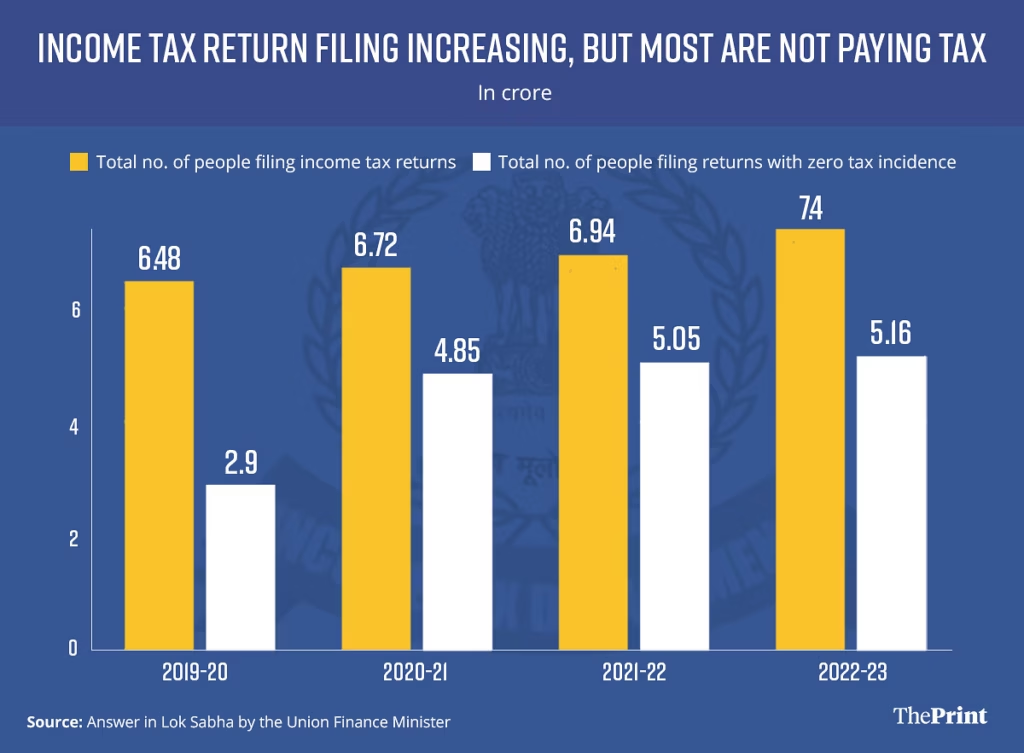

Statistics and Data to Know

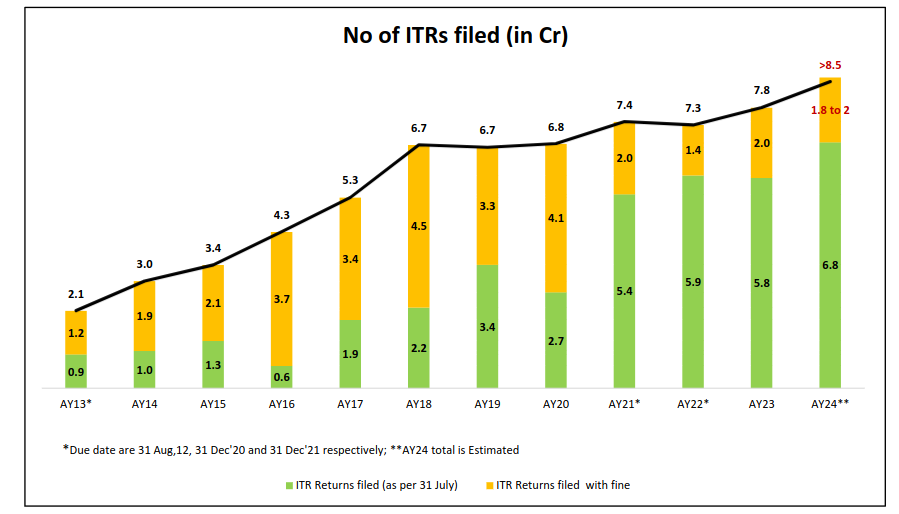

- In FY 2023-24, over 7.7 crore ITRs were filed in India, showing how compliance is steadily increasing.

- Nearly 90% of returns are now filed online, according to the Income Tax Department.

- Refunds worth over ₹3 lakh crore were processed in FY 2023-24, proving the importance of timely filing for salaried taxpayers.