These 11 Daily Habits Separate the Financially Free from the Rest: If you’ve ever wondered why some people always seem financially free—never broke, always ahead of the curve—it’s not because they won the lottery or had wealthy parents footing the bill. The truth is, financially secure people share a set of daily habits that keep them grounded, disciplined, and prepared for the unexpected. The good news? These aren’t complicated. They’re straightforward routines anyone can adopt—whether you’re a college student managing loans or a mid-career professional building wealth.

These 11 Daily Habits Separate the Financially Free from the Rest

Being never broke, always ahead isn’t about luck—it’s about building smart habits that compound over time. By budgeting, avoiding debt traps, planning for emergencies, and balancing today’s pleasures with tomorrow’s needs, you create lasting financial freedom. Start with one habit today, and let consistency do the heavy lifting. Financial freedom isn’t just for the wealthy—it’s for anyone willing to practice discipline.

| Habit / Insight | Key Data & Stats | Professional Takeaway | Reference Link |

|---|---|---|---|

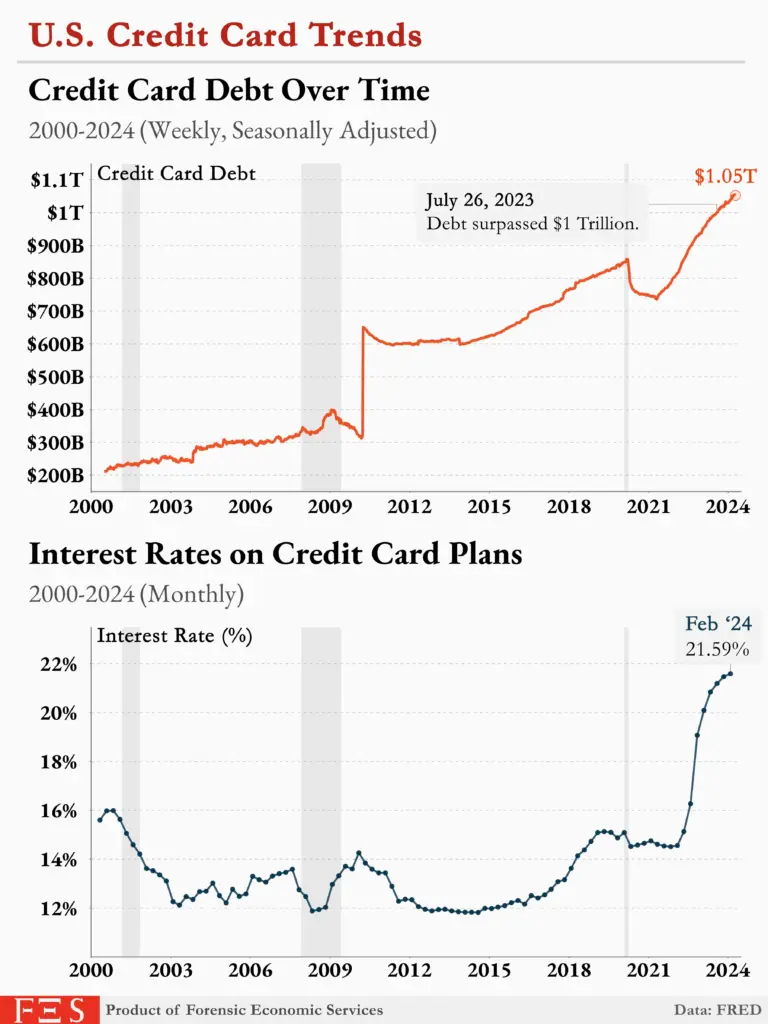

| Avoiding credit card debt | U.S. household credit card debt hit $1.13 trillion in 2024 | Pay balances in full each month to dodge 20%+ APR interest | Federal Reserve |

| Building emergency funds | 57% of Americans can’t cover a $1,000 emergency | Aim for 3–6 months of living expenses saved | Bankrate |

| Weekly “Money Night” | Saves average families $500/month | Treat it like a financial date night | News.com.au |

| Avoiding impulse shopping | 60% of online purchases are unplanned | Apply the 24-hour “cooling off” rule | Statista |

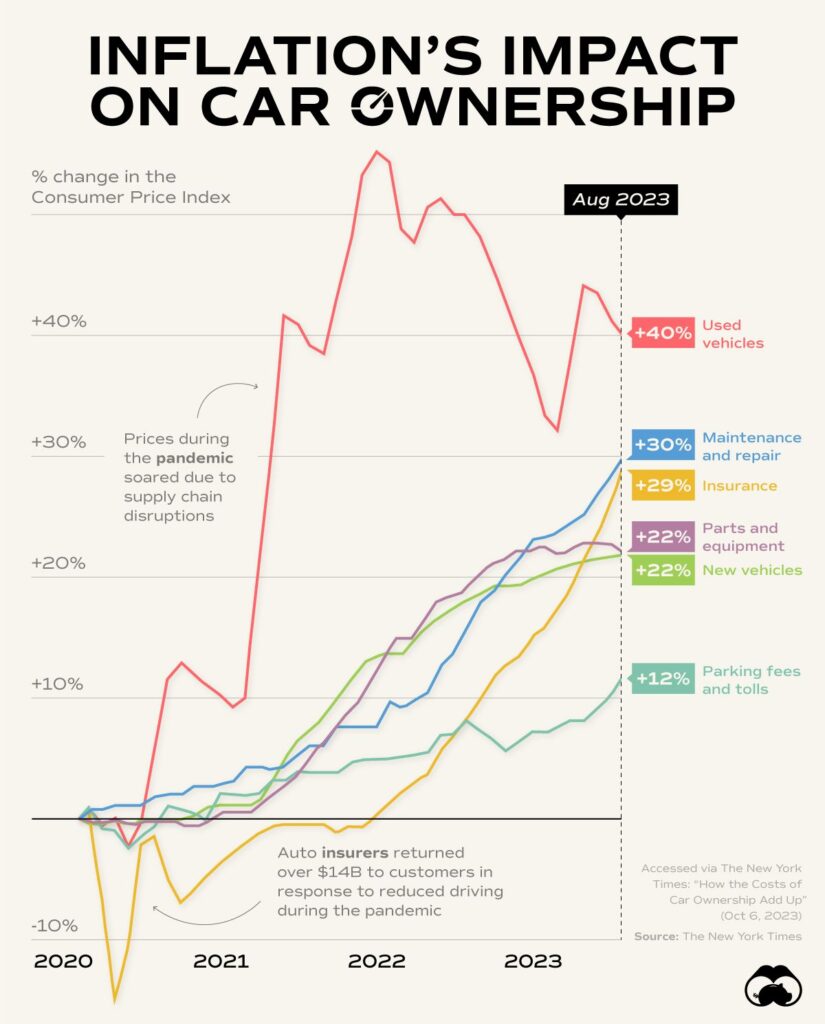

| Cost-smart commuting | Average American spends $9,000/year on car ownership | Carpool or use public transport to cut costs | AAA |

Why Habits Matter More Than Luck?

Here’s the thing: financial freedom isn’t about luck—it’s about consistent, intentional choices. Just as a healthy diet shapes your body, daily money habits shape your financial future. Think of money like a garden. If you water it with discipline—budgeting, saving, planning—it grows and provides shade when life gets hot. But if you neglect it, weeds like debt and poor spending take over fast.

The 11 Daily Habits Separate the Financially Free from the Rest

1. They Avoid Impulse Shopping

Impulse buying is the silent wallet killer. Studies show six in ten online purchases are unplanned. Smart spenders stop themselves by:

- Waiting 24 hours before checking out.

- Avoiding “1-click purchase” setups.

- Shopping with lists instead of moods.

A young nurse in California cut her monthly spending by $300 simply by deleting shopping apps from her phone.

2. They Don’t Live on Takeout

According to the USDA, the average American household spends over $3,500 annually on eating out. Financially disciplined people know small daily habits—like packing lunch—compound into thousands saved.

Meal prepping doesn’t just save money—it saves time and promotes healthier living.

3. They Pay Credit Cards in Full

Carrying a balance with an APR of 20%+ is like running on a treadmill with bricks in your backpack. Financially savvy folks use credit cards for points and cash back but always pay in full.

This habit protects credit scores and keeps interest from eating away at income.

4. They Budget Without Shame

A budget isn’t a punishment—it’s a freedom plan. Financially free people treat budgets as a way to give their money purpose.

Tools like Mint or YNAB make it easy to track where every dollar goes.

5. They Don’t Overspend on Gifts

The average American spends nearly $1,000 on holiday gifts (NRF). Financially free families plan gift budgets in advance, focusing on thoughtfulness rather than cost.

The habit reduces stress during the holidays and keeps credit card bills manageable in January.

6. They Always Pay Bills on Time

Late payments hurt twice: fees plus damage to your credit. Just one late payment can drop your credit score by up to 100 points (Experian).

People who stay ahead automate payments to avoid ever missing deadlines.

7. They Aren’t Brand-Obsessed

Why pay double for a brand name when the generic works the same? Choosing store brands over name brands can save $1,500–$2,000 per year for the average household.

Smart shoppers splurge only when quality truly matters.

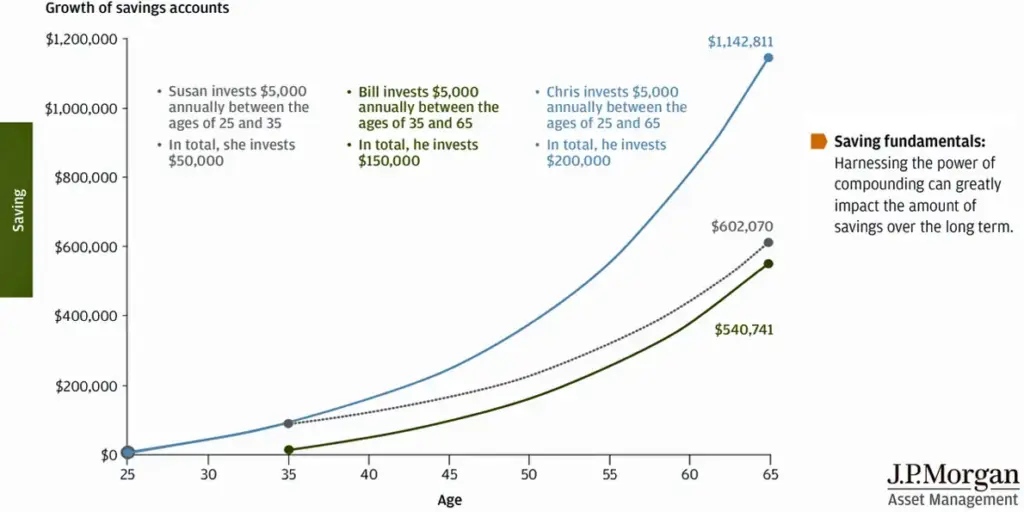

8. They Think Long-Term, Not Just Today

Financially free people balance living for today with investing for tomorrow. They use retirement vehicles like 401(k)s and Roth IRAs to harness compound interest—the “eighth wonder of the world,” as Einstein famously said.

9. They Keep Commuting Costs Low

Owning a car costs nearly $9,000 a year (AAA). Those who are financially free cut costs through:

- Carpooling

- Public transit

- Remote work negotiations

One family in Chicago saved $6,000 a year by ditching their second car.

10. They Use To-Do Lists, Not Wish Lists

Productivity links directly to financial health. To-do lists keep bills, deadlines, and responsibilities organized—preventing costly mistakes.

Financially stable people treat their calendars as money maps.

11. They Build and Guard an Emergency Fund

Bankrate reports that 57% of Americans can’t cover a $1,000 emergency. Financially free people prioritize emergency funds, aiming for 3–6 months of expenses in a separate account.

This single habit prevents small crises from becoming financial disasters.

The Bigger Picture: Generational Differences

Millennials and Gen Z face higher student debt, rising housing costs, and inflation. But studies show younger generations are also more open to side hustles, digital budgeting tools, and investing apps like Robinhood or Acorns.

Meanwhile, Baby Boomers emphasize traditional savings and pensions. The takeaway? No matter your age, adapting habits to your era is key to staying financially free.

The Mindset Behind Financial Freedom

Habits are powerful, but they don’t stick without the right mindset. People who are never broke don’t just follow routines—they adopt a way of thinking about money that guides their choices.

Delayed Gratification

The Stanford “Marshmallow Experiment” showed kids who waited for a bigger reward instead of grabbing candy right away were more successful later in life. Financially free adults apply the same principle. Instead of blowing cash on the latest phone, they save, invest, and enjoy bigger rewards later.

Scarcity vs. Abundance Thinking

Many people operate from scarcity—the belief that money is always limited. This mindset often fuels overspending (“I better enjoy it now”). Financially free folks practice abundance thinking. They see money as a tool, believe opportunities will come, and avoid fear-based decisions.

Focus on Growth, Not Just Cutting Costs

Cutting lattes won’t make you rich alone. Wealth builders focus on earning more, learning new skills, or investing. According to the U.S. Bureau of Labor Statistics, workers who continually upskill earn 15–20% more over their lifetimes compared to peers who don’t.

Treating Money Like a Business

Successful people think of their personal finances like a company:

- Income = revenue

- Bills = expenses

- Savings/investments = profit

- Debt = liabilities

Running your money like a business keeps you accountable and helps track performance.

A 30-Day Financial Reset

To start living these habits, follow this one-month reset:

- Week 1: Track spending. Record every dollar. Awareness is the first step.

- Week 2: Build a budget. Assign categories: needs, wants, savings.

- Week 3: Automate. Bills, savings, investments—set them on autopilot.

- Week 4: Save $500–$1,000. Build a starter emergency fund, even if it means selling unused items or cutting nonessentials.

ICAI Bhubaneswar Hosts Literacy Drive – Tax & Finance Lessons Reach RD Women’s University

Zero GST on Health & Life Insurance Backed by Ministers – Why Companies Are Still Worried

Expert Voices

- “Personal finance is 80% behavior and only 20% head knowledge.” – Dave Ramsey

- “Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Experts agree: wealth isn’t just about earning—it’s about behavior and discipline.