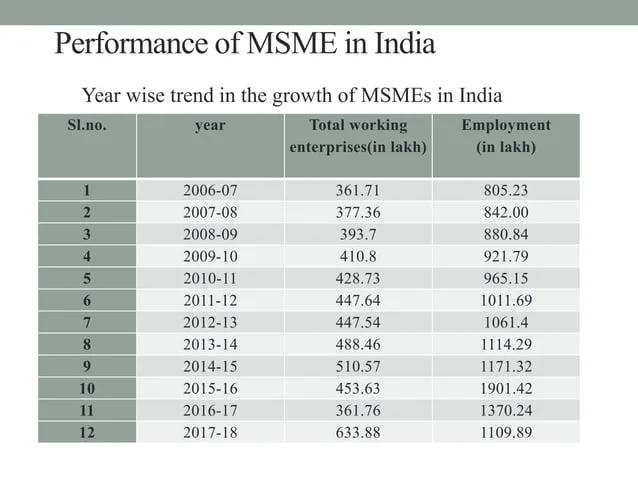

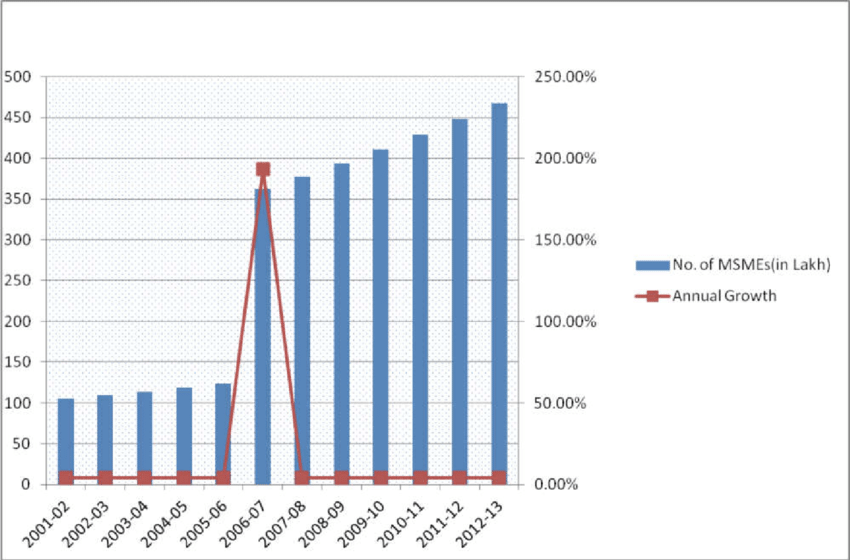

MSMEs Eye Relief as GST Revamp Promises Easier Compliance: Running a small or mid-sized business is no walk in the park. If you’re part of India’s MSME (Micro, Small, and Medium Enterprises) community, you already juggle challenges like tight budgets, delayed payments, and government compliance. When the Goods and Services Tax (GST) rolled out in 2017, it was pitched as the “One Nation, One Tax” system. While it streamlined many old taxes, it also created fresh hurdles for MSMEs—complicated rules, heavy filing schedules, and painfully slow Input Tax Credit (ITC) refunds. Fast forward to today, and change is finally on the horizon. The government is preparing a major GST overhaul—dubbed GST 2.0—that promises to simplify tax slabs, quicken refunds, and reduce compliance headaches. For the more than 63 million MSMEs in India, which contribute around 30% to GDP and employ over 110 million people, these reforms could be a game-changer.

MSMEs Eye Relief as GST Revamp Promises Easier Compliance

The GST 2.0 reform could be the breakthrough MSMEs have been waiting for since 2017. With simplified tax slabs, faster ITC refunds, and reduced compliance stress, it promises to ease operations and boost growth. While challenges like revenue loss and strict filing requirements remain, the direction is clear—making GST work for small businesses rather than against them. For India’s MSMEs, this is more than just tax reform—it’s an opportunity to breathe easier, compete stronger, and grow faster.

| Key Aspect | Impact on MSMEs | Stats / Info |

|---|---|---|

| Simplified tax slabs | Easier pricing, less confusion | Move from 4 slabs (5%, 12%, 18%, 28%) → 2 slabs (5% & 18%); 40% for luxury goods |

| Faster ITC refunds | Better liquidity | 90% of refunds within 2–3 weeks expected |

| Easier compliance | Less paperwork, fewer disputes | Tackles duty inversion & classification issues |

| Formalization of small units | More MSMEs in formal economy | Easier registration and compliance |

| Revenue impact | Fiscal cost manageable | Govt may lose ₹1.1 lakh crore (~0.3% of GDP) |

Why GST Was Introduced and Where MSMEs Struggled?

Before GST, businesses had to navigate a jungle of taxes—state VAT, excise duty, service tax, octroi, and more. GST promised simplicity, merging them into one. For big corporations, that was a win. But MSMEs found themselves facing:

- Monthly and quarterly filing requirements they weren’t prepared for.

- ITC refund delays that often stretched months, locking up working capital.

- Classification disputes—products like packaged food or small consumer goods were stuck in endless debates over slab rates.

- Audits and notices that drained time and energy from already lean operations.

That’s why GST 2.0 is so critical: it aims to fix these pain points once and for all.

What’s Changing in GST 2.0?

Simplified Tax Slabs

The four-tier GST rate system (5%, 12%, 18%, 28%) will be trimmed down to two primary slabs: 5% and 18%. A steep 40% rate will apply only to luxury and sin goods like tobacco, alcohol, and luxury cars.

This restructuring makes compliance easier and reduces classification disputes. Small businesses won’t waste hours figuring out whether a product should fall under 12% or 18%.

Example: A furniture manufacturer today may pay 12% GST on chairs and 18% on sofas. Under GST 2.0, both could fall under the same slab, eliminating confusion.

Faster ITC Refunds

One of the biggest challenges MSMEs face is delayed refunds. When businesses pay GST on raw materials, they expect refunds when selling at a lower rate or exporting. The backlog, however, often tied up working capital for months.

Under GST 2.0, 90% of refunds are expected to be processed within 2–3 weeks. This gives MSMEs the cash they need to pay salaries, reinvest in operations, or expand production.

Example: A textile exporter in Tiruppur buying fabric at 18% GST but exporting finished shirts at 5% will no longer wait months for refunds. Liquidity improves almost instantly.

Easier Compliance

The revamp also focuses on streamlining compliance:

- Fewer disputes: No more endless back-and-forth with authorities over classification.

- Duty inversion addressed: Refunds will reduce mismatches when input taxes are higher than output taxes.

- Simplified filing: Fewer returns and less paperwork for MSMEs.

Think of it like the U.S. tax system suddenly cutting forms in half—filing is easier, and small errors no longer drag you into bureaucratic quicksand.

Encouraging MSME Formalization

Millions of tiny shops, traders, and service providers avoided GST registration due to complexity. With GST 2.0:

- Easier entry and compliance.

- Access to formal benefits like loans, subsidies, and ITC claims.

- Greater participation in the digital economy.

This could bring many MSMEs into the formal economy, boosting productivity and government revenues in the long run.

Sector-Specific Impact of MSMEs Eye Relief as GST Revamp Promises Easier Compliance

Manufacturing

Manufacturers will see relief from duty inversion issues and smoother refund processing. This makes them more competitive, especially against imports.

E-commerce

Small online sellers will benefit from clear slab rates and reduced compliance burden, allowing them to scale faster.

Exporters

Faster refunds improve working capital cycles, making Indian goods more attractive in global markets.

Services

Freelancers, IT firms, and consultants will enjoy fewer disputes around GST rates for services.

Comparing GST Globally

India’s GST overhaul isn’t happening in isolation. Many countries have already simplified their indirect tax systems:

- Australia: A flat 10% GST rate makes filing easy.

- United Kingdom: Standard VAT at 20%, with reduced rates for essentials.

- Canada: Dual system (federal + provincial), but with predictable processes.

India’s two-slab approach aims to strike a balance—simple enough for compliance, but flexible enough for revenue collection.

Case Study: Small Exporter in Tiruppur

Ramesh, who runs a small textile unit, often had over ₹25 lakhs locked in refund backlogs. Salaries got delayed, vendor payments stretched, and growth stalled.

With GST 2.0’s promise of refunds within weeks, he’ll finally have the cash flow to reinvest quickly. That means more production, more jobs, and stronger exports. His story reflects what thousands of MSMEs face daily.

Expert Opinions

Industry leaders are optimistic but cautious.

- FICCI: Says reforms will “improve ease of doing business and reduce compliance stress.”

- ASSOCHAM: Calls GST 2.0 a “critical move to strengthen MSMEs.”

- UBS Report: Notes a possible annual revenue loss of ₹1.1 lakh crore (0.3% of GDP), but calls it fiscally manageable.

Practical Steps for MSMEs

With GST 2.0 expected around Diwali 2025, MSMEs should start preparing now:

- Track updates regularly on the GST Council.

- Train your team on new slabs and filing rules.

- Invest in software like ClearTax, Zoho Books, or Tally to automate filings.

- Plan cash flow by factoring in faster refunds.

- Consult professionals—just as U.S. small businesses often hire CPAs, MSMEs can benefit from GST experts.

Challenges Ahead

Even with reforms, challenges remain:

- Revenue hit: Government could lose significant revenue initially.

- Strict accuracy required: A new GSTN update disallows edits in GSTR-3B. Errors must be corrected via GSTR-1A, making precision vital.

- Implementation risks: Any delay in rollout could frustrate MSMEs that are already struggling.

Future Outlook

The big picture looks promising. By simplifying compliance, speeding refunds, and reducing disputes, GST 2.0 could finally deliver on the promise of “One Nation, One Tax.” For MSMEs, it means more freedom to focus on business rather than bureaucracy.

As reforms roll out, expect:

- Greater formalization of small enterprises.

- Stronger global competitiveness for exporters.

- Improved cash flow for small businesses.

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

Tracking GST on Foreign OIDAR Services? Supreme Court Says “Let the Council Decide”

GST Revamp Could Pull Thousands of Small Units Into Formal Economy