Health & Life Insurers Eye Zero GST: When it comes to health insurance and life insurance, one thing that often annoys policyholders is how much of their premium goes into taxes instead of coverage. In India, the buzz is growing louder: the government is considering removing the 18% GST (Goods and Services Tax) on these essential policies. This move, part of broader GST 2.0 reforms, could dramatically change how affordable insurance is for millions of families. But here’s the kicker: while the news sounds awesome—almost too good to be true—there are nuances that could affect how much you actually save. Let’s dig into the details.

Health & Life Insurers Eye Zero GST

The idea of zero GST on health and life insurance premiums is both exciting and complicated. For everyday families, it could mean real savings—maybe not the full 18%, but enough to matter. For professionals in finance and insurance, it’s a major industry shake-up that could expand the customer base and reshape products. The bottom line? This reform has the potential to make insurance affordable for millions, but only if insurers don’t offset it with price hikes. Either way, this is one reform worth keeping your eye on.

| Aspect | Details |

|---|---|

| Current GST | 18% tax on both life and health insurance premiums. |

| Proposed Change | Full GST exemption under GST 2.0 reforms (expected late 2025). |

| Potential Savings | Up to 15–18% on premiums, depending on insurer pricing. |

| Caveat | Insurers may raise base premiums by 6–10% due to loss of Input Tax Credit (ITC). |

| Timeline | GST Council decision expected by Sept–Oct 2025. |

| Official Source | GST Council Updates |

Why This Move Is a Big Deal?

Right now, whenever someone buys insurance in India, they pay an extra 18% in GST. For example, if your annual premium is ₹30,000 (~$360), you shell out ₹5,400 ($65) more—just for tax.

Scrapping GST could finally put some money back in people’s pockets. For middle-class households, this is meaningful relief. For professionals and entrepreneurs who pay hefty premiums, the savings could be even larger.

The Fine Print: Will You Actually Save?

Here’s where things get tricky. If premiums are “exempted” instead of “zero-rated”, insurers won’t be able to claim Input Tax Credit (ITC)—a system that helps them offset taxes they pay on business expenses.

- Without ITC, insurers face higher costs on everything from technology to operations.

- To make up for this, many could increase base premiums by 6–10%.

So, while the government promises 18% savings, in practice, you may only save around 8–12%—still a win, but not as dramatic as it first sounds.

Real-Life Example: The Kumar Family

Take the Kumar family in Delhi. They currently pay:

- Base health premium: ₹40,000

- GST (18%): ₹7,200

- Total: ₹47,200

If GST is removed:

- Base premium (same): ₹40,000

- GST: 0

- Total: ₹40,000

- Savings: ₹7,200

But if the insurer bumps the base premium by 10%:

- New base premium: ₹44,000

- GST: 0

- Total: ₹44,000

- Savings drop to ₹3,200

Even with a price adjustment, the family still benefits—but the real impact is far less than the headline 18%.

Historical Context: Why GST Was Applied

When India rolled out GST in 2017, insurance was categorized as a taxable service. The logic? Insurance companies are service providers. At 18%, though, premiums became significantly more expensive, sparking criticism.

For years, industry bodies like IRDAI (Insurance Regulatory and Development Authority of India) and consumer groups have pushed for lowering or scrapping GST to boost penetration. Finally, the government seems ready to listen.

International Comparisons of Health & Life Insurers Eye Zero GST

Looking globally helps us understand where India stands:

- United States: There’s no GST or VAT on insurance premiums. Instead, state-level rules apply, but federal taxation on premiums isn’t a burden.

- United Kingdom: Life insurance is generally exempt from VAT, which reduces consumer costs.

- Singapore: Health insurance premiums are exempt from GST, similar to what India is considering.

- Australia: Life insurance is exempt from GST, while health insurance has specific exemptions for government-supported plans.

By removing GST, India would be aligning itself with global best practices, making insurance more affordable and encouraging wider adoption.

Why the Government Wants This?

There are two big reasons:

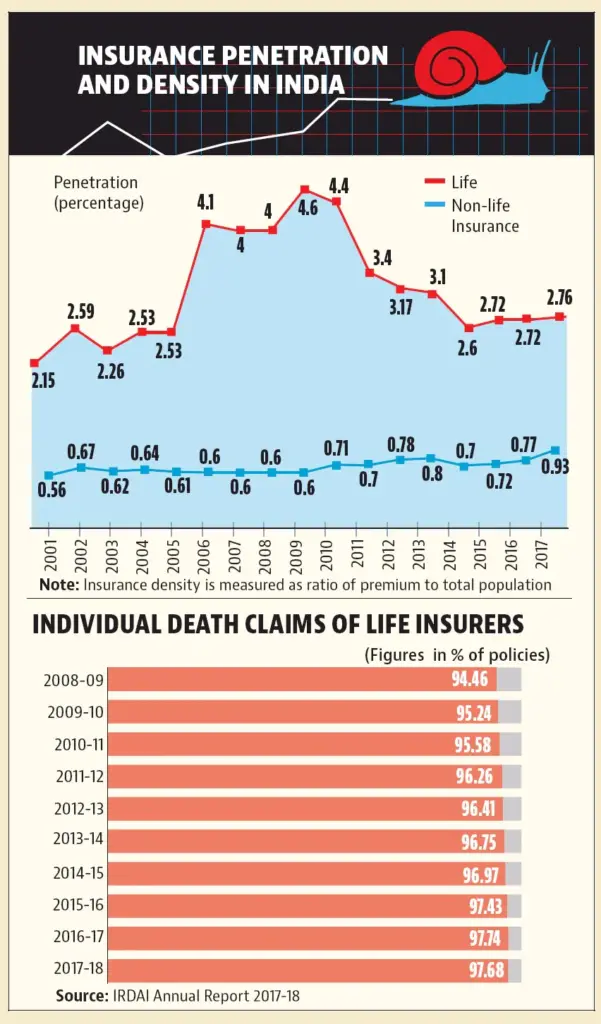

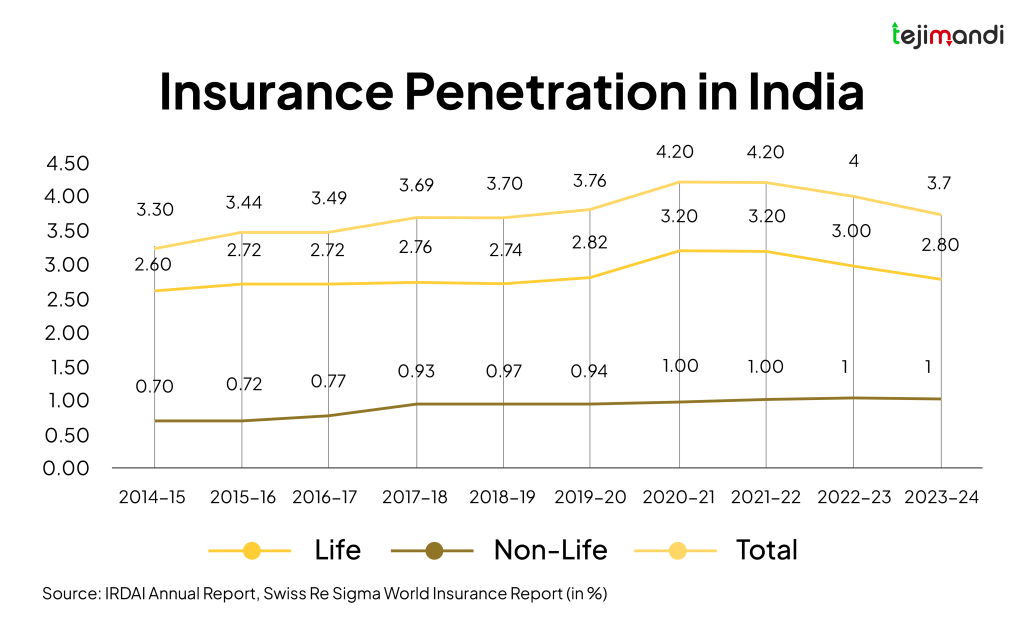

- Low Insurance Penetration: India’s penetration rate is just 4.2% of GDP, compared to the global average of 7.1%. Removing GST could nudge more families into buying protection.

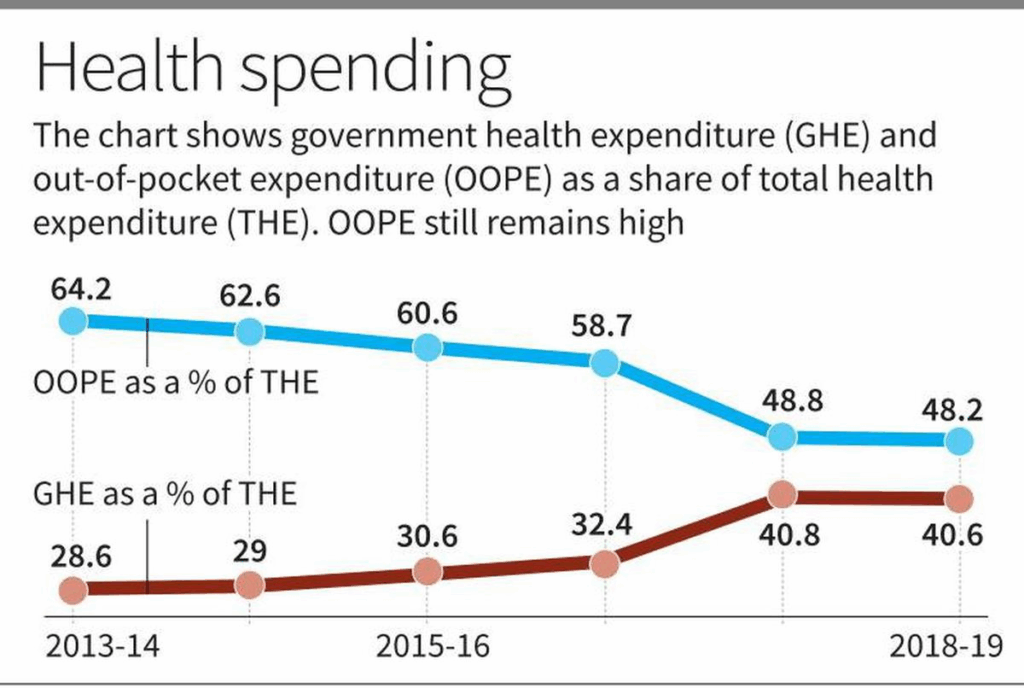

- Soaring Medical Inflation: Healthcare costs in India are growing at around 14% per year. Without affordable insurance, many households risk financial ruin from a single hospitalization.

This reform isn’t just about tax relief—it’s about financial security for the masses.

The Revenue Trade-Off

The government collects roughly ₹35,000 crore annually from GST on insurance. Scrapping it means a direct revenue hit. But the government hopes that:

- More people will buy insurance, expanding the base.

- Reduced out-of-pocket healthcare costs will ease pressure on public hospitals.

- Economic productivity improves when families don’t fall into debt traps due to medical bills.

In other words, the short-term loss could translate into long-term economic resilience.

Expert Opinions

- Financial Advisors: Many are cautiously optimistic, noting it could improve affordability but warning clients to “wait and see” before expecting full savings.

- Insurers: Companies like LIC and ICICI Prudential have expressed concerns about losing ITC, hinting at possible premium adjustments.

- Government Officials: Sources quoted in Reuters suggest the government is ready to absorb revenue losses if it boosts insurance penetration.

This tug-of-war between industry caution and government optimism makes the final outcome uncertain.

Zero GST on Health & Life Insurance Backed by Ministers – Why Companies Are Still Worried

Massive GST Scam In Nepal Exports – Tiles And Auto Parts Dealers Under Fire

No GST on Compost Centers or Chennai’s Wet Waste Processing, Rules AAR

The Consumer Psychology Factor

From a behavioral perspective, even a small price drop can shift buying patterns. In India, where many households hesitate to buy insurance due to affordability, a visible 10–15% cut could convince first-time buyers.

Insurance is often seen as a “grudge purchase.” Lowering costs makes it less painful, nudging people toward healthier financial decisions. This is exactly what the government hopes to achieve.

What Professionals Should Watch

For financial advisors, brokers, and insurance professionals, here’s what to expect:

- Short-term turbulence: Expect changes in product pricing and adjustments in commission structures.

- Surge in demand: As affordability rises, advisors may see more first-time buyers entering the market.

- Repositioning of products: Expect insurers to repackage plans with new features to balance margins while keeping premiums attractive.

Practical Advice for Consumers

Here’s what you can do to prepare:

- Don’t Drop Current Coverage: The worst move is to cancel policies while waiting for reforms. Stay covered.

- Time Renewals: If your renewal is due around October or November, consider waiting a bit to see if the change passes.

- Compare Plans: Not all insurers will pass on benefits equally. Use comparison sites and ask your agent tough questions.

- Budget for Adjustments: Even if you save, keep in mind insurers may reprice products in 2026.