Bhopal Bank Employee Under Scanner: When you hear about financial scams, maybe you picture Wall Street hustlers, cryptocurrency rug-pulls, or a Netflix docuseries about con artists in sharp suits. But the truth? Banking frauds happen everywhere—sometimes in the most ordinary places. The latest case is making waves in central India: a Bhopal bank employee is under the scanner after a multi-crore fraud surfaced. This case involves nearly ₹4 crore ($480,000 USD) siphoned through fake accounts and identity theft. While this might sound like a faraway story, the reality is clear: fraud doesn’t stop at borders. The exact tactics being used in Bhopal today are the same ones that regularly hit American families, professionals, and even corporations.

Bhopal Bank Employee Under Scanner

The Bhopal bank employee fraud is more than a local scandal—it’s a case study in how fraud operates globally. Fraudsters thrive when banks cut corners, customers let their guard down, and regulators fail to act fast. The lesson is simple: protect your identity like treasure and demand accountability from banks. In a world where scams don’t stop at borders, vigilance is your best defense.

| Detail | Summary |

|---|---|

| Incident | Multi-crore (₹4 crore / ~$480K USD) fraud uncovered in Bhopal |

| Main Suspect | Former private bank employee, under police investigation |

| Victim Discovery | Fraud exposed when a man got an income tax notice in Oct 2024 |

| Fraud Method | Fake accounts, forged documents, SIM cards under false names |

| Timeline | Fraudulent account opened in Feb 2021, active until 2024 |

| Investigating Authority | MP Nagar Police, Commissioner Harinarayanchari Mishra |

| Bank’s Role | Accused of 6+ month delay in addressing the victim’s complaint |

| Official Source | Times of India |

The Fraud Breakdown: What Happened in Bhopal?

The scam came to light when a Bhopal resident received an income tax notice for a bank account he didn’t even know existed. Imagine the IRS sending you a bill for a business you never owned—that’s the level of shock this victim experienced.

Investigators soon discovered that his ID documents—once given to an insurance agent—were misused to open a bank account back in 2021. This account wasn’t meant for deposits or car loans. Instead, it was a “mule account,” a fake account used to launder scam money through the system.

The prime suspect? A former bank employee. Police are also scrutinizing the branch manager of that period to determine whether negligence or outright complicity was involved. For over three years, the account operated quietly, supported by forged documents and even a SIM card activated under fake details.

At least three people are currently under investigation. Authorities are demanding answers from the bank, especially since the victim claims the bank dragged its feet for over six months before responding.

Historical Context: Banking Frauds Are Nothing New

This isn’t the first time banking systems have been exploited. Fraudsters have been at it for centuries:

- In the U.S., Charles Ponzi’s scheme (1920s) promised investors 50% returns in 45 days and ended in disaster.

- Bernie Madoff’s Ponzi scheme ($65 billion) remains the largest financial fraud in U.S. history.

- In India, the PNB Scam (2018) involving businessman Nirav Modi amounted to over $2 billion.

The Bhopal fraud, while smaller in scale, underscores how fraudsters still rely on one thing: weak verification systems.

Why Bhopal Bank Employee Under Scanner Matters Everywhere?

While the Bhopal case is unfolding in India, the tactics mirror fraud in the U.S. and beyond:

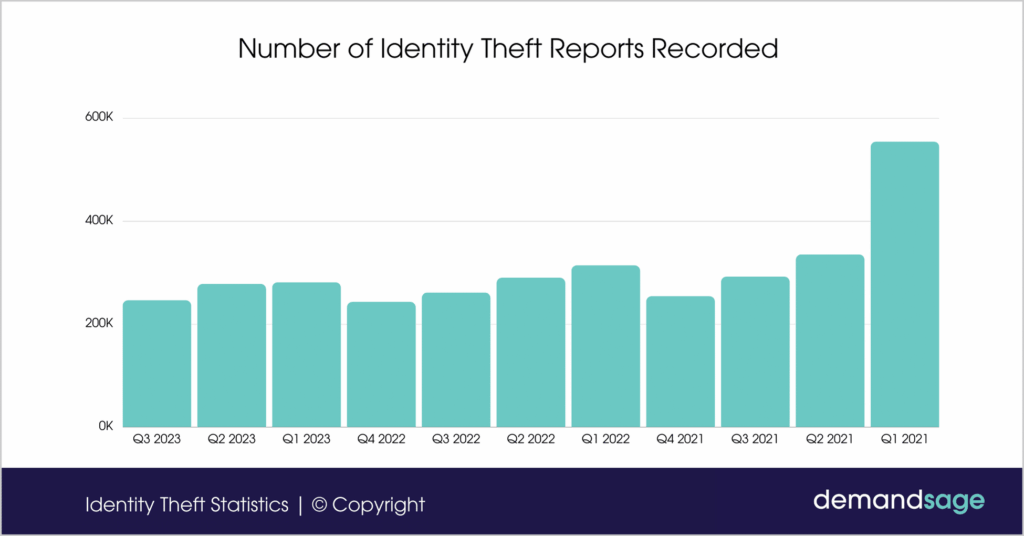

- Identity Theft: The FTC reported over 1.1 million identity theft cases in 2023.

- Mule Accounts: The FBI highlights mule accounts as central to international fraud.

- Bank Negligence: In 2022, Wells Fargo was fined $3.7 billion for mishandling accounts.

Whether it’s Bhopal or Boston, the formula is the same: stolen IDs, fake accounts, and oversight failures.

Expert Insights

Dr. Ramesh Singh, Financial Crime Analyst, noted:

“The weakest point in bank fraud is almost always the KYC process. Fraudsters don’t need to hack—they just need banks to be lazy.”

Donna Gregory, former FBI Cyber Crime Unit head, said:

“Money mule networks are the backbone of global fraud. Without them, scams simply can’t cash out.”

Both voices highlight the same truth: this fraud wasn’t a genius operation—it was enabled by systemic sloppiness.

How These Frauds Typically Work?

Step 1: Identity Theft

Fraudsters collect IDs via phishing emails, shady middlemen, or data leaks.

Step 2: Account Opening

Banks approve fake accounts when verification steps are skipped or poorly done.

Step 3: Money Laundering

Dirty money from scams is cycled through multiple accounts to cover its trail.

Step 4: Staying Invisible

Fraudsters use fake SIM cards and forged documents to keep the scam running.

The Human Impact of Banking Fraud

Fraud isn’t just about numbers on a balance sheet. For victims, the impact often runs much deeper—and the Bhopal case is a sharp reminder of that.

Emotional Stress

Imagine waking up to a tax notice or a bank alert saying you owe money on an account you never opened. Victims often describe feeling shocked, embarrassed, and helpless. In fact, the Identity Theft Resource Center (ITRC) in the U.S. reports that nearly 77% of fraud victims experience emotional distress, including anxiety and sleep loss.

Financial Consequences

While some banks eventually reimburse stolen funds, the process can take months or even years. Meanwhile, victims may face frozen accounts, denied loans, or damaged credit scores. In the Bhopal case, the victim was dragged into an income tax investigation simply because his stolen documents were misused.

Social Repercussions

Fraud also affects trust. Victims often feel isolated or ashamed to share their experience, fearing people will think they were careless. In cultures where financial reputation matters, this stigma can be long-lasting.

Steps Toward Recovery

Victims can take concrete actions:

- Report immediately to police and cybercrime authorities.

- Freeze accounts and credit to stop further damage.

- Seek legal advice to challenge wrongful tax or loan claims.

- Connect with support organizations like the Identity Theft Resource Center in the U.S. or local cybercrime helplines in India.

The key lesson? Fraud isn’t just about stolen money—it’s about stolen peace of mind. And that’s why prevention and rapid response are so critical.

Global Fraud Statistics

- India: Over 95,000 cyber fraud cases recorded in 2023 (National Crime Records Bureau).

- USA: Consumers lost nearly $10 billion in 2023 to scams (FTC).

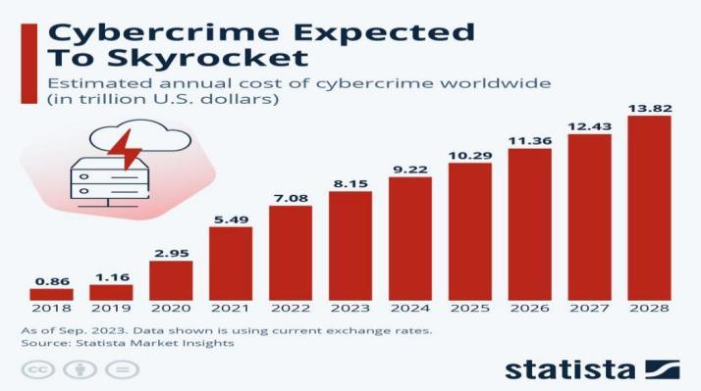

- Worldwide: Cybercrime is expected to cost the global economy $10.5 trillion annually by 2025.

How to Protect Yourself

1. Guard Your Documents

Never hand out IDs casually. If you must, verify the channel and keep receipts.

2. Monitor Your Credit Reports

In the U.S., use AnnualCreditReport.com. In India, check with CIBIL.

3. Watch for Red Flags

Look out for unexpected bank statements, strange tax notices, or new accounts you never opened.

4. Demand Accountability

If your bank drags its feet, escalate complaints. In the U.S., go to the FDIC or CFPB. In India, escalate to the RBI Ombudsman.

5. Report Fraud Fast

In the U.S., report via IdentityTheft.gov.

In India, use the National Cyber Crime Portal.

Legal & Regulatory Framework

In India:

The Reserve Bank of India (RBI) mandates strict KYC rules. If banks fail, victims can seek help through the Banking Ombudsman Scheme.

In the U.S.:

The Federal Deposit Insurance Corporation (FDIC) and the Consumer Financial Protection Bureau (CFPB) regulate banking protections. Victims can also escalate through the FTC for fraud-related issues.

India vs. USA: Comparing Fraud Trends

- India: Most frauds tied to digital payments, fake accounts, and phishing.

- USA: More scams tied to credit cards, loans, and investment frauds.

- Common Ground: Both countries report delays in banks responding to fraud complaints, which worsens losses.

Hope Travels Dragged Into Prosecution Over Major Tax Fraud Case

Patna Man Arrested in ₹1 Crore Cyber Fraud Case in Lucknow

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases