New GST Slash May Slash Car Prices: If you’ve been waiting for the right time to snag your dream set of wheels, the latest GST slash on cars might just be the game-changer you were hoping for. India’s government is rolling out a major tax overhaul, and this could mean big savings for buyers across the board—from first-time car owners eyeing a compact hatchback to families upgrading to an SUV. The move simplifies India’s complex tax system, but let’s be real: what most of us care about is how much cheaper cars will get and what this means for your pocket. So, buckle up—because whether you’re a gearhead or just someone who wants an easier commute, these changes might finally make your dream ride affordable.

New GST Slash May Slash Car Prices

The GST slash on cars is shaping up to be a huge win for buyers. From small hatchbacks to SUVs, vehicles across the board will see meaningful price drops—sometimes over ₹1 lakh. Lower EMIs make it sweeter. But while buyers rejoice, states worry about revenue, and EV makers face new hurdles. Bottom line? If you’ve been holding back on buying, this festive season might be the best time in years to finally make that purchase.

| Category | Details | Stats / Data |

|---|---|---|

| GST on small cars | Cut from 28% → 18% | Price drops of ₹20,000–₹75,000 |

| SUVs & Sedans | 50% tax slab reduced to 40% | Savings up to ₹1.15 lakh |

| EVs | Still at 5% GST | Lose cost advantage over ICE cars |

| Buyer Impact | Lower EMIs | Savings of ₹600–₹2,000 monthly |

| State Revenue | Kerala warns of ₹5,000 crore shortfall | Concern over federal revenue loss |

Why the GST Slash Matters?

Think about the last time you walked into a dealership. The sticker price already made your eyes water, and then came the taxes, cesses, and other add-ons. For years, Indian buyers have been paying one of the highest tax rates on cars in the world. That’s partly why small cars dominate the market—because big SUVs and sedans often get taxed into luxury territory.

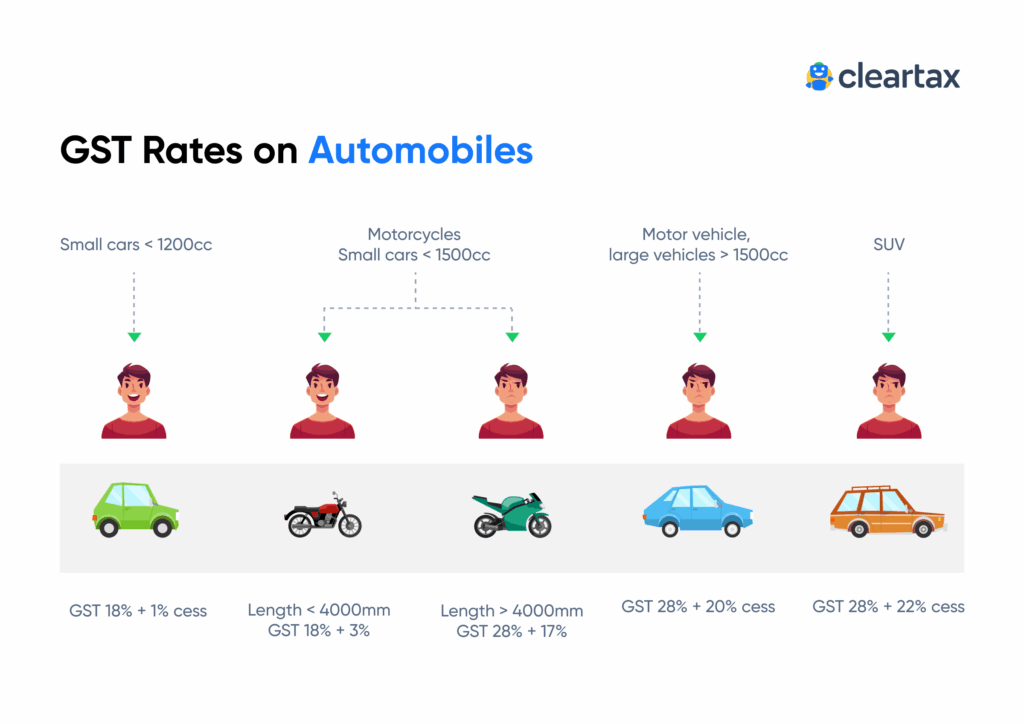

Now, the proposed GST slash cuts the clutter:

- Small hatchbacks drop from 28% → 18%

- SUVs and sedans shift to 40% instead of ~50%

- EVs still enjoy 5% GST

This makes cars more accessible for middle-class buyers, reduces the burden on EMIs, and could even spark a rebound in India’s slowing auto sector.

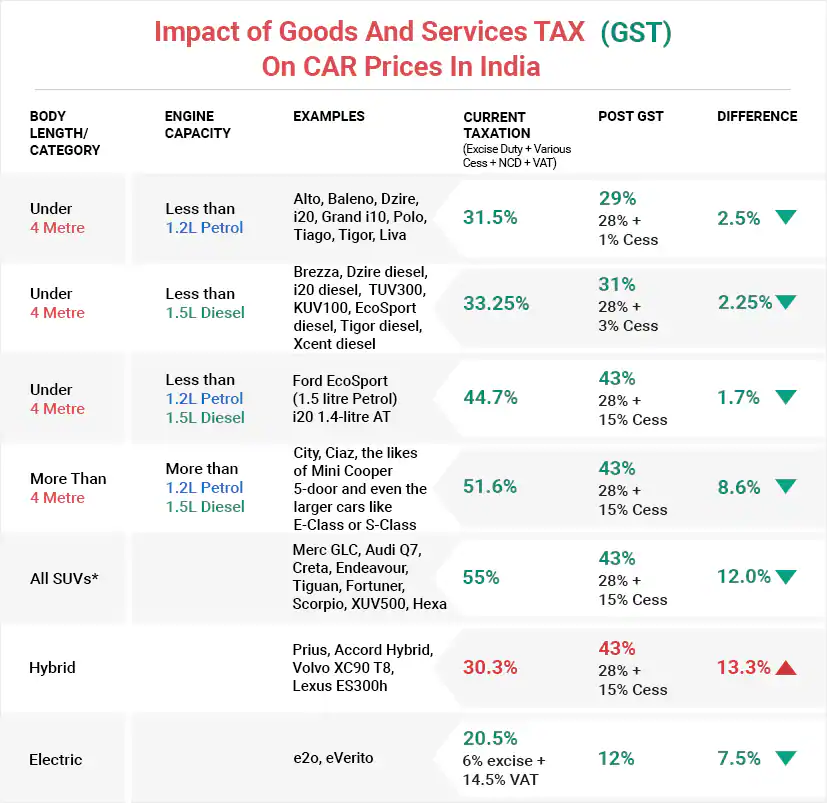

A Quick Look Back: How Car Taxes Evolved in India

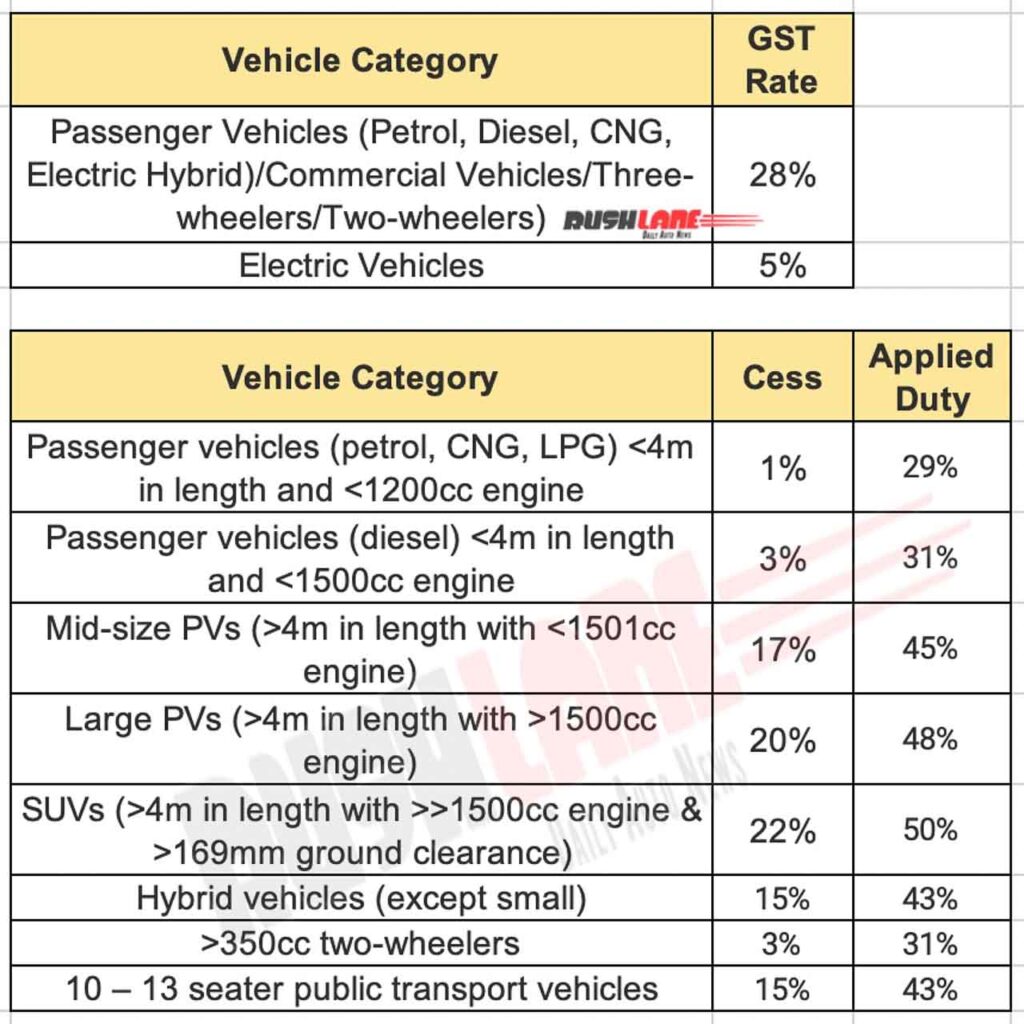

When GST (Goods & Services Tax) was rolled out in 2017, cars were slapped with a 28% tax, plus a compensation cess of up to 22%. Effectively, some cars ended up paying nearly 50% in taxes—one of the steepest in the world.

Compare that with the United States, where car sales tax is usually just 6–10% depending on the state. Or Europe, where VAT on cars averages 15–20%. Clearly, Indian buyers have been paying a premium just to own wheels.

This new GST reform narrows that gap, making cars in India much more globally competitive.

How Much You Could Actually Save?

According to NDTV Profit, here’s what the GST cut means in real-world savings:

- Maruti Wagon R – Save around ₹60,000

- Maruti Baleno – Save about ₹75,000

- Hyundai Creta – Cut costs by ₹55,000

- Mahindra XUV700 – Whopping ₹1.15 lakh off

On top of that, monthly EMIs could drop by ₹600 to ₹2,000. That’s like covering your weekend outings, subscriptions, or gas for the month.

Breaking Down the Benefits

For First-Time Buyers

Cars finally feel within reach. With an 8–12% price drop, that first car for your college grad or your family’s daily commute just got more realistic.

For Middle-Class Families

Sedans and SUVs now come closer to budget. Think of it as moving one tier up—what felt like a stretch last year might now fit neatly into your budget.

For Auto Enthusiasts

Car folks love upgrades. Lower taxes mean you can consider a higher trim, maybe even that turbocharged model, without torching your bank account.

Consumer Behavior Shift: What to Expect

Price cuts often shift how people buy. Here’s what experts predict:

- More first-time buyers entering the market.

- Shift from two-wheelers to entry-level cars for urban families.

- Growth in SUV and sedan sales as middle-class buyers upgrade.

- Pressure on the used car market, as new car affordability increases.

In short, the Indian car market could see its biggest sales boom since 2017.

Wider Impacts: Industry, Jobs, and Economy

- Auto Industry Boost – Car makers like Maruti Suzuki, Mahindra & Mahindra, Ashok Leyland, and TVS are expected to gain momentum.

- Job Creation – Higher sales mean more demand in manufacturing, dealerships, finance, and after-sales services.

- Stock Market Lift – Brokerage houses project auto stocks to rise as affordability increases.

- Supply Chain Push – Ancillary industries like steel, rubber, and electronics could also benefit.

The Flip Side: Concerns for States & EVs

Not everyone’s celebrating. States like Kerala warn about huge revenue losses (₹5,000 crore shortfall). That could lead to hikes in road taxes or registration fees later.

Then there’s the EV challenge. With ICE vehicles getting cheaper, EVs lose some cost advantage. This might slow India’s EV adoption curve unless the government provides new incentives for electric mobility.

Impact of New GST Slash May Slash Car Prices on Financing and Car Loans

One often-overlooked benefit of the GST slash on cars is how it reshapes the financing landscape. Since more than 75% of car buyers in India rely on loans to purchase vehicles, the reduction in taxes doesn’t just mean cheaper sticker prices—it translates into lighter borrowing needs.

Here’s how:

- Lower Principal Amount – With cars becoming 8–12% cheaper, the loan amount you apply for reduces automatically.

- Reduced Interest Burden – A smaller loan size means less total interest paid over the tenure, potentially saving buyers thousands more in the long run.

- Easier Loan Approvals – Lower ticket sizes make it easier for banks and NBFCs to approve applications, especially for younger buyers or first-timers.

- Improved Affordability for Premium Cars – Buyers who were previously priced out of SUVs or sedans may now qualify for loans on those segments without stretching their income-to-debt ratio.

For example, a family taking a ₹10 lakh loan at 9% interest over 5 years pays around ₹2.45 lakh in interest. If the same car gets cheaper by ₹1 lakh due to GST cuts, the family only borrows ₹9 lakh, saving nearly ₹25,000 in interest payments in addition to the upfront ₹1 lakh discount.

Expert Opinions

Economists and auto analysts are weighing in:

- Nomura Research predicts a 10–15% jump in auto sales post-GST cut.

- CRISIL Ratings suggests that while buyers will benefit, state finances could come under stress, forcing adjustments elsewhere.

- Auto consultants believe this could revive dormant segments like sedans, which have been overshadowed by SUVs in recent years.

Pro Tips for Buyers: Maximize Your Savings

- Wait till the rollout – Expected around Diwali 2025.

- Compare loan offers – Banks/NBFCs may revise car loan rates after GST changes.

- Don’t skip negotiation – Dealers may offer freebies like extended warranty or accessories.

- Check state road tax policies – Some states might adjust fees.

- Plan festive purchase – Combine GST cuts with Diwali offers for maximum savings.

Step-by-Step Guide to Estimate Your Savings

- Find your car’s current ex-showroom price.

- Apply current GST rate (28% small cars / 50% SUVs).

- Apply new GST rate (18% / 40%).

- Subtract → That’s your saving.

- Divide by loan term → That’s your EMI reduction.

Example: A ₹10 lakh SUV at 50% GST = ₹15 lakh final price. New 40% GST = ₹14 lakh. You save ₹1 lakh upfront, lowering EMI by about ₹1,500–₹2,000 per month.

Future Outlook: What’s Next?

This GST reform is just one step. Industry experts expect:

- Potential further rationalization of GST slabs in the next 3–5 years.

- Incentives for EV buyers to restore competitiveness.

- Growth in shared mobility and leasing models as cars become cheaper to operate.

- Push for “Make in India” auto exports, since lower domestic costs could improve competitiveness abroad.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

GST Overhaul Sparks Split Among Analysts – What It Means for You