Family Torn Apart Over R56,000 Death Benefit After R2 Million Payout: When it comes to death benefits and family inheritance, emotions run hot and legal fights can get messy fast. That’s exactly what’s happening in South Africa right now, where a mother and her children are locked in a bitter dispute over a seemingly small R56,000 death benefit, even though the mother already pocketed close to R2 million in pension payouts. This case—Mother vs. Children: Family Torn Apart Over R56,000 Death Benefit After R2 Million Payout—shows us just how complicated financial planning, legal allocations, and family trust can get after someone passes away. And while this story is unfolding in South Africa, the lessons hit home for folks in the United States too. If you’ve ever dealt with wills, estates, pensions, or insurance policies, you know the struggle is real.

Family Torn Apart Over R56,000 Death Benefit After R2 Million Payout

The case of Mother vs. Children: Family Torn Apart Over R56,000 Death Benefit After R2 Million Payout is more than just a family drama—it’s a real-world lesson in financial planning, fairness, and communication. Whether you’re in South Africa, the U.S., or anywhere else, the principles remain the same: update your documents, talk to your family, and plan ahead. At the end of the day, money shouldn’t destroy families—it should support them.

| Point | Details |

|---|---|

| Case | Mother vs. Children over R56,000 death benefit despite R2 million payout |

| Date of Husband’s Death | December 2015 |

| Initial Allocation | Pension board split among children |

| Mother’s Share After Complaint | 97% (approx. R54,320) |

| Daughter’s Share | 3% (approx. R1,680) |

| Authority Involved | Pension Fund Adjudicator (PFA) South Africa |

| Main Issue | Whether mother—already financially stable—should still get majority of benefit |

| Source | IOL News |

Why This Story Matters?

Let’s keep it real—money fights tear families apart faster than almost anything else. According to a CNBC survey, more than 68% of Americans say finances are their number one source of stress in family relationships. When someone passes away, things only get trickier: life insurance, pensions, retirement accounts, property, and “who gets what” can quickly turn into a battlefield.

This case is a stark reminder that without proper planning, even a modest amount of money can ignite years of legal drama.

Breaking Down the Case: Family Torn Apart Over R56,000 Death Benefit After R2 Million Payout

The Timeline

- 2015 – Husband dies, leaving his wife as the nominated beneficiary of his retirement annuity.

- Initial decision – The annuity board first allocates the benefit to the children.

- Mother’s objection – She challenges the decision, claiming rights as the nominated beneficiary.

- Reallocation – After review, the board gives 97% to the mother and only 3% to the daughter.

- Daughter fights back – She takes the case to the Pension Fund Adjudicator (PFA), arguing she had real financial needs and wasn’t properly considered.

The Financial Context

The mother wasn’t broke. Reports show she already received nearly R2 million in other payouts (including from the Government Employees Pension Fund) and also runs a business with assets like a guesthouse and vehicles. Meanwhile, the daughter claimed she was financially dependent during COVID-19 and had mounting medical expenses.

This imbalance is what triggered the PFA to step in and say, “Hold up—this allocation doesn’t add up.”

Historical and Cultural Context

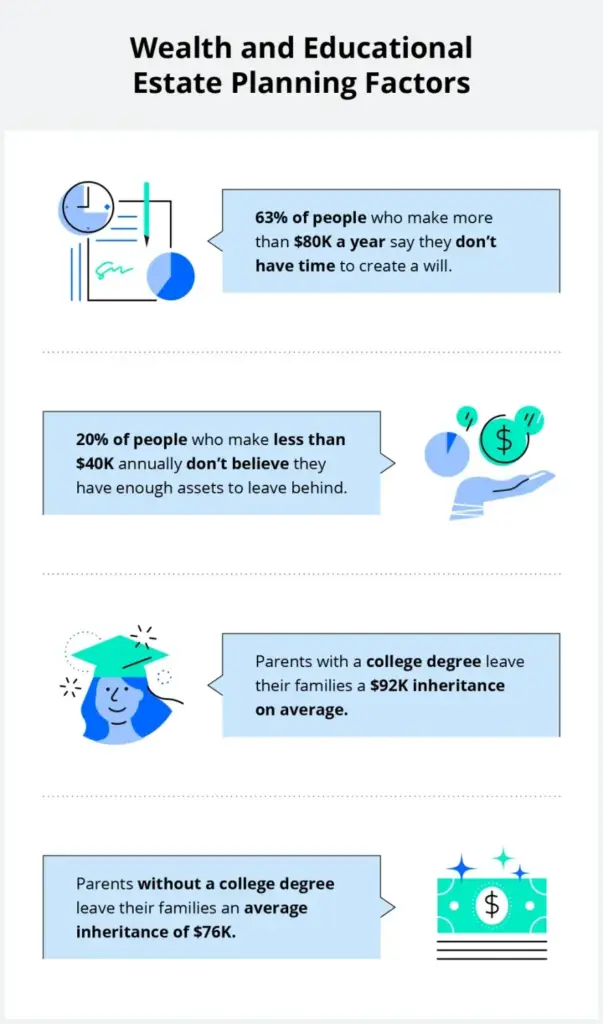

Inheritance disputes aren’t new. Across cultures—from Native American tribes dividing land to modern-day Americans fighting over estates—money after death often exposes long-buried tensions. A WealthCounsel study found that 70% of wealth transfers fail by the second generation, usually because of poor communication, lack of planning, or disputes among heirs.

Even in Native American traditions, disputes over land and rights have historically caused family rifts, showing that cultural values, property, and money are always deeply tied together.

U.S. Legal Comparison

In the United States, similar disputes fall under ERISA (Employee Retirement Income Security Act) for pensions and retirement accounts. Under ERISA:

- Beneficiary designations override wills. Just like in this South African case, if your account lists one person, they get it, regardless of what your will says.

- Surviving spouses usually get priority unless they legally waive their rights.

- Children can contest if they can prove dependency or show that the designation was made under fraud, duress, or mistake.

Lessons for American Families

1. Know How Beneficiaries Work

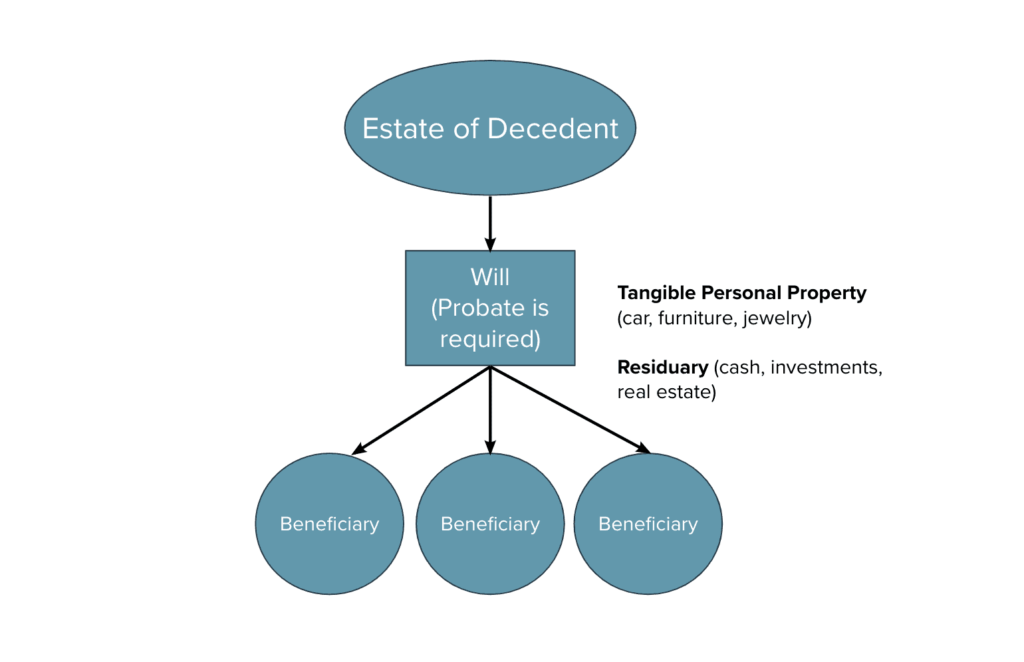

When you set up retirement accounts (like a 401(k) or IRA), you name beneficiaries. This seems simple, but the kicker is that the beneficiary designation overrides your will.

Example: If you forget to update your 401(k) after a divorce, your ex could still inherit it.

2. Communicate Early and Clearly

Family disputes often start because folks don’t talk about money. It may feel awkward, but having “the money talk” before tragedy strikes avoids drama later.

3. Understand Financial Needs vs. Legal Rights

Just because someone is financially stable doesn’t mean they’ll automatically get less in a payout. Courts and boards weigh factors like dependency, age, and needs.

4. Don’t Ignore Estate Planning

A will isn’t enough. You also need:

- Living trust (for easier transfer of assets)

- Updated beneficiary designations (401(k), IRA, life insurance)

- Power of attorney (financial and healthcare)

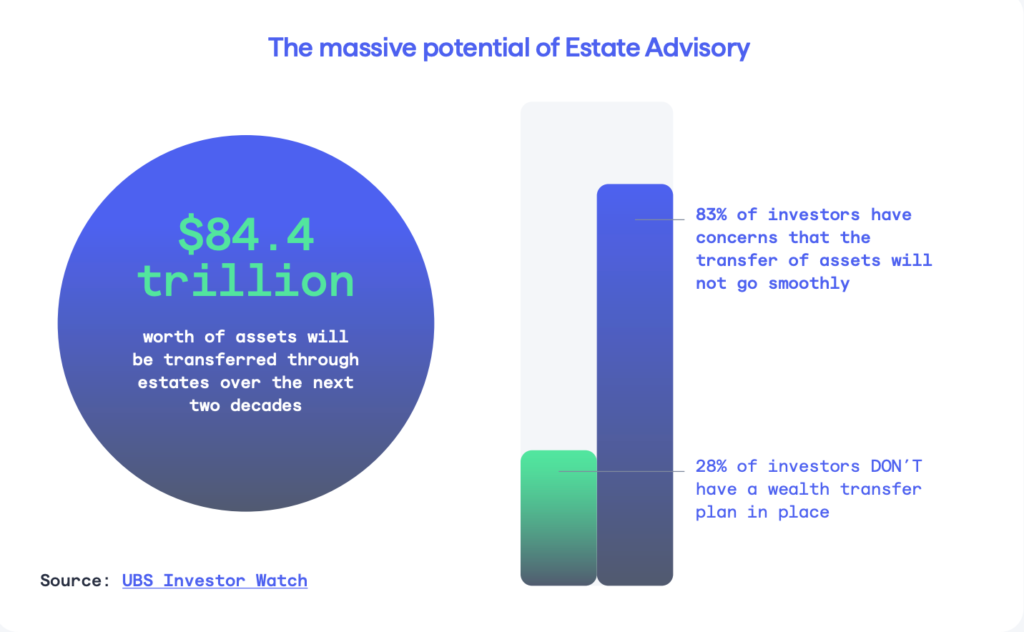

Statistics on Inheritance Disputes

In the U.S., inheritance battles are more common than you’d think. According to the American Association of Retired Persons (AARP), around 1 in 4 families experience some kind of conflict over estates. Legal battles can drag on for years and cost tens of thousands of dollars in legal fees, often eating into the inheritance itself.

A Caring.com survey found that only 33% of Americans have a will or estate plan, leaving most families vulnerable to disputes like the one in this South African case.

Practical Guide: Avoiding Family Disputes Over Death Benefits

Here’s a step-by-step action plan to keep your family from ending up in court like this South African family:

Step 1: Review Your Beneficiaries Regularly

- Do it after marriage, divorce, birth of a child, or death in the family.

Step 2: Keep Paperwork Up-to-Date

- Missing forms or late submissions can delay payouts for months.

Step 3: Balance Fairness with Reality

- Adjust designations if one child depends on you financially more than others.

Step 4: Get Professional Help

- Estate attorneys and financial planners aren’t just for the wealthy. They can explain tax rules, survivor benefits, and strategies to avoid probate.

Practical Checklist for Readers

- Review all beneficiary forms today.

- Update documents after life events.

- Communicate your intentions with family.

- Set up a living trust if assets are complex.

- Consult a professional estate planner.

Expert Perspective

According to estate attorney Jonathan Fields:

“Most inheritance fights aren’t about greed—they’re about misunderstanding. Clear communication and legally binding documents are your best protection against family fallout.”

Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud

Experts Warn Dismantling Justice Department Tax Division Could Cost Billions