Big Tax Bill Update: If you’ve been following the news, you’ve probably heard about the Big Tax Bill Update—officially called the One Big, Beautiful Bill Act (OBBBA), signed into law on July 4, 2025. One of the biggest headlines in this law is the shake-up of the Child Tax Credit (CTC). For families across the U.S., this isn’t just some boring tax talk—it’s real money back in your pocket. And when bills are stacking up higher than a pile of pancakes at IHOP, that matters. But here’s the thing: tax laws are like those tricky instruction manuals you get when you buy a new grill—confusing, full of jargon, and easy to mess up. So let’s break this down in plain English, with practical examples, so you can understand exactly how the Child Tax Credit changes will affect your family.

Big Tax Bill Update

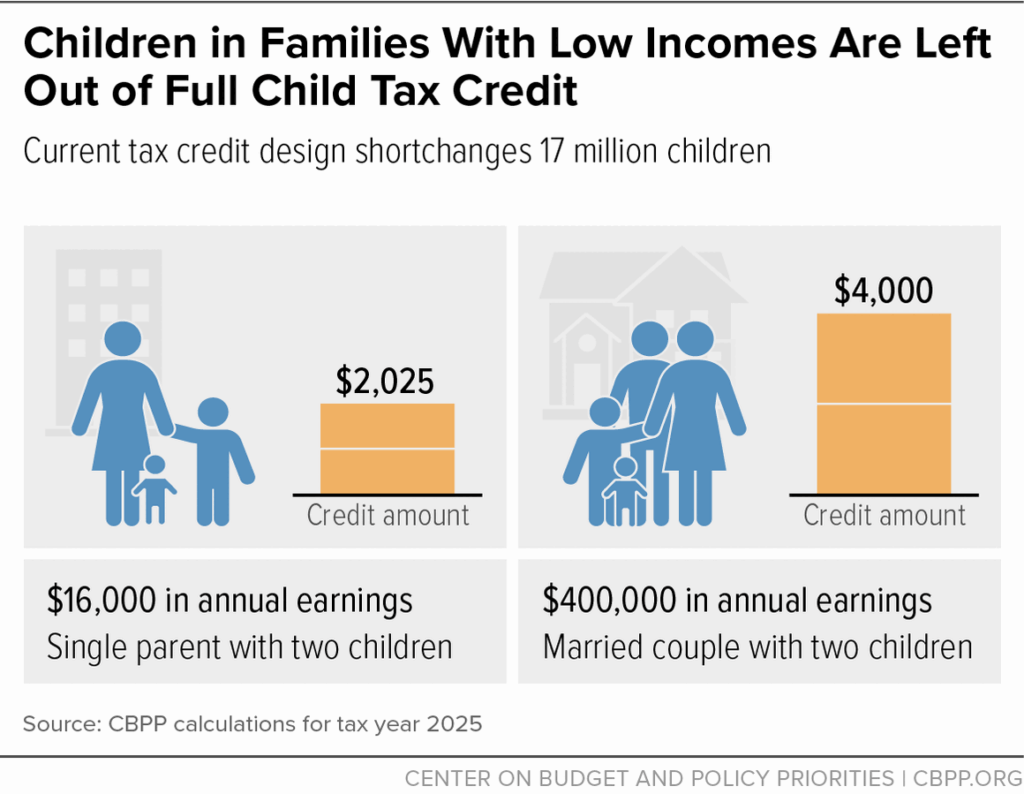

The Big Tax Bill Update has reshaped the Child Tax Credit in ways that will touch nearly every American family. With the credit rising to $2,200 per child, inflation adjustments starting in 2026, and refunds up to $1,700 for lower-income families, this is welcome relief for millions. But stricter SSN rules mean some households—particularly mixed-status families—will lose out. Whether you’re a parent planning your budget, a tax professional advising clients, or simply curious about family policy, knowing the details of the new CTC can help you prepare for tax season and beyond.

| Feature | Update (2025 onward) | Details & Resources |

|---|---|---|

| Credit Amount | $2,200 per child | Increased from $2,000. Inflation-adjusted starting 2026. IRS.gov |

| Refundable Portion | Up to $1,700 per child | Families with low tax liability can still get cash back. |

| Income Phase-Out | $200K (single), $400K (joint) | Thresholds fixed, not inflation-adjusted. |

| SSN Requirement | Child + at least one parent | Parents without SSNs no longer eligible. |

| Signed Into Law | July 4, 2025 | One Big, Beautiful Bill Act (OBBBA). |

A Quick History of the Child Tax Credit

The Child Tax Credit was introduced in 1997 under President Bill Clinton as a $400-per-child benefit. Over the years, Congress has raised and reshaped it:

- 2001 (Bush tax cuts): Increased to $1,000 per child.

- 2017 (Trump’s Tax Cuts and Jobs Act): Boosted to $2,000 per child, widened eligibility.

- 2021 (Biden’s American Rescue Plan): Temporarily expanded to $3,000–$3,600 per child with monthly advance payments. This cut child poverty nearly in half according to the U.S. Census Bureau.

- 2022 onward: Expansion expired, dropping back to $2,000 per child.

Now in 2025, the OBBBA bumps the credit up again—to $2,200—with inflation adjustments starting in 2026.

What Exactly Changed in the Big Tax Bill Update?

1. Bigger Credit Amount

The new law increases the CTC to $2,200 per child.

- Example: A family with three kids will now get $6,600 instead of $6,000—that’s an extra $600 every year.

- Starting in 2026, the credit amount will rise automatically with inflation.

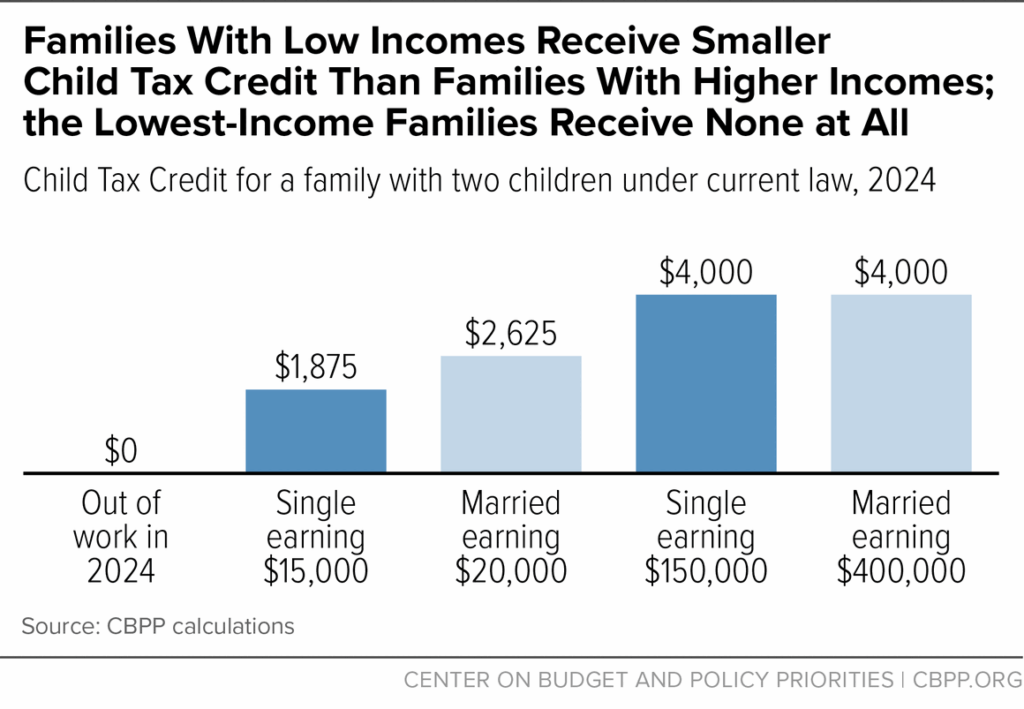

2. Refundable Portion (Cash Back for Families)

For lower-income families, this is huge.

- Maximum refundable amount: $1,700 per child.

- Even if you owe no taxes, you can still get money back.

Think of it as the government saying, “We know raising kids is expensive—here’s a little help.”

3. Income Phase-Outs Stay the Same

- Single parents: $200,000.

- Married couples filing jointly: $400,000.

These thresholds aren’t tied to inflation. So while middle-income families are safe for now, more households could eventually get phased out as incomes rise.

4. Stricter SSN Rules

To qualify:

- The child must have a Social Security Number (SSN).

- At least one parent or spouse must also have an SSN.

This means many mixed-status families—where the kids are U.S. citizens but the parents don’t have SSNs—are excluded. Researchers estimate this could affect millions of children.

Real-Life Scenarios: How Families Will See the Change

Scenario 1: Single Mom with Two Kids

- Income: $35,000.

- Old law: $4,000 credit ($2,000 per child). Refundable part limited.

- New law: $4,400 credit. Refundable portion = $3,400.

- Result: $900 more cash back at tax time.

Scenario 2: Married Couple with Three Kids

- Income: $120,000.

- Old law: $6,000 credit.

- New law: $6,600 credit.

- Result: Extra $600 saved.

Scenario 3: Mixed-Status Family

- Two U.S.-citizen kids, but parents don’t have SSNs.

- Old law: Eligible for $4,000.

- New law: Zero—because parents can’t meet the SSN requirement.

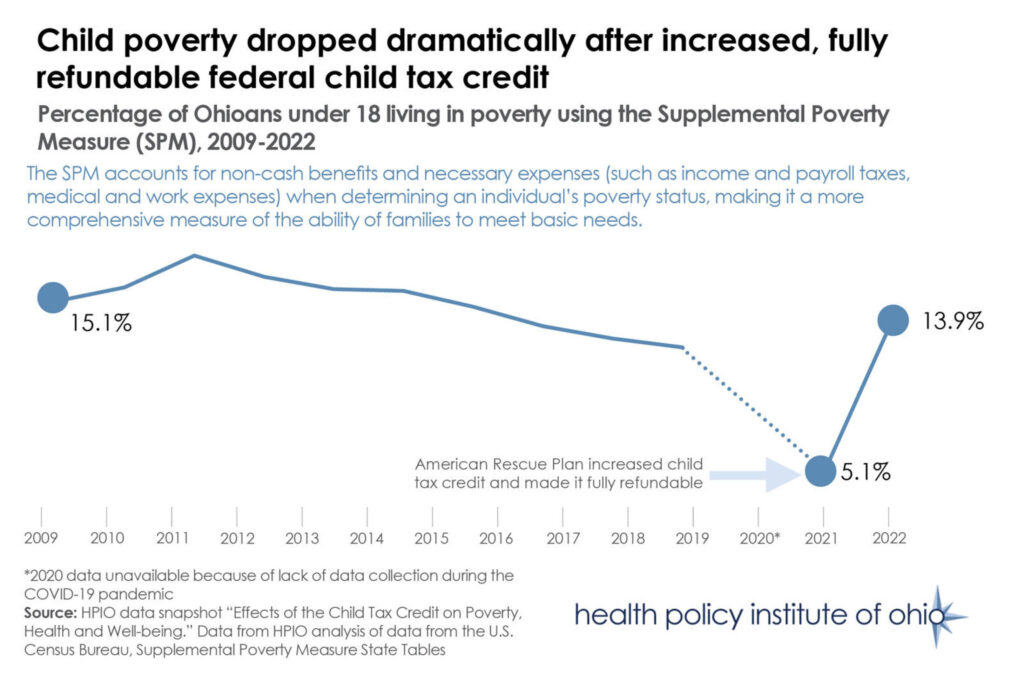

The Impact on Child Poverty

The Child Tax Credit has a proven track record in fighting child poverty. According to the Census Bureau:

- In 2021, expanded CTC payments helped cut child poverty to 5.2%, the lowest on record.

- After the expansion expired in 2022, poverty rates jumped back to 12.4%.

The new bump to $2,200 will help, but experts say it won’t replicate the dramatic reductions seen in 2021—especially since mixed-status families are excluded.

Comparing the CTC with Other Family Tax Benefits

The CTC is just one piece of the tax puzzle. Families may also qualify for:

- Earned Income Tax Credit (EITC): Refundable, aimed at low- to moderate-income workers. Can be worth thousands.

- Child & Dependent Care Credit: Helps cover daycare, babysitting, and after-school care—up to 35% of qualifying expenses.

- State Child Tax Credits: States like California, Colorado, and New York offer their own credits. Check your state’s Department of Revenue for eligibility.

Knowing how these credits work together can maximize your refund.

Step-by-Step Guide: How to Claim the Child Tax Credit

- File Form 1040 (your main tax return).

- Attach Schedule 8812 (Credits for Qualifying Children and Other Dependents).

- Enter SSNs for each child and at least one parent.

- Calculate your credit using IRS worksheets or tax software.

- Submit your return early to speed up your refund.

Pro tip: Use the IRS’s free Child Tax Credit calculator (updated before filing season) at IRS.gov.

Practical Tips for Families

- Double-check your SSNs: Don’t wait until April to find out you’re missing a card.

- Plan your income: If you’re close to $200K or $400K, consider how bonuses or investment income affect eligibility.

- File early: The IRS gets backed up fast—early birds get faster refunds.

- Bundle credits: Don’t forget EITC or Dependent Care Credits—they can add thousands more to your refund.

Insights for Professionals and Employers

If you’re an HR professional, financial advisor, or tax preparer, these updates matter for your clients and employees:

- Employees may adjust withholdings once they know how much extra they’ll get.

- Tax pros can strengthen relationships by guiding families through overlapping credits.

- Employers should consider financial wellness sessions to help workers plan for their refunds.

New Income Tax Bill Tackles Filing Delays and Gives Your Refund Back

Income Tax Bill 2025 Brings No Rate Hike – But Here’s The Catch

Politics and the Future of the CTC

The Child Tax Credit has always been political. Republicans typically push for higher credits tied to work requirements, while Democrats favor refundable credits that help low-income families. The OBBBA tries to balance both: more money, but tougher SSN rules.

Looking ahead, inflation indexing ensures the credit grows. But in 2026 or 2027, new Congresses could expand—or cut—it again. With child poverty and family finances remaining front-page issues, expect the CTC to keep sparking debate.