Advisory On Excess Inventory Amid GST Uncertainty: The auto industry has been buzzing with one major headline: FADA issues advisory on excess inventory amid GST uncertainty. For anyone connected with cars, bikes, or even planning a vehicle purchase, this is a story that could impact your wallet, your decisions, and the entire market landscape. The Federation of Automobile Dealers Associations (FADA), the apex body representing vehicle dealers across India, has waved a red flag about holding too much stock in the middle of ongoing discussions on GST 2.0 reforms. For dealers, it’s a call to exercise caution. For customers, it’s a reason to think twice about the timing of a car purchase.

Advisory On Excess Inventory Amid GST Uncertainty

The FADA advisory on excess inventory amid GST uncertainty is a reminder of how quickly tax reforms can reshape entire industries. Dealers are being urged to avoid repeating past mistakes, while customers must balance patience with practicality. If GST 2.0 brings rates down from 28% to 18%, it could ignite demand, improve affordability, and align India’s auto industry closer to global norms. Until then, the best strategy for everyone is caution, preparation, and reliance on official updates—not rumors.

| Key Point | Details |

|---|---|

| Inventory Levels | Dealers currently holding about 55 days’ worth of stock—considered high. |

| GST 2.0 Reform | Proposal to cut GST on vehicles from 28% to 18% for entry-level cars and two-wheelers. |

| Financial Risk | Excess inventory could tie up dealer liquidity and force discounting if reforms take effect later. |

| Advisory Message | Dealers urged to avoid overstocking and stop speculative communication with customers. |

| Festive Season Impact | With sales peaking during Onam, Ganesh Chaturthi, Navratri, and Diwali, caution is critical. |

| Official Source | FADA Official Website |

A Little History: GST & Auto Industry Challenges

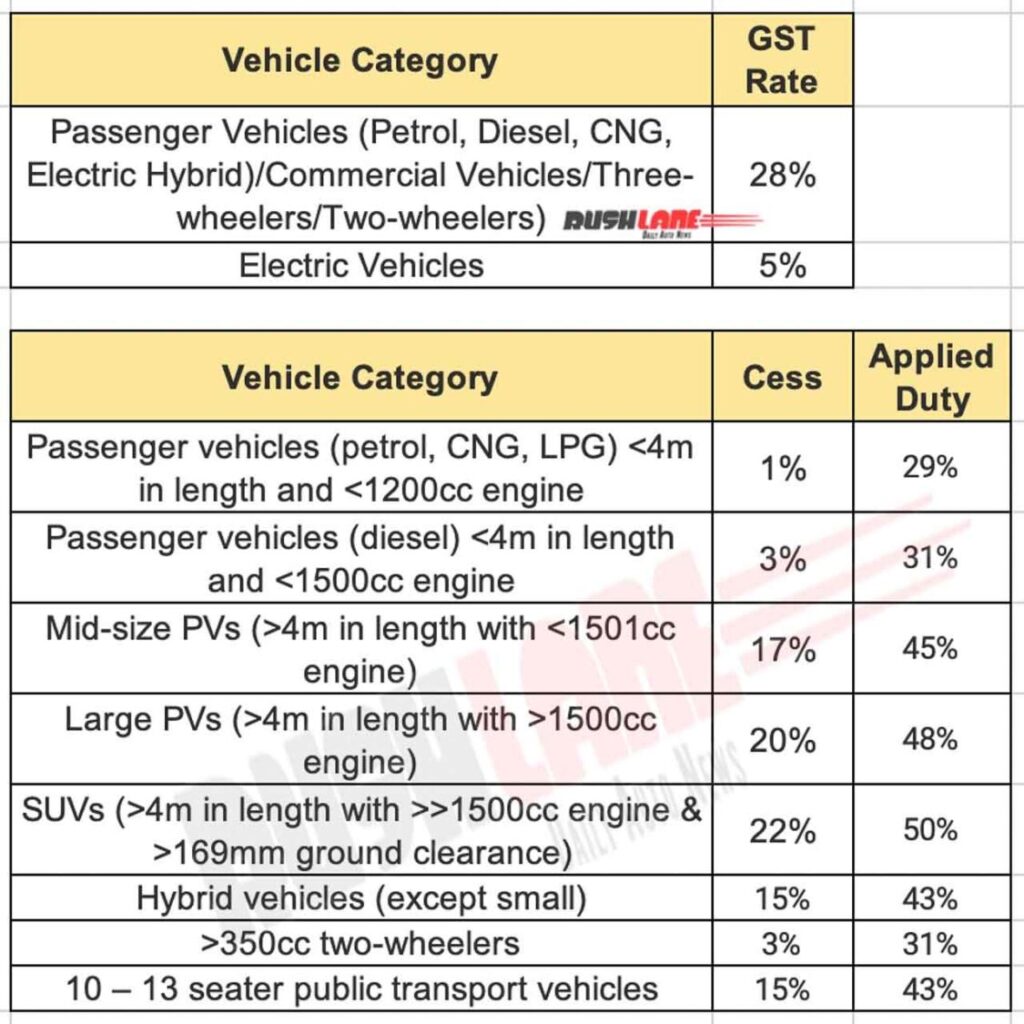

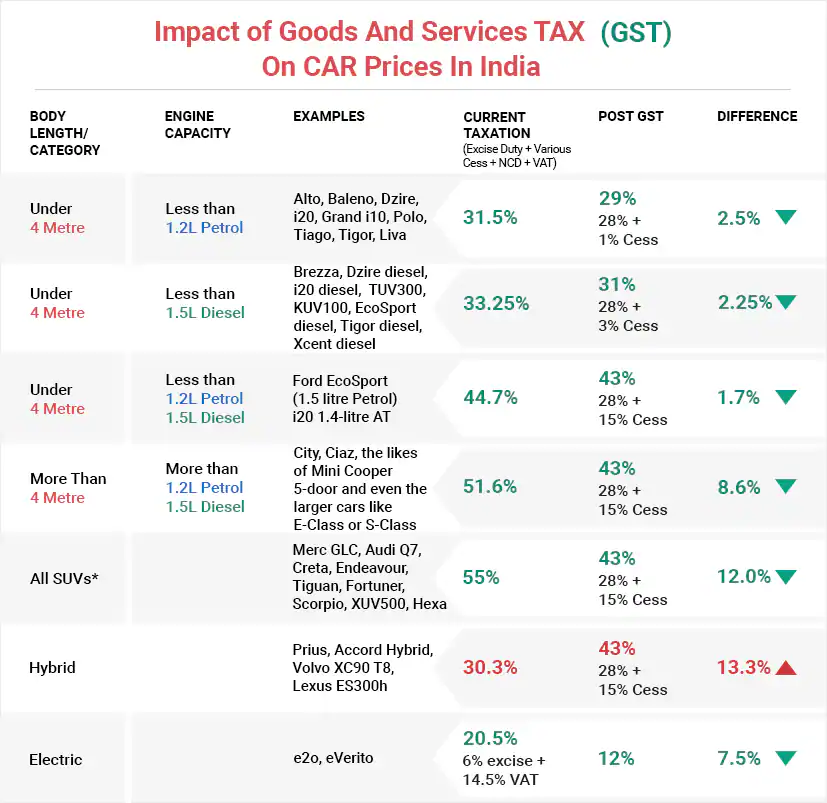

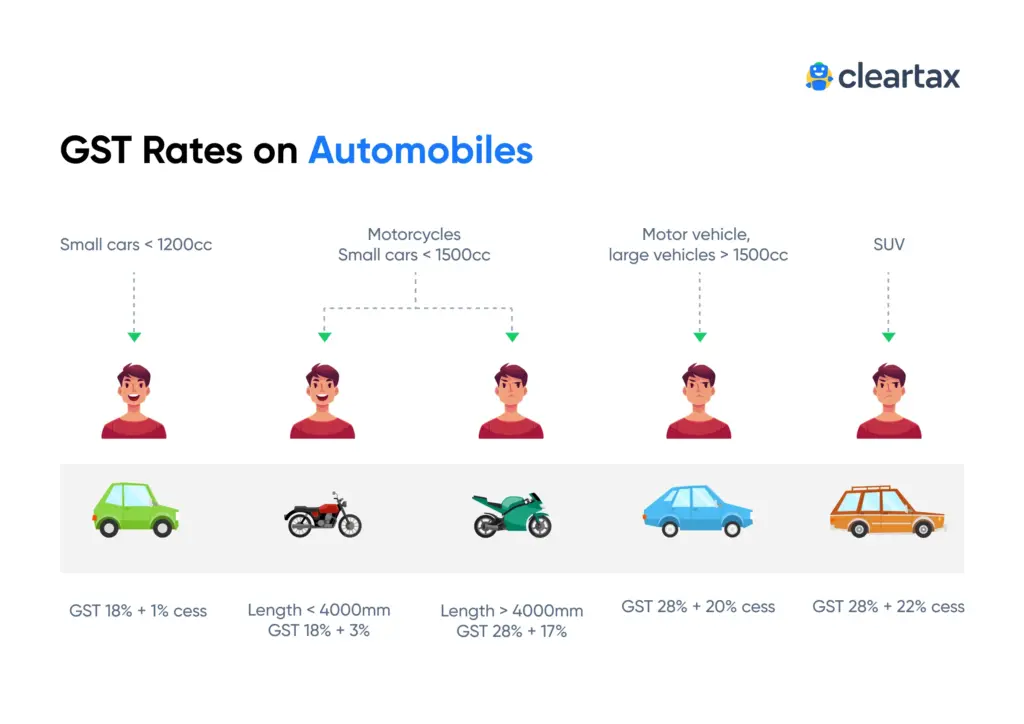

When GST was first introduced in India in 2017, it was hailed as a game-changer—a “One Nation, One Tax” dream. But the auto industry found itself at the highest slab of 28%, with an additional cess on larger cars and SUVs. For comparison, basic household items often fall under 5% or 12% GST.

Over the years, this high tax burden has been a recurring pain point for automakers and dealers. Several challenges stand out:

- Demonetization (2016): Rural car and two-wheeler sales slowed as cash dried up.

- BS6 Transition (2020): Dealers had to sell older BS4 stock at fire-sale prices before stricter emission rules took over.

- COVID-19 Pandemic (2020–21): Months of lockdown left dealerships with unsold cars, huge EMIs, and severe cash flow issues.

Each time, dealers bore the brunt of sudden policy shifts. Now, with GST 2.0 reforms being floated, many are determined not to repeat past mistakes.

What’s Cooking With GST 2.0?

The government is considering simplifying GST into two slabs. If the proposal goes through, vehicles—especially entry-level cars and two-wheelers—might drop from the current 28% bracket to 18%.

That’s a serious difference. For example:

- A hatchback priced at ₹6 lakh (~$7,200) could drop by nearly ₹60,000–₹70,000.

- A scooter or entry-level motorcycle might become ₹7,000–₹12,000 cheaper.

This could make cars and bikes more accessible to millions of families. But here’s the catch—there’s no official word on the timing or scope of this reform. The government may roll it out in stages, exclude certain vehicles, or even delay it until after the festive season.

Why Advisory On Excess Inventory Amid GST Uncertainty Is So Important?

FADA’s message is straightforward but crucial. Dealers should not fall into the trap of over-ordering from manufacturers in anticipation of a festive rush.

The risks include:

- Liquidity Crunch: More cars in stock = more cash stuck in inventory.

- Price Shock: If GST cuts are announced after stocking up, dealers may be forced to sell at heavy discounts.

- Speculative Communication: Telling customers to “wait for lower prices” could cause a sales freeze, hurting both customers and dealers.

- OEM Pushback: Automakers often pressure dealers to absorb stock, but this time, dealers must protect themselves.

By controlling inventory, FADA wants dealers to avoid the same chaos they faced during the BS6 transition, when thousands of vehicles had to be liquidated at a loss.

Case Study: Dealer A’s Dilemma

Let’s imagine Dealer A in Mumbai orders 200 extra hatchbacks in August 2025, each costing ₹6 lakh ex-showroom under 28% GST.

- If GST drops to 18% in October, those cars should now cost only ₹5.3 lakh.

- Customers expect the benefit of the lower tax.

- Dealer A is forced to sell each car at a discount of ₹70,000, losing a total of ₹1.4 crore ($170,000).

On top of this, there are interest costs, storage charges, and the risk of unsold inventory piling up during a crucial sales period. That kind of loss can wipe out a small dealership.

The Festive Season Twist

Festivals in India aren’t just cultural celebrations—they’re also economic engines. Auto sales spike during Onam, Ganesh Chaturthi, Navratri, and Diwali, with many families considering this an auspicious time to buy.

Normally, dealers prepare for this by stocking up. But this year, with GST 2.0 rumors flying, the strategy is different.

- Customers might delay purchases, waiting for lower prices.

- Dealers can’t openly advertise “GST discounts” because nothing is official.

- OEMs may still push inventory targets, leading to dealer-OEM tension.

FADA’s advisory is essentially telling dealers to tread carefully, keep promotions flexible, and avoid speculative claims that could backfire.

Global Perspective: How Does India Compare?

India’s auto tax policy is among the most stringent in the world.

- United States: Taxes vary by state, usually between 5%–9%. The average dealer inventory is 45–50 days.

- Europe: VAT on vehicles ranges between 19%–21%, much lower than India’s 28% GST + cess.

- India: At 28% plus cess, India sits at the top of the global tax chart, making vehicles more expensive relative to income levels.

This is why GST 2.0 is being watched so closely—it could finally align India closer to global tax norms.

Practical Advice for Dealers

- Keep Inventory Lean – Stick to 50–55 days of stock and avoid “overstuffing” showrooms.

- Educate Customers – Share facts, not speculation. Transparency builds trust.

- Negotiate With OEMs – Push back on forced stock loading; ask for support if tax reforms cause valuation issues.

- Focus on Retail, Not Wholesale – Move cars to customers, not just onto your lot.

- Prepare Flexible Campaigns – Offer finance schemes, extended warranties, and festive packages that don’t depend on GST cuts.

Practical Advice for Customers

- Buy Based on Urgency – If you need a car now, don’t wait. If you can delay, wait for clarity.

- Look Out for Festive Deals – Even if GST isn’t cut, dealers will still roll out offers during Diwali.

- Verify Official News – Only trust announcements from the GST Council or FADA, not social media rumors.

- Calculate Real Savings – A GST cut might save you ₹50,000, but a Diwali deal with accessories and insurance could be worth almost as much.

Expert Voices

- FADA President Manish Raj Singhania has stated that “dealers must ensure financial stability and be cautious about excessive stocking.”

- Economists argue that reducing GST could revive sluggish demand in entry-level vehicles, where sales growth has been nearly flat for two years.

- Auto Analysts point out that affordability is the key to mass-market growth, and a cut from 28% to 18% could be the biggest stimulus since GST’s launch in 2017.

Wider Economic Implications

The GST 2.0 debate goes beyond cars and bikes—it ties directly to India’s economic momentum.

- For Customers: Lower GST means more disposable income and higher affordability.

- For Dealers: Better liquidity and reduced risks of inventory loss.

- For Automakers (OEMs): A sales surge, especially in small cars and two-wheelers.

- For the Government: Short-term revenue dip, but potentially higher tax collections as volumes rise.

India’s auto sector contributes nearly 7% to GDP and supports over 3.7 crore jobs (source: SIAM). Any tax change here ripples across the entire economy.

Step-By-Step Guide: Navigating GST Uncertainty

For Dealers

- Track GST Council announcements weekly.

- Base inventory on actual retail demand.

- Keep credit lines flexible for sudden policy changes.

- Train sales staff to answer customer questions factually.

For Customers

- Time purchases with clarity from the government.

- Compare festive deals vs. expected tax cuts.

- Stay cautious of “insider claims” about prices dropping.

- Use EMI calculators to see if waiting actually saves you more money.

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

Govt Plans 40% Sin Tax on Alcohol, Cigarettes and Gaming Under GST 2.0 Shock Plan

Zero GST on Health & Life Insurance Proposed – Will Your Premiums Finally Drop?