Lower GST On ICE Vehicles Could Impact EV Growth: If you’ve been keeping an eye on India’s auto industry, here’s a big one: Lower GST on ICE vehicles could impact EV growth, according to a fresh HSBC Investment Research report. The study warns that while cutting GST (Goods and Services Tax) on traditional cars and SUVs might sound like a sweet deal for buyers, it could unintentionally slow down the electric vehicle (EV) momentum India has been working so hard to build. Think of it this way: EVs right now enjoy a tax advantage. While most ICE (Internal Combustion Engine) vehicles are taxed at 28% plus a cess, EVs are taxed at just 5%. This tax gap is one of the main reasons EVs have started gaining traction. If that gap shrinks, EVs suddenly lose their edge—kind of like a basketball team giving away a 20-point lead.

Lower GST On ICE Vehicles Could Impact EV Growth

The HSBC report makes one thing clear: Lower GST on ICE vehicles could impact EV growth in India. While tax cuts may make cars cheaper in the short run, they risk undermining years of progress in clean mobility. India now faces a crucial balancing act—between affordability, government revenue, and its climate commitments. The coming months, especially with potential announcements around Diwali, will reveal whether policymakers double down on EV growth or take a step back.

| Point | Details |

|---|---|

| Current GST Rate | ICE Vehicles: 28% + cess; EVs: 5% |

| HSBC Report Warning | Lower GST on ICE vehicles may reduce EV cost advantage, slowing adoption |

| Proposed GST Scenarios | Small cars: 18% GST; larger cars: up to 40%; flat cuts of 18% with/without cess |

| Revenue Loss for Govt. | $4–6 billion, depending on the model |

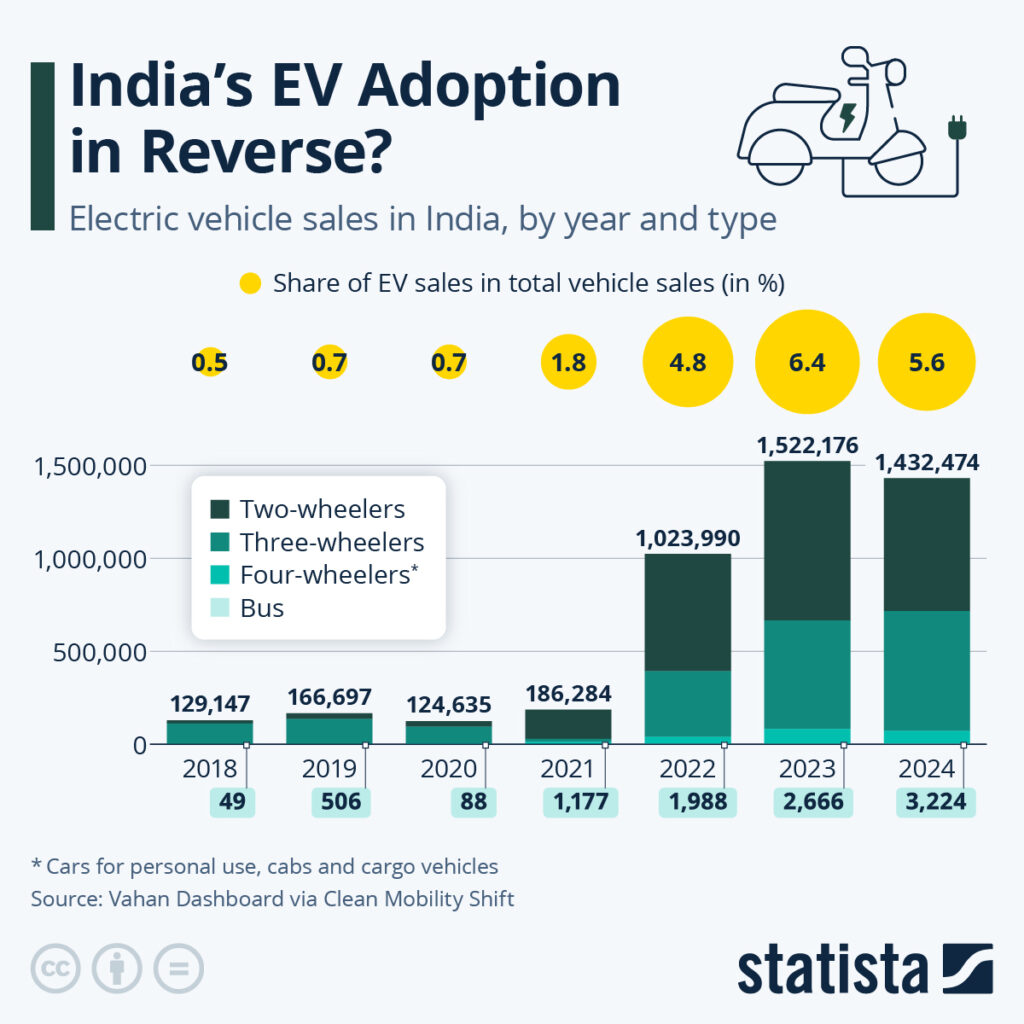

| EV Market in India | EV sales crossed 1.5 million units in FY2023, growing at 150% YoY (NITI Aayog) |

| Why It Matters | Could boost ICE demand in short term, but hurt EV adoption long term |

Why GST Matters in India’s Auto Market?

India’s GST is like America’s sales tax, but it’s applied nationwide. Right now:

- EVs = 5% GST (super low to encourage clean mobility).

- ICE cars = 28% GST + up to 22% cess.

That means EVs often look more affordable despite higher production costs.

Example: A compact EV priced at ₹12 lakh ($14,000) vs. a small ICE car at ₹9 lakh ($10,800). After GST:

- EV → 5% tax → final price ₹12.6 lakh.

- ICE → 28% tax → final price ₹11.5 lakh.

If GST drops to 18%, that ICE car slides to around ₹10.6 lakh. Suddenly the EV isn’t such a no-brainer.

Historical Context: Why GST Favored EVs

Back in 2017, when GST was rolled out, India was still figuring out its green mobility vision. Policymakers deliberately kept EVs at 5% GST to encourage early adoption. Combined with the FAME scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles), this tax cut helped build an EV ecosystem from scratch.

By 2020, major cities like Delhi, Bengaluru, and Pune had started to see EVs in cabs and delivery fleets. By 2023, India had crossed 1.5 million EV sales in a single year, almost double from 2022.

Cutting ICE GST now risks undoing much of that progress.

What HSBC’s Report Says?

HSBC laid out three possible GST reform scenarios:

1. Targeted Adjustment

- Small cars drop to 18% GST, large ones to 40% (no cess).

- Prices drop around 8% for small cars and 3–5% for larger cars.

- Govt. loses about $4–5 billion in tax revenue.

2. Uniform GST Cut, Keep Cess

- Across-the-board cut to 18% GST, but cess stays.

- Prices fall 6–8%.

- Govt. loses $5–6 billion.

- EVs lose their pricing edge.

3. Flat GST Cut + No Cess (Unlikely)

- GST slashed to 18% flat, and cess eliminated.

- Auto-sector revenues could drop by almost 50%.

HSBC’s bottom line: While consumers may cheer short-term savings, the EV transition could take a hit.

Global Comparison: How India Stacks Up

- United States: Federal EV tax credits go up to $7,500, plus state-level rebates. No major tax breaks for ICE cars.

- Europe: Countries like Norway make ICE cars more expensive through higher taxes. Today, nearly 80% of new car sales there are EVs.

- China: Offers purchase subsidies, lower registration fees, and even restrictions on ICE cars in certain cities.

Compared to these, India’s approach already tilts heavily toward EVs. Lowering GST on ICE cars would reverse that tilt.

Consumer Behavior and EV Barriers

While sales are growing fast, EV adoption in India still faces hurdles:

- Price sensitivity: For first-time buyers, upfront price matters more than lifetime savings.

- Charging infrastructure: India has around 10,000 public chargers, far below what’s needed.

- Battery costs: Still make up 40% of the car’s price.

- Resale value concerns: Many buyers are unsure how EVs will hold value compared to gas cars.

If ICE cars get cheaper, these psychological and practical barriers may keep buyers away from EVs.

Industry Reactions on Lower GST On ICE Vehicles Could Impact EV Growth

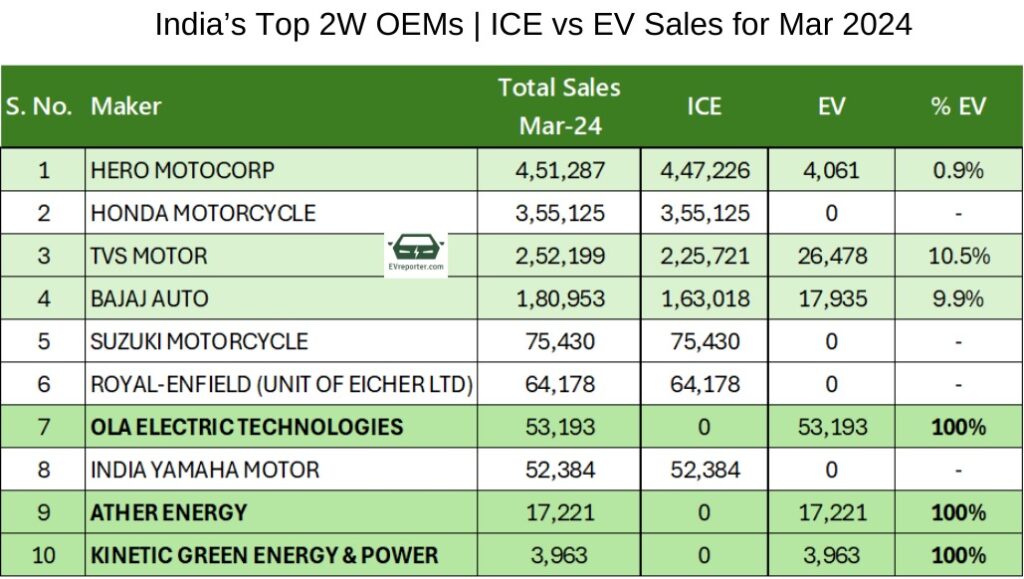

- Automakers like Maruti Suzuki and Hyundai have been lobbying for lower GST on small ICE cars, arguing affordability boosts sales and jobs.

- EV startups such as Ola Electric and Ather Energy warn that reducing ICE GST could derail India’s clean mobility roadmap.

- Component suppliers also worry: EVs require different supply chains, so slower adoption delays investment.

Jobs and Economy Angle

The auto industry employs more than 37 million people in India, directly and indirectly. Lowering GST on ICE cars could temporarily boost employment in factories, dealerships, and ancillary industries.

But experts warn: EVs are the future. If India slows down now, it could lose out on:

- Becoming a global hub for EV manufacturing.

- Attracting green investments.

- Building long-term resilience against oil imports.

It’s a classic case of short-term job creation vs. long-term industry competitiveness.

Real-Life Impact in India

Some states have shown how smart policies can make a big difference:

- Delhi: EV sales jumped to 12% of all new registrations in 2023 after local subsidies.

- Maharashtra: Purchase incentives reduced EV costs by nearly ₹2 lakh.

- Karnataka: Special policies encouraged startups like Ola Electric to set up EV plants.

Rolling back EV incentives at the national level could undo this state-level progress.

The Balancing Act: Affordability vs. Sustainability

India’s middle class is price-sensitive, no doubt. Cheaper cars mean more sales, more jobs, and economic growth. But climate math doesn’t lie. India has committed to net-zero emissions by 2070. EVs are central to that goal.

So policymakers face a choice:

- Push affordability now, or

- Stick with EV momentum for the future.

Practical Advice

For Buyers

- EV GST remains at 5%, so they’re still cheaper long-term.

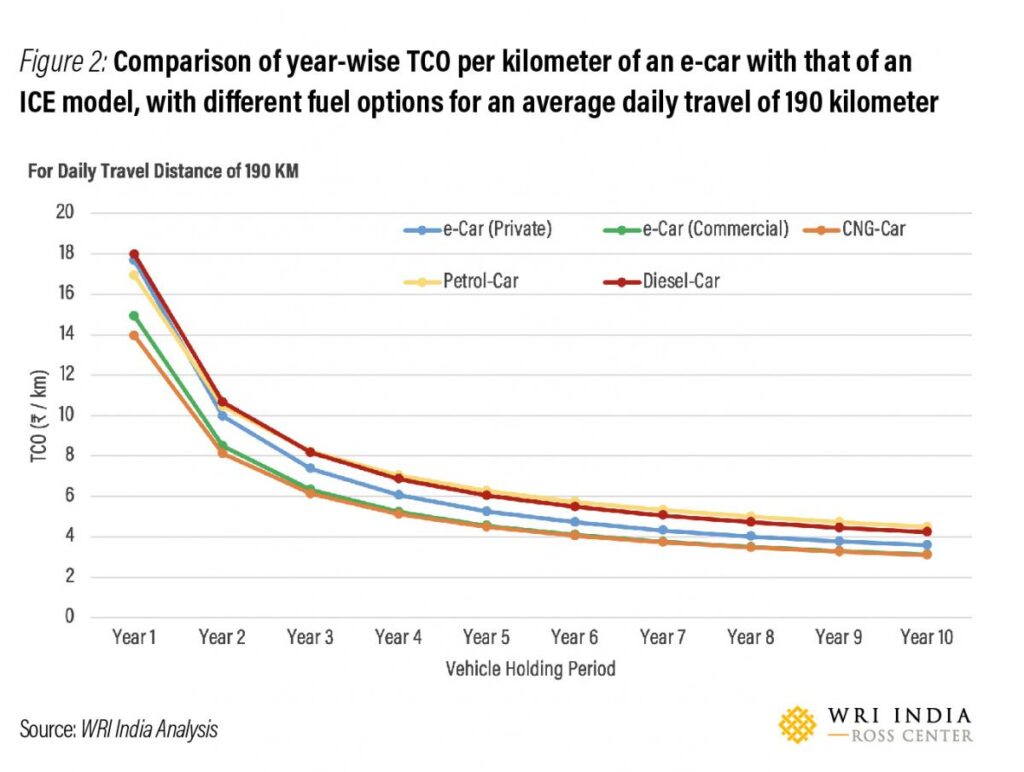

- Consider lifetime fuel costs: EVs average ₹1/km, while gas cars are closer to ₹6/km.

- Look for state-level subsidies for extra savings.

For Auto Industry Pros

- Expect price wars if ICE GST is cut.

- EV makers should highlight lifetime savings more aggressively.

- Invest in charging partnerships to ease buyer hesitation.

For Policymakers

- Consider tiered GST cuts: relief for entry-level cars but not for luxury vehicles.

- Maintain EV tax breaks.

- Use revenue from luxury car sales or fossil fuel levies to fund charging infrastructure.

Future Outlook

If ICE GST drops:

- Short-term: ICE sales will spike.

- Medium-term: EV adoption slows, startups struggle, charging infra investments stall.

- Long-term: India risks missing its climate goals and losing out on EV leadership globally.

If EV incentives are protected while cutting ICE GST smartly:

- India can still balance affordability with sustainability.

- Millions of green jobs could be created.

- India can position itself as a leader in EV exports, competing with China.

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash

Centre Plans Major GST Overhaul — Four Slabs May Shrink to Just Two

Nomura Predicts 10% Jump in Car Demand If GST Rate Is Cut- Check Details