Lower GST On Household Items: The buzz around lower GST on household items is heating up across India, and it’s more than just another tax story. The GST Council, India’s top decision-making body on indirect taxes, is gearing up for reforms that could reshape how families shop, how businesses plan, and how the economy grows. If you’re picturing complicated financial jargon—don’t worry. At its core, this is about cheaper groceries, more affordable appliances, and even savings on your insurance bills. Think about walking into Target in the U.S. and realizing your usual shopping cart just got 5–10% cheaper overnight. That’s the potential scale of what Indian households may soon experience.

Lower GST On Household Items

The lower GST on household items is set to be a defining reform for India in 2025. By moving from four slabs to two, cutting taxes on essentials, and simplifying compliance, the GST Council hopes to fuel demand and strengthen the economy. While revenue challenges and rollout issues remain, for the average Indian family, this could mean real savings and more breathing room in monthly budgets.

| Aspect | Details |

|---|---|

| New GST Structure | Simplified from four slabs (5%, 12%, 18%, 28%) to 5% and 18%, with 40% for luxury/sin goods. |

| Items Likely Cheaper | Groceries (butter, cheese, noodles, jam, juices), big appliances (ACs, TVs, dishwashers), scooters, small cars, and possibly insurance premiums. |

| Potential Price Drop | Up to 7–8% on appliances; food items shifting from 12% to 5% slab. |

| Economic Impact | ₹1.98 lakh crore boost to consumption; ₹85,000 crore annual revenue hit (SBI Research). |

| Timeline | Final GST Council review in Sept–Oct 2025, rollout planned before Diwali. |

| Official Source | GST Council – Government of India |

GST in India: A Quick Refresher

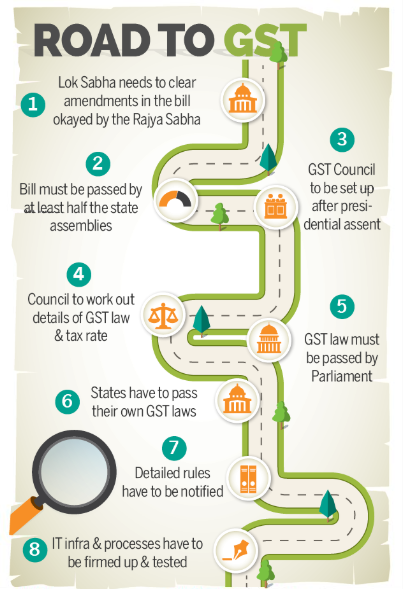

The Goods and Services Tax (GST) was introduced in India in July 2017. Its purpose was to replace a patchwork of central and state taxes that made trade inefficient and confusing. Before GST, every state had different tax rates, rules, and exemptions.

GST streamlined this by creating a unified system with four main tax slabs: 5%, 12%, 18%, and 28%. While this was a major improvement, it also introduced complexities. Businesses often debated which slab applied to which product. For example, was flavored yogurt a luxury (18%) or a food staple (5%)?

Fast forward to 2025, and India is now preparing for the next big step—simplification into just two slabs, 5% and 18%, with an additional 40% for luxury goods like tobacco, high-end cars, and alcohol.

Why Simplify GST Now?

The timing isn’t random. India’s economy is at a point where inflation, global slowdowns, and rising household costs are squeezing middle-class families. Consumer demand, a major driver of India’s growth, has been soft. By lowering GST on essentials and common goods, the government hopes to:

- Stimulate consumer spending ahead of the festive season.

- Provide relief to the middle class and lower-income groups.

- Simplify compliance for businesses, reducing disputes and litigation.

- Boost overall GDP growth by 0.6–0.8%, according to economic projections.

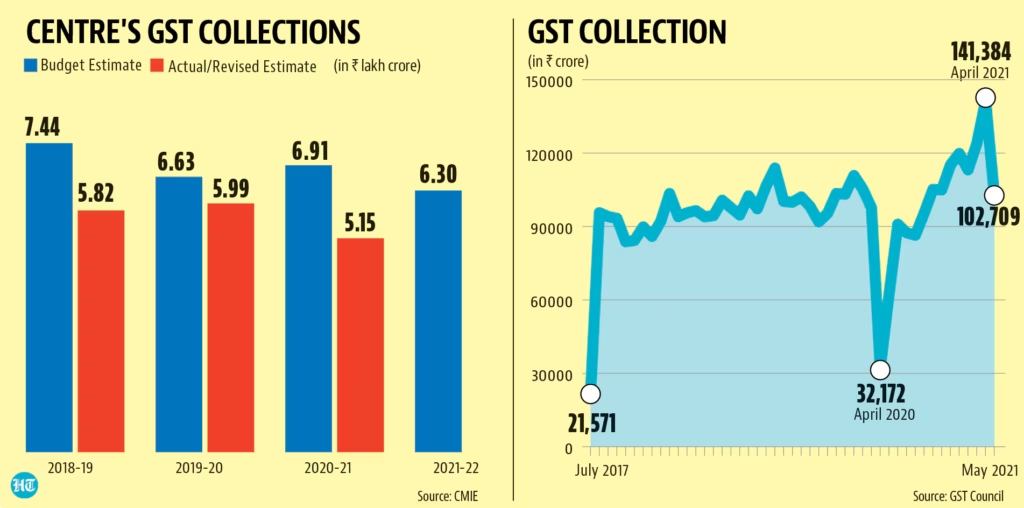

SBI Research has pegged the potential boost to household consumption at ₹1.98 lakh crore ($23 billion), while warning of a ₹85,000 crore ($10 billion) annual revenue loss.

Lower GST On Household Items: Items That Will Get Cheaper

Let’s walk through the shopping list of what may soon become lighter on the wallet:

Everyday Essentials (12% → 5%)

- Butter, ghee, cheese

- Jams, mayonnaise, packaged juices

- Instant noodles, pasta, chips, namkeen

- Tooth powder and basic personal care items

For families, this translates into monthly grocery bill savings of 3–5%.

Home Appliances & Durables (28% → 18%)

- Air conditioners

- Large-screen TVs (above 32 inches)

- Dishwashers, washing machines

- Cement (important for construction and housing)

Example: A TV priced at ₹60,000 could drop by ₹4,000–5,000 after the cut.

Automobiles

- Small cars and two-wheelers under 250cc will move from 28% to 18%.

This will benefit young professionals, students, and rural households where scooters are primary transport.

Insurance Premiums

The Council is also considering a 5% or zero GST rate for health and life insurance premiums. This could save policyholders thousands annually, while encouraging more Indians to buy insurance.

Case Study: Household Savings Example

Take the Kumar family, a middle-class household in Bengaluru. Their typical annual expenses:

- Groceries & packaged food: ₹1,20,000

- Appliances (occasional purchases): ₹1,00,000

- Two-wheeler: ₹90,000

- Health insurance premiums: ₹25,000

Before reforms: ₹3,35,000 total spend.

After reforms: Savings of ₹15,000–20,000 annually (lower grocery bills, cheaper appliances, reduced insurance tax).

That’s equivalent to two months of school tuition fees or a short vacation.

Global Comparisons: Where Does India Stand?

- United States: No national GST, only state-level sales tax (0–10%). Each state decides rates, leading to big variation.

- European Union: VAT ranges from 15%–27%, with reduced rates (as low as 5%) for food and essentials.

- Singapore: Flat 9% GST, simple and uniform, but less flexible.

India’s two-slab plan would bring it closer to global best practices while still protecting essentials with a lower rate.

Industry Reactions

- FMCG & Retail: Expect strong growth in demand as prices fall, especially in packaged foods and beverages.

- Auto Industry: Experts predict a 15–20% boost in small car and scooter sales around Diwali.

- Insurance Sector: Lower GST on premiums could improve penetration in rural areas where uptake is low.

- State Governments: Concerned about the revenue hit, though higher consumption may partly offset losses.

Economist opinions are split: while most agree it’s good for consumers, some caution about fiscal stress.

Challenges and Risks

- Revenue Loss – States depend heavily on GST collections; a loss of ₹85,000 crore annually may force budget cuts.

- Classification Issues – Deciding what counts as “essential” vs. “luxury” will always spark disputes.

- Implementation Delays – Rolling this out before Diwali means businesses must update systems quickly.

- Consumer Awareness – Ensuring price cuts are passed on to consumers, not absorbed by retailers.

Practical Advice For Consumers

- Delay Major Purchases: If you’re planning to buy a TV, AC, or vehicle, wait until post-October for GST savings.

- Check MRPs Carefully: Companies must revise prices after tax cuts—don’t pay old rates.

- Insurance Timing: Consider renewing or buying new policies after the GST cut.

- Leverage Festive Discounts: Combine GST savings with Diwali offers for maximum value.

Historical Context: Earlier GST Tweaks

This isn’t the first time GST rates have been slashed:

- 2017–2018: Rates on over 200 items, including chocolates and sanitary napkins, were cut.

- 2019: Electric vehicles moved to 5% GST to promote clean energy.

- 2020–2022: Several medical equipment and COVID-related products saw temporary GST relief.

The current reform, however, is by far the largest structural overhaul since GST’s introduction.

Looking Ahead: Long-Term Outlook

If successful, this reform could:

- Build consumer trust in GST as a fair, simple tax.

- Reduce compliance costs for small businesses.

- Encourage more Indians to buy insurance and invest in durable goods.

- Strengthen India’s global competitiveness by aligning with international VAT/GST systems.

However, balancing consumer benefits with government revenue stability will remain the biggest challenge.

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

GST Slashed To Just Two Rates As 99 Percent Items Get Cheaper This Diwali

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags