Hyderabad Shops Report Big Diwali Sales: and the news is sending ripples across India’s retail industry. To put it into perspective for an American reader, imagine if Congress suddenly announced a nationwide sales tax cut just weeks before Christmas. The malls would be packed, e-commerce platforms overloaded, and shoppers racing to grab deals. That’s exactly what’s happening in India right now, with Hyderabad at the center of it all. Over the past few years, the Goods and Services Tax (GST) in India has been both a blessing and a burden. It streamlined the old, messy system of multiple state and federal taxes, but the higher slabs often left consumers frustrated. This year, with proposed GST cuts on consumer goods, Hyderabad — one of India’s busiest retail hubs — is seeing Diwali sales that rival the U.S. Black Friday shopping rush.

Hyderabad Shops Report Big Diwali Sales

Hyderabad shops report big Diwali sales after GST cut — and the story is more than just a headline. It shows how policy shifts directly impact consumer confidence and spending power. For families, it means stretching budgets further. For retailers, it’s a chance to recover losses and thrive. And for professionals worldwide, it’s proof that India’s retail market is dynamic, resilient, and worth watching.

| Point | Details |

|---|---|

| Topic | Hyderabad Shops Report Big Diwali Sales After GST Cut |

| Why It Matters | Lower GST = lower prices = more shopping power |

| Retail Impact | Electronics, jewelry, apparel, and festive décor seeing double-digit growth |

| Stats | India’s retail sector projected to reach $1.3 trillion by 2026 |

| Consumer Behavior | Families delayed purchases, now splurging post-GST cut |

| Professional Angle | Retailers, supply chain experts, and investors must track GST policy changes |

| Reference Link | Official GST Council Website |

GST in India: A Quick History

India introduced GST in July 2017, replacing dozens of central and state taxes. The goal? Simplify the system and create a “one nation, one tax” structure. But it wasn’t perfect:

- Goods were divided into slabs: 5%, 12%, 18%, and 28%.

- Luxury goods like cars and air conditioners were taxed at 28%, while daily-use items had lower slabs.

- Retailers often struggled with compliance, while customers saw prices rise on certain products.

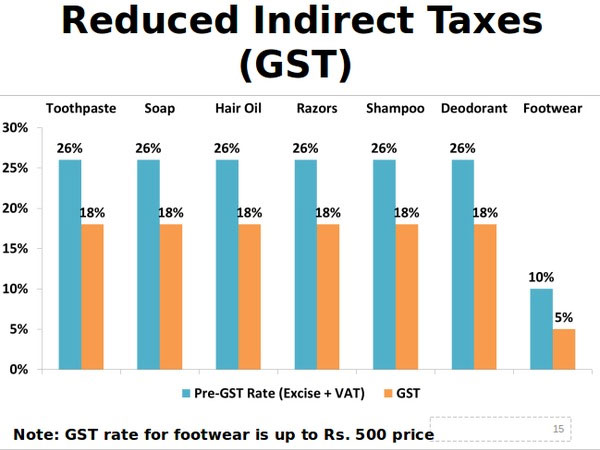

Over time, the GST Council has rationalized rates to ease pressure. For example:

- Electronics and appliances have moved from 28% down to 18%.

- Jewelry saw GST fall by 3%, spurring festive demand.

- Small businesses received compliance relief through simplified filing.

The most recent round of proposed cuts, arriving just before Diwali, has made the biggest splash yet.

Why Hyderabad Shops Report Big Diwali Sales?

Hyderabad isn’t just another Indian city — it’s a blend of tradition and technology. Known for its IT corridor (with companies like Microsoft and Google having offices here), the city also boasts historic jewelry markets, textile bazaars, and sprawling shopping malls. This unique mix makes it the perfect lens to view how GST changes ripple across demographics.

Electronics and Appliances

In high-income neighborhoods like Banjara Hills and Gachibowli, young tech workers are spending big on appliances, televisions, and smartphones. A popular electronics chain in Hyderabad reported that TV sales jumped by 18% compared to last Diwali, directly linked to the GST cut.

Jewelry and Gold Markets

At Laad Bazaar, Hyderabad’s famous jewelry district, jewelers are seeing packed shops. One store owner said: “Last year, people were hesitant. This year, with a 3% cut on gold, families are buying bigger pieces. It feels like the old Diwali days again.”

Apparel and Fashion

From malls like GVK One to budget-friendly street markets, clothing retailers are experiencing a sharp rise in sales. With apparel GST reduced in some categories, families are buying festive wear in bulk, often coordinating entire wardrobes for Diwali gatherings.

Consumer Psychology: How GST Cuts Change Behavior

Consumers are smart. Just like Americans wait for Black Friday or Cyber Monday, Indian shoppers timed their purchases to coincide with the GST news. Surveys from industry associations suggest:

- 37% of families delayed electronics purchases in September, hoping for price drops.

- 46% of shoppers said the GST cuts were their main reason for upgrading appliances this Diwali.

- Many households budget for Diwali gifts — with reduced GST, those budgets stretch further.

For context, think of it like a family in Texas waiting for the back-to-school sales tax holiday to buy laptops. The behavior is identical — wait, plan, splurge.

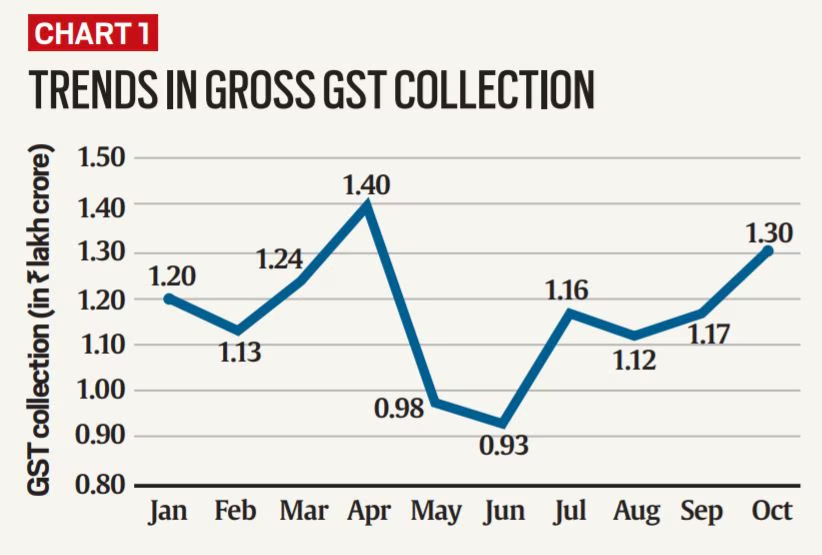

The Retail Numbers

- Retail Market Size: $950 billion in 2023, projected to cross $1.3 trillion by 2026.

- Festive Sales Growth: Hyderabad traders report 20–25% higher footfall versus 2022.

- Gold & Jewelry: Nationally, sales rose 15% year-on-year in the weeks following the GST cut announcement.

- E-commerce: Platforms like Amazon India and Flipkart expect record-breaking orders, with categories like smartphones and home appliances leading.

Case Study: One Shop’s Experience

Take Sri Durga Electronics, a mid-sized Hyderabad retailer. In 2022, Diwali sales were sluggish; customers browsed but rarely bought. This year? Different story.

- In just the first 10 days of October, the shop sold 40% more refrigerators and washing machines than the same period last year.

- Families who had postponed purchases are now buying two or three big-ticket items at once.

- The owner credits the GST cut for at least 70% of the increase in demand.

This micro-example mirrors the broader trend.

Global Comparison: U.S. vs. India

For readers in the U.S., here’s how to think about it:

- Diwali is India’s Christmas + New Year’s + Thanksgiving rolled into one.

- GST Cuts are like U.S. states announcing “no sales tax” weekends — except nationwide.

- Consumer Psychology: Just like Americans line up outside Best Buy, Indians crowd bazaars and e-commerce carts, especially when tax cuts sweeten the deal.

Step-By-Step: How GST Cuts Spark Sales

- Announcement – GST Council lowers rates.

- Price Change – Shops adjust tags and online listings.

- Customer Awareness – News spreads quickly via WhatsApp, local media, and word of mouth.

- Shopping Frenzy – Families buy in bulk, prioritizing big-ticket goods.

- Economic Ripple – Retail profits rise, supply chains get busier, stock markets respond.

Practical Advice for Shoppers

- Buy Big Items First – Electronics and jewelry see the biggest savings.

- Compare Deals – E-commerce platforms often adjust faster, but local stores may throw in freebies.

- Track GST Updates – Rates may shift again; government websites provide official changes.

- Think Long-Term – For small businesses, saving GST receipts helps with future filings.

Professional Insights

For professionals, this GST cut isn’t just a consumer story. It has business and investment implications:

- Retail Strategy – Brands must align promotions with tax policy changes.

- Investor Angle – Stocks of jewelry and electronics companies often rise during festive booms.

- Supply Chain Impact – Logistics companies see surging demand as goods move faster.

- Policy Signals – Frequent GST tweaks indicate the government’s focus on stimulating consumption.

Future Outlook

The big question: will sales sustain after Diwali? Analysts say it depends on whether GST cuts are permanent or temporary. If slabs are permanently simplified into just 5% and 18%, it could unleash steady consumer demand year-round.

Long-term, India’s retail story is bullish. With rising incomes, growing e-commerce penetration, and tax rationalization, the country could soon rival the U.S. as one of the world’s biggest consumer markets.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

GST Cuts Could Boost Consumption by ₹2 Lakh Cr – Can Economic Growth Offset Losses?