Zero GST on Health & Life Insurance Proposed: If you’ve ever sighed looking at your insurance bill, you know the pain of seeing that 18% GST (Goods and Services Tax) slapped on top of your health or life insurance premium. For years, this tax has been a sore point for middle-class families and senior citizens who already struggle with rising healthcare costs. But here’s the big news: The Indian government is now proposing to scrap GST entirely on individual health and life insurance premiums. If this move goes through, your premiums could finally feel lighter. The question is—will you really save the full 18%, or will insurers raise the base price to make up for their losses? Let’s break it down in plain English.

Zero GST on Health & Life Insurance Proposed

The proposal to remove GST from health and life insurance premiums could be one of the most consumer-friendly tax reforms in recent years. While there may be some adjustments by insurers, the overall cost of insurance is expected to fall significantly. For families, this means lower out-of-pocket expenses and more affordable access to financial protection. For India, it could mean millions more citizens covered by insurance—a win for both the economy and social security. So, will your premiums drop? The answer is a resounding yes—but keep your eyes open for how insurers adjust their pricing.

| Point | Details |

|---|---|

| Current GST Rate | 18% on health and life insurance premiums |

| Proposed Change | Zero GST (0%) on premiums |

| Expected Decision Date | September–October 2025 |

| Potential Savings | Example: ₹20,000 premium drops from ₹23,600 (with GST) to ₹20,000 |

| Revenue Loss to Govt. | Estimated ₹10,000–₹17,000 crore annually |

| Consumer Impact | Lower premiums expected, though insurers may adjust base rates |

| Official Source | GST Council – Government of India |

Why Was GST Applied to Insurance in the First Place?

When GST was introduced in July 2017, it replaced multiple indirect taxes with a single tax system. Insurance services were categorized as “financial services” and taxed at 18%, up from the earlier service tax of 15%.

At the time, the government argued that insurance was a service just like banking or telecom, so it deserved the standard tax rate. But critics pointed out that insurance isn’t a luxury—it’s a safety net. Unlike dining out or luxury cars, health and life insurance provide essential protection for families.

This is why, years later, policymakers are considering a rollback under the new GST 2.0 reforms.

Why Scrap GST on Insurance Now?

- Simplification of Tax Slabs

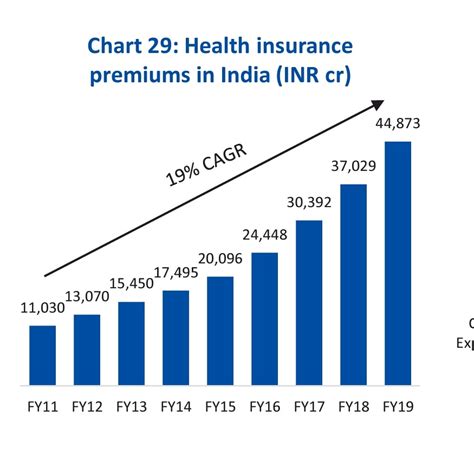

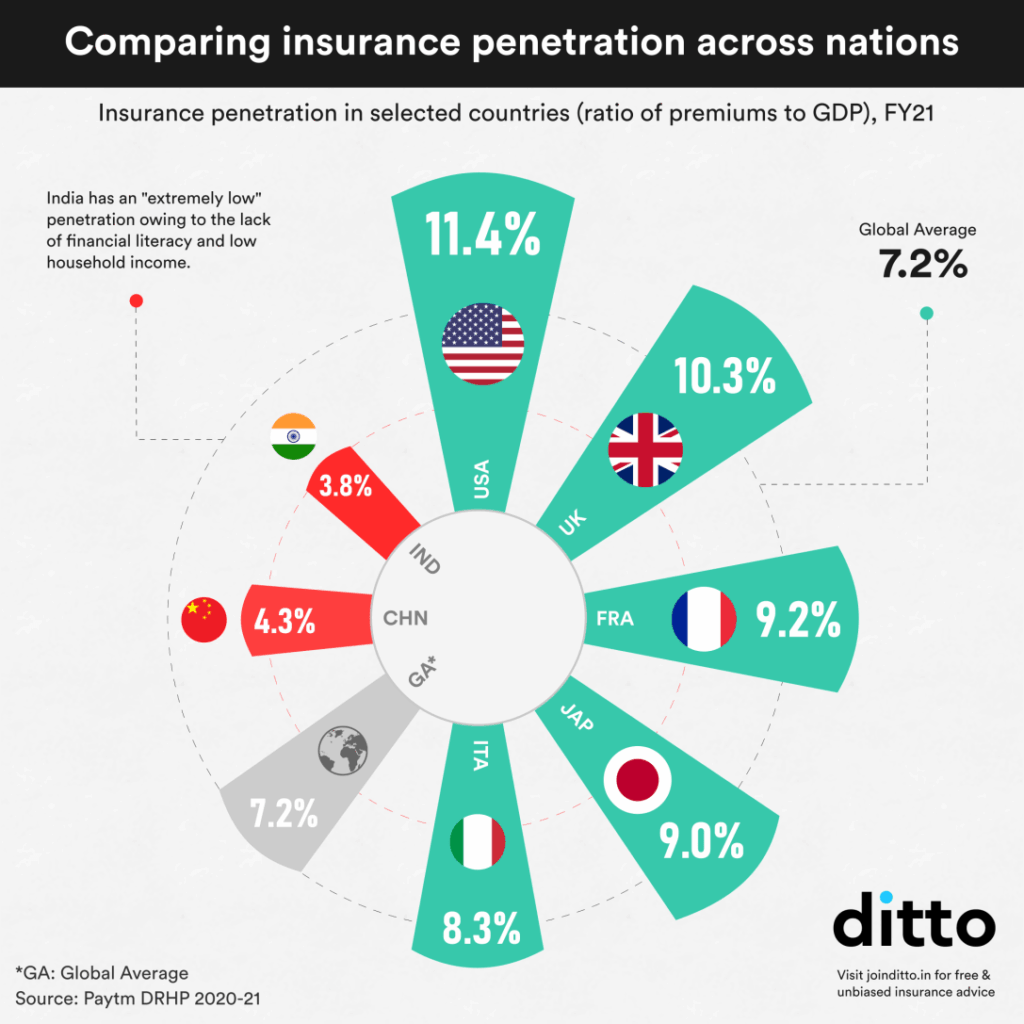

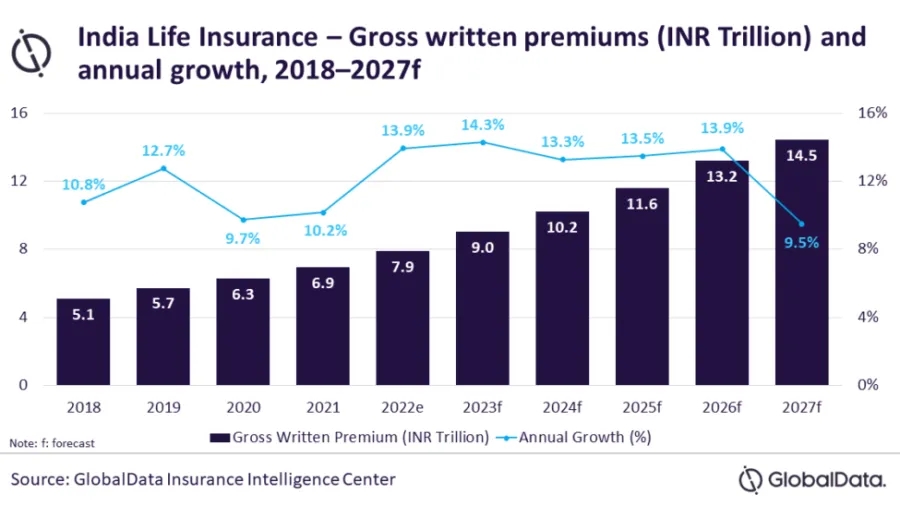

GST 2.0 aims to cut the current four slabs (5%, 12%, 18%, and 28%) down to just two: 5% and 18%, while exempting essentials like health and life insurance. - Boosting Insurance Penetration

India’s insurance penetration is only 3.7% of GDP, compared to the global average of 7%. Countries like the U.S. and Japan have much higher coverage. Lowering premiums by removing GST could help millions of Indians buy their first policy. - Rising Healthcare Costs

Medical inflation in India is running at 14% per year, one of the highest in Asia. Families are already stretched thin—removing GST would offer much-needed relief. - Political Timing

With elections around the corner, this proposal is being seen as a middle-class-friendly “gift.” Tax relief on essentials plays well with voters.

How Much Could You Really Save?

Let’s look at a real example:

- Base premium: ₹20,000

- GST @ 18%: ₹3,600

- Total paid today: ₹23,600

With GST scrapped:

- Base premium: ₹20,000

- GST: 0%

- Total paid: ₹20,000

That’s ₹3,600 saved per year. Over a 20-year policy term, you save ₹72,000—a significant amount for the average family.

For senior citizens paying ₹1,00,000 annually, this could mean a saving of ₹18,000 each year. Over 15 years, that’s ₹2.7 lakh saved—money that can fund medicines, travel, or household expenses.

Will Insurance Companies Raise Base Premiums?

Here’s the fine print. Currently, insurers can claim Input Tax Credit (ITC) on certain expenses like services from hospitals or agents. If GST is removed, they lose this benefit. To offset the loss, insurers may:

- Increase the base premium slightly,

- Reduce discounts and promotional offers, or

- Bundle more services into higher-priced plans.

Even so, experts agree that the net cost for consumers will still be lower without GST, just not a straight 18% drop.

How Do Other Countries Handle Insurance Taxes?

- United States: No federal tax on health insurance premiums. In fact, tax credits are given for buying insurance under the Affordable Care Act.

- United Kingdom: Life insurance is exempt, but health insurance carries a 12% Insurance Premium Tax (IPT).

- Singapore: Health insurance is GST-exempt, making coverage more affordable.

Compared globally, India’s 18% tax looks unusually high, which explains why the reform has gained momentum.

Who Benefits the Most?

Middle-Class Families

They see immediate savings on family floater policies, often between ₹3,000–₹10,000 annually.

Senior Citizens

With higher premiums, seniors save the most. A ₹1 lakh annual premium without GST means an extra ₹18,000 in their pockets.

Young Professionals

Even affordable term plans become cheaper. A ₹10,000 yearly policy now won’t carry an extra ₹1,800 in tax.

Expert Reactions on Zero GST on Health & Life Insurance Proposed

- Financial Advisors: Call it a “long overdue relief” that will increase insurance penetration in India.

- Economists: Warn of a ₹10,000–₹17,000 crore revenue loss for state governments, but agree that long-term benefits outweigh the loss.

- Insurers: Some push for a compromise, like reducing GST to 5% instead of removing it completely.

Case Studies

- Ravi, Age 35 (Software Engineer):

Pays ₹20,000 annually for a family health plan. With GST, total is ₹23,600. If GST is scrapped, he saves ₹3,600 annually. Over 20 years, that’s ₹72,000—money he could invest in his child’s education fund. - Anita, Age 60 (Retired Teacher):

Premium is ₹80,000 annually. GST adds ₹14,400. With zero GST, she saves ₹2.88 lakh over 20 years, enough to cover her post-retirement medical expenses.

What Should Policyholders Do Now?

Step 1: Review Your Policy Renewals

If your renewal is due after October 2025, you could benefit directly from the GST cut.

Step 2: Compare Policies

Use tools like IRDAI and Policybazaar to check premiums with and without GST.

Step 3: Ask Your Insurer Questions

Find out if they plan to adjust base premiums after GST removal.

Step 4: Stay Informed

Follow GST Council announcements for official updates instead of relying on social media rumors.

The Bigger Picture: How India Wins

- Higher Insurance Penetration: More Indians covered means less reliance on out-of-pocket healthcare spending.

- Financial Security: Families avoid selling assets during medical emergencies.

- Economic Boost: Insurance sector may see double-digit growth, attracting global investors.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

Nomura Predicts 10% Jump in Car Demand If GST Rate Is Cut- Check Details

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

Challenges Ahead

- Revenue Loss: Governments may push back against losing up to ₹17,000 crore annually.

- Implementation Delays: Even after approval, updating IT systems and premium structures could take time.

- Insurer Pushback: Companies may quietly hike premiums, reducing the benefit to consumers.