CRA Penalizes Taxpayer for Not Reporting Home Sale: When it comes to taxes, one costly mistake many Canadians make is failing to report the sale of their home. Yep, you read that right—even if the property is your principal residence and you don’t owe a dime in taxes, the Canada Revenue Agency (CRA) still requires you to report it. And if you don’t? Well, let’s just say the CRA doesn’t play games. In fact, a recent Tax Court of Canada case (2025) shows just how ugly it can get. A Toronto taxpayer got slapped with a $21,000+ penalty for failing to disclose the sale of a property—even though he assumed the gain was tax-free. That’s like forgetting to scan your Costco receipt at the exit and then getting charged for shoplifting. Brutal, right?

CRA Penalizes Taxpayer for Not Reporting Home Sale

Here’s the bottom line: never skip reporting your home sale. Even if the Principal Residence Exemption makes it tax-free, the CRA demands the paperwork. The 2025 court case proves how serious the consequences can be—$21,000 serious.

So, whether you’re a first-time seller or a seasoned real estate investor, make sure you:

- File Schedule 3 and T2091(IND).

- Amend returns quickly if you missed a sale.

- Seek professional advice if things get messy.

Stay ahead of the CRA, and you’ll sleep a whole lot better at night.

| Topic | Details |

|---|---|

| Case Example | Toronto taxpayer hit with $21,000 penalty for not reporting property sale (Tax Court of Canada, 2025). |

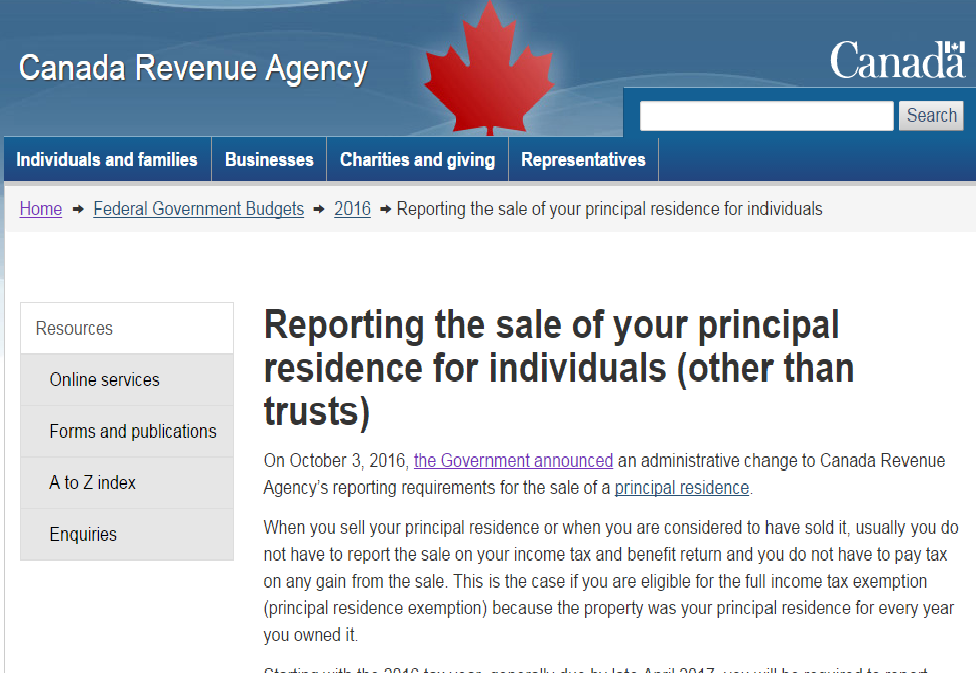

| Rule Since 2016 | All home sales must be reported on Schedule 3 and Form T2091(IND). |

| Common Mistake | Assuming the Principal Residence Exemption (PRE) means “no reporting required.” |

| Penalties | Up to $8,000 late designation penalty, or gross negligence fines (10–50% of understated tax). |

| CRA Authority | No statute of limitation for reassessments if a home sale isn’t reported. |

| Resources | CRA – Reporting Sale of Principal Residence |

Why Reporting Your Home Sale Matters?

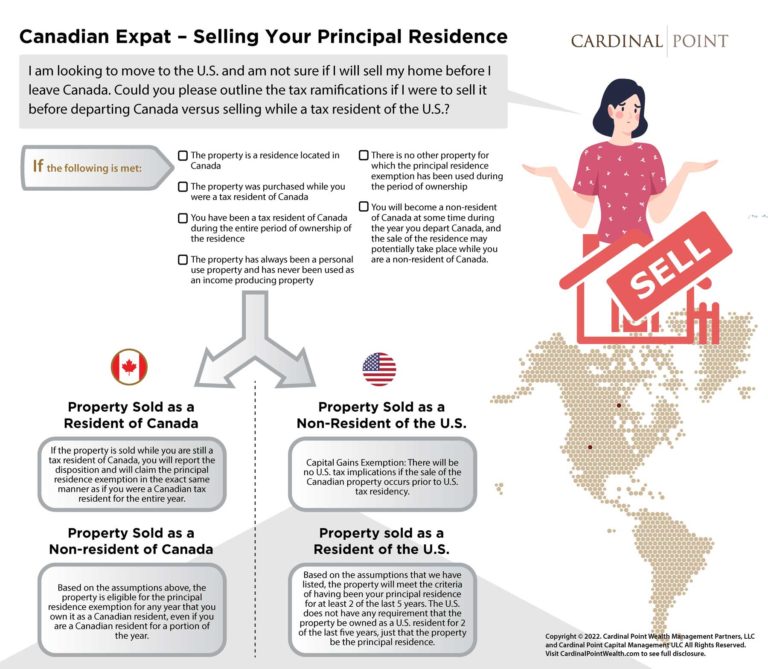

Back in the day—before 2016—people could sell their home, claim the Principal Residence Exemption (PRE), and never mention it on their tax return. The CRA basically worked on the honor system. But let’s be real—that’s like telling your kid, “Don’t eat the cookies before dinner,” and walking out of the kitchen.

The problem? Too many folks were flipping homes or stretching the rules. So, the CRA tightened the screws. Since 2016, all property sales must be reported, even if they’re fully exempt from tax.

That includes:

- Your primary home (principal residence).

- A vacation property (like a cottage) that you designate as principal residence for certain years.

- Partial sales, such as selling part of your property’s land.

Miss the reporting? You’re risking penalties, interest, and possibly years of CRA audits.

The 2025 Court Case: A Real-Life Wake-Up Call

Let’s break this down.

- The setup: A taxpayer sold several properties in 2016 but “forgot” to report one. This one had a capital gain of $159,282.

- CRA’s move: They denied his PRE claim, reassessed his return, and nailed him with a gross negligence penalty of more than $21,000.

- Why? Because he was no newbie—he had experience in real estate. The court said he should’ve known better.

- Lesson learned: The CRA doesn’t care if you “didn’t know” or if “your accountant forgot.” Responsibility lands on you.

This case sets a precedent: forgetting to report isn’t a small slip-up—it’s negligence.

Similar Cases That Show the CRA’s Tough Stance

This isn’t the first time the CRA has come down hard.

- In 2022, a taxpayer in Vancouver lost their PRE claim after failing to report the sale of a condo they didn’t actually live in. CRA classified it as a rental property, leading to a reassessed tax bill of nearly $60,000.

- In another case, a couple who flipped three homes over five years were denied PRE completely. CRA taxed their profits as business income instead of capital gains, which meant paying tax on 100% of the profit rather than 50%.

The message is clear: the CRA takes real estate sales very seriously, and even honest mistakes can cost thousands.

What the Numbers Say?

According to the Canadian Real Estate Association (CREA), more than 667,000 homes were sold across Canada in 2021. Even with rising interest rates, housing turnover remains significant—hundreds of thousands of sales occur every year.

CRA’s compliance reports highlight that real estate continues to be one of the most audited sectors. In fact, billions of dollars in previously unreported or misreported gains have been reassessed since the 2016 rule change. Many of these stem from homeowners incorrectly assuming that PRE meant they didn’t need to report.

How CRA Penalizes Taxpayer for Not Reporting Home Sale (Step-by-Step)?

Okay, so how do you avoid getting torched by the CRA? Here’s the playbook.

Step 1: Fill Out Schedule 3 (Capital Gains)

Report the sale details, including:

- Year of purchase and sale.

- Sale price.

- Property address.

Step 2: Complete Form T2091(IND)

This is where you designate the property as your principal residence for the years you owned it.

Step 3: File With Your Tax Return

Make sure these forms are included with your return the year you sold the home. No excuses.

Pro tip: Even if you think the gain is exempt, always file. It’s like insurance—better safe than slapped with a bill.

Common Scenarios Explained

Family With Two Properties

You own a cottage and a city home. You can only claim PRE for one property per family per year. Choose carefully.

Rental Suite or Airbnb

If you rent out a basement or Airbnb part of your home, the CRA may reduce your PRE. Keep receipts and document usage.

House Flipper

Sell too fast and CRA may say it’s business income—100% taxable.

Inherited Property

When you sell an inherited house, it’s a capital gain unless designated as a principal residence. Reporting is required.

What Happens If You Don’t Report?

Here’s the scary part. The CRA has teeth.

- Late Designation Penalty: Up to $8,000 (or $100 per month late).

- Gross Negligence Penalty: 10–50% of understated tax. In the 2025 case, that meant $21,000+.

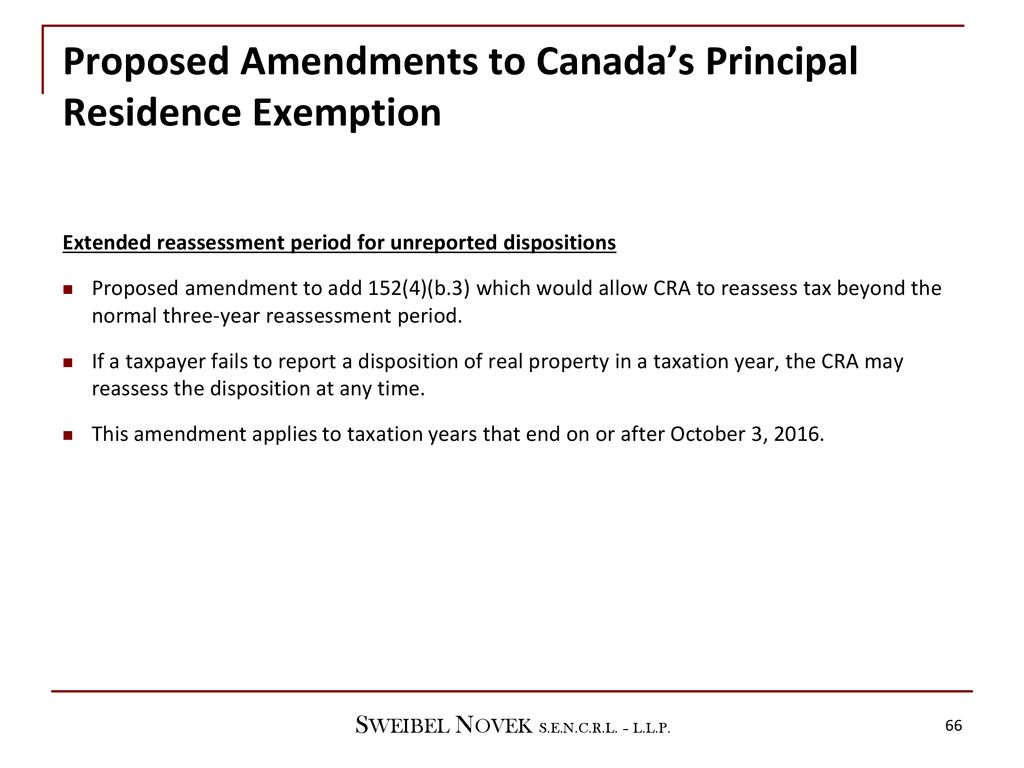

- No Time Limit: Normally, the CRA can reassess returns up to 3 years later. But if you don’t report a home sale, they can reassess at any time.

That means even if you sold a property in 2017, forgot to report it, and think you’re safe—surprise! CRA can still come knocking.

How to Fix a Mistake If You Forgot to Report?

Don’t panic—you’ve got options.

- File an Amendment

Use CRA’s T1 Adjustment Request to fix your return. Attach Schedule 3 and Form T2091. - Voluntary Disclosures Program (VDP)

If CRA hasn’t contacted you yet, you may qualify for this program. It can reduce or eliminate penalties if you come forward first. - Taxpayer Relief Provisions

Already hit with penalties? You can request relief (Form RC4288). CRA may waive penalties or interest in certain cases.

Pro Tips From Tax Professionals

- Document everything: Keep closing documents, real estate contracts, and proof of residence.

- Don’t double dip: You can’t claim multiple principal residences in the same year.

- Hire an expert: Accountants and tax lawyers often catch mistakes before CRA does.

- Stay updated: CRA rules change often; what was fine five years ago may no longer fly.

Actionable Checklist

- Report all property sales, even if exempt.

- File Schedule 3 and T2091 every time.

- Track years for PRE designation if you own more than one property.

- If renting part of your home, calculate partial exemption.

- Correct mistakes early through amendments or VDP.

$496 GST/HST Credit Confirmed for 2025—Here’s Who Qualifies and When You’ll Get Paid

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

Big Win for Taxpayers: Supreme Court Dismisses SLP Against GST Order on ECL Blocking