Massive ₹47 Crore GST Credit Fraud Scheme: The headline has shocked the business world: Thane man arrested in massive ₹47 crore GST credit fraud scheme. While white-collar crimes often sound complicated, this case shows just how creative fraudsters can get when trying to cheat the system—and how damaging it can be for the economy, taxpayers, and honest businesses. On August 19, 2025, Vivek Rajesh Maurya, a businessman from Thane, was arrested for allegedly orchestrating a fraudulent scheme worth ₹47.32 crore (about $5.6 million USD). His company, KSM Enterprises, was accused of creating fake invoices to illegally claim tax credits. Authorities say not a single product was ever moved, yet the company filed massive paperwork to pocket taxpayer money.

Massive ₹47 Crore GST Credit Fraud Scheme

The Thane man arrested in the ₹47 crore GST credit fraud scheme is more than just a headline—it’s a reminder of how systemic fraud can ripple through society. Every rupee lost is a road not built, a hospital not funded, or a teacher unpaid. For professionals, the takeaway is simple: honesty in compliance isn’t just legal—it’s survival. Whether you’re in India, the U.S., or anywhere else, tax fraud might look clever at first, but it always catches up.

| Aspect | Details |

|---|---|

| Accused | Vivek Rajesh Maurya |

| Entity Used | KSM Enterprises |

| Fraud Amount | ₹47.32 crore ($5.6 million approx.) |

| Method | Fake GST Input Tax Credit (ITC) claims |

| Evidence Seized | Bank passbooks, cheque books, mobile phones, fake firm documents |

| Legal Status | Judicial custody for 14 days |

| Official Resource | Central Board of Indirect Taxes and Customs (CBIC) |

| Investigation Status | Ongoing – more people may be named |

Understanding GST and ITC Fraud

GST Explained Simply

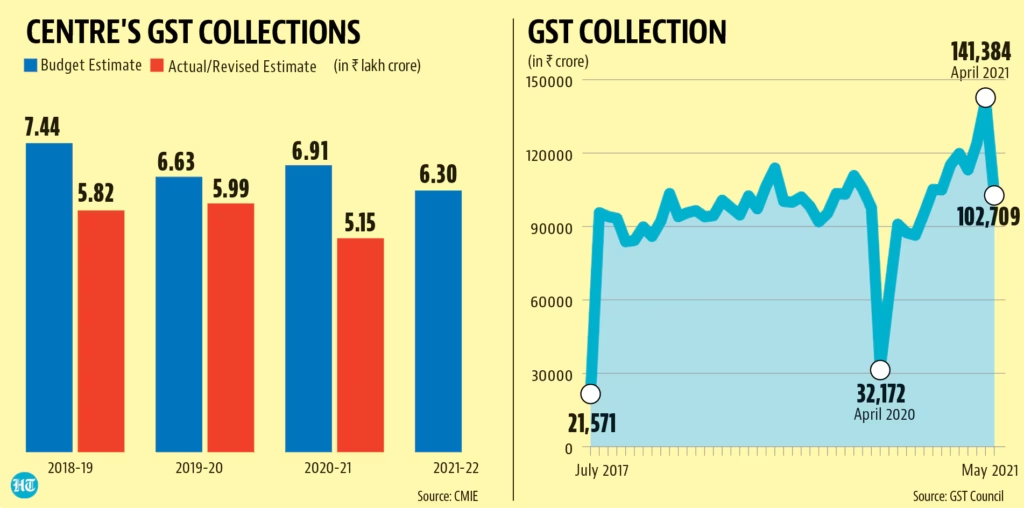

GST, or Goods and Services Tax, is India’s version of sales tax—but smarter. It was introduced to replace multiple state and central taxes with a single, unified tax system. Just like when you buy a soda in the U.S. and see sales tax added at checkout, in India that’s GST.

Input Tax Credit (ITC)

Businesses can claim credit for taxes they pay on purchases. For example, if a restaurant buys flour and pays ₹5,000 GST, they can subtract that amount from their tax bill when they sell bread or pizza.

The Trick of ITC Fraud

Fraudsters abuse this system by creating bogus invoices without any real exchange of goods. They then claim ITC refunds or sell those fake credits to other businesses looking to reduce their tax liability. Imagine filing a tax refund on a paycheck you never received—that’s the game.

How the Thane Case Was Busted

The Central GST Thane Commissionerate Anti-Evasion Wing didn’t just stumble upon the fraud. They used:

- AI-driven invoice matching systems to detect inconsistencies.

- Proprietary data analysis tools to cross-check suppliers and clients.

- Surprise raids at Maurya’s residence that uncovered financial records.

Among the seized items were:

- Bank passbooks and cheque books linked to shell firms.

- Multiple phones used for coordination.

- Documents showing patterns of fake invoice circulation.

Maurya reportedly confessed to running the scheme, admitting he received commissions and personally benefitted.

Why Massive ₹47 Crore GST Credit Fraud Scheme Case Matters?

Fraud like this isn’t victimless. The ₹47 crore lost here could have funded:

- Free school lunches for over 2 million children.

- Construction of 300+ rural health clinics.

- Salaries for 10,000+ government school teachers for a year.

Every rupee siphoned off through fraud reduces the resources available for public welfare.

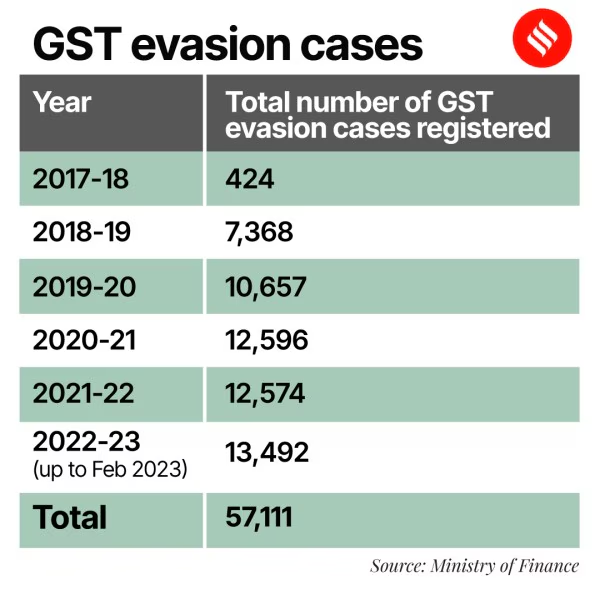

The CBIC estimates that India loses over ₹1.5 lakh crore annually to tax evasion and fraud. To put it in perspective, that’s more than the annual budget of India’s health ministry.

Why Do People Commit ITC Fraud?

Psychologists and financial crime experts suggest a few key motives:

- Greed – The temptation of quick money.

- Perceived Loopholes – Belief that “the system is too big to catch me.”

- Peer Influence – Seeing others cheat and get away with it.

- Desperation – Businesses under financial stress sometimes turn to fraud.

Fraudsters often underestimate the reach of digital audits and overestimate their ability to stay hidden.

Real-World Example: How Fraudsters Operate

Suppose a company generates a fake invoice for “1,000 smartphones” worth ₹2 crore. No phones exist, but the invoice claims ₹36 lakh in GST. The company then “claims” this ₹36 lakh as ITC.

Other companies might “buy” this fake credit at a discount—for example, paying ₹25 lakh to save ₹36 lakh in taxes. The fraudster pockets the difference, while the government loses ₹36 lakh. Repeat this across dozens of fake firms, and suddenly you have a ₹47 crore fraud.

Global Comparisons

This isn’t unique to India:

- U.S. IRS loses about $441 billion every year to tax fraud.

- European Union loses an estimated €93 billion annually due to VAT fraud.

- In the U.K., “carousel fraud” with VAT scams has been a major issue for decades.

It’s a global problem—and governments everywhere are scrambling to close loopholes.

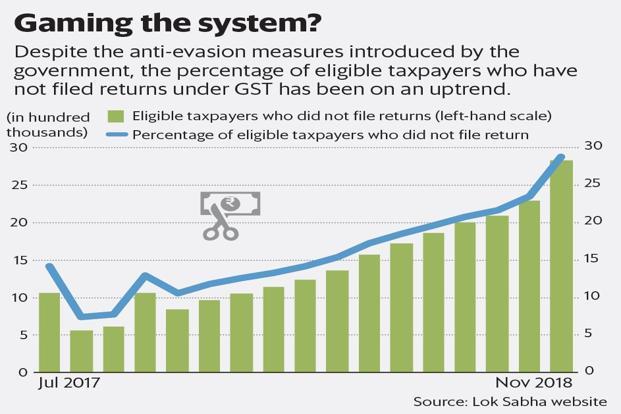

Policy Reforms in India

To tackle such fraud, the government has introduced:

- E-invoicing system – Mandatory digital invoices for larger companies.

- Real-time invoice matching – GST portal cross-checks every transaction.

- Data analytics hubs – AI used to track suspicious patterns.

- Whistleblower provisions – Citizens can report fraud through CBIC’s official channels.

These steps are helping, but fraudsters keep adapting, which is why vigilance is key.

What Happens After an Arrest? The Legal Process

When someone is caught in GST fraud above ₹5 crore:

- Arrest – Usually under Section 69 of the CGST Act.

- Custody – Judicial or police custody, depending on the case.

- Charge Sheet – Filed in a special GST court.

- Trial – Evidence, witness testimonies, and forensic audits are presented.

- Punishment – If convicted, up to 5 years in prison plus fines.

Maurya is currently in 14-day judicial custody, but if found guilty, his punishment could be severe.

How Businesses Can Protect Themselves?

1. Verify Suppliers

Always check GST numbers on the official GST portal.

2. Automate Accounting

Software like QuickBooks, Zoho Books, and Tally can flag errors.

3. Conduct Internal Audits

Quarterly checks by an external Chartered Accountant can save you later headaches.

4. Build a Compliance Culture

Train employees to recognize red flags.

5. Report Suspicious Activity

Use the CBIC helpline to report potential fraud.

Historical Context: India’s Biggest GST Frauds

- Delhi 2021 – ₹4,500 crore racket with 500+ fake companies.

- Bengaluru 2023 – ₹1,200 crore fake ITC scheme.

- Punjab 2024 – Fake fertilizer trading worth ₹300 crore.

Compared to these, ₹47 crore may look smaller, but it’s still devastating for the local economy.

Expert Opinion

“Fraud of this scale undermines trust in the tax system,” says Ramesh Menon, a tax consultant from Mumbai. “For honest businesses, it’s demoralizing. But the silver lining is that authorities are getting faster and sharper at detecting such crimes.”

Hope Travels Dragged Into Prosecution Over Major Tax Fraud Case

Two Company Directors Arrested – Separate Tax Fraud Cases Expose New Crackdown

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid