12% & 28% GST Slabs Axe Approved: The Indian economy just got a massive shake-up. 12% & 28% GST slabs axe approved—yep, you heard that right. The Group of Ministers (GoM) has given the green light to scrap two of the most confusing tax rates in the country. If you’re wondering, “Okay, cool… but what does that mean for me as a consumer or a business owner?”—this article breaks it all down in plain English. This move could be a game-changer. It aims to simplify India’s complicated Goods and Services Tax (GST) system, cut red tape, and hopefully put more money back into the pockets of both families and businesses. But there’s a lot to unpack here—so let’s dive in.

12% & 28% GST Slabs Axe Approved

So, will consumers and businesses finally benefit from the 12% & 28% GST slabs axe approved move? The answer is a resounding yes. Families can look forward to cheaper essentials and durable goods, businesses will gain from simpler compliance and better margins, and the economy could see a surge in consumption-driven growth. The only roadblock? States’ concerns over revenue loss. If the Centre steps in with a fair compensation package and the rollout is smooth, this reform could finally make GST live up to its promise—simple, transparent, and pro-growth.

| Key Point | Details | Source |

|---|---|---|

| GST Reform | 12% and 28% slabs scrapped | GST Council Official Site |

| New Slabs | 5% and 18% (40% “sin tax” for luxury items remains) | Reuters |

| Impact on Consumers | Everyday goods (food, toiletries, appliances, cars) expected to get cheaper | India Today |

| Impact on Businesses | Simplified compliance, lower tax disputes, potential sales boost | Moneycontrol |

| States’ Concerns | Fear of losing revenue; demand for central compensation | Hindustan Times |

| Implementation | Pending GST Council approval (likely before Diwali 2025) | Economic Times |

A Quick Refresher: What Is GST Anyway?

Launched in 2017, the Goods and Services Tax (GST) was India’s biggest tax reform since independence. It replaced a messy patchwork of central excise duty, service tax, VAT, and state-level taxes with a single system.

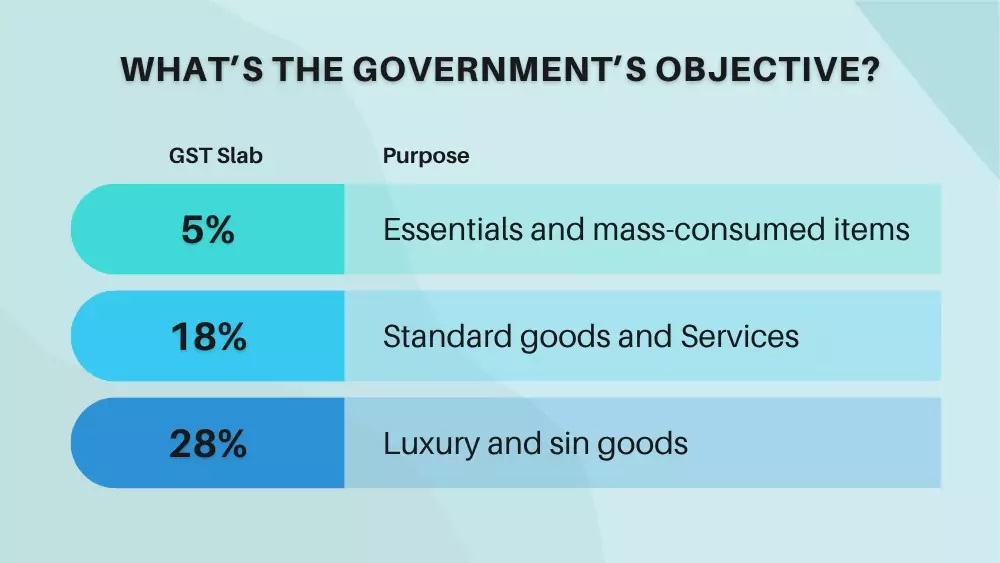

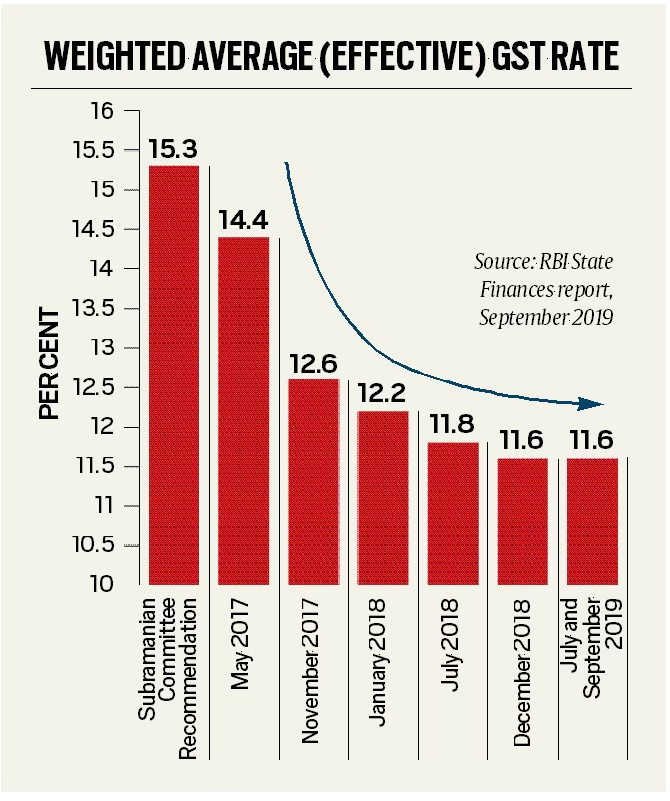

But instead of a flat rate, India adopted multiple slabs: 5%, 12%, 18%, 28%, plus an extra 40% “sin” tax for products like cigarettes and luxury cars. While the goal was inclusivity—taxing essentials lightly and luxuries heavily—it made compliance complex.

Businesses often struggled to figure out which rate applied to their products. This led to disputes, confusion, and in many cases, increased compliance costs.

Now, the government has finally decided to simplify by eliminating the 12% and 28% slabs—a move many economists have been demanding for years.

Why This Move Matters?

- For Consumers: Lower taxes translate into cheaper products and services.

- For Businesses: Simplified compliance, reduced disputes, and easier logistics.

- For the Economy: A streamlined system can increase consumption, which drives nearly 60% of India’s GDP.

Imagine going shopping without worrying whether your toothpaste falls under 12% or 18%. That’s what simplification means—less confusion, more predictability.

Global Perspective: How Does India Compare?

India’s original multi-slab GST system was unique and complex compared to global peers.

- United States: No nationwide GST. Sales taxes vary by state and range between 4%–10%.

- European Union: Uses Value-Added Tax (VAT) with one or two main slabs, typically 15%–27%.

- Singapore: A flat 8% GST across the board.

- Australia: A single 10% GST.

By moving to just two slabs (5% and 18%), India now takes a step closer to global best practices. It balances simplicity with equity—keeping essentials cheaper while taxing non-essentials moderately.

What Gets Cheaper for Consumers?

Here’s how this reform impacts households:

- Packaged Food: Snacks, biscuits, and cereals drop from 12% to 5%.

- Personal Care: Shampoos, soaps, deodorants, cosmetics—all likely to cost less.

- Household Goods: From detergents to light bulbs, everyday use items get cheaper.

- Durables & Automobiles: Cars, fridges, ACs, and washing machines shifting from 28% to 18% will mean big-ticket savings.

- Insurance: The GoM has suggested removing GST on health and life insurance premiums, which could save families thousands annually.

Example: A car priced at ₹10 lakh (around $12,000) attracted ₹2.8 lakh tax at 28%. Under the new 18% rate, it would be ₹1.8 lakh, saving buyers ₹1 lakh (over $1,200).

Sector-by-Sector Impact of 12% & 28% GST Slabs Axe Approved

FMCG (Fast-Moving Consumer Goods)

With items like packaged foods, soaps, and household goods taxed lower, FMCG companies are set for a demand boost. Experts predict higher sales volumes in rural and urban markets alike.

Automobiles & Electronics

From hatchbacks to SUVs, fridges to laptops—prices could fall. The automobile sector, which has struggled with high costs, might finally see a revival.

Real Estate & Construction

Cement (28% to 18%) and construction inputs getting cheaper could reduce housing costs. Developers will likely pass on benefits, making homes more affordable.

Insurance & Finance

Exempting premiums from GST is a major win for households. It also helps insurers attract more buyers in a price-sensitive market.

Startups & SMEs

Simplified compliance reduces legal disputes and lowers administrative overheads—letting entrepreneurs focus on growth rather than paperwork.

Businesses: What Should You Do Now?

- Rework Pricing Models – Reflect the lower GST in your pricing strategy. Passing benefits to customers can build loyalty.

- Upgrade Billing Systems – ERP and accounting software must be updated to match new tax rates.

- Plan Marketing Campaigns – Festive season promotions highlighting “Now Cheaper Under New GST” can drive sales.

- Stay Transparent – Ensure savings are visible on invoices to prevent customer skepticism.

States’ Concerns – The Elephant in the Room

While consumers and businesses cheer, state governments are worried. GST is a shared revenue model between the Centre and states. Lower slabs mean states could lose significant revenue.

For instance, Punjab has already demanded ₹60,000 crore in pending dues and compensation. Other states are seeking assurances to cover shortfalls in welfare and infrastructure funding.

If compensation isn’t provided, states could struggle to maintain essential public services. This tug-of-war between Centre and states will be critical in shaping the final rollout.

Expert Opinions

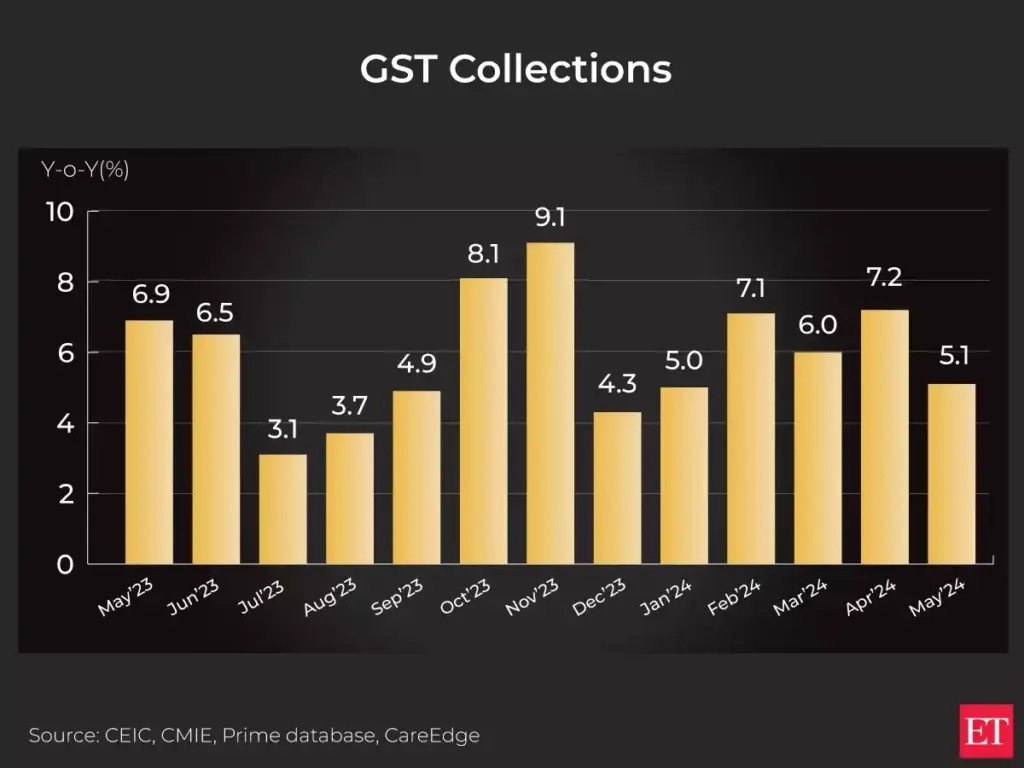

- Economists: Lower tax rates encourage compliance and expand the tax base. Long-term, this could even increase government revenues.

- Industry Leaders: FMCG and automobile sectors expect strong festive demand once rates kick in.

- State Officials: Some warn of “fiscal instability” unless compensation is locked in.

Challenges and Risks

- Implementation Delays: Rolling this out before Diwali 2025 requires fast policy action.

- Retailer Manipulation: Some sellers may pocket savings instead of reducing prices.

- Short-Term Revenue Dip: The Centre and states will need to bridge the gap until compliance improves.

- Awareness Issues: Both consumers and small retailers need education to understand the new rates.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

Supreme Court Halts ₹273.5 Crore GST Demand Against Patanjali

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

Future Outlook – What’s Next for GST?

If implemented smoothly, this reform could:

- Boost consumption growth by 2–3% annually.

- Encourage foreign investors by signaling tax stability.

- Create space for interest rate cuts as inflationary pressure eases.

- Lay the foundation for India to eventually move toward a single GST slab, like Australia and Singapore.

In short, this reform is not just about reducing prices—it’s about reshaping India’s entire tax system for efficiency and growth.