Bidar Youth Arrested For ₹9.25 Crore GST Evasion: When news broke that a Bidar youth was arrested for ₹9.25 crore GST evasion using fake bills, it was more than just a headline—it was a peek into the darker side of modern business practices. At first glance, it might seem like a routine tax fraud case, but this story has layers that impact entrepreneurs, taxpayers, and professionals across the globe. Tax evasion is not some distant issue happening in boardrooms filled with Wall Street suits. It’s happening everywhere—even in small towns like Bidar, Karnataka. And the methods fraudsters use? Surprisingly clever, yet shockingly destructive. This case is an example of how governments are cracking down, why compliance is critical, and what professionals can learn to stay ahead.

Bidar Youth Arrested For ₹9.25 Crore GST Evasion

The case of the Bidar youth arrested for ₹9.25 crore GST evasion using fake bills is more than just a story about one man’s greed. It’s a reminder of how fragile trust in financial systems can be and how important compliance is in sustaining economies. For businesses, the lesson is simple: play by the rules. For professionals, the message is clear: expertise in taxation and compliance is only going to get more valuable. And for everyone else? Remember that tax money funds the schools, hospitals, and roads we all depend on. Fraud doesn’t just cheat the government—it cheats society.

| Aspect | Details |

|---|---|

| Who was arrested | Rahul Kishan Rao Kulkarni, youth from Bidar, Karnataka |

| Amount of fraud | ₹9.25 crore (approx. $1.1 million USD) evaded through fake GST bills |

| Method used | Created fake companies, bogus invoices, and misused Aadhaar/PAN of family |

| Impact | 132 people enabled to claim illegal Input Tax Credit (ITC) |

| Investigation | Joint effort by Karnataka & Telangana tax officials |

| Official reference | Goods and Services Tax (GST) Portal |

| Legal consequence | Offender in judicial custody; penalties can include 5+ years imprisonment |

| Broader trend | Karnataka saw ₹39,577 crore GST evasion detected in FY 2024–25 |

What Happened in Bidar?

Rahul Kishan Rao Kulkarni was accused of masterminding a GST fraud worth ₹9.25 crore. Over four years, he created shell companies using his relatives’ Aadhaar and PAN cards, issued fake invoices, and allowed more than 130 businesses to claim fraudulent Input Tax Credit (ITC).

Now, let’s simplify this. Imagine you run a small coffee shop in Austin. You buy beans from a supplier and pay sales tax on them. When you sell lattes to customers, you get to deduct that earlier tax—you don’t pay tax twice. That’s ITC. But Kulkarni essentially created receipts for beans he never bought and cashed them in as credits. In short, it’s like trying to deposit fake checks into a bank account.

Why GST Matters?

GST, or Goods and Services Tax, was rolled out in India in July 2017. Its purpose? To simplify the tax maze by replacing multiple indirect taxes (excise duty, VAT, service tax, etc.) with one unified tax.

The system was designed to:

- Make business compliance easier.

- Reduce corruption and loopholes.

- Create a transparent, digital-first tax environment.

And for the most part, it has worked. But as this case shows, fraudsters evolve as quickly as the rules do.

How Fraudsters Pull It Off?

Kulkarni’s approach is classic in GST scams. Fraud typically falls into these categories:

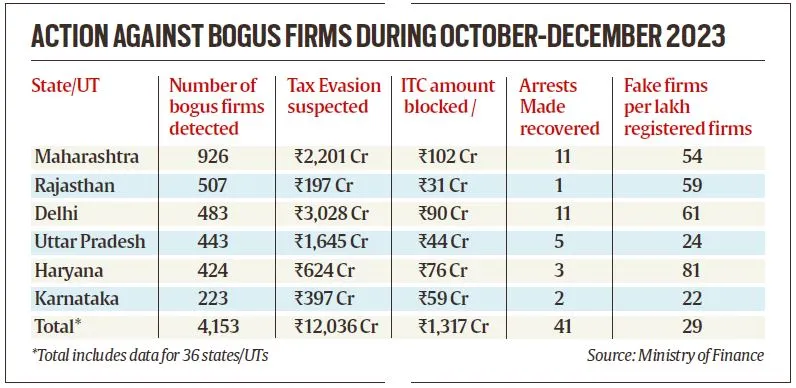

- Fake Firms: Setting up companies with no employees, no operations, just paper trails.

- Bogus Invoices: Issuing bills for goods or services that never existed.

- Fake ITC Claims: Businesses then deduct tax they never paid, saving millions illegally.

- Multiple States Involved: Often fraudsters use multiple jurisdictions to stay under the radar.

Globally, this isn’t new. In Europe, the so-called “VAT carousel fraud” costs the EU more than €50 billion every year, according to the European Commission.

How Authorities Catch Bidar Youth Arrested For ₹9.25 Crore GST Evasion?

For years, people assumed tax evasion was easy to get away with. But now, governments are investing in technology-driven enforcement. Here’s how they nailed this case:

- AI & Big Data: Matching invoices across thousands of businesses. If Company A sells goods worth ₹1 crore, but Company B never reports buying them, that’s a red flag.

- Cross-Border Collaboration: In this case, Karnataka and Telangana officials shared intelligence.

- Banking Trails: Authorities trace suspicious fund transfers. Even if cash changes hands, it often leaves digital breadcrumbs.

- Surprise Raids: Enforcement agencies frequently raid offices, seizing computers and records.

- Whistleblower Tips: Many frauds are exposed when insiders or competitors report suspicious activities.

The message is clear: tax fraud may look smart in the short run, but long-term? You will get caught.

Why This Case Matters Beyond Bidar?

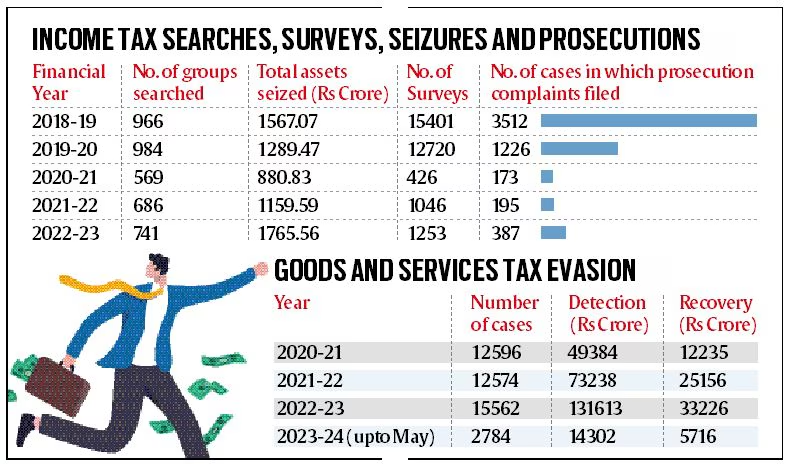

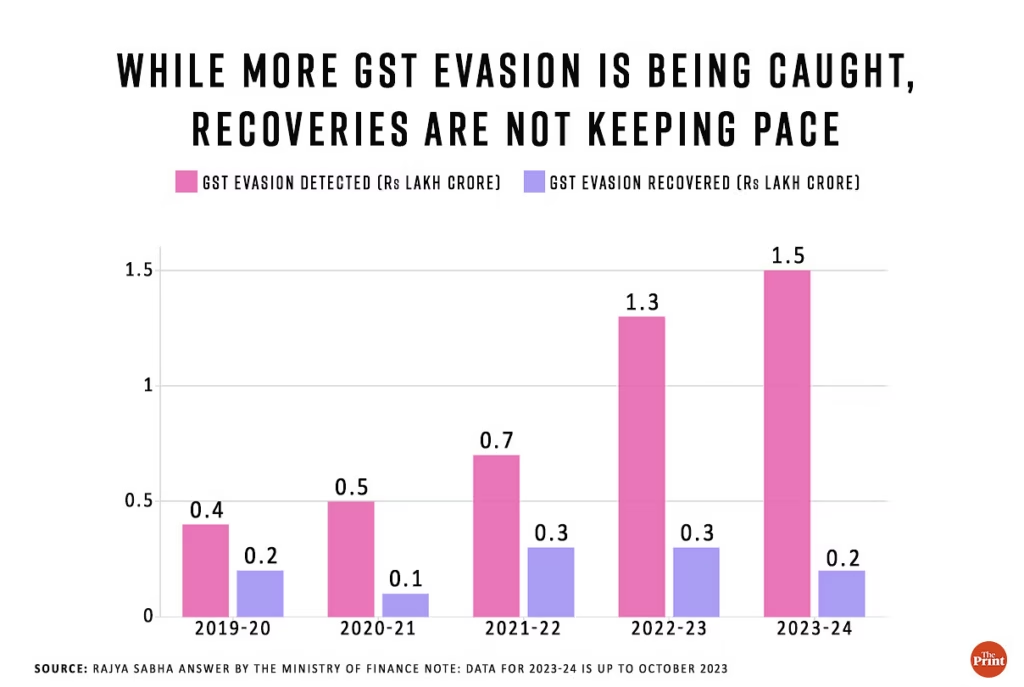

1. Scale of the Problem

Karnataka reported ₹39,577 crore in GST fraud in FY 2024–25 alone. That’s more than five times the previous year. Imagine what that money could do for schools, hospitals, or infrastructure.

2. Global Phenomenon

Tax fraud isn’t just India’s headache. In the U.S., the IRS estimates $441 billion lost annually to tax evasion. From big corporations parking profits in offshore havens to small businesses underreporting sales, the scale is staggering.

3. Impact on Honest Businesses

For small and medium enterprises, these scams are devastating. Honest business owners end up paying full taxes while fraudsters undercut them with lower prices. It’s unfair competition at its worst.

Practical Tips: How to Stay Compliant

If you’re a business owner, freelancer, or consultant, here’s a checklist to keep yourself safe:

- Keep Proper Records: Store invoices, receipts, and contracts digitally.

- Verify Vendors: Check every vendor’s GST number on the GST portal.

- Use Accounting Software: Tools like QuickBooks, Tally, or Zoho Books make reconciliation easy.

- Educate Employees: Train your team to spot fake invoices.

- Hire Professionals: Chartered Accountants (CAs) and Certified Public Accountants (CPAs) are your allies.

- Stay Updated: Tax laws change constantly.

Career Angle: Opportunity in Compliance

Here’s the silver lining. With rising fraud, demand for tax professionals, auditors, and forensic accountants is at an all-time high.

- For Students: Specializing in taxation or forensic accounting is a smart career move.

- For Professionals: Adding certifications like CPA, CMA, or CFE (Certified Fraud Examiner) can open doors.

- For Businesses: Having in-house compliance experts isn’t a cost—it’s an investment against risk.

Real-Life Stories: Tax Fraud Across the World

- India: In Telangana, a company was busted for a ₹100 crore GST scam just last year.

- USA: Actor Wesley Snipes served three years in prison for willful failure to file tax returns.

- Europe: VAT carousel fraud continues to plague the EU, draining billions annually.

- South America: Brazil has cracked down on fake invoice schemes tied to fuel and agriculture industries.

These cases show fraud is global, and no profession, industry, or country is immune.

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

Expert Insight: Why Compliance Builds Trust

As someone with years of experience in finance and compliance, I can say this: compliance isn’t just about avoiding jail—it’s about building credibility. Investors, partners, and customers trust businesses that are transparent. Cutting corners might look profitable for a moment, but it destroys long-term growth.